Momentum Investing: Backtesting

-

I have watched recently published podcast of Mr Prashant Shah with Mr Vijay Thakkar on Momentum Investing.

I was aware of the concept and I had already tried to carry out backtesting of the Momentum investing concept in GoogleSheet on Nifty 200 shares. I had pulled daily data of Nifty 200 shares for 8.5+ years with the help of GoogleFinance functions. Although it was done with very limited resources but I could get clear idea of its benefits. But deployment of this concept in live scenario was impossible for obvious reasons.

Mr Shah has thoroughly explained how it can be backtested and implemented in the virtual and thereafter in the real environment. Immediately, I opened account with Definedge.

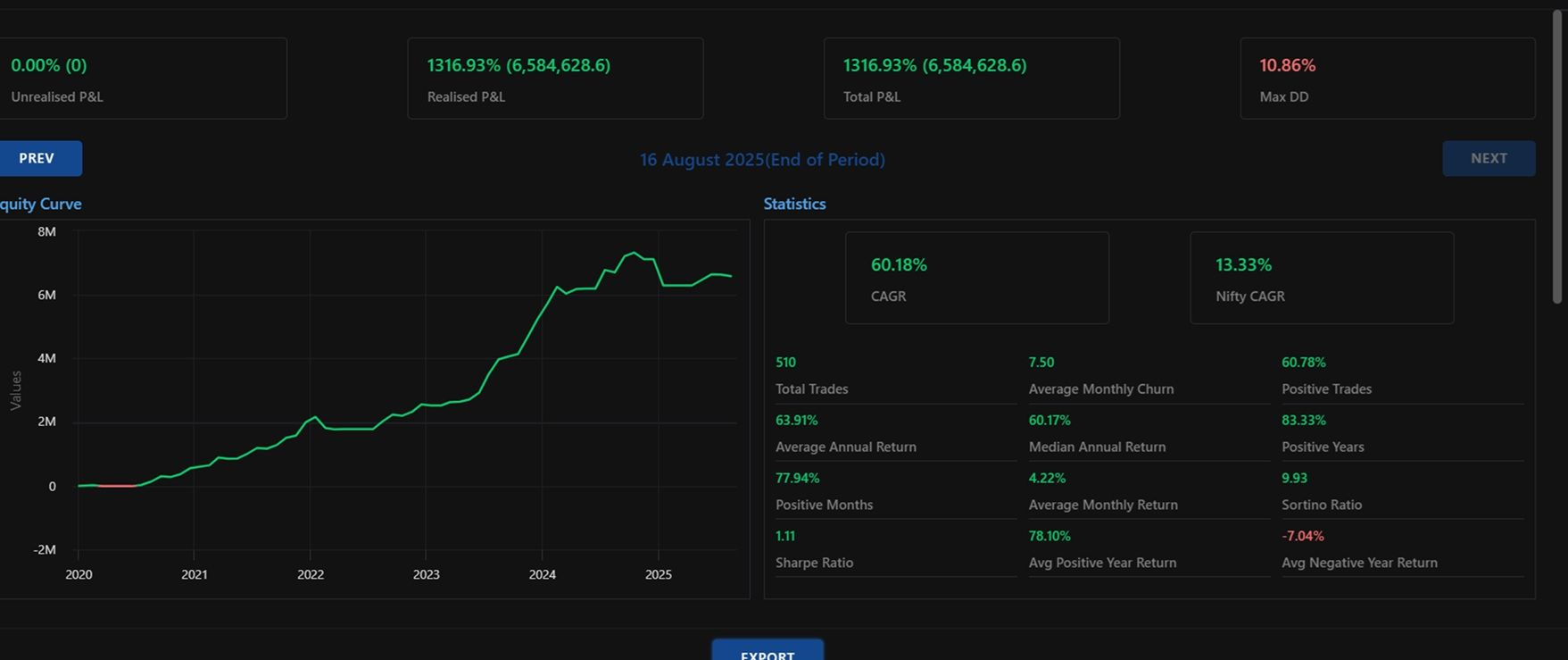

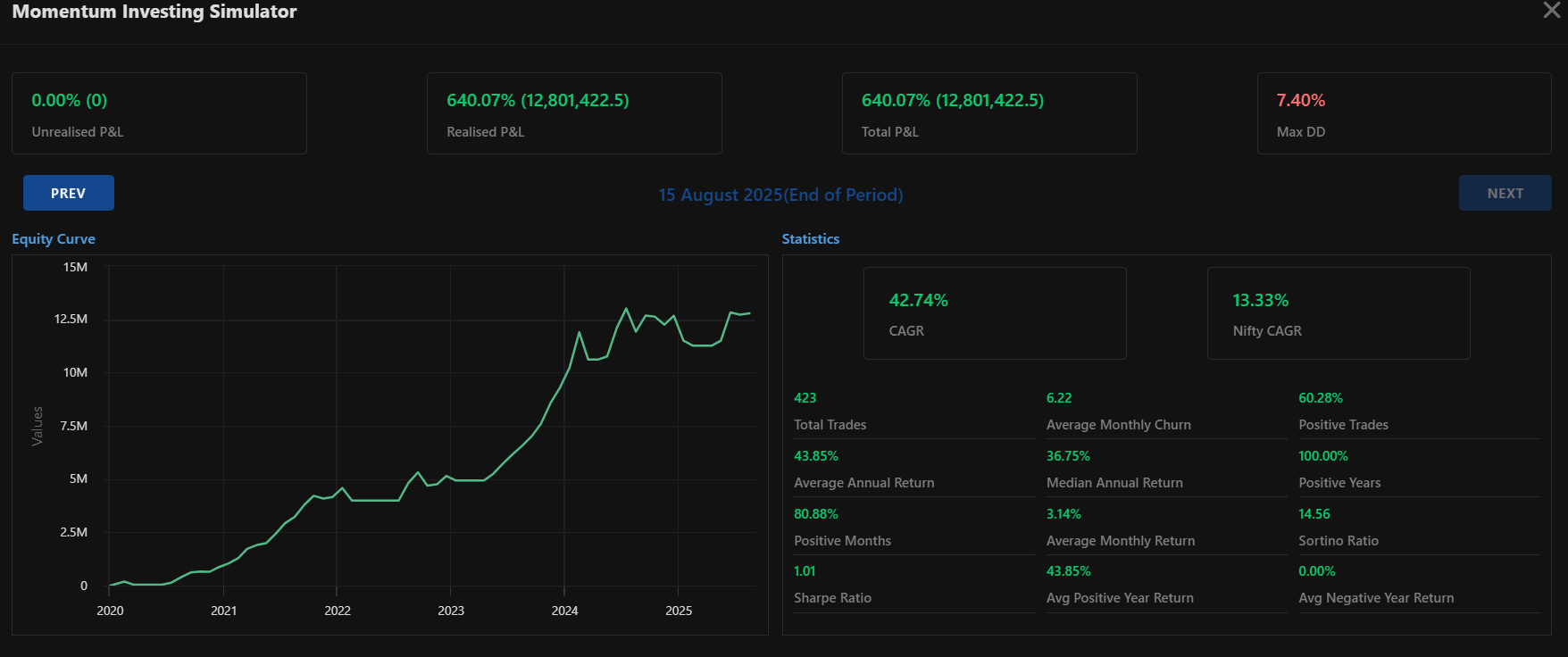

After doing multiple rounds of backtesting on different Nifty group shares I got some very good results. One of the results is attached. CAGR of 60+ is unbelievable. Max DD is 10.86%. I tested the strategy for various periods and got good results.As I am new to this platform and still exploring the features, I want to know that which built-in functions can be used in reducing the drawdowns in real life scenario.

