- 17 years Rising Trendline

- 100MEMA

Pro User

@Guru Kumar We have forwarded the query to our tech team. Please allow us some time to resolve.

@Santosh C Will update regarding the same.

@Akash Feedback appreciated. Will convey it to the team.

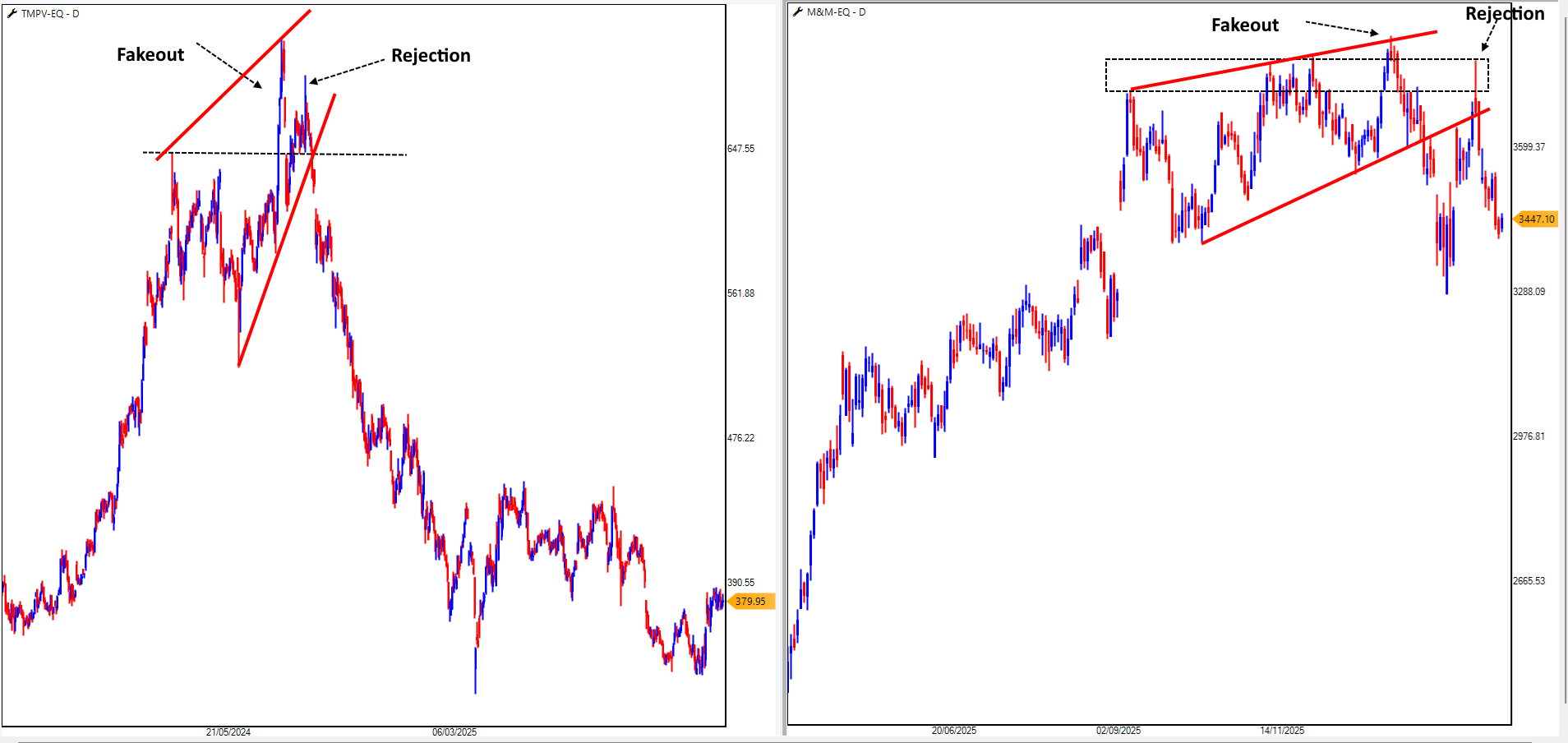

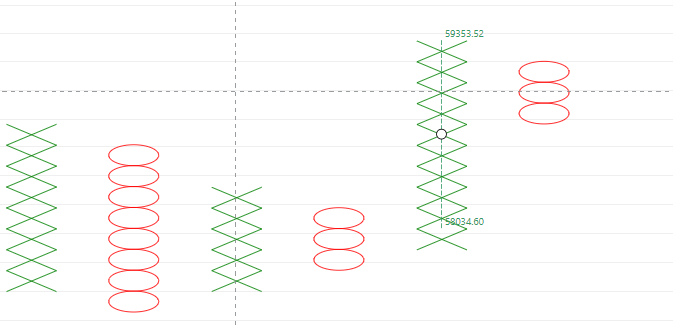

The charts reveal a textbook case of institutional distribution in TataMotors and M&M.

