The Moral Greeks – A Complete Ethical & Psychological Compass for the Short Straddle Intraday Trader

The Moral Greeks – A Complete Ethical & Psychological Compass for the Short Straddle Intraday Trader

-

The Moral Greeks – A Complete Ethical & Psychological Compass for the Short Straddle Intraday Trader

The Moral Greeks – A Complete Ethical & Psychological Compass for the Short Straddle Intraday Trader(When Market Math Meets Moral Mindset)

Introduction – When Numbers Find Their Soul

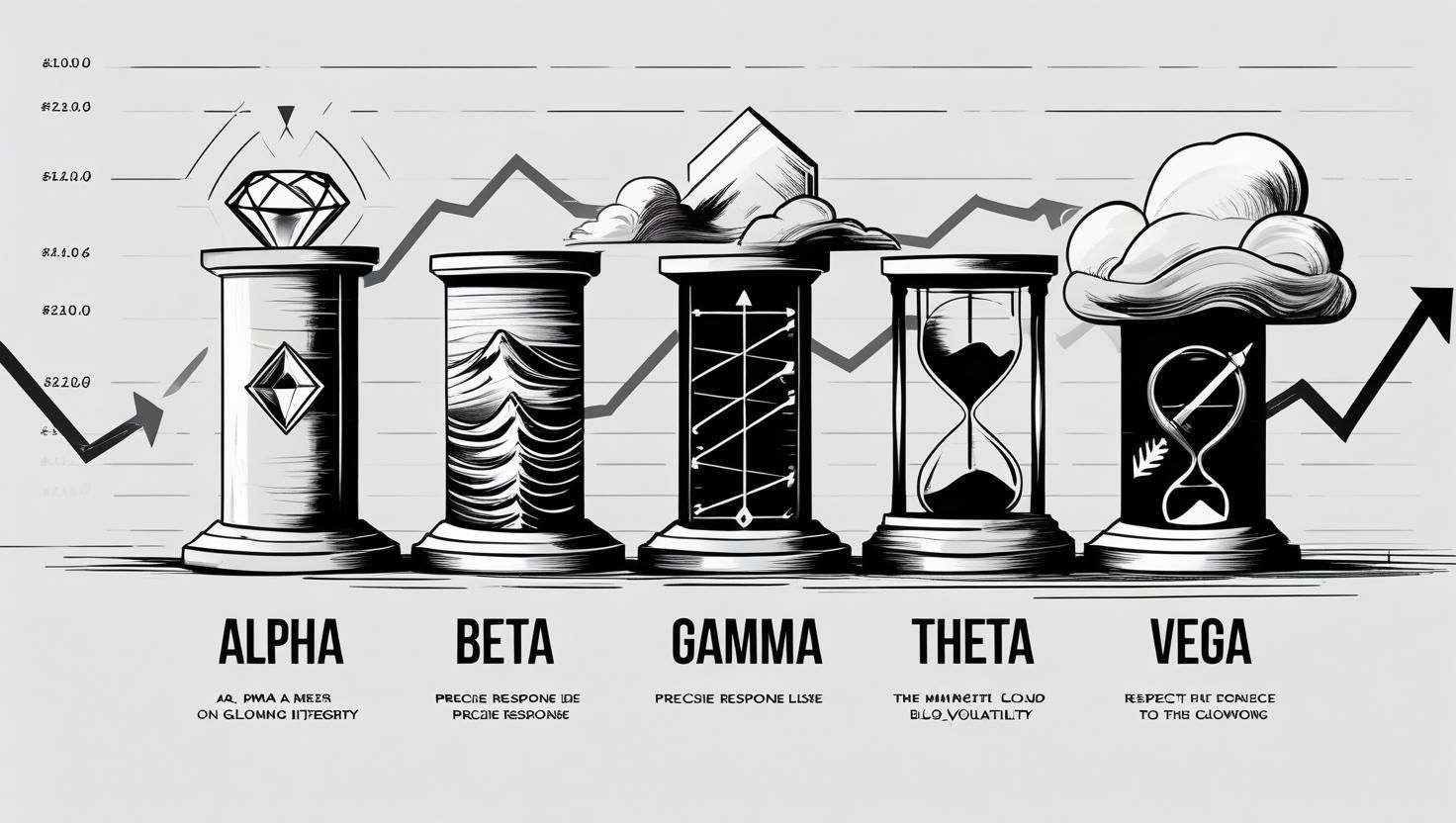

Introduction – When Numbers Find Their SoulIn options trading, we live and breathe the Greeks — Alpha, Beta, Gamma, Theta, Vega.

They measure returns, sensitivity, time decay, and volatility risk. But the market is not just a place of numbers — it is a stage where discipline, emotions, and ethics play out every second.For a short straddle intraday trader, the game is not about chasing jackpots — it’s about controlled premium decay, precise execution, and risk survival.

That’s where the Moral Greeks come in — a way to see the technical Greeks through an ethical and psychological lens.Think of them as your inner compass:

Technical Precision + 🧭 Moral Discipline + 🧠 Psychological Control

Technical Precision + 🧭 Moral Discipline + 🧠 Psychological Control

️ The Moral Greeks – Core Meanings & Expanded Wisdom

️ The Moral Greeks – Core Meanings & Expanded Wisdom

1️⃣ Alpha – The Edge of Integrity

- Technical: Alpha is the excess return you generate over a benchmark.

- Ethical: In trading morality, Alpha is your moral surplus — the decision to take only the trades that fit your setup, even when greed tempts you to break the rules.

- Psychological: Alpha is your truth advantage — the courage to admit you’re wrong and exit quickly without ego.

Straddle Example: You have a rule to sell strikes 200± points from spot. Market feels slow. Your mind whispers, “Come closer for more premium.” Alpha says — No.

Straddle Example: You have a rule to sell strikes 200± points from spot. Market feels slow. Your mind whispers, “Come closer for more premium.” Alpha says — No.Mantra: “My Alpha is born from my clarity and my honesty.”

