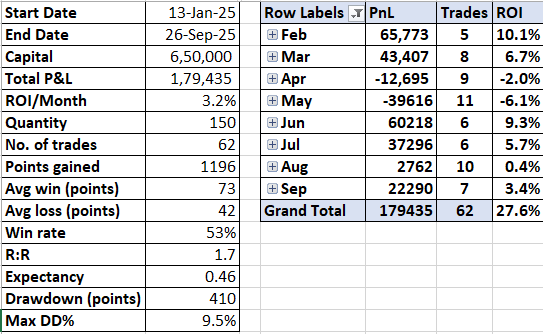

Renko | Nifty Short Straddles (45 DTE) | Positional Trading System

-

Everyone knows the saying 'simple strategies work'. Definedge's SAR strategy using MAST indicator on Nifty/BN futures has been well-known and is one of the simplest ones I have ever seen. To trade it with utmost discipline is a different thing altogether

Concept:

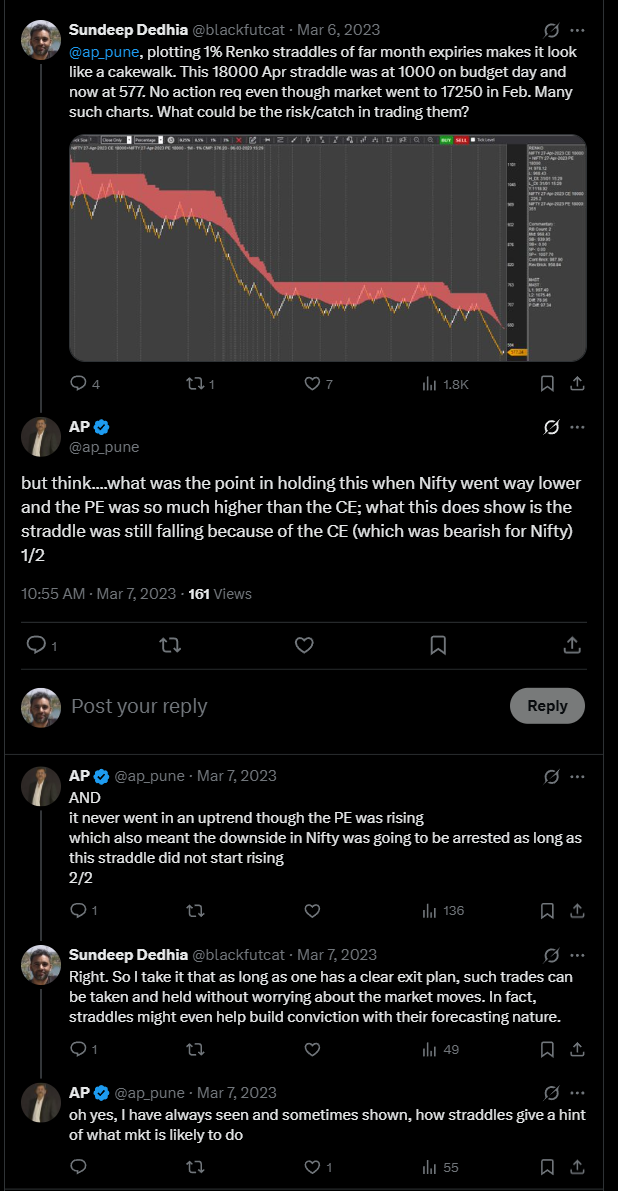

It is widely agreed that BRN (big round numbers) work as major levels of support/resistance. I have always been amazed at how straddles of BRN strikes far from the ATM give hints about what's really happening under the radar. Long back I had posted a chart and a conversation with AP sir provided motivation to dig deeper into this area. However, only a few months ago did I start developing a simple strategy with the idea that markets move in ranges and BRN strikes can act as good pillars to hang our hammock and lie in it peacefully while eating premium.