In #TataMotors, the 2024-2025 period saw a classic Bearish Rising Wedge formation. As the wedge tightened at the ₹620–₹700 range (demerger adjusted), we witnessed a final Blow-off Top (Fakeout), a move designed to trap breakout buyers before a sharp Rejection confirmed the trend reversal.

The result? A massive ~50% correction from the highs.

History Repeating in #M&M?

We are now seeing a remarkably similar structure unfolding in #M&M. The price action is mimicking the same exhaustion signals that preceded the Tata Motors crash:

1.The Bearish Wedge: Narrowing price action indicating diminishing buying momentum.

2. The Fakeout: A spike above resistance to hunt liquidity.

3.The Rejection: A swift move back into the wedge, signaling that the "Smart Money" is exiting.

If #M&M follows the result of #TataMotors, we know the answer now.

#KeepItSimple

@Vinubhai Patel Dear Sir,

We would like to inform you that our systems undergo daily trade and position updates early each morning following the late-night receipt of trade files from the Exchange.

Because of ongoing OMS server processing, you might notice some data inconsistencies between 6:00 AM and 7:30 AM. We recommend checking your account after this period for the most accurate information.

You can use the CUTTING AVERAGE for the strategy.

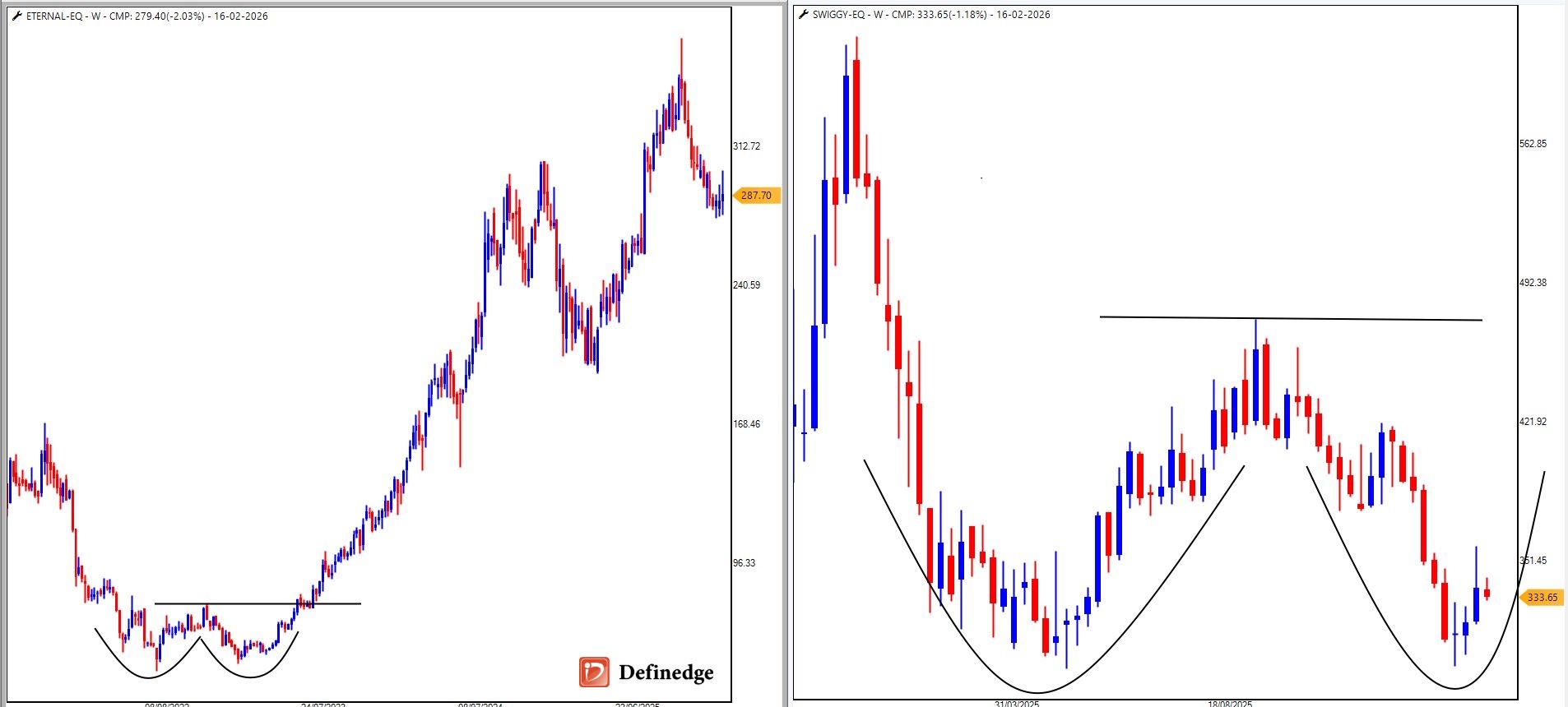

If you missed the Zomato rally after its 2023 double bottom, you might want to keep your eyes on the Swiggy chart right now.

Right Click on the TradePoint icon and go to the Path. You will find the MyMkt folder. PLace the excel file there.

Open the chart and select MyMkt and you will find the stock data.

In case you don't find, you can connect with our customer care.

@Atul-Bansal Sir it is incorrect. You have to filter the stocks that are trading within the 10% of the range of 52-Week High for Longs and 52-Week Low for shorts.

As I can see, you are backtesting IRCTC for Long which is at 52W Low.

Currently we don't have that feature. We appreciate your feedback and let us analyse the feasibility.

As per SEBI rules, 2-Factor Authentication (2FA) is mandatory for logging into trading and demat accounts. A PIN alone is considered a single-factor authentication and is therefore not permitted.

