Beyond the Crowd: A Closer Look at Nifty Metals Index Chart

-

Herd mentality is a phenomenon that often grips traders and investors, especially during market euphoria.

As the Nifty Metals index witnesses a robust rally, it becomes crucial for market participants to discern whether they should follow the herd or exercise caution.

In this article, I have highlighted crucial technical patterns that suggest a potential reversal in the prevailing bullish trend on the chart of the Nifty Metals index.

November saw the Nifty Metals index surge by an impressive 8.76%, and the momentum carried forward into the first half of December with an additional gain of 6% to ~7,500. While such gains may be enticing for many investors, it's essential to take a closer look at the technical aspects of the market to avoid succumbing to herd mentality.

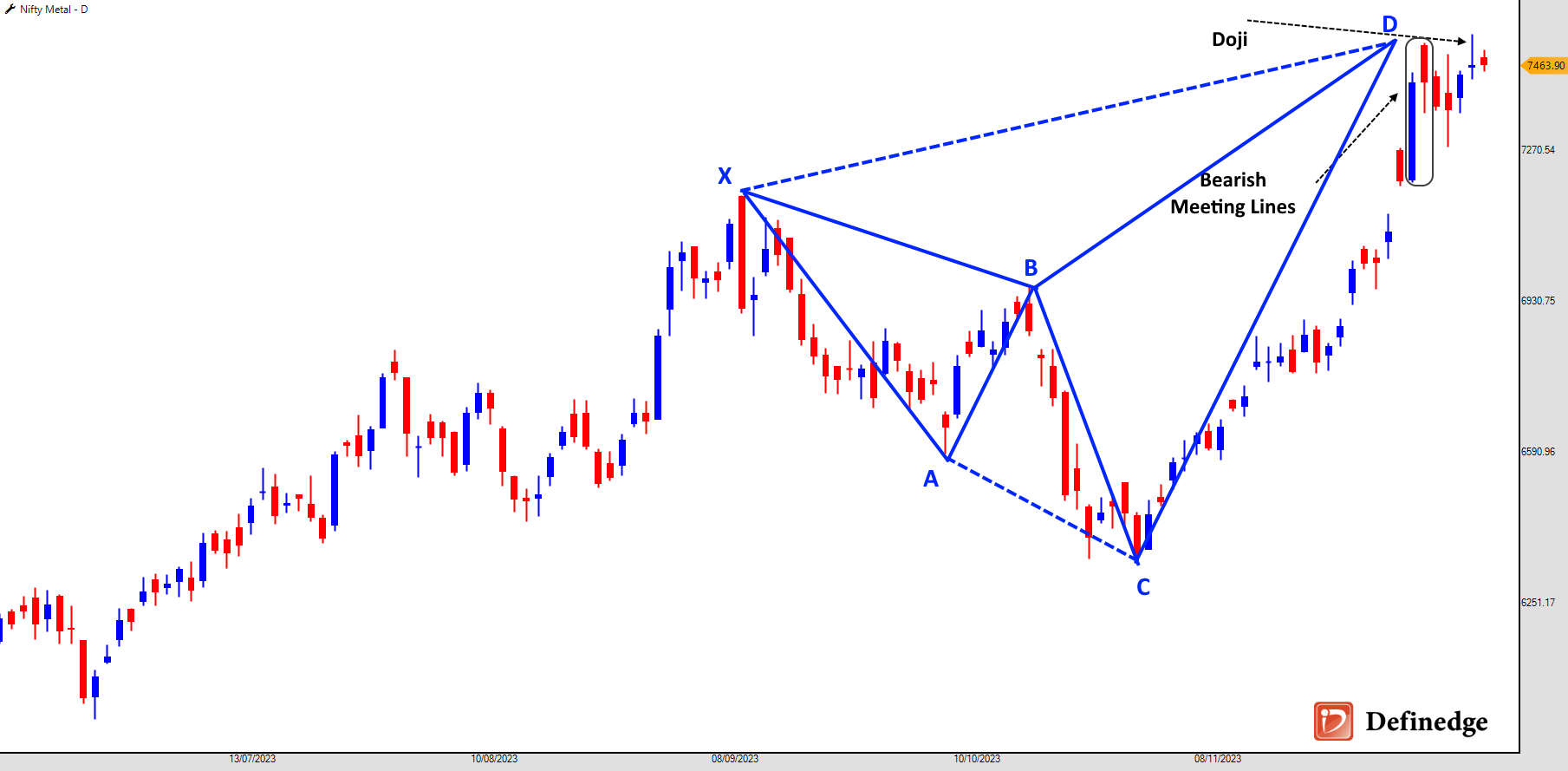

Nifty Metals Index, Daily Chart

Source: TradePoint, Definedge-

Bearish Harmonic Pattern:

A bearish harmonic pattern is visible on the daily chart of the Nifty Metals Index. The bearish harmonic pattern indicates a potential reversal in the ongoing uptrend. The harmonic patterns help to identify key turning points in the market. -

Bearish Meeting Lines Candlestick Pattern:

The bearish meeting lines candlestick pattern is another noteworthy signal on the chart. This pattern occurs when two consecutive candlesticks have almost the same closing prices but differ in their overall trend. In this case, the bearish meeting lines pattern suggests a potential shift in sentiment from bullish to bearish. -

Doji Candlestick Pattern:

The appearance of a Doji candlestick on the chart adds another layer of complexity to the analysis. A Doji occurs when the opening and closing prices are virtually the same, signalling indecision in the market. In the Nifty Metals Index context, the Doji pattern may indicate a struggle between buyers and sellers at the highest levels, potentially heralding a reversal.

To sum up, with the recent bullish run in the Nifty Metals Index, investors must exercise prudence and not blindly follow the crowd. The presence of bearish harmonic patterns, bearish meeting lines candlestick patterns, and Doji candlestick patterns on the daily chart suggest the potential exhaustion of bullish momentum. Traders and investors should consider these technical signals and conduct further research before making investment decisions.

-

-

Please make a teaching video on harmonics