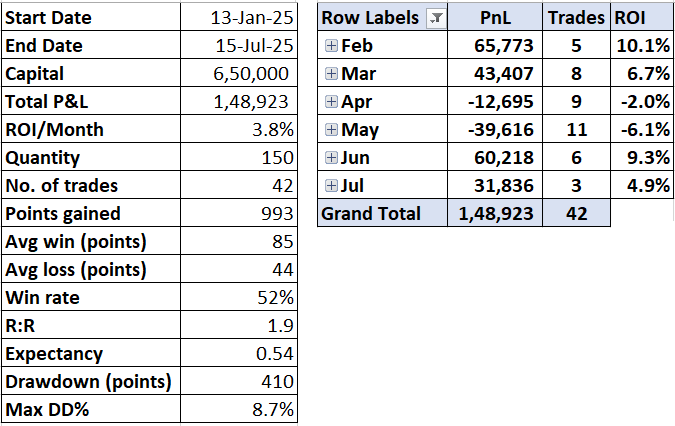

So here are the rules and performance of this strategy since January 2025. I traded this live from Feb. to May but gave up thereafter due to a reason I'll explain in the end. I am still keeping track of each trade and intend to do so in the near future.

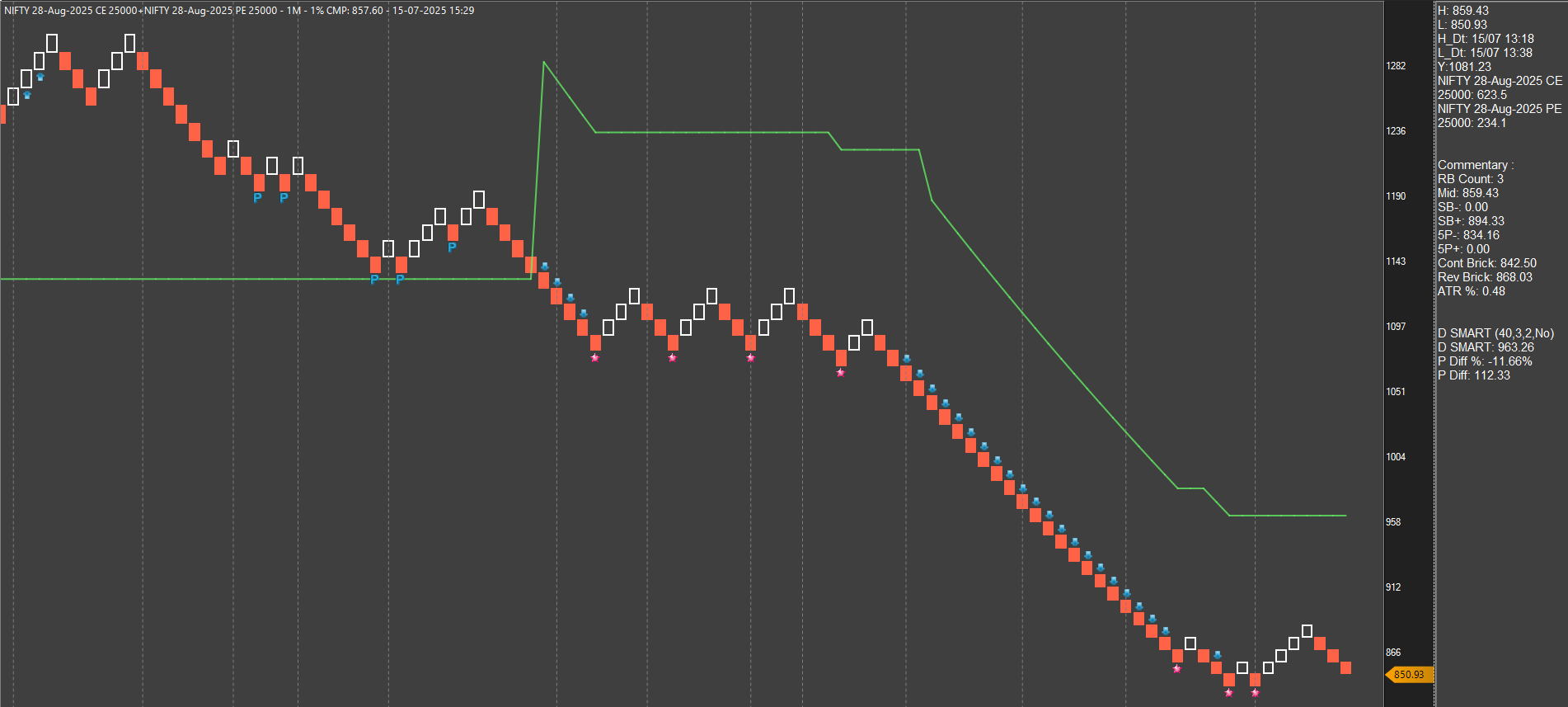

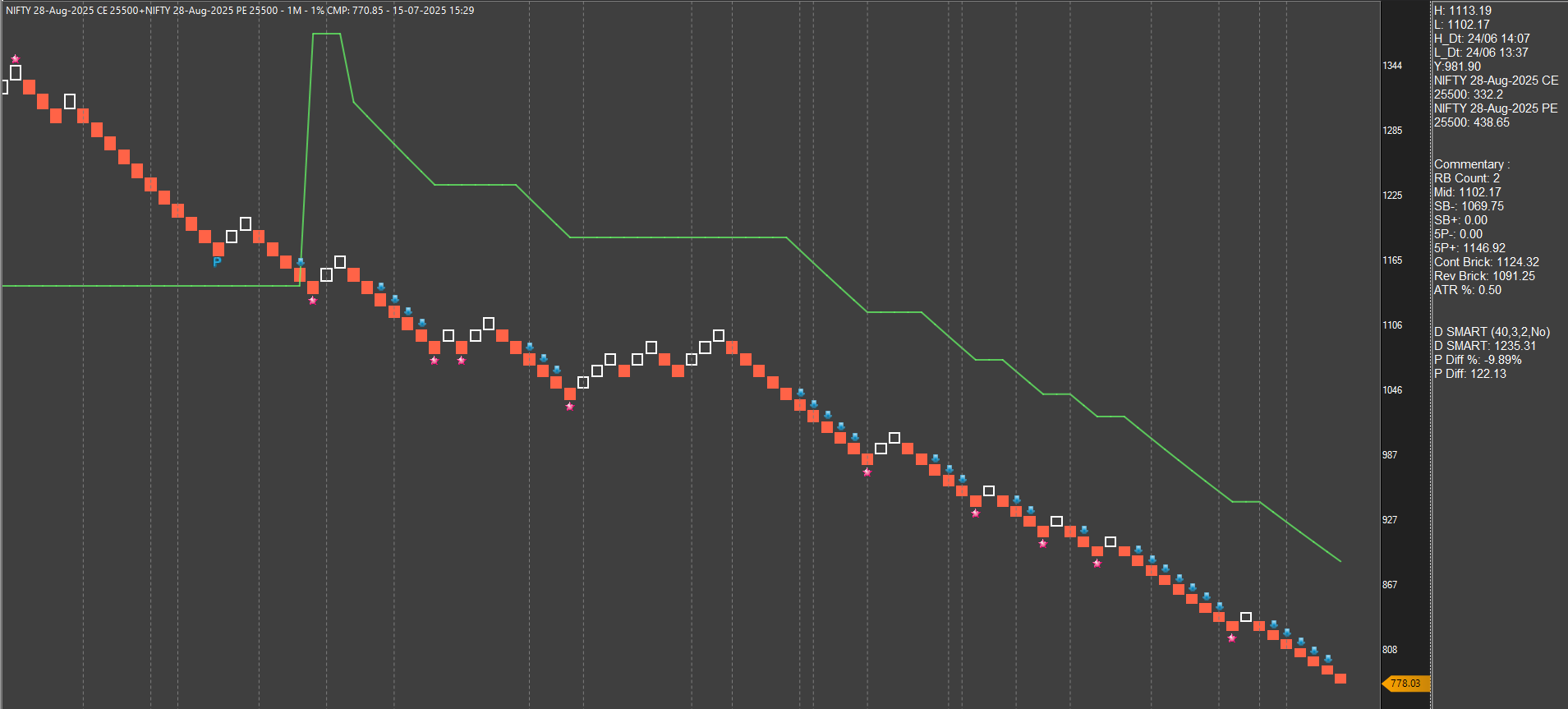

Instrument & Charting Method: Nifty monthly options; Renko 1% box size, 1-min

Capital & Position Sizing: 3,25,000 per straddle. Minimum 2 straddles (1 each above and below ATM)

Indicator: D-Smart

Rules:

- Sell next month straddles - 45 DTE.

e.g. if Aug 28th is the expiry, start trading that from July 14th. Trade this expiry until Aug. 11th and then switch over to Sep. expiry which will be 45 DTE. - Entry - choose two BRN (big round number) strikes, one each above and below the spot price. For e.g., today Nifty spot is 25200, so choose 25000 and 25500. Sell those straddles if the price is below D-Smart.