Biometric login is allowed as it works along with device-level security and registered credentials, fulfilling the 2FA requirement. For devices that do not support biometrics, login via password/OTP is provided to ensure compliance and account safety.

@Atul-Bansal @Paresh-Topiwala The scanner is available in the RZone. Check the image below.

@Somu R We appreciate your feedback and have communicated it to the team. Let us check the feasibility before we assure.

@Guru-Kumar We have upgraded our servers on the weekend and that may be the reason you are experiencing the issue on weekends. We always believe in offering the best experience and would request you to check it for a week or so. If the problem persists, you can get in touch with us.

@Ashok Prasun Sir, are you talking about the Laidback strategy?

@Aadil Shaikh Yes sir.

The US-India trade deal reshapes market sentiment, boosts foreign inflows, and opens opportunities across exports, technology, manufacturing, and defence, guiding traders and investors on short, medium, and long-term positioning.

@Vandana Joshi Can you plz DM your client code. Our team will connect with you over a call.

@Abhi Trader Can you plz DM the client code. Our team will connect with you.

@Abhi-Trader We appreciate the post from you. Can you post the period (Start and End date) for the actual backtesting? It will be easy for our team to check.

@Abhi-Trader @Manigopal-Vutla @Vandana-Joshi Please note that the backtesting considers closing prices, but we always recommend to entry at the 3:15pm for the entry day, as they are close to the day's price (as 15mins average are near to the entry).

DXY is hovering at the long-term support area. The rising DXY will have a negative impact on Gold & Silver.

Join me at 7pm to discuss about the Commodity Trend. [Register here](https://i.definedge.in/gsbb30)

Regarding the exit strategy, how will the system decide which candle low?

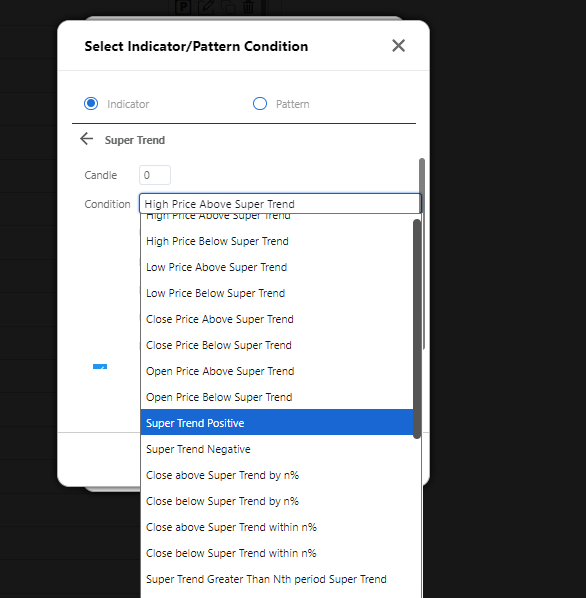

Regarding Super Trend turned Positive, there is a criterai in the system builder.

Add Super Trend turned Positive at 1 and add High above the Previous Bar from the system builder.

Can you please share the sample image.

