Hello Prashant Sir,

I have done your P&F Course one month back and its fantastic Sir.

Below is the process which I follow and my querries

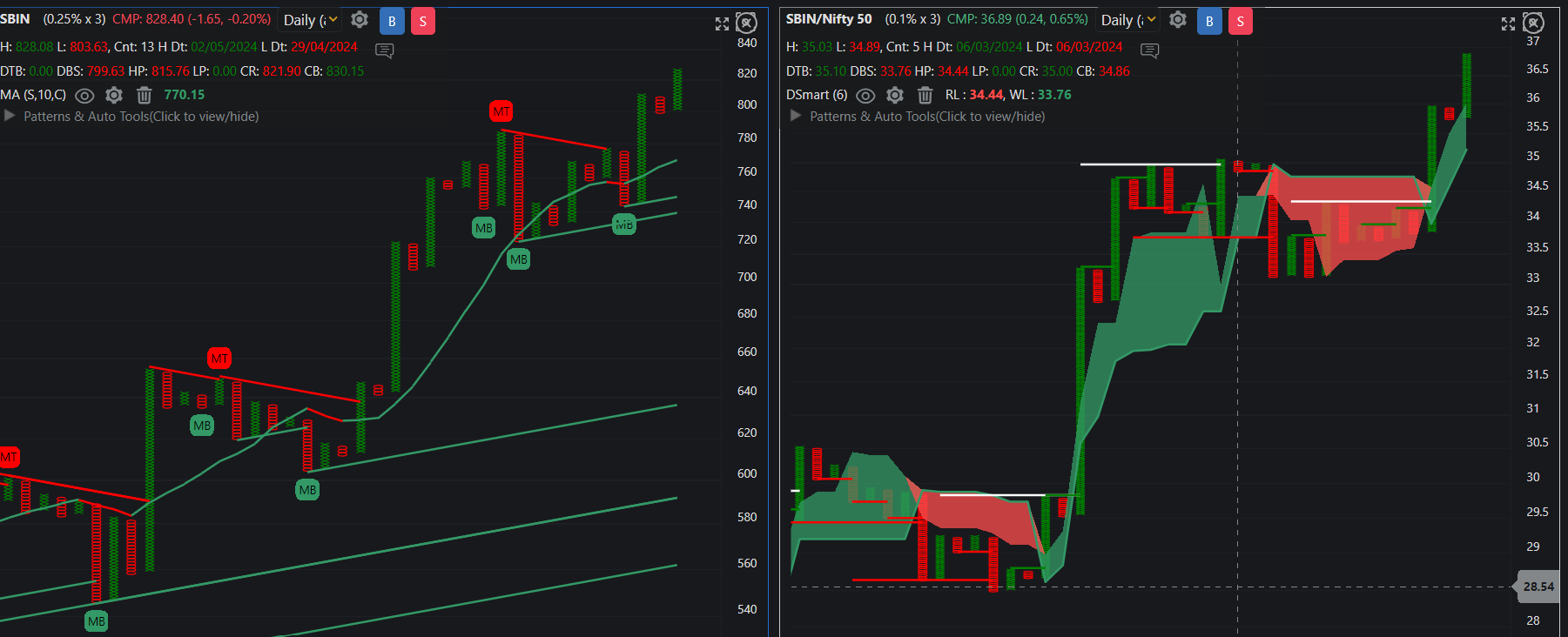

I first look at other market class then at breadth analysis. Then I do index and sector analysis and select outperforming index/sector and then run each of them on P&F Fusion matrix and save Matrix bullish universe and Matrix Pullback universe and then run Matrix bullish universe on price scanner for Strong break out patterns like Multi column break out or AFT or Turtle bullish patterns or TTB or Bullish broadening or bear trap/ variation or any major bull pattern F/T on .25% chart for Frontliners and 1% on others usually keeping SL on WL of D SMART and I run Matrix Pullback universe for Multi Oops or Ziddi Bulls or 123 PB etc. on .25% chart for Frontliners and 1% on others usually keeping SL on WL of D SMART.

My stock selection has improved exponentially. Thanks Sir.

My question no.1 is as to whether saving and using Matrix bullish universe and Matrix Pullback universe is more effective?

or may I save stocks having say Total Performance score above 8 and do the rest of process? or do you suggest any modifications?

Why I am telling you this is because although saving and using Matrix bullish universe and Matrix Pullback universe gives good results on a few occasions I have experienced that SUN PHARMA, TCS, DMART, COLPAL which were in 8 + 8 = 16 zone on Fusion matrix at one time, Come down to Total Performance score of 6 and below or even negative 2 and give a DBS on lower time frame whereas Stock like ICICI Bank or SBI which were once showing total performance score of only 3 at one time are now outperforming with total performance score of 9 or even 16 and have given breakouts on lower time frames and giving fantastic results.

Sometimes I also run the above universes for MAX or BOOST or DIP stratagy on multi time frames.