2️⃣ Beta – The Edge of Alignment

- Technical: Beta measures sensitivity to market movement.

- Ethical: In moral terms, Beta is moral adaptability — the wisdom to align with changing conditions without losing your identity as a trader.

- Psychological: Beta is your emotional correlation — knowing the market’s mood without becoming its puppet.

Straddle Example: A quiet market with low IV? You sit tight, let decay work. Suddenly IV spikes on news? You trim your lot size — not because of panic, but because you’re aligned with new reality.

Straddle Example: A quiet market with low IV? You sit tight, let decay work. Suddenly IV spikes on news? You trim your lot size — not because of panic, but because you’re aligned with new reality.Mantra: “I align with the market’s rhythm, but I am not its puppet.”

3️⃣ Gamma – The Edge of Response

- Technical: Gamma is the rate of change of Delta — how quickly your position’s sensitivity changes.

- Ethical: Gamma is responsible adaptability — you adjust only when the truth changes, not because fear screams in your ear.

- Psychological: Gamma is mental agility — the ability to respond with clarity, not react in chaos.

Straddle Example: NIFTY breaks VWAP with strong volume — your plan says exit one leg. You act instantly. But a single 5-point flicker? You stay calm. That’s moral Gamma.

Straddle Example: NIFTY breaks VWAP with strong volume — your plan says exit one leg. You act instantly. But a single 5-point flicker? You stay calm. That’s moral Gamma.Mantra: “I respond, I don’t react.”

4️⃣ Theta – The Edge of Patience

- Technical: Theta measures time decay in options.

- Ethical: Theta is patience dividend — the faith in your edge to let small, consistent decay work in your favor.

- Psychological: Theta is composure in waiting — resisting the urge to close early just because “nothing is happening.”

Straddle Example: Market is calm, IV stable, and your MTM is +₹3000. Your plan says hold for ₹5000. Theta reminds you — time is your ally, not your enemy.