Thank you for taking the time to share such detailed feedback on the issues and blockers. We truly appreciate the effort and clarity with which you have highlighted the challenges. Such inputs help us improve the platform experience for everyone.

At Definedge, providing the greatest experience and ensuring that issues are handled in an organised and efficient manner while preserving the system's stability and functionality are our top priorities.

@Vinubhai Patel You can create the scanner in the system builder.

You need to update the stocks group daily.

The scanner are perfect.

@Jatin Patel Following Monday of the Bullish Weekly Candle. If its daily, at the opening of the next day.

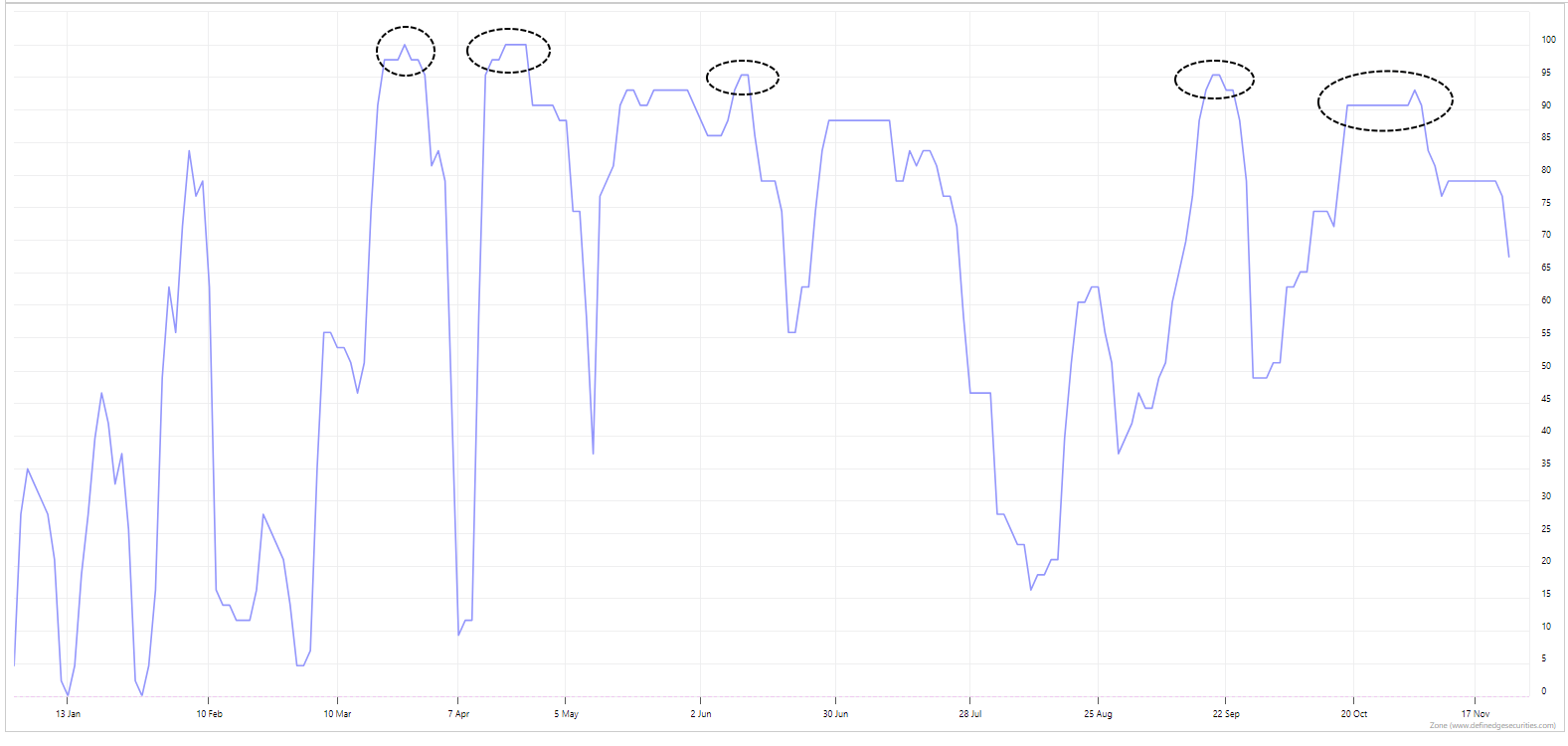

What traders need to accept now is that 45 out of 46 sectoral indices are in negative RSI territory. Let us keep the charts aside because if I post the chart, the reader may analyse as per his knowledge and concludes the view.