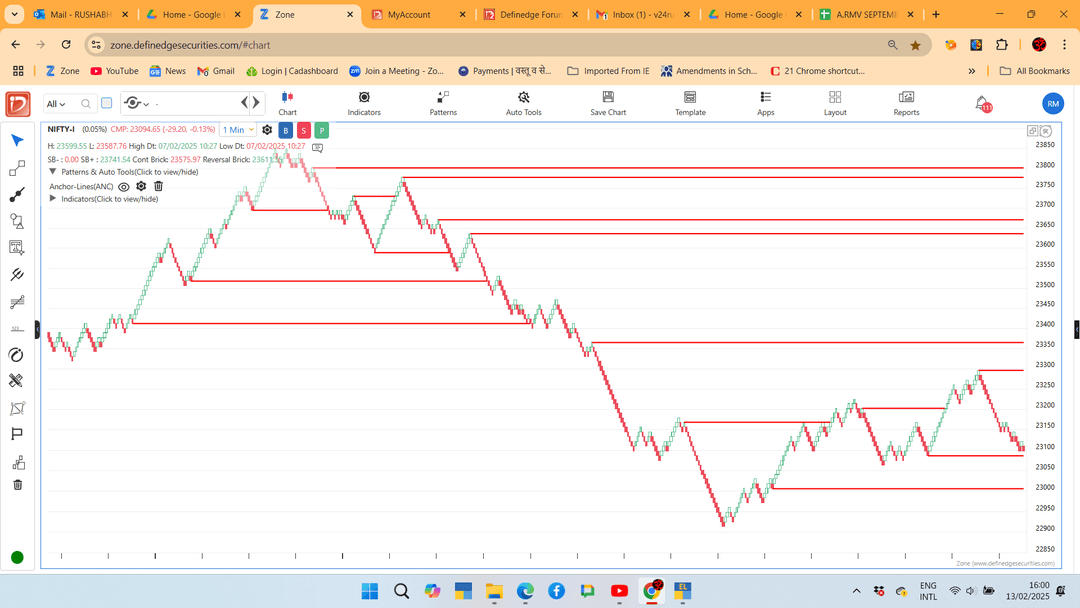

I use TOI feature on RENKO Chart on set up explained by Shri Raju on Market kya lagta hai and then use price pattern on RENKO CHART 1min .05% on NIFTY Spot and buy NIFTYBEES If both are showing bullishness and Exit NIFTYBEES when reverse happens. I use PNF set up also samew.10% ay. Dsmart is always my SL.

I want to trade NIFTY BEES (Bullish trades) and for reverse I want to use options (Short calls or buy Puts. Could you please guide me in my this area of trade in NIFTY via NIFTYBEES?

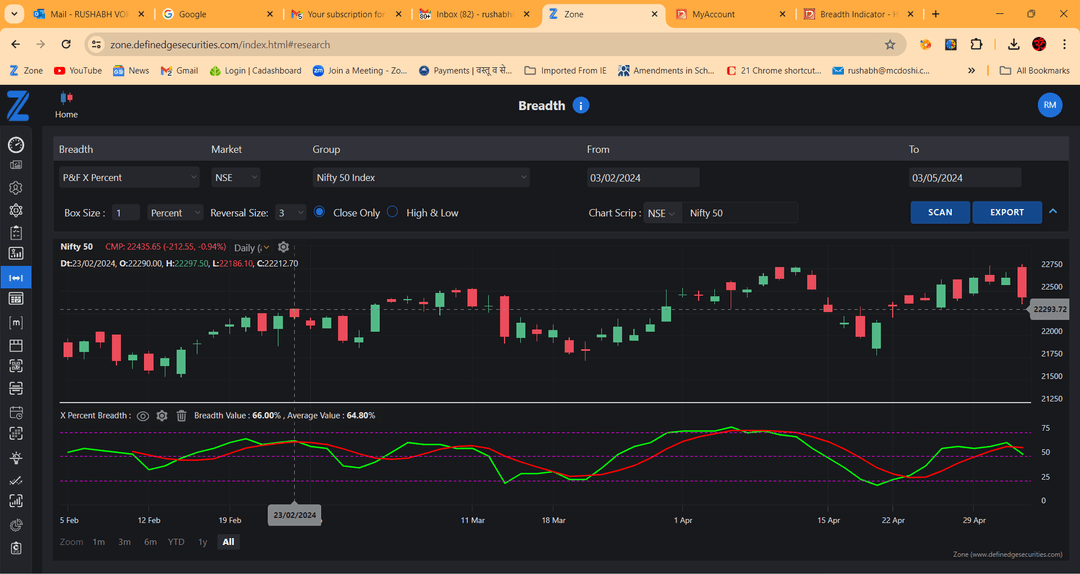

I have also started rebalancing my overall portfolio Equity and Debt mix, determining market conditions using Breadth analysis, Segment analysis, NIFTY/NIFTY 500 trade setups (bullish/bearish using dsmart on daily time frame .10% p&f chart.

Looking forward for your valuable guidance Sir. Thanks for everything to you and your entire hardworking, dedicated and selfless team.

hatsapp-image-2024-11-04-at-13.26.59.jpeg)

hatsapp-image-2024-11-04-at-13.26.59.jpeg) ️

️