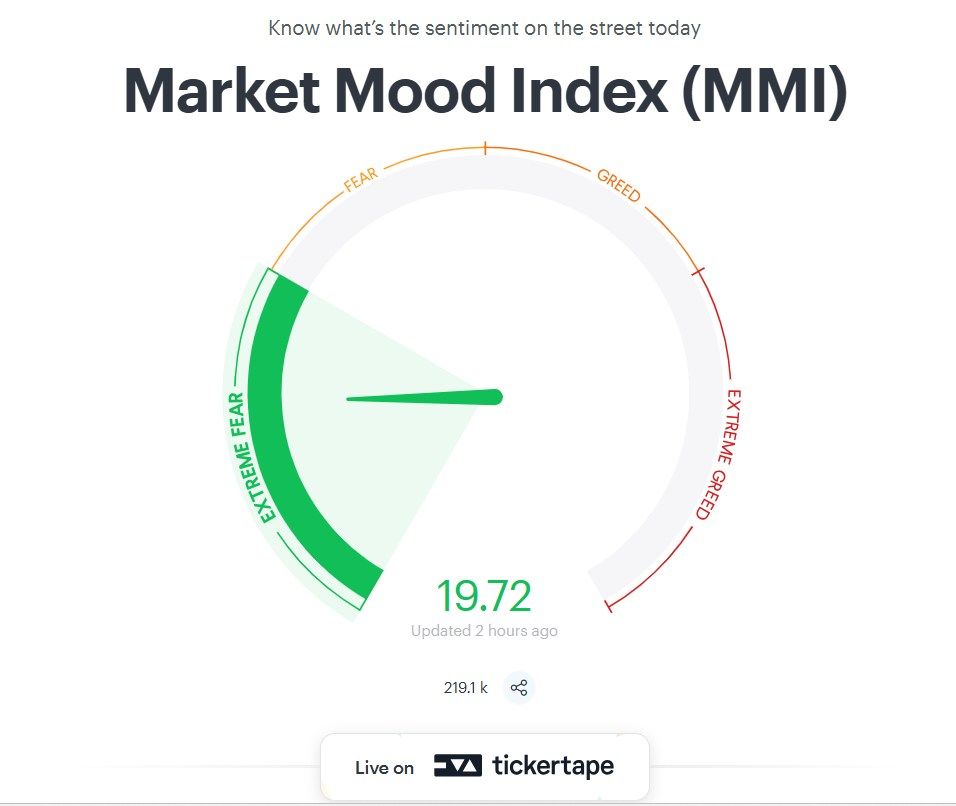

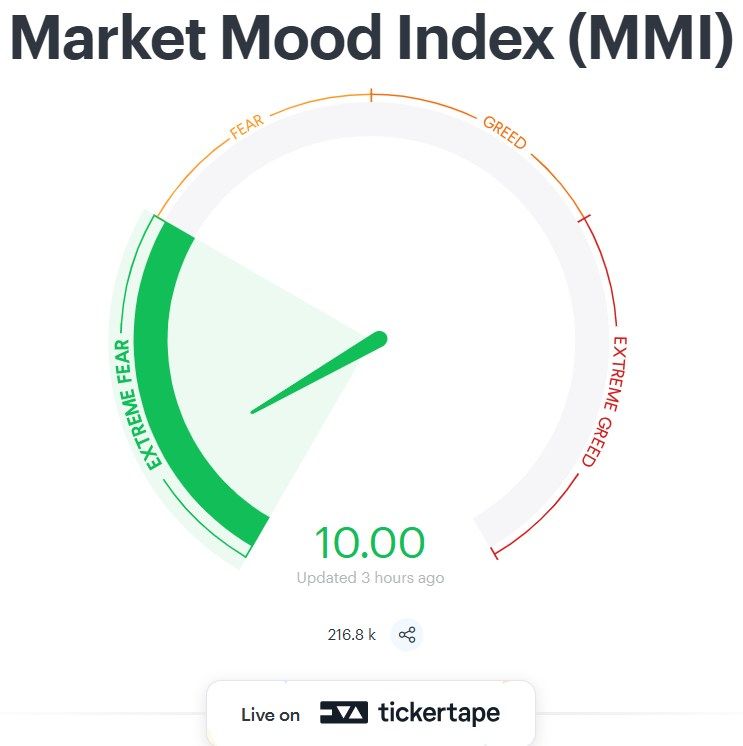

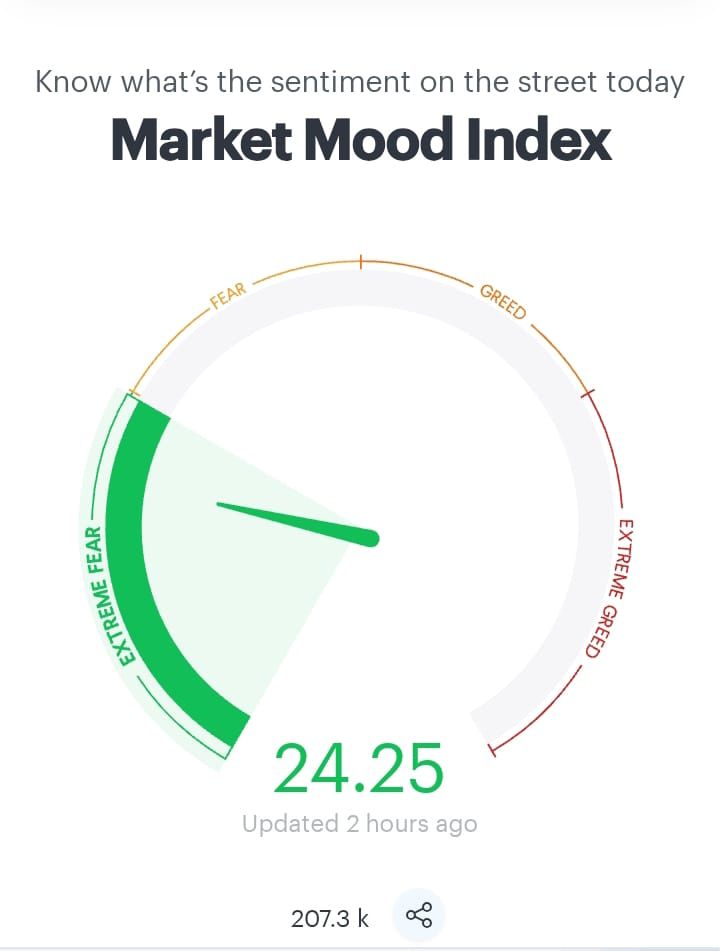

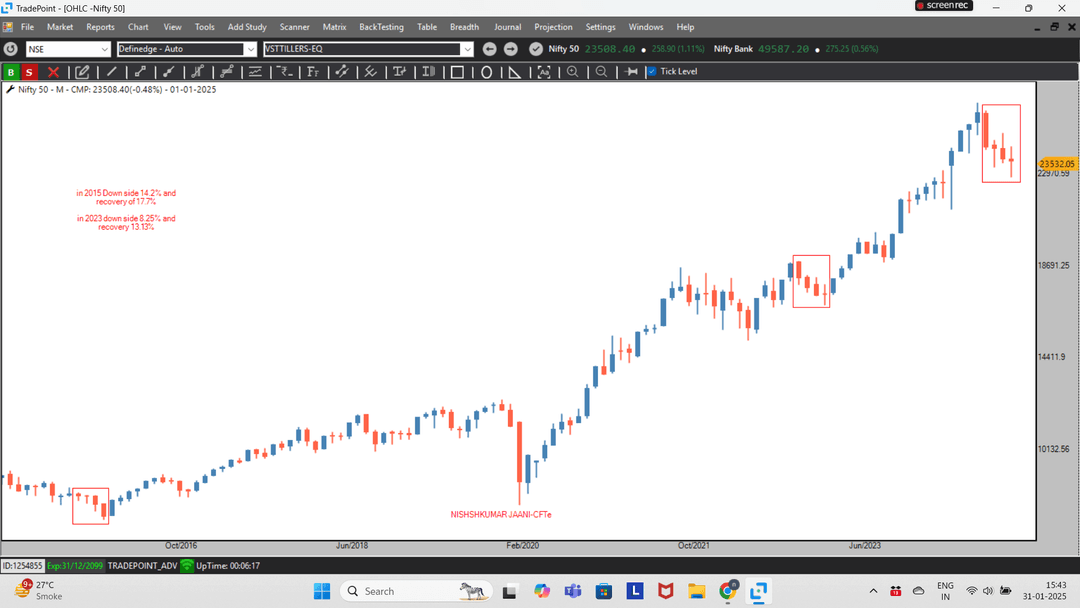

Market Mood Index hits Extreme Fear — Historically a Bottoming Zone

Market Mood Index hits Extreme Fear — Historically a Bottoming Zone

(MMI) tracks 6 key factors to capture the collective emotions driving Indian markets:

1️⃣ FII Activity – Gauges directional stance of foreign institutions via Index Futures positioning

2️⃣ Volatility & Skew – Measures risk expectations and downside probability via VIX & IV skew