According to the most recent RSI levels on the daily Heikin Ashi chart of 46 sectoral indices, 45 sectors have an RSI structure that is lower than their RSI averages. Only one sector, PSU Banks, has a new RSI crossover that is positive. Take a moment to think about that.

Read article here: https://www.definedgesecurities.com/blog/education/not-a-crash-not-a-rally-just-a-warning/

@Prashant Jaiswal Yes, you are right.

You can watch this video if you have any doubts.

https://www.youtube.com/watch?v=2dzubtUxp9o

@Hiral-Mehta-176456257495 Negative crossover on MACD above the Zero Line may indicate a pause to bullish momentum.

The follow-up can be a retracement or reversal, which will be confirmed as the price move unfolds. For bulls, this can be a profit-booking setup.

@Vinubhai Patel We appreciate your feedback. Let us check how we can implement it seamlessly.

@Prashant Jaiswal The Andrew Cardwell RSI Range Shift concept will be the same on the OHLC, P&F, Heikin Ashi, Renko or any other chart form.

The difference between the various charting methods will be in the RSI calculations, but the range shift theory based on the RSI levels will remain constant for all.

@Vinubhai Patel You can scan the Super Pattern or Anchor Column Follow Through pattern for the Flag and Pennant in the P&F scanner.

For Triangle, there is a Triangle scanner in P&F.

For Rectangle, you can scan Triple Top or Quadruple.

NSE has discontinued USDINR Futures, so you can't find the chart now.

@Smit K Thanks for highlighting. Our team is working on the changes, and soon we may release them in the next update.

@SANTOSH CHOUDHARI Plz allow us some weeks.

@Smit K Let us check with the team.

@Akash sure we will update it.

@Anuj Mehta Request you to watch this video for create system using System Builder

@SANTOSH CHOUDHARI Let me check Santoshji.

