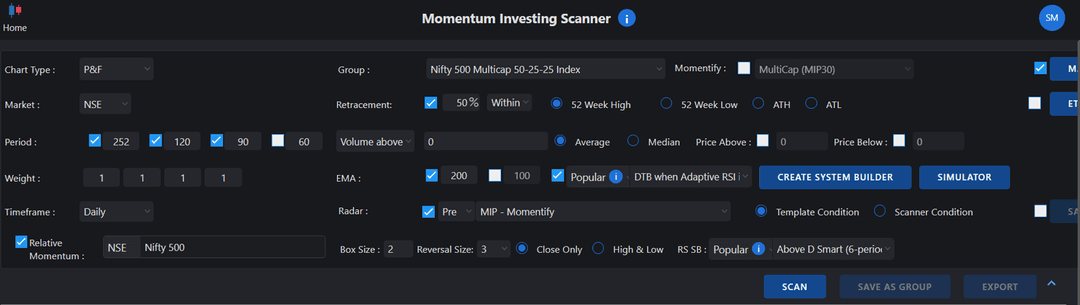

We are currently replicating the strategies described in Mr Prashant Shah’s book, comparing the outcomes with those presented in the book, and engaging in discussions on the forum.

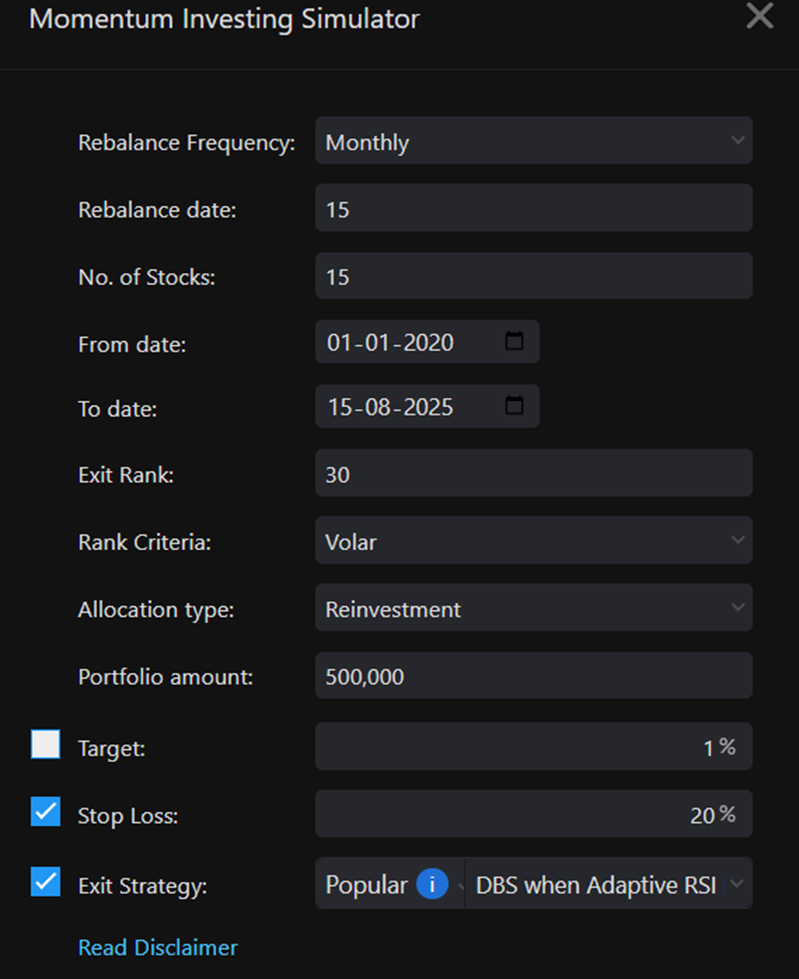

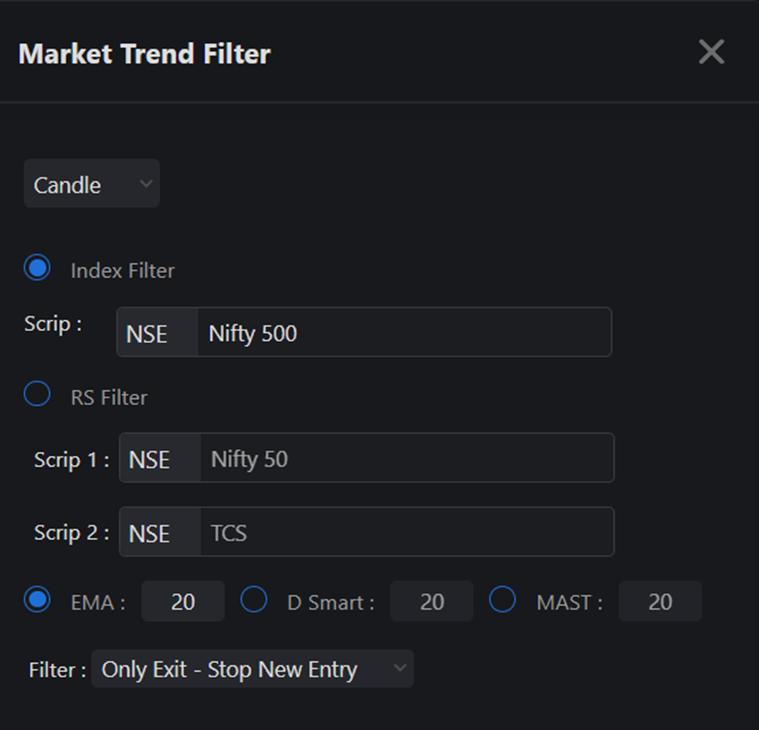

In my assessment, any difference in results may stem from minor variations in one or more parameters. This observation is not intended to challenge anyone’s understanding. The book was written a few months ago, and since then the system may have undergone multiple refinements, which could also explain the deviations.

That, however, is not the key issue. These strategies should be viewed as guiding frameworks that demonstrate how parameter adjustments can help in achieving optimized outcomes.

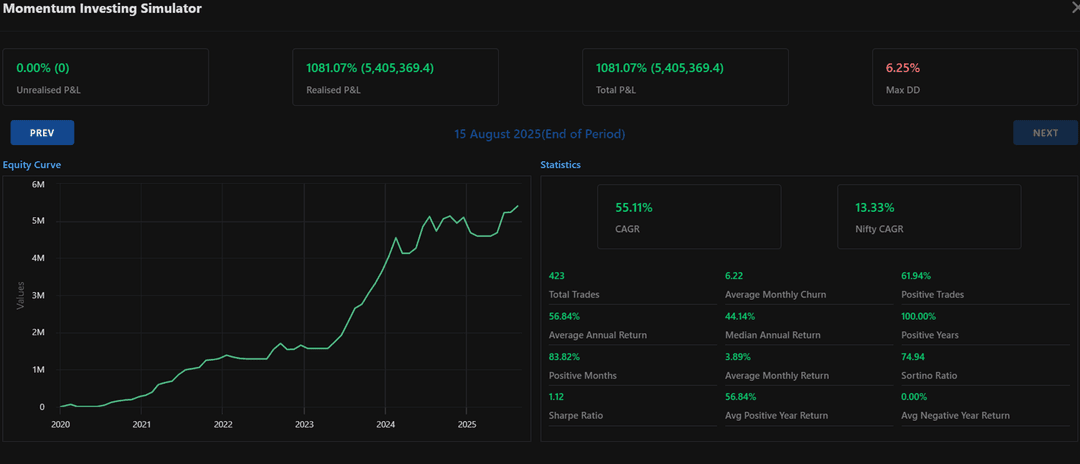

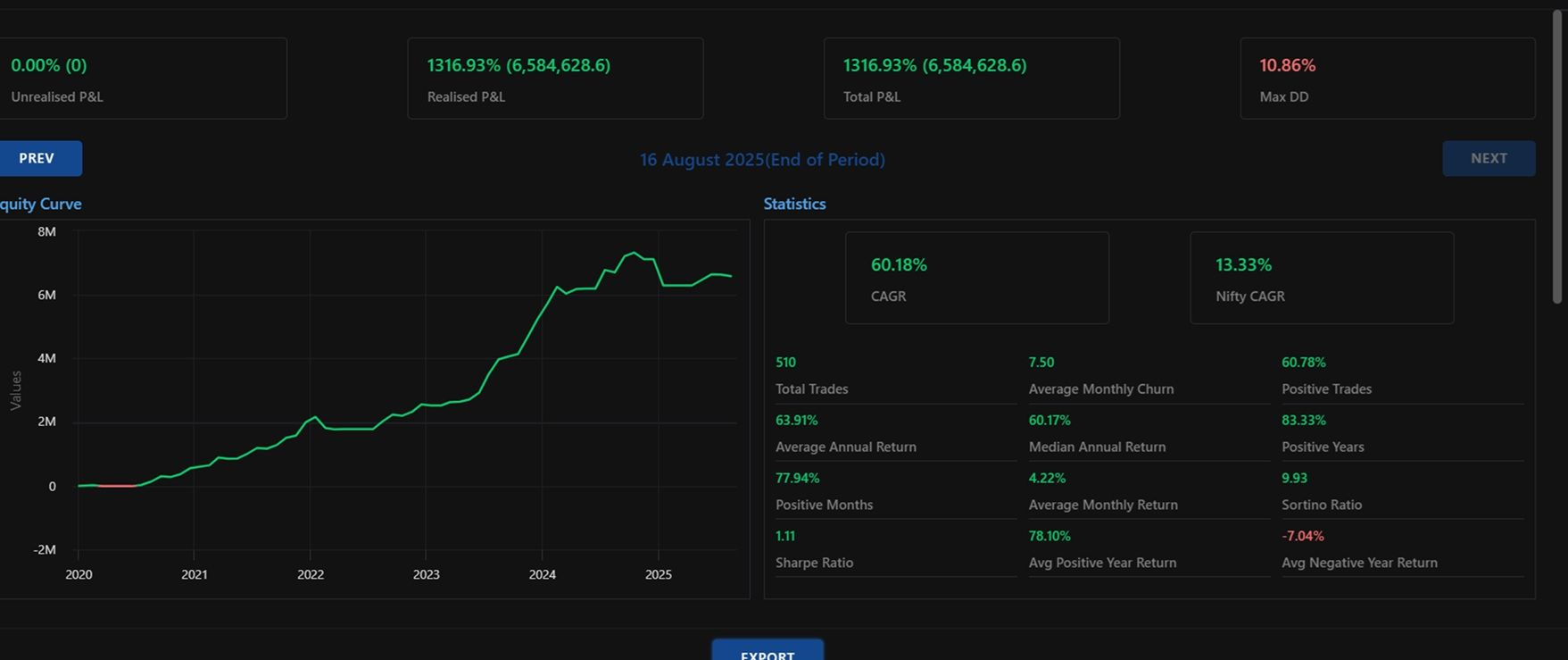

While the back tests suggest the possibility of substantial gains—running into crores of rupees—there is no guarantee that markets will behave in exactly the same way in the future. Performance may improve, or it may deteriorate. More crucial than the projected gains is our psychological preparedness: Are we truly ready to remain invested for the duration assumed in these back tests? How will we react when faced with such huge potential profits? At present, many of us may be comfortable investing ₹20,000–25,000 in a single stock. But when the situation demands an allocation of ₹4–5 lakhs in one company, the psychological challenge could be significant.

Therefore, our focus should be on adapting these strategies to minimize drawdowns, as initial losses can easily undermine confidence. By working in this direction and openly sharing our experiences, we can create valuable learning opportunities for all participants.

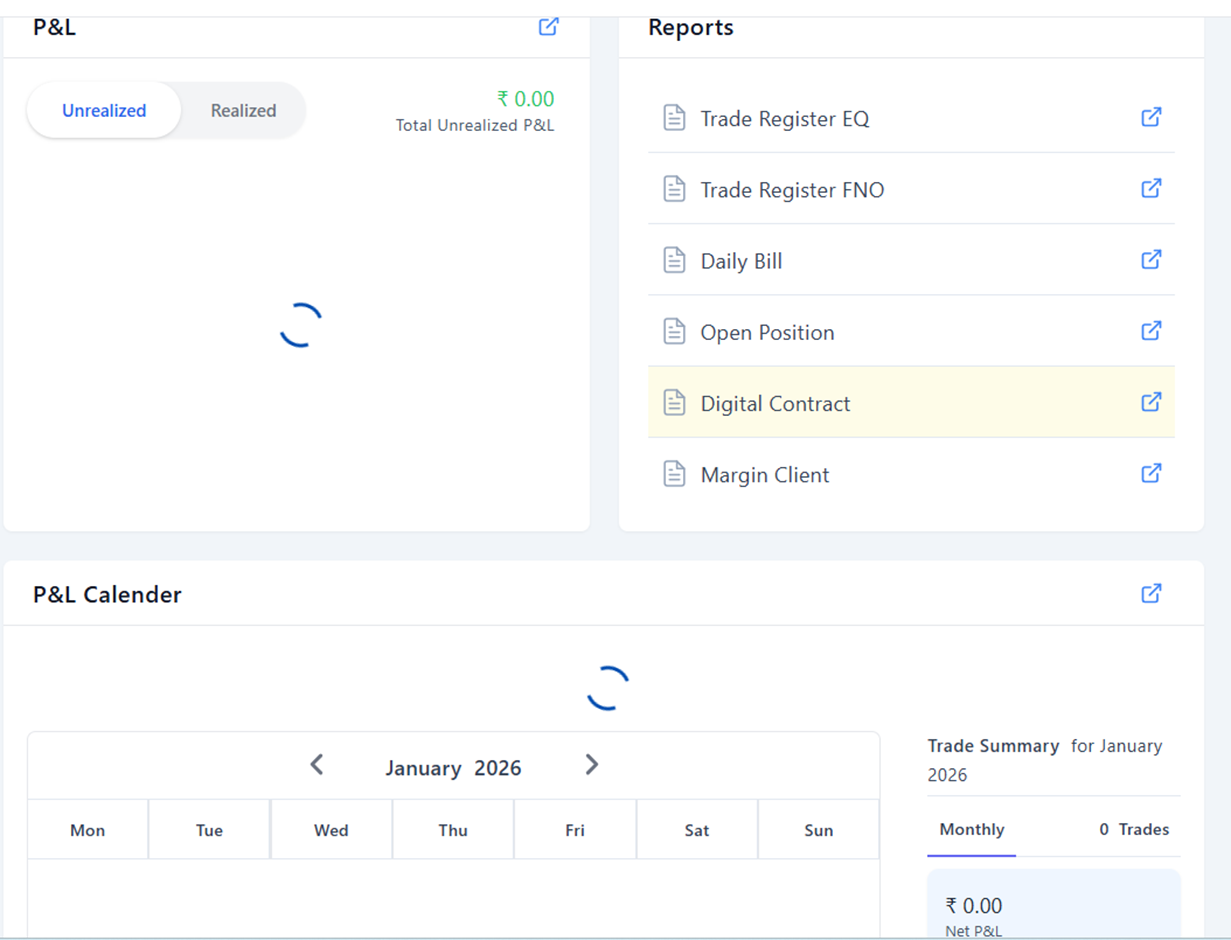

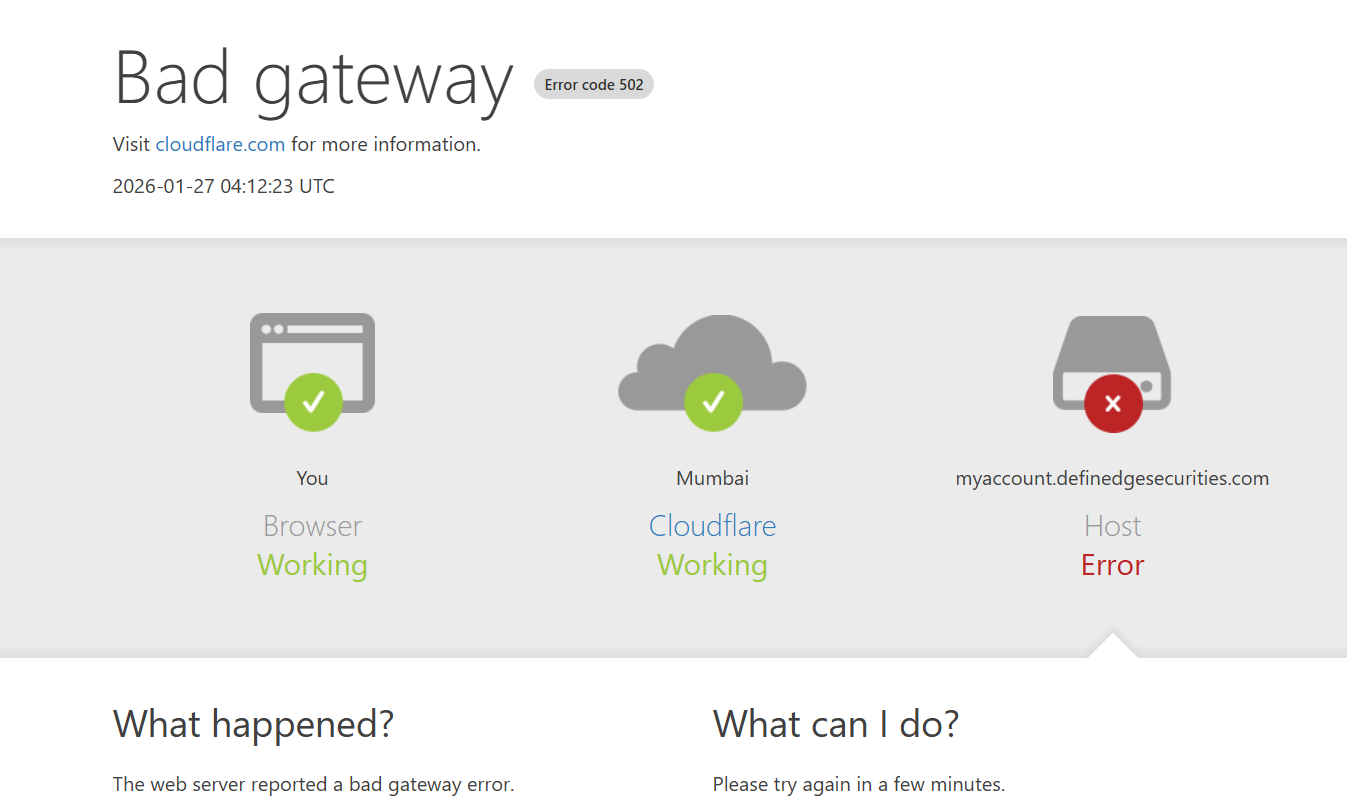

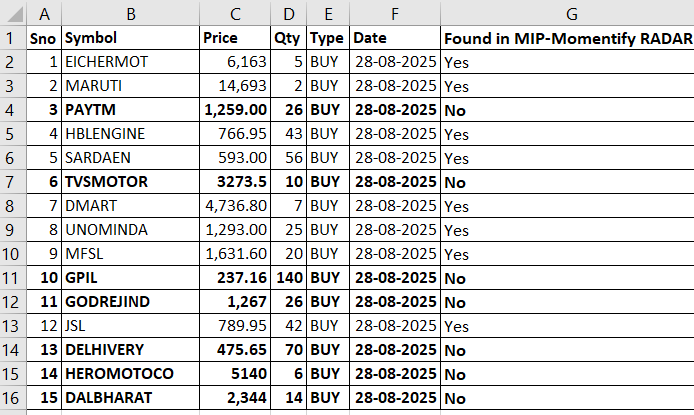

#VGM Framework – Live Portfolio Snapshot

#VGM Framework – Live Portfolio Snapshot