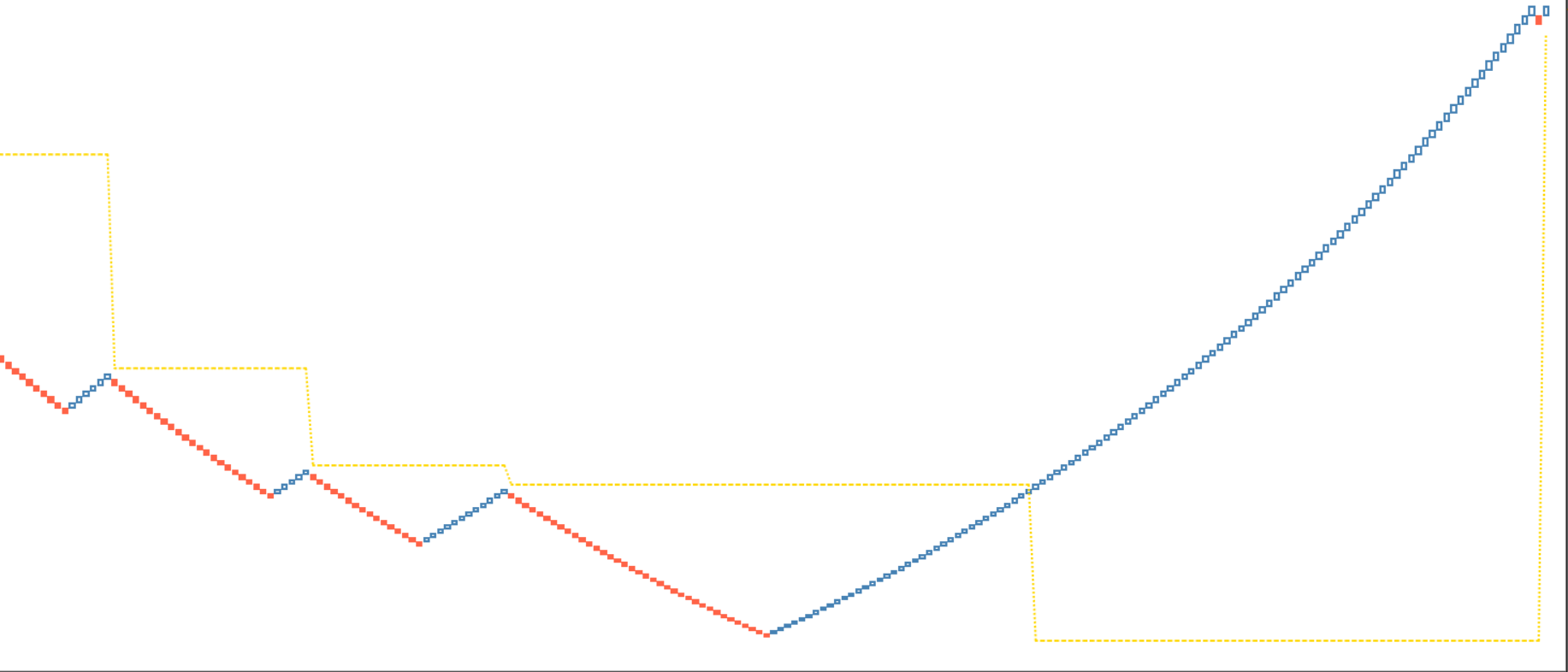

3️⃣ Momentum – 90D vs 30D trend strength of Nifty 50

4️⃣ Market Breadth – Modified Arms Index showing participation & volume confirmation