-

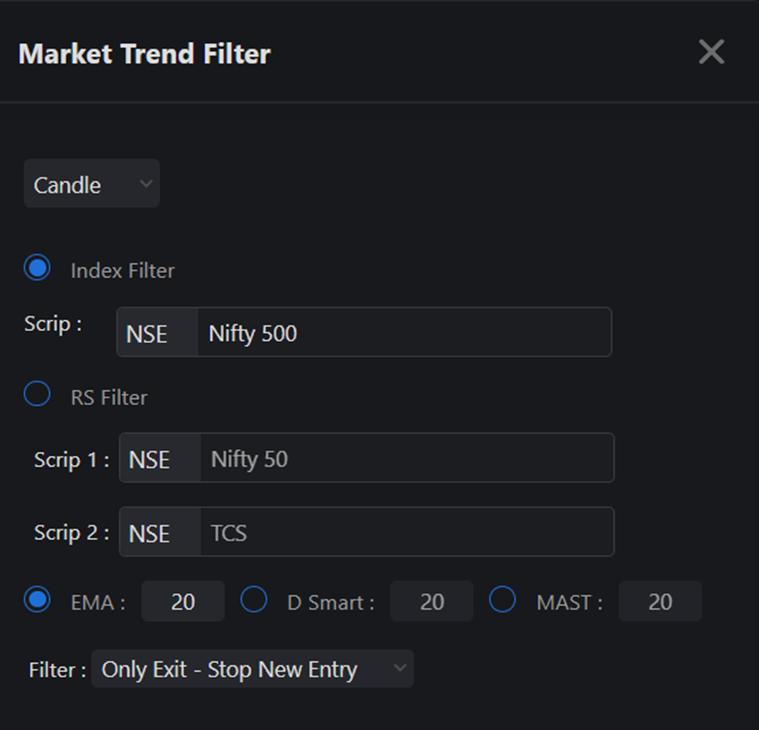

Good work in a short time. The drawdown in your strategy is already under control. You may also explore using a Market Trend Filter to further manage drawdowns.

Please test the strategy results across multiple periods and on different groups. It is acceptable if the CAGR reduces slightly, but ensure you check it during bearish market phases as well as on a broader universe like the Nifty 500 index.

For deeper understanding, you can refer to my book on Momentum Investing or watch the videos available in the Learn section of Momentify.

