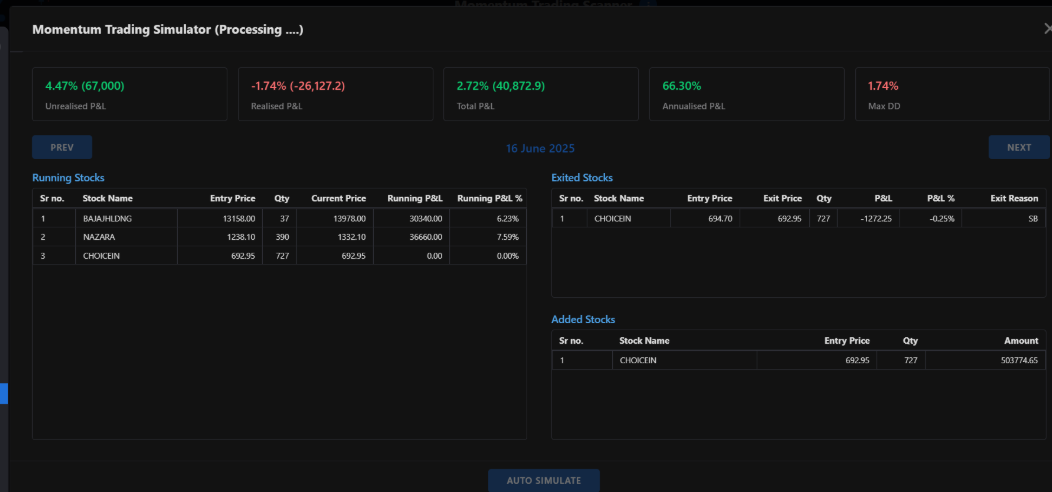

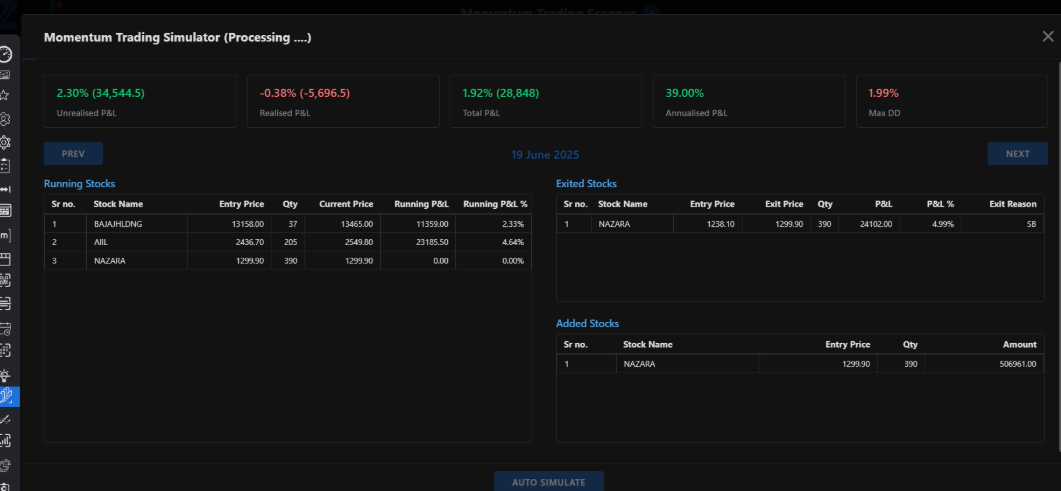

Just saw yesterday uploaded Momentum Trading video, the simulator option has now been discontinued in the Momentum Trading Scanner . Request to please keep the simulator button in Momentum Trading also. Same above conditions tested in Momentum Trading Back testing are giving no results ( 0 trades).

Prathmesh Kalubarme

All Replies

-

-

Also while back testing, I encountered a particular challenge:

-

If there are multiple strategies in Str 1,2 and 3 with diff box sizes and the trading box size is lower, same stock is exited and added at the rebalance- Can this be blocked somehow- same stock cannot be exited and added at the same time.

-

If TSL option is given along with SL for Momentum Trading, exits could be more efficient.