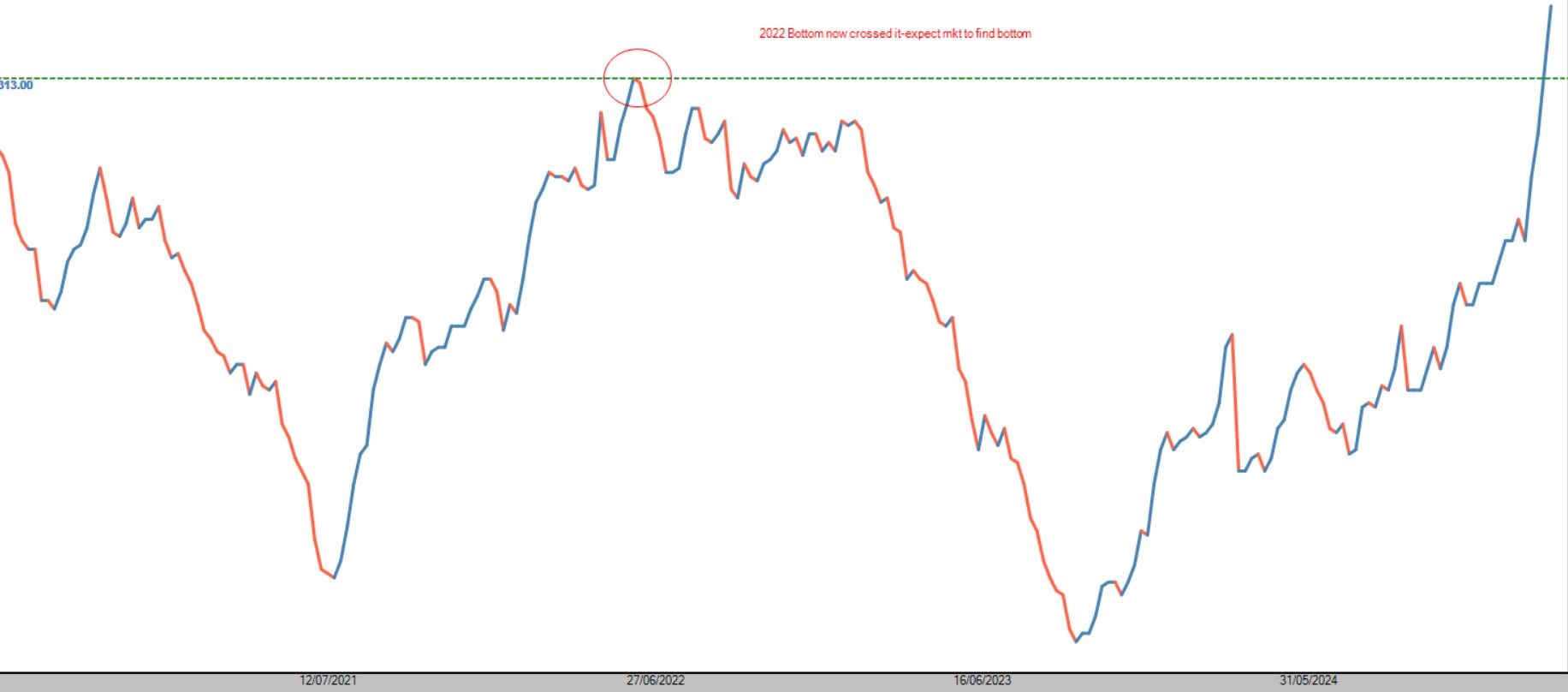

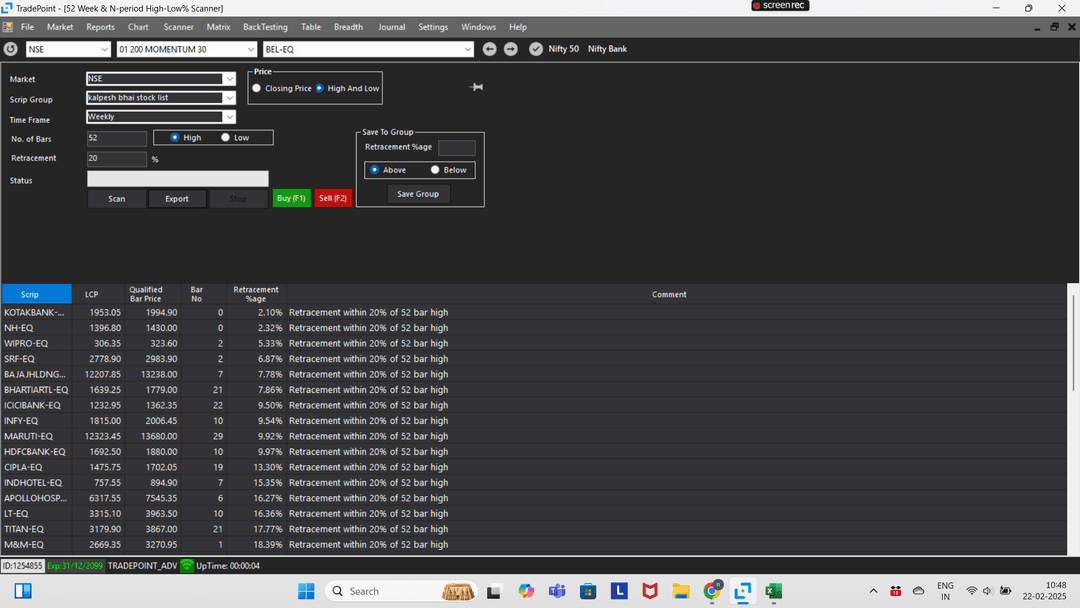

