KK's Corner: RS Patterns in Nifty 50 Stocks

-

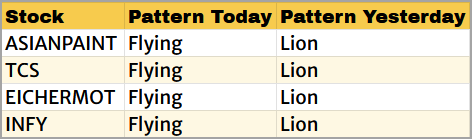

Here is another interesting way to dice the data and identify stocks to focus on, especially for day traders. Here is the table capturing the stocks with Flying RS Pattern today and Lion pattern (another bullish pattern) that was recorded the previous day. Remember, Nifty closed in the red yesterday, but the Lion stocks closed in the green. Have a look at the table given below.

You may recall that there were 18 stocks that qualified as Flying Pattern today. Out of this 18 stocks, four stocks listed above qualified as Lion pattern yesterday.

There were 2 stocks (BPCL, Kotak Bank) that qualified as Flying pattern today and had a Bullish Star Pattern yesterday. The simple conclusion is that if you had focused on the stocks with bullish RS patterns formed yesterday, you could have probably zoned in on the potential trading candidates for today's trading.

Hope this helps.

-

Innovative as usual by KK sir

-

Insightful as always.

-

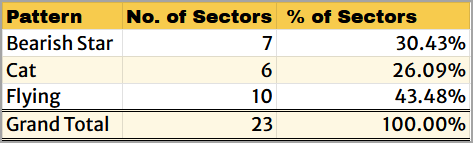

Another update, but with NSE Sectors this time. Here is the Ratio Trend Matrix grouping of the 23-sectors.

Out of the 23-sectors, it is disappointing to note that only 10 sectors or 43.48% of the sectors qualified as Flying pattern, meaning they managed to outperform Nifty 50.

There were 7-sectors qualifying as Bearish Star pattern suggesting that they closed in the green but still underperformed the Nifty 50 index.

And, there were 6-sectors that qualified as Cat pattern, suggesting that they closed in the red even though the Nifty 50 index closed in the green.

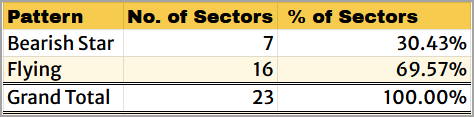

Now, contrast this to the pattern distribution on Friday when Nifty staged a handsome recovery. Here is the pattern distribution for Friday.

We had a much bullish distribution on Friday where 16 out of 23-sectors or close to 70% sectors qualified as Flying pattern, suggesting outperformance. Nice to note that we did not have a Cat pattern on Friday. There were Bearish Star ones but this means these sectors too closed in the green, but underperformed Nifty.

Basically, the data from Friday and today does not evoke confidence about the sustenance of the rally. This could still be a pull back in a downtrend. If you notice the PF-X% breadth, it has not improved a whole lot today. Contrast this to the price & breadth movement at the March 2023 lows.

Hope you get the message. Things can still improve going forward and we may end up hitting new highs. But based on the data till date, such a possibility is not something that appears highly probable.

-

very informative sir

Market Mood Index hits Extreme Fear — Historically a Bottoming Zone

Market Mood Index hits Extreme Fear — Historically a Bottoming Zone