Regards,

Prashant -

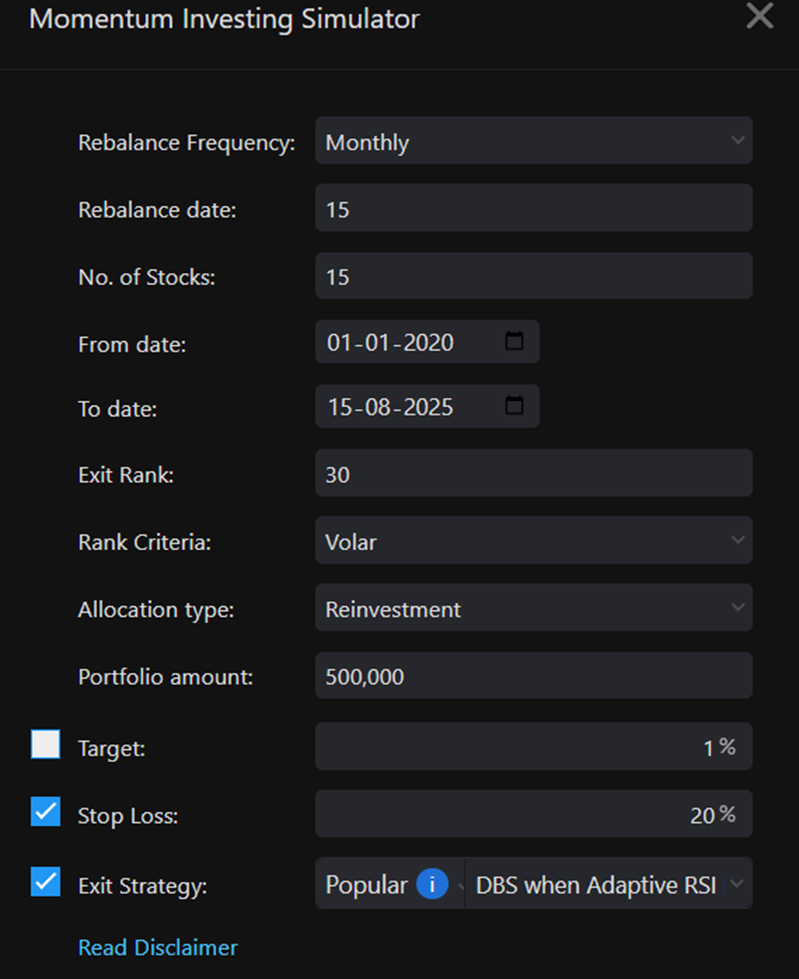

Hi Rajendraji, I am eager to know, how the CAGR is attained taking base Group as Nifty 200... The Highest CAGR i found at 53% when i back tested with Nifty Midcap, 25% retracenebt from 52 Week High, with 20 DSmart, Keep stocks- No new entry and monthly rebalancing, 12 stocks and 24 Exit Rank.. Can you please explain, how the 60% CAGR is attained with 60% positive trades..

-

Hi Rajendra ji, I could see 53 % CAGR with Nifty Midcap, with specification like in market trend D Smart 20, Keep stocks, 12-24 stocks and exit rank, monthly rebalancing. I could see onky 37% CAGR in Nifty 200..

Could you please share the specific parameters or criteria you used while back-testing this impressive 60% CAGR strategy in Nifty 200?.

-

Sir, I could get CAGR of 53% in Nifty midcap over 5 yr period. Could you please show the specifications how the 60% CAGR attained.

-

@Rajendra Manke

Hello Sir, congratulations on achieving such low Max DD figure in your strategy. If you could please share the parameters set to achieve such low Max DD, it would be very helpful. Thank you. -

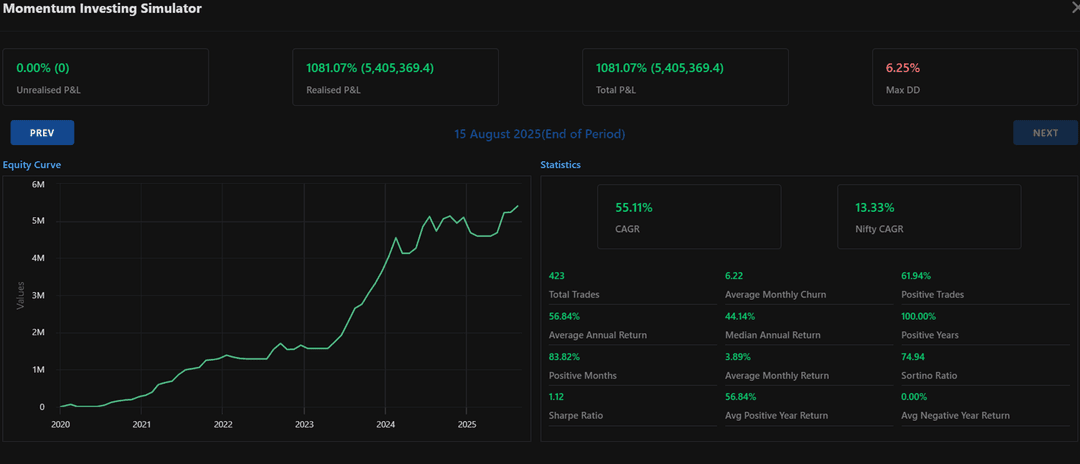

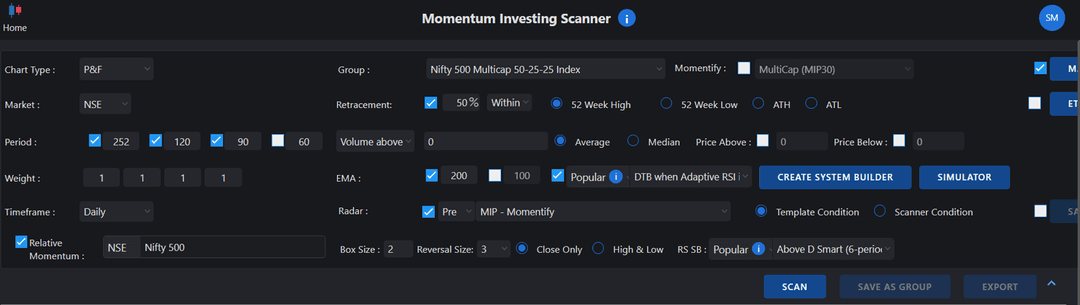

This backtest was done in the month of Aug but now the same parameters are not giving such results. I am giving result of one more backtest. You can try/modify.