5️⃣ Price Strength – % of stocks near 52W highs minus % near 52W lows

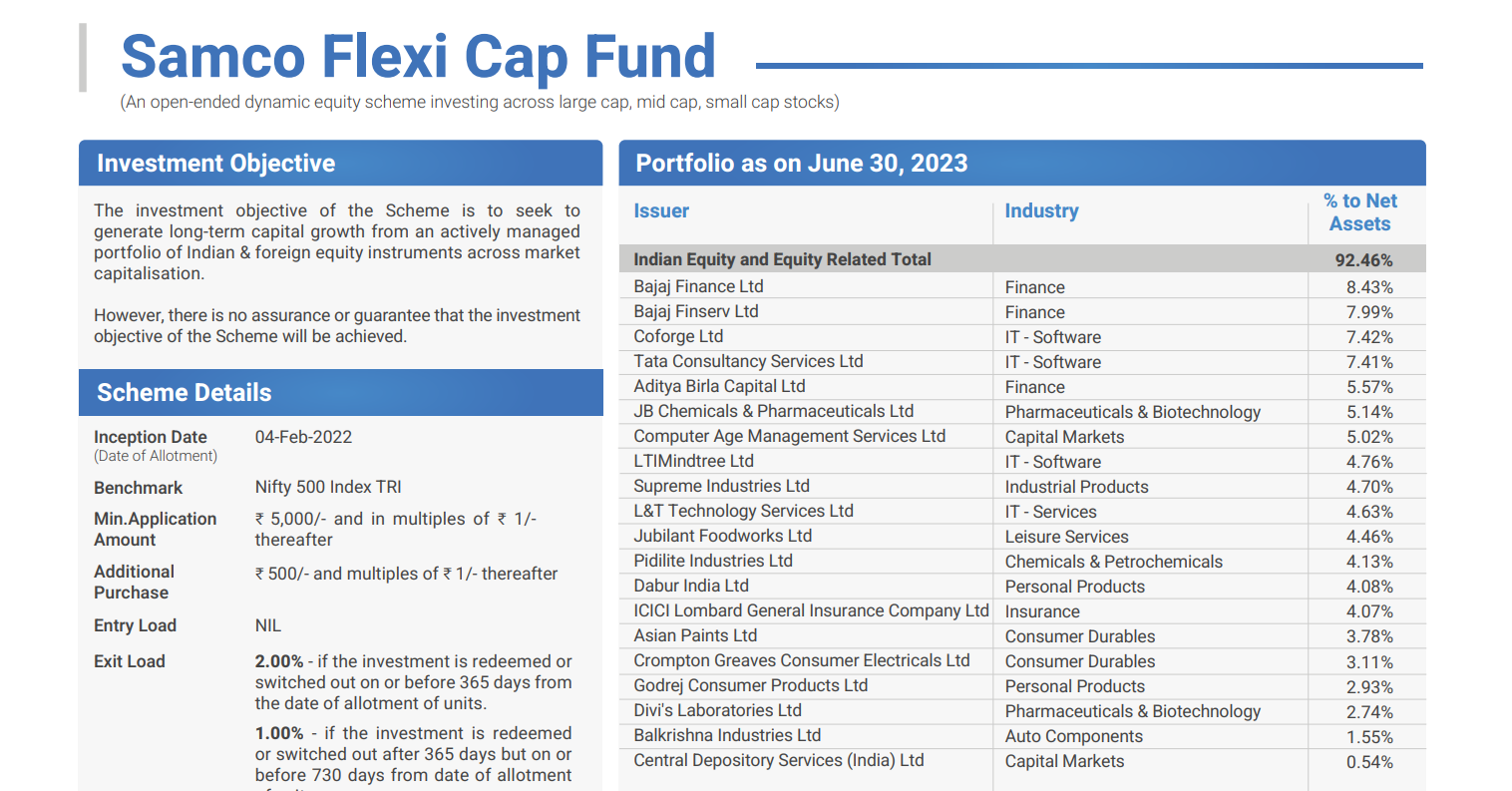

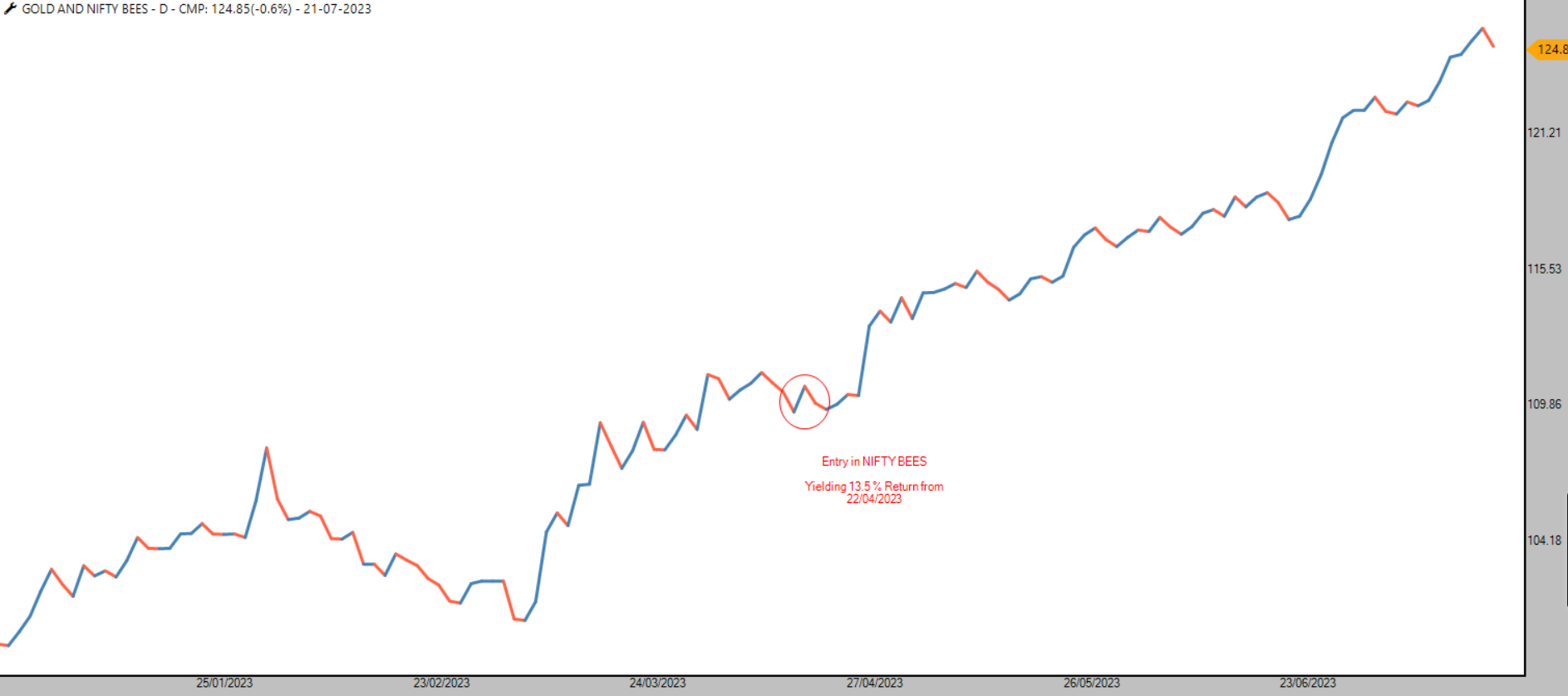