I work from Mumbai office

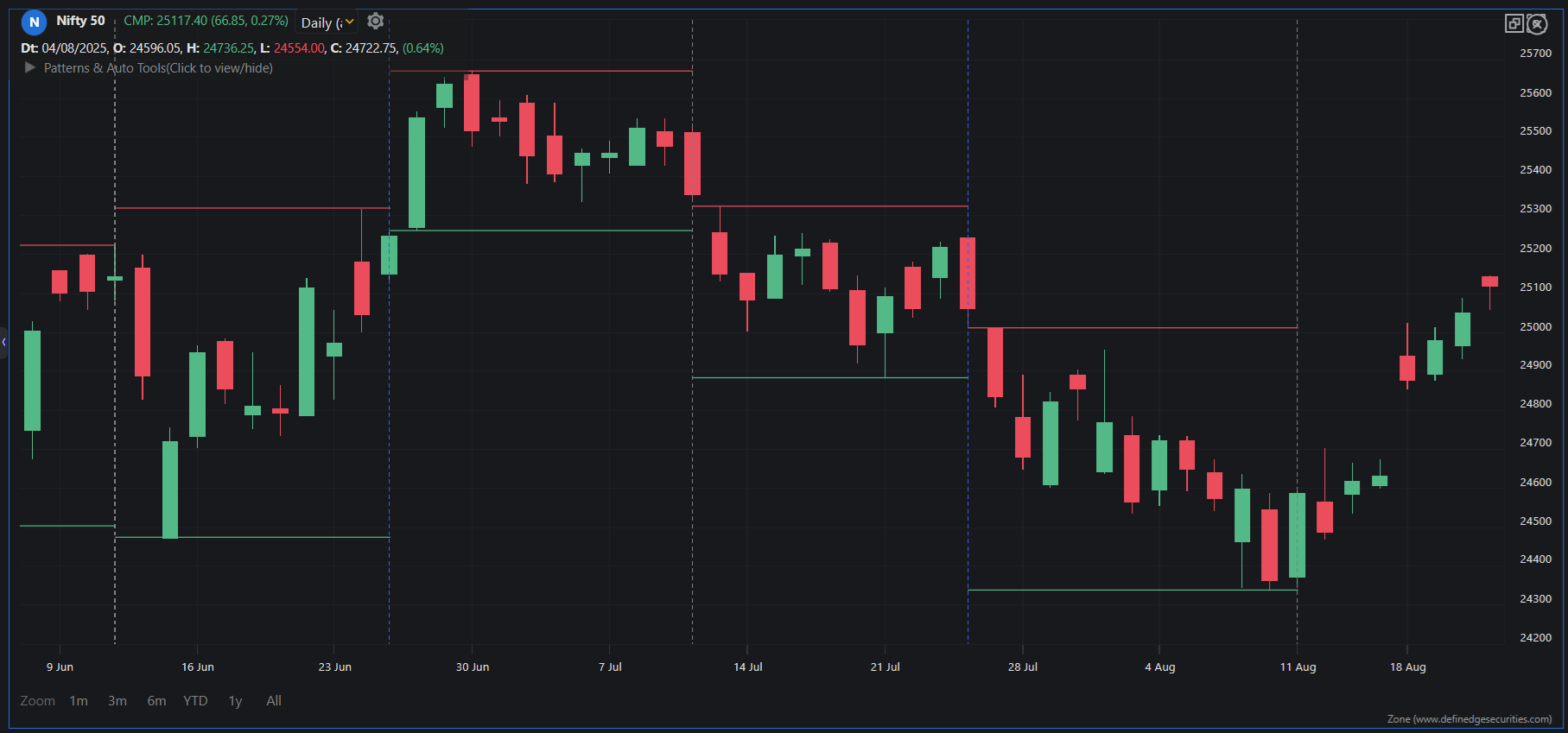

The Nifty is managing to hold on to the higher levels, but the broader market is clearly feeling the heat from the bears.

The 50-day Exponential Moving Average (DEMA) is acting as a crucial support zone, with the index hovering right around it.

However, the bigger worry for the bulls lies in the Bearish Range Shift on the RSI. Although some might argue for the Positive Reversal theory, but this theory would come in the picture if the price action convincingly reversed. As of now, that confirmation is still missing.

@SANTOSH CHOUDHARI Do you mean Stan Weinstein’s Stage Analysis?

@SANTOSH CHOUDHARI SIr, what is your basis for comparing the stocks with others using OHLC in the Dynamic Ultimate Matrix that will help you make the decision?

We need to understand whether that is workable in deciding a trade.

Rise with clarity as the Nifty Analysis feature on Definedge Zone blends setups, breadth, and pattern insights to illuminate the path for every trader.

https://www.definedgesecurities.com/blog/products/nifty-analysis-on-the-move-in-one-screen/

@Deepakk Chabria Uppar le jane mein mehnat karte hai sir

I have forwarded the issue to the concern team. Please allow us some time to check and revert.

You can start with the Basics of Candlestick and Point & Figure courses, practise them and then move to advanced-level courses on Gurukul.

Incase you have any doubts, you can ping me.

Sir you can select the strategy or pattern or indicators based on the charting method and scan the systems as per your requirement.

You can also check our YouTube videos based on Options by Abhijit Phatak and Raghunath Reddy.

Can you guyz explain the structure in detail and let me check.

Can you provide a detailed explanation of the conditions, @Akash?

You can also connect with our support team for the conditions.

Scan the Dynamic Ultimate Matrix to spot leaders, filter laggards, and compare stocks with their peers. A simple, humanised guide for Indian traders.

https://www.definedgesecurities.com/blog/education/when-data-learns-to-talk-dynamic-ultimate-matrix/

A concerning technical structure where the NSE All Sectors market breadth is consistently forming lower highs. This divergence suggests that despite the allure of recent prices near 52-week highs for Nifty50, the market may set a bull trap, enticing optimistic buyers into a rally that actually lacks broad-based participation.

As the slope of the breadth indicator heads south, it reveals a deterioration in the internal market strength. This weakening foundation is likely to excite the bears, as the fading momentum signals a shift in control that could precipitate a broader correction.

Sure. Our team will connect with you soon.

Feedback Appreciated!

Hi Sir, there are no discounts available right now. However, the courses are worth every penny because of the immense knowledge and value they offer.

@Akash

Count Retracement Breakout (CRB) tool is a new addition to the Point & Figure charting method. Often, a strong trend is difficult to trade with an affordable stop-loss. However, what if there were a tool that showed the retracement and breakout levels at the current trend levels.

Biggest Anchor Levels are plotted on the chart for easy identification of Anchor Follow Through levels (Breakout Levels).

Scan Breakout across Candlestick, P&F, Renko, Line Break and Kagi charts at one place in BREAKOUT SCANNER. Spot bullish and bearish breakouts faster, trade smarter, and gain the edge every trader deserves.

@Vishal Shah It is available only on Zone Mobile.

41 out of 500 stocks in Nifty500 had a Open=High structure ....What are your thoughts?

Every trader carries a secret desire in the heart – to be early in a trend that eventually becomes a headline.

Are you one of them?

Why Trends Begin With Sectors, Not Stocks....

