Discretionary vs System Trading: Differences, Pros & Cons

Discretionary vs System Trading: Differences, Pros & Cons

-

Introduction: Trading as Your Ethical Mirror

Introduction: Trading as Your Ethical MirrorIn a world chasing quick profits, many forget:

“Trading is not just about making money; it’s about building discipline, patience, and emotional resilience.”

Choosing between Discretionary Trading and System Trading isn’t merely technical; it’s a path of ethical alignment with your temperament and lifestyle, guiding you toward sustainable, calm trading.

This guide will help you understand both methods deeply so you can trade with clarity, inner calm, and consistency.

What is Discretionary Trading?

What is Discretionary Trading?Discretionary trading means making decisions using your personal judgment based on:

Market structure & price action

Market structure & price action

News, sentiment, and market feel

News, sentiment, and market feel

Live adaptation to the market’s rhythm

Live adaptation to the market’s rhythmYou adjust your actions in real-time, using intuition, pattern recognition, and context reading developed with experience.

️ What is System Trading?

️ What is System Trading?System trading means executing a clear, rule-based method including:

Predefined entry and exit conditions

Predefined entry and exit conditions

Position sizing

Position sizing

Risk management rules

Risk management rulesDecisions are mechanical, consistent, and emotion-free, allowing you to act clearly even under pressure.

️ Pros & Cons

️ Pros & Cons Discretionary Trading

Discretionary TradingPros:

️ Flexible during sudden market shifts

️ Flexible during sudden market shifts- 🧐 Can skip low-quality trades during uncertain conditions

- 🧩 Uses intuition for nuanced decisions

Cons:

Prone to emotional swings and inconsistency

Prone to emotional swings and inconsistency Difficult to backtest precisely

Difficult to backtest precisely ️ Dependent on your mental state

️ Dependent on your mental state

System Trading

System TradingPros:

Consistent, disciplined execution

Consistent, disciplined execution- 🧪 Easy to backtest and refine

- 🧘 Emotionally neutral, reducing stress

Scalable with capital and across instruments

Scalable with capital and across instruments

Cons:

Inflexible during regime shifts

Inflexible during regime shifts ️ Takes all signals, including low-quality trades

️ Takes all signals, including low-quality trades Requires patience and faith during drawdowns

Requires patience and faith during drawdowns

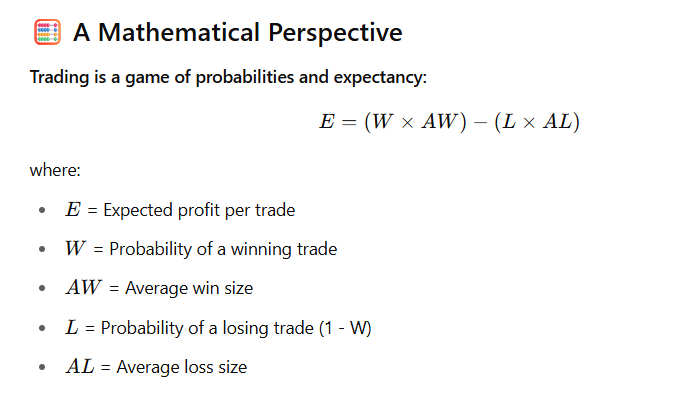

🧮 A Mathematical Perspective

Trading is a game of probabilities and expectancy:

In System Trading:

You can quantify W, AW, and AL through backtesting, ensuring the system has a positive expectancy over a large sample size.

You can quantify W, AW, and AL through backtesting, ensuring the system has a positive expectancy over a large sample size.

Execution is consistent, ensuring actual performance aligns with mathematical expectancy if you avoid emotional interference.

Execution is consistent, ensuring actual performance aligns with mathematical expectancy if you avoid emotional interference.In Discretionary Trading:

Expectancy often fluctuates based on trader judgment.

Expectancy often fluctuates based on trader judgment.

Your emotional state may skew the effective W and AL by:

Your emotional state may skew the effective W and AL by:- Cutting winners early due to fear

- Holding losers due to hope

The core takeaway:

“System trading is a direct application of probability theory to the market, while discretionary trading is applying intuition to manage probabilities live.”

If your discretionary methods maintain a positive expectancy while controlling AL (losses) and letting AW (wins) expand, your trading will still align with this mathematical core.

A Clear Comparison

A Clear ComparisonDiscretionary Trading fits when:

- You excel at live market reading

- You value flexibility

- You have limited capital needing precision

- You enjoy the craft of pattern recognition

System Trading fits when:

- You want consistent, disciplined execution

- You wish to remove emotional interference

- You prefer data-driven trading

- You aim to scale capital systematically

The Power of the Hybrid Model

The Power of the Hybrid ModelMany experienced traders adopt a Hybrid Trading Model:

Use systematic, rule-based entries, exits, and risk management to align with proven expectancy.

Use systematic, rule-based entries, exits, and risk management to align with proven expectancy.

Use discretion to skip trades during low-conviction conditions, unexpected news, or liquidity crunches.

Use discretion to skip trades during low-conviction conditions, unexpected news, or liquidity crunches.

Manual flexibility on exits while respecting the system’s structure when market structure demands.

Manual flexibility on exits while respecting the system’s structure when market structure demands.Example:

A Renko or MA-based system for entries but skipping trades on RBI policy days, or adjusting exits when volatility compresses or expands significantly.This allows you to protect your expectancy formula while respecting real-world market conditions.

Conclusion: Align Your Method with Your Mindset

Conclusion: Align Your Method with Your MindsetDiscretionary and System Trading are complementary tools.

The true goal is clarity, consistency, and emotional balance while aligning with mathematical expectancy and ethical discipline. “Trading is a sacred dance between discipline and trust. When your methods align with your temperament, the market becomes your mirror, not your enemy.”

“Trading is a sacred dance between discipline and trust. When your methods align with your temperament, the market becomes your mirror, not your enemy.”

When your trading style aligns with your temperament, values, and the math of positive expectancy, your journey becomes calmer, clearer, and financially as well as spiritually rewarding.

Nifty 500 (Broad Market) – Long-Term RSI Perspective

Nifty 500 (Broad Market) – Long-Term RSI Perspective