- SL/Exit - D-Smart line is the stop. Switch to the next nearest BRN straddle as per entry rules.

Dealing with various scenarios when spot is at or near a BRN, for e.g. 25000:

- In such a scenario, there will be confusion regarding strike selection between 24500/25000/25500. Normally, it will be easy to choose as only 2 out of the 3 strikes will be below D-Smart.

- In few scenarios (when VIX is low and market is extremely sideways), all 3 strikes will be below D-Smart. Sell the two strikes which are lowest in premium among the three.

- A rare scenario is when only 1 BRN strike among the 2/3 is below D-Smart. In this case, just sell that one and wait to sell whichever strike goes below D-Smart first.

Statistics:

Note: there is no P&L for January as the trades started from Jan 13th ran all the way until Feb end.Currently active trades: August 25000 and 25500 straddles

End Note:

So the reason that I stopped trading this system was what happened in May. Selling naked straddles overnight is not for the faint hearted. I always hedged them and that took away some profits which I was giving up unhappily. However, the Indo-Pak war days gave me uncomfortable days in spite of the hedges. The psychology got to me and I started breaking rules. Eventually I realised that this system was not for me and gave up. As it happens with all, I was left with my mouth gaping when June resulted in a huge positive month Anyway, this is a good system on its own with hardly any work to do and decent returns. It's up to the trader to manage the risk and psychology. Would love to hear feedback/thoughts.

Anyway, this is a good system on its own with hardly any work to do and decent returns. It's up to the trader to manage the risk and psychology. Would love to hear feedback/thoughts. - Sell next month straddles - 45 DTE.

-

Thanks for sharing. Will do paper trades for few months.

-

I wa trading this Strategy but not like you,I was searching which straddle price is trading below D smart, i was deploying that. But i was very inconsistent, once booked loss ws affraiding to deploy next trade. But as u said it is a good strategy for office peoples, not to monitor frequently.But should have discipline. I am very indiscipline person. Our mind is main culprit which always trying to find some holygrail setup but its not possible. I will start again to deploy from next month. Anyway many Thanks a lots for sharing in details.

-

@Ashish Talekar, you got that right - discipline is the most important thing. Both, in execution as well as risk management. I won't tell you to paper trade because I know it's very hard to just sit aside and watch a system wherein trades run for days/weeks together. Discipline is tested only in real trades. The last two months (June/July) have been excellent for this system. July return is 6% as of today. The system will work but just make sure you are comfortable with your risk management. All the best.

-

Status update: I have started trading this system again now that I have come to terms with my psychological barriers with regards to the risks associated with this system. I have been able to develop multiple trading systems that are catering to different timeframes and complementing each other. I can also see that the system has nicely weathered the storms of war and tariffs in 2025. All this has helped immensely in boosting my confidence to carry overnight positions. Going with this system for the long-term now.