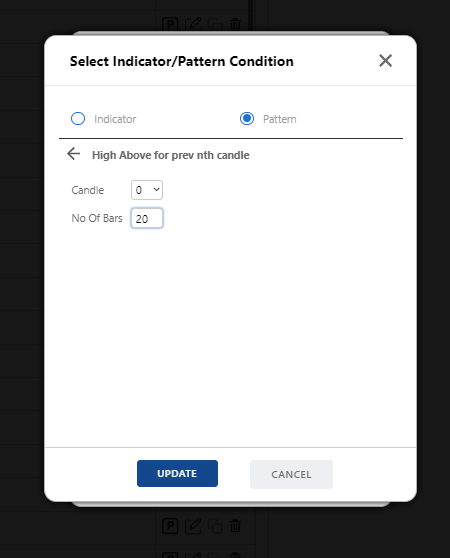

@Akash If you are trading X Bar High Breakout or X Bars Low Breakout, you will get the same pattern under OHLC Scanner.

You can change the number of bars according to your requirements.

@Viswanath B You can go to Stocks Group > Grop Manager in RZone and overwrite or upload new group.

@OMESH YADAV Omeshji, Master Scanner helps to filter the stock if you are using multiple scanners to filter down the stocks.

Regarding the values, checkout this blog [https://www.definedgesecurities.com/blog/education/when-cricket-meets-charts-syncing-eden-gardens-pitch-with-the-stock-market-pitch/]

@Akash Aakashji can you explain in detail about the pattern?

You can DM me your number, will connect with you.

@MITESH HUF SHAH Appreciate your feedback. We will consider it in the list of features to be added.

@Radhakanta Samantara Our clients are the driving force behind everything we do at Definedge, and it's Free for Definedge Demat account holders.

@Bhaavin Ashar I have forwarded it to the concerned team. Please be patient, as our tech teams will review the issue.

Trade with clarity, not guesswork. Spot the truth behind every price move.

With Volume Spread Analysis, learn to identify strength, weakness, and smart accumulation.

Enroll FREE on Definedge Gurukul, exclusive to Definedge Securities demat holders!

https://gurukul.definedgesecurities.com/courses/master-volume-spread-analysis-vsa/