While the back tests suggest the possibility of substantial gains—running into crores of rupees—there is no guarantee that markets will behave in exactly the same way in the future. Performance may improve, or it may deteriorate. More crucial than the projected gains is our psychological preparedness: Are we truly ready to remain invested for the duration assumed in these back tests? How will we react when faced with such huge potential profits? At present, many of us may be comfortable investing ₹20,000–25,000 in a single stock. But when the situation demands an allocation of ₹4–5 lakhs in one company, the psychological challenge could be significant.

Therefore, our focus should be on adapting these strategies to minimize drawdowns, as initial losses can easily undermine confidence.

-

@Rajendra Manke these are excellent results sir, and I hope its profitable for you. Your maximum draw down is already under control.

I need to learn P&F now in order to understand how this strategy works.

thanks for sharing -

great insight rajendra bhai, hope you keep posting more insights and make this thread more valuable, will try to post insights too

-

Just for information : group selection- https://forum.definedgesecurities.com/topic/3638/nifty-500-vs-nifty-500-multicap-50-25-25

-

@Saju Raj

Thanks for highlighting this. I had similar concerns about the backward maintenance of the list. I had even checked with support earlier and was advised to go ahead and use it for backtesting—so this clarification is important.I also asked how MIP–Momentify outputs would flow into Momentify Investments, especially whether they refresh on every rebalancing date. I was told they remain static, which seems logically incorrect and makes it inconsistent.

Another observation: the Radar scanner allows filtering by recent quarterly results, but this preference isn’t saved when the scanner query is saved. Because of that, it’s unclear whether, on a rebalancing date in Momentify Investing, Radar actually considers only those companies that have declared their recent quarterly results.

Additionally, the system currently doesn’t allow the Nifty 750 list (Nifty 500 + Nifty Microcap 250) in the Momentum Investing Scanner, even though the same list is allowed in Momentum Trading Backtesting.

@Prashant-Shah

These points are not criticisms of the Definedge team—your team is working hard and continuously improving the platform. I’m just sharing these inconsistencies so they can be addressed going forward. -

@Saju-Raj thanks for bringing this up. I spent some time on the weekend on the strategy shared, and was wondering why results on the Nifty 500 Multicap 50-25-25 were so different than the regular Nifty 500 group - the stocks should be the same. This explains it.

@Prashant-Shah

Since all the different groups and indices are available for backtesting, Please could the team do 1 of the below options- allow only the groups which are free of survivorship bias for backtesting

- share a list of all the groups which are free of survivorship bias so that users can select accordingly.

This will help members backtest on correct data, otherwise they will be misled by the results.

-

@Saju-Raj & @Rajendra-Manke

I ran the same parameters on Nifty 500 group. Posting the results below so all who're viewing this thread get the correct backtest results.Its still a very good strategy, with a controlled drawdown, just not as good as with the Nifty 500 Multicap group. Needs to be tested in different periods though, longer periods as well.

Longer period backtests result in significantly higher drawdowns of 20%+.

-

@Rajendra Manke Nifty 750 list in Investing scanner is probably Nifty Total Market, which is the common name for that index

-

@Rajendra Manke

You r absolutely correct Rajendra Sir. Focus must be on keeping the DD as low as possible. Many thanks for sharing these parameters and giving an insight into this strategy. I was trying with candlesticks but wil now try P&F as well. Thank you. -

@Prashant Shah

is Max DD of 25-32 for return of 150-450% on Total PNL considered good? (period 4-6 years) -

@NISHIT GALA

Instead of asking others, ask yourself how much loss you can tolerate on a single position.

Muthoot Finance | #VGM Setup Update

Muthoot Finance | #VGM Setup Update