Statistics

-

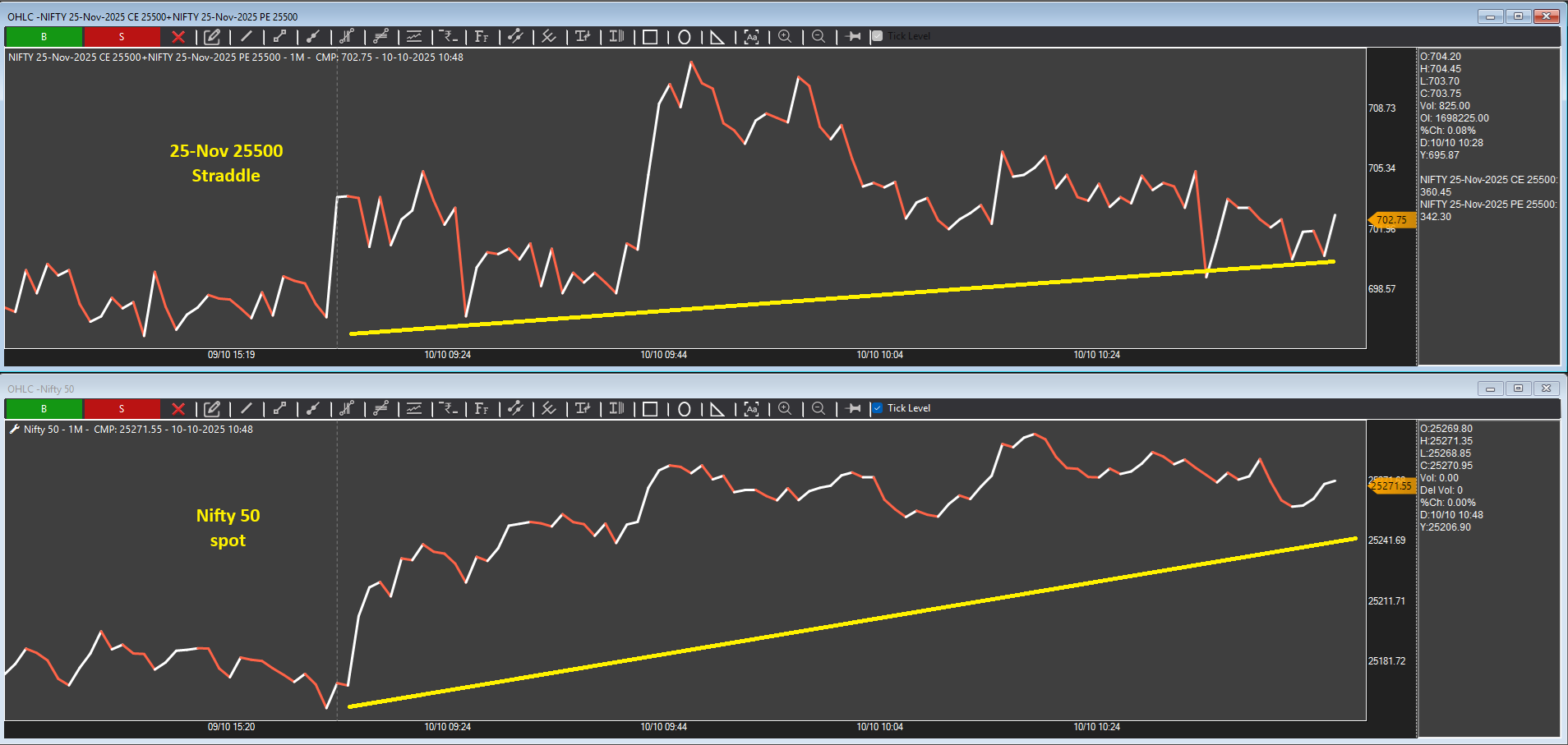

Interesting phenomenon today. November 25500 straddle going up along with Nifty spot (currently 25280) since morning. Generally, this would be the case if Nifty is extremely bullish and trending but doesn't look like it. This uptrend is not convincing, so far.

-

The scenario on 10-Oct (posted above) did give a valuable hint. Trump news in the evening confirmed. Now another interesting scenario developing right now at about 2pm. Nifty spot going up since a couple of hours but 25-Nov 26000 straddle not interested at all.

-

Interesting! About the 10th Oct 25500 straddle when Nifty Spot @ 25300... I'd assume that if a higher than ATM straddle is going up and spot isn't going down then that'd be - mildly directional - sideways no?

and about the 25Nov 26000 straddle - it did open gap down of 30pts and went down 20 pts since breaking morning open .. isn't that significant for a 45DTE straddle?

Do tell me, I haven't ever tracked 45DTE straddles.

Market Mood Index hits Extreme Fear — Historically a Bottoming Zone

Market Mood Index hits Extreme Fear — Historically a Bottoming Zone