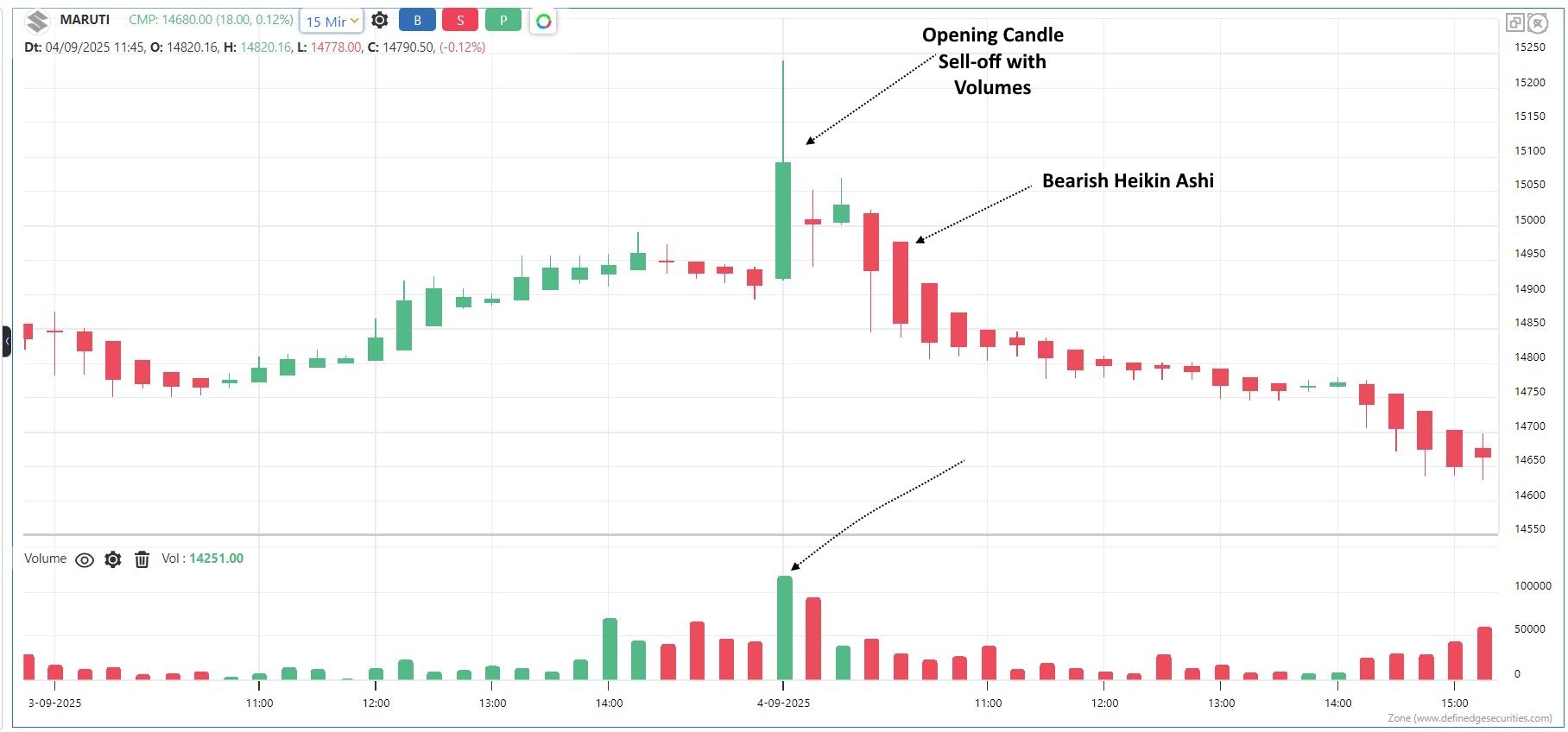

Dalal Street opened on an optimistic note as the Goods and Services Tax (GST) announcements fueled excitement across sectors. The Nifty opened higher yesterday, signalling positive sentiment. However, the real lesson for Indian stock market traders lies not just in the numbers, but in the psychology of “buy the rumor, sell the news.”

In trading psychology, “buy the rumor, sell the news” is a common phenomenon where investors build positions ahead of an anticipated event, such as a policy change, corporate result, or government announcement.

For Indian traders, GST revisions provide a textbook example of this strategy.

GST Buzz and the Auto Sector Rally

Ahead of the GST announcement, there was strong buzz around a possible tax reduction in the automobile sector. Anticipating positive reforms, traders and investors aggressively bought into auto stocks.

• Maruti Suzuki surged in the run-up but fell 4% from its high once the news became official.

• Bajaj Auto declined nearly 3% from the top levels.

• Tata Motors also gave up about 3% after the announcement.

This reaction highlights how expectations are often priced in well before the official confirmation.

Why Do Stocks Fall After Positive News?

Key Lessons for Indian Stock Market Traders

Here is the Maruti Heikin Ashi Chart to understand these key lessons:

y

y

Learn more about the Lunar Phase here https://www.youtube.com/watch?v=XWGbyNWZ9TQ&t=76s

The Neuro-Sponge Hypothesis impacts stock market traders by causing information overload and poor decisions. Learn strategies to filter noise, avoid mistakes, and see how Definedge Pathshala’s structured learning helps traders achieve consistent success. Read more

Watch the strategy - https://www.youtube.com/watch?v=JFNkoBNUb-Q&t=53s

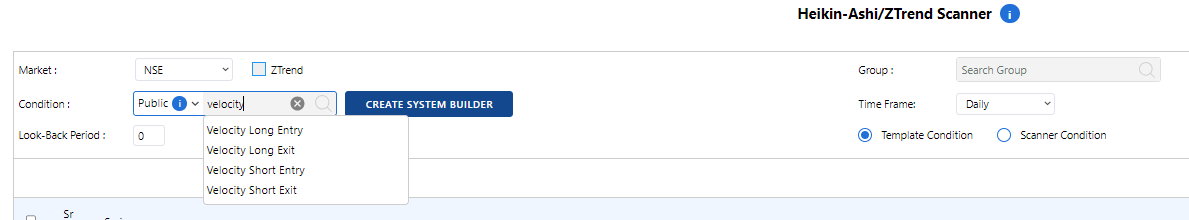

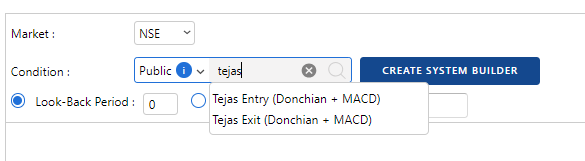

The scanner is available in the Public Condition:

To scan this system/setup in your RZone, follow these steps:

Select “NSE” as the market.

Go to Public condition section, choose either:

– Tejas Entry (Donchian + MACD) - For Scanner

– Tejas Exit (Donchian Exit) - For Backtesting

Set the lookback period to 0.