Straddle Example: Market is calm, IV stable, and your MTM is +₹3000. Your plan says hold for ₹5000. Theta reminds you — time is your ally, not your enemy.Mantra: “I let time work for me, not against me.”

️

️

5️⃣ Vega – The Edge of Volatility Respect

️

️- Technical: Vega is sensitivity to implied volatility changes.

- Ethical: Vega is respect for uncertainty — knowing when volatility is too unpredictable for your style.

- Psychological: Vega is calm in chaos — staying centered when market noise rises.

Straddle Example: Budget day. IV is wild. You know this is not your arena. Moral Vega says — Capital saved is capital earned.

Straddle Example: Budget day. IV is wild. You know this is not your arena. Moral Vega says — Capital saved is capital earned.Mantra: “I respect the storm, but I do not fear it.”

️

️

Table 1 – Moral Greeks in Ethical & Psychological Language

Table 1 – Moral Greeks in Ethical & Psychological LanguageGreek Technical Definition Ethical Edge Psychological Edge Pitfall if Unbalanced Alpha Outperformance vs. benchmark Integrity in decision-making Self-honesty in execution Chasing alpha → greed & overtrade Beta Sensitivity to market movements Moral adaptability Emotional stability High beta → market mood puppet Gamma Change rate of Delta (responsiveness) Responsible adaptability Mental agility High gamma → knee-jerk reactions Theta Time decay effect on options Patience dividend Composure in waiting Impatience → premature exits Vega Sensitivity to volatility changes Respect for uncertainty Calm in chaos Ignoring vega → blind to danger

Applying the Moral Greeks to Short Straddle Intraday Trading

Applying the Moral Greeks to Short Straddle Intraday TradingA short straddle intraday trader survives by balancing Theta’s reward and Vega’s risk while keeping Alpha, Beta, and Gamma in harmony.

Here’s how to use them in real market conditions:

Alpha – Integrity in Premium Selling

- Take only planned strike distances & IV setups.

- No “revenge trades” after a stop-loss hit.

Beta – Market Mood Awareness

- Hold strong in a calm, range-bound market.

- Reduce position size when volatility wakes up.

Gamma – Smart Adjustments

- Adjust on predefined triggers (VWAP break, IV spike, volume surge).

- Avoid over-hedging on small random moves.

Theta – Patience for Profitable Decay

- Trust your time advantage — don’t panic close early.

- Understand that flat periods are your income engine.

Vega – Volatility Respect

- Avoid trading in chaotic, news-heavy sessions.

- Remember: survival > action on high-risk days.

Table 2 – The Moral Greeks Compass for Straddle Traders

Table 2 – The Moral Greeks Compass for Straddle TradersGreek Ethical Rule in Straddle Psychological Rule in Straddle Alpha No trade outside plan; steady decay harvesting No jackpot chasing; SL respected Beta Align with market’s tone Avoid over-adjusting on noise Gamma Adjust only on structural change Respond, don’t react Theta Let time work for you Resist impatience Vega Respect high volatility Stay calm in chaos

🧭 One-Line Moral Compass

“My Alpha is my honesty

, my Beta is my balance

, my Beta is my balance  , my Gamma is my graceful adjustment

, my Gamma is my graceful adjustment  , my Theta is my patience

, my Theta is my patience  , and my Vega is my respect for the storm

, and my Vega is my respect for the storm  ️.”

️.”

Conclusion – A Trader’s Silent Code

Conclusion – A Trader’s Silent CodeMarkets will tempt you to abandon your rules. They will bait you with “quick money” and scare you with sudden storms. The Moral Greeks are your shield — guiding you to:

- Trade with integrity (Alpha)

- Adapt with wisdom (Beta)

- Adjust with precision (Gamma)

- Wait with patience (Theta)

- Respect with humility (Vega)

A short straddle intraday trader doesn’t win by predicting every move.

He wins by surviving with discipline, letting time and structure pay him while protecting his capital like a warrior’s life force.