Dear Prashant Sir/Definedge team - can you please help with clarification of the original post 3 points and the 2 challenges in the comment .

Thanks

-

-

-

Once rebalance ( monthly/weekly) option is selected, would the portfolio stocks not get replenished immediately from basket post rule based exit of one of the stocks from the portfolio and wait for next rebalance? Or would this be immediate replenishment + rebalancing?

-

If RS options is selected, would RS be checked against all strategies (1,2 and 3 - as per selection) or RS would only be checked against the trading box size and timeframe only?

-

Can Virtual Trading strategies not be made and checked on Momentify?

Thanks.

-

-

also for momentum trading , would adding market breadth as a parameter to stop new entries in addition to the overall market trend filter would reduce drawdowns? Please add more user customization options like these : like adding breadth as additional market filter for new entries, using adx for ranking , etc would help every individual user leverage their strengths and comfort

-

Also, can we introduce Reinvest + SIP option . Currently its either or.

-

Hi Prashant,

Firstly, thanks a lot to you and Definedge team for creating great value for the investor community. I have been following and learning from Definedge and Weekend Investing (Alok Jain) videos from the last few years and practicing momentum methods based on my learnings.

The Momentum Investing Engine is truly powerful, enabling individual investors to manage funds professionally and automatically.

I back tested with my P&F strategy using MI engine and it validates the idea of momentum investing. (2014-2025)

