KK's Corner - Simple Santa Strategy - Revised

-

Here is a simple strategy to identify stocks that are relatively strong and worthy enough to look for an entry going forward. This strategy is suitable for someone who wishes to do very short-term swing trades with a holding period of few days to a couple of weeks or so.

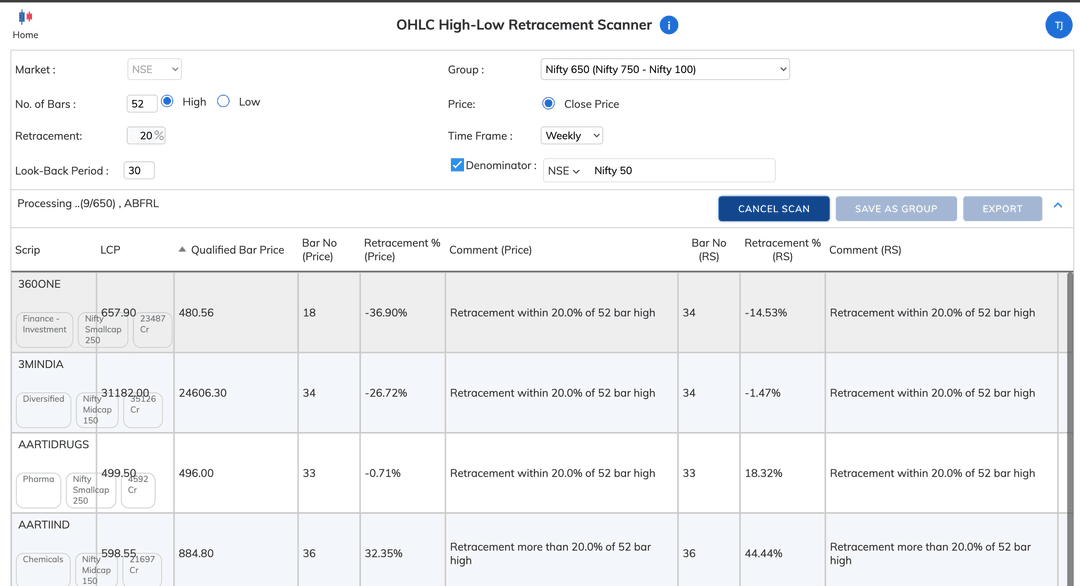

The first step is to identify candidates that have hit a 52-week high in ratio chart at any time x-days ago. The “X” here could be 10-days, 15-days, or 20-days look back. You can use the High-Low Retracement Scanner in RZone to shortlist stocks that have hit a 52-week high in the ratio chart at anytime x-days ago. For our example, I am looking for all candidates that hit 52-week high in ratio charts at any time 30-days ago.

I filtered the stocks that hit 52-week high somewhere between the last 10-35 days. Again, feel free to experiment with different look back periods. There were 178 stocks that qualified from the Nifty 650 universe, and I imported this list into RZone.

From this new group of 178-stocks, I am now looking for those where price has been consolidating / correcting in the last 10-days so that disparity index is not elevated. Basically, I am looking for candidates that are not too overbought in relation to their 10-day EMA & 20-day EMA. Remember, we are focusing on an ultra-short-term swing strategy here.

I have created scanner called “10-20 EMA Dec.23” which is listed in public domain. Four stocks qualified in this scanner. The qualified stocks were Eclerx, Sequent, Ajanta Phama & Welent. You can choose to buy the stocks at current price provided the risk is affordable. Have a stop loss below the most recent low. Use the 10-EMA as your trailing stop loss going forward. Exit 1/3 rd quantity at 1:2 risk-reward and trail the rest using 10-day EMA as your trailing stop loss.

Alternatively, you can run any of your favourite entry scanner in the universe of 171-stocks and look for entry opportunities. For instance, you can use the Momentum Entry New scanner in 0.5% Renko chart with the recent swing low being the initial stop loss. Switch to D-SMART in 0.5% once the D-SMART crosses your entry price.

You can do this exercise over the weekend to generate list of stocks to focus for the upcoming week. Run the 10-20 EMA Dec.23 scanner after the market close every day to look for fresh entry candidates for the next day.

I am just giving some broad ideas here. You can fine tune the parameters & entry conditions based on your preference. Hope this helps.

PS: Another important concept that I missed out highlighting earlier is that this strategy is relevant only in a bullish market where the broader market is outperforming the Nifty 50 index. Do not try this out when Nifty 50 index is not in an uptrend. -

sir few questions. 1) when using the high low retracement what % should we keep? 2) while running the 10-20 ema we should use daily time frame or weekly?

-

is this correct scanner/settings sir?

-

Thanks for the detailed writeup sir

-

Weekly Once

High Low momentum Scanner

Time Frame: Daily

No.of Bars: 250

Look back: 0Scan

Choose RS Bar: 10 Days to 35 Days

Save as a groupDaily Once:

Run Price Scanner : 10-20 EMA Dec.23 Time Frame: Daily -

@RAGUNATH_AG thank you sir

-

@Tapan Jani Use the daily time frame. Again, feel free to use any other entry method you may deem fit.