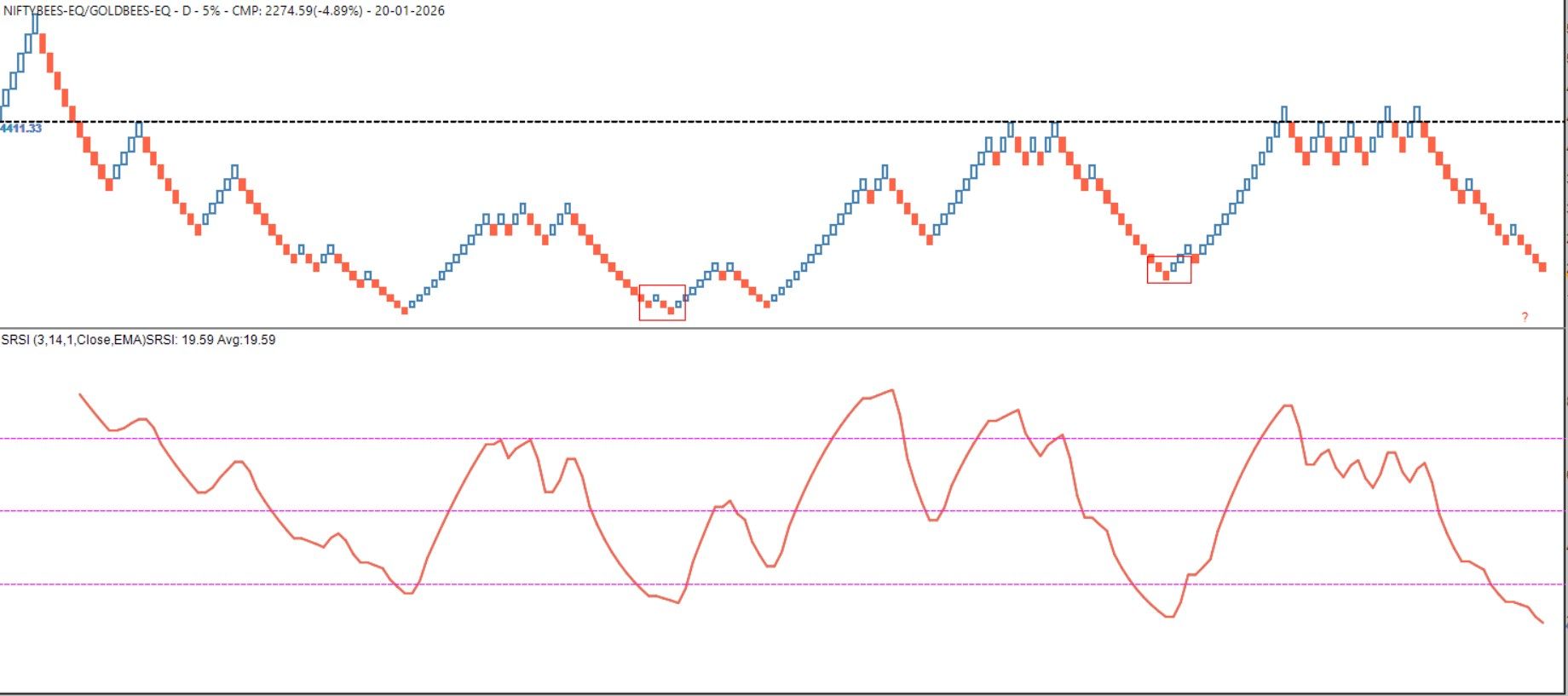

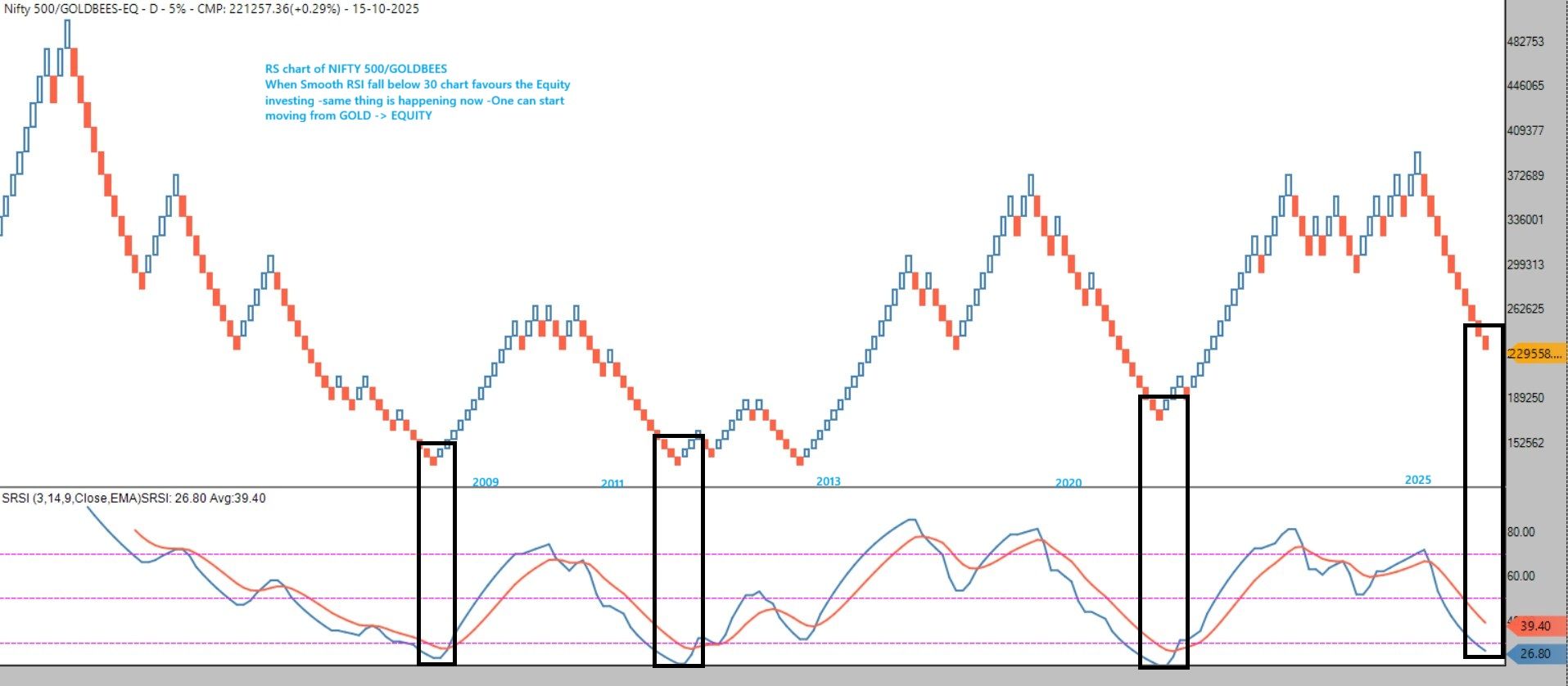

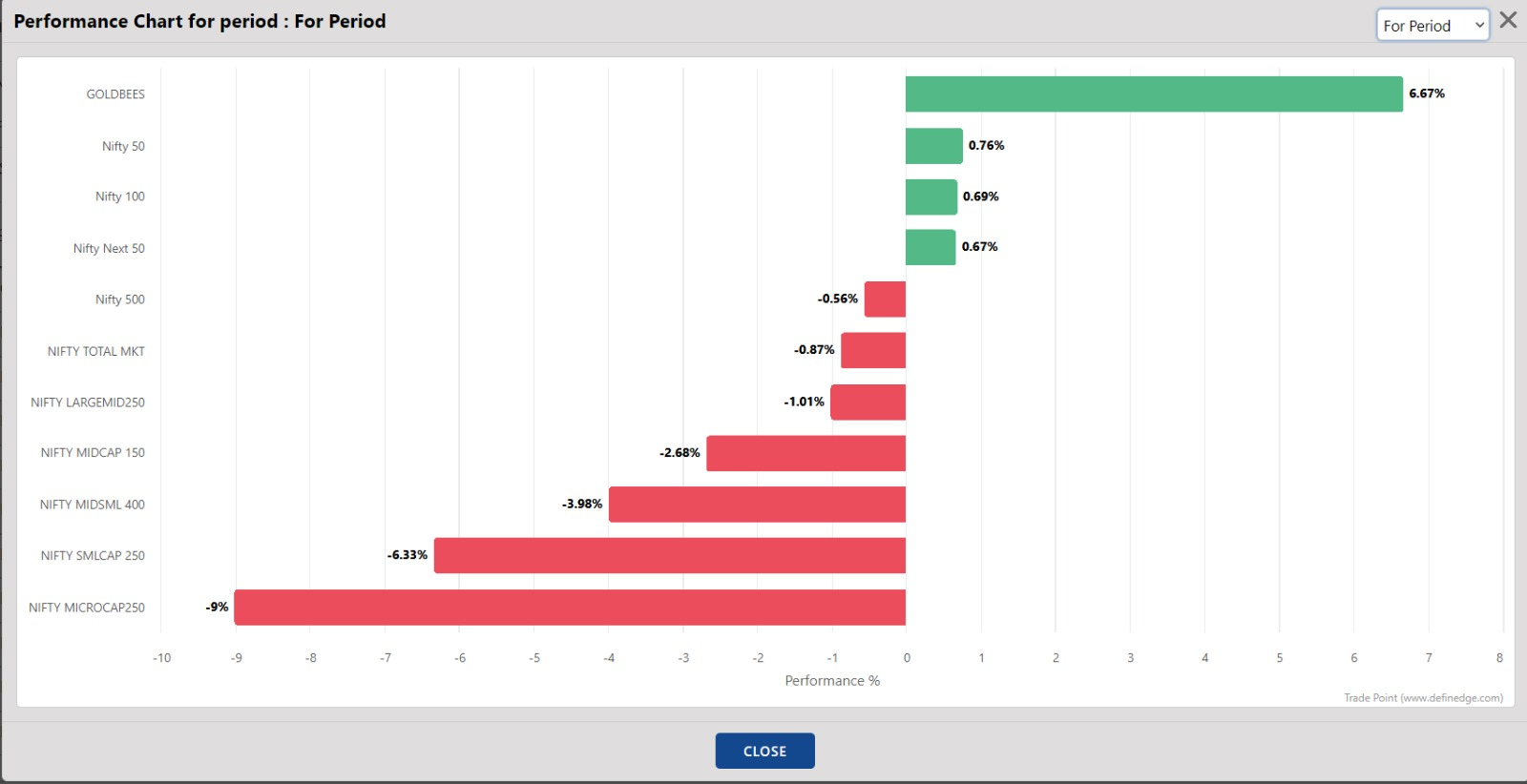