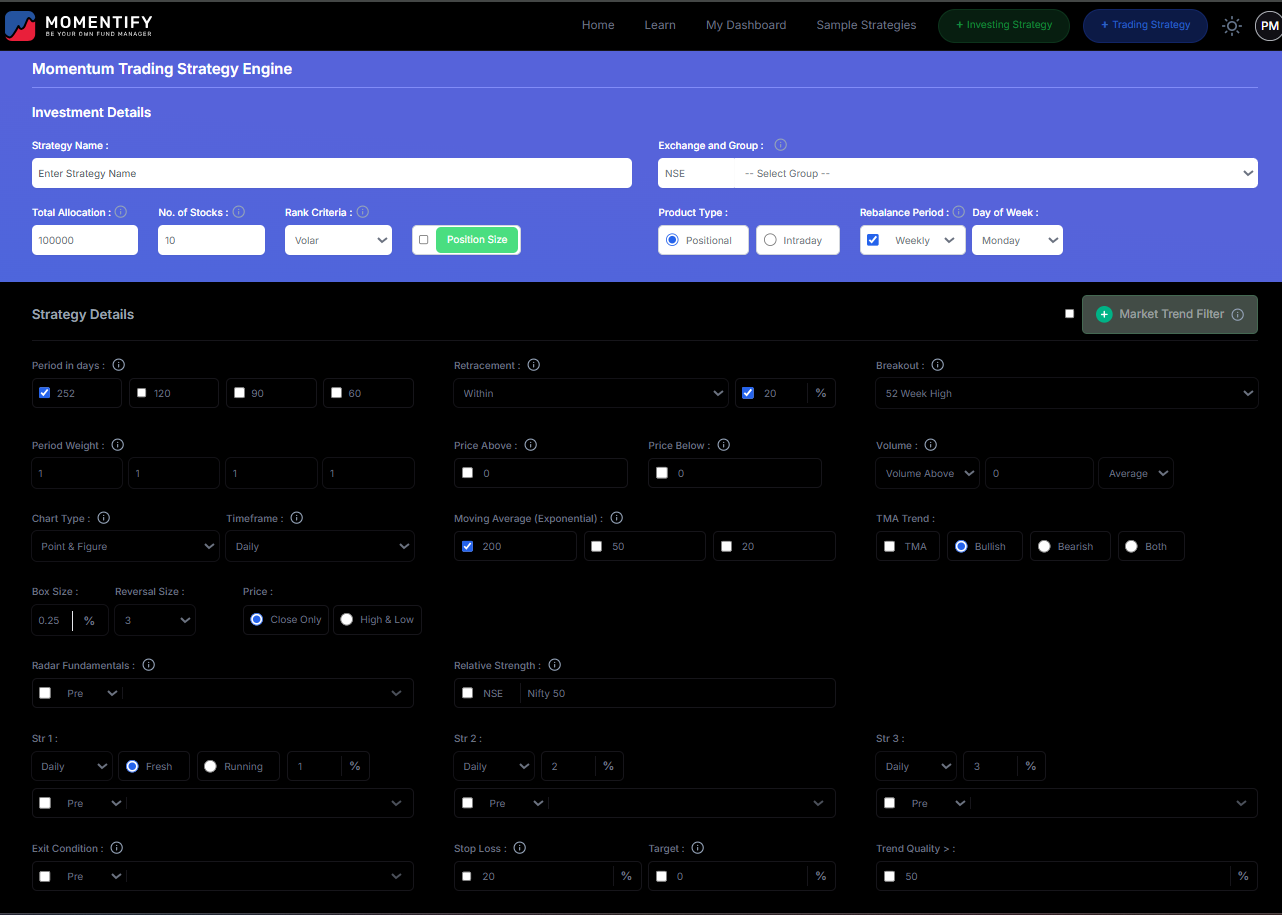

However , I believe certain enhancement options can give more momentum riding options for users:

-

In the market trend filter - if the market trend doesn't qualify for equity stocks then if any other asset class ; lets say gold is having momentum- it gives an option to exit as per rules from current equity and switch to gold. Since we are trading momentum hence asset classes should also not matter. Moreover, it makes money more efficient ,an added advantage of using momentum strategies

-

In relative momentum option, using P&F give multiple box values to check this strength. This will give a good filtration for only strong momentum basket items across time range

-

Flexibility in adding rank criteria as per own comfort technical parameters : For example using P&F rules in MI engine, one might have a better understanding of possible momentum using ADX . So I would prefer ranking stocks using ADX (rising and above average- for example and +DMI crossover -DMI) rather than Volar/RSI

Some Questions about using MI engine for MI Trading:

a) Is it possible to exit one stock based on rule and then again add to basket another stock immediately after exit from the current ranked list of stocks as replacement? How to execute it using MI trading engine? Rebalancing happens on every exit for replacement of the exited stocks

b) Is it possible to check the above scenario some workaround way in MI trading simulator?

Looking forward to your views and recommendations.

Thanks.

-

-

Some questions , clarifications needed and additional feature requests :

Question & Clarifications :

1) ATE NOT able to split orders according to AMT specified and then accordingly splitting orders for that AMT and max lot size allowed for that Index Option :

In ATE, while adding strategy using - Load from Group option- currently it works on index options only using the changes in qty and NOT using the amount . For eg : If I am trading nifty ATM CE using option scanner entry and exit conditions and while defining strategy, I have to mention lot qty . If I mention suppose Rs 1 Lakh- the order does not get split into multiple orderes based on max lot size of that index option ( 36 for N, 45 for FN and 60 for BN) . I have to use multiple strategies with different lot sizes for accomodating that Rs 1 lakh amt into lot sizes for max capital allocation to trade. Is this supposed to work any other way, am I using it correctly ?2) ATM strike price clarification for using in Option Scanner

Is the default ATM strike price set to index future and then we have adjust accordingly for spot?New Feature Requests:

-

Create and save template for ATE strategy and use it again on one click in new strategy

All options can be kept as default as defined by user in template and then use it again in a new strategy using a single click. Ability to modify certain parameters like lot qty and max loss, etc -

Create and save template for Option Scanner entry and exit rules

Using the template for a new scanner entry linked to a startegy on one click with some modification in ATM strike price selection; TSL and SL parameters -

Back testing in Desktop with TSL, Exit time as is in Zone Web

-

Ability to back test entry in different box size and exit condition in different box size

-

Momentify Momentum Trading Engine - Clarifications

Momentify Momentum Trading Engine - Clarifications

Momentify Momentum Trading Engine - Clarifications

Momentum Investing Engine - Suggested enhancements

Momentum Investing Engine - Suggested enhancements

Momentum Investing Engine - Suggested enhancements

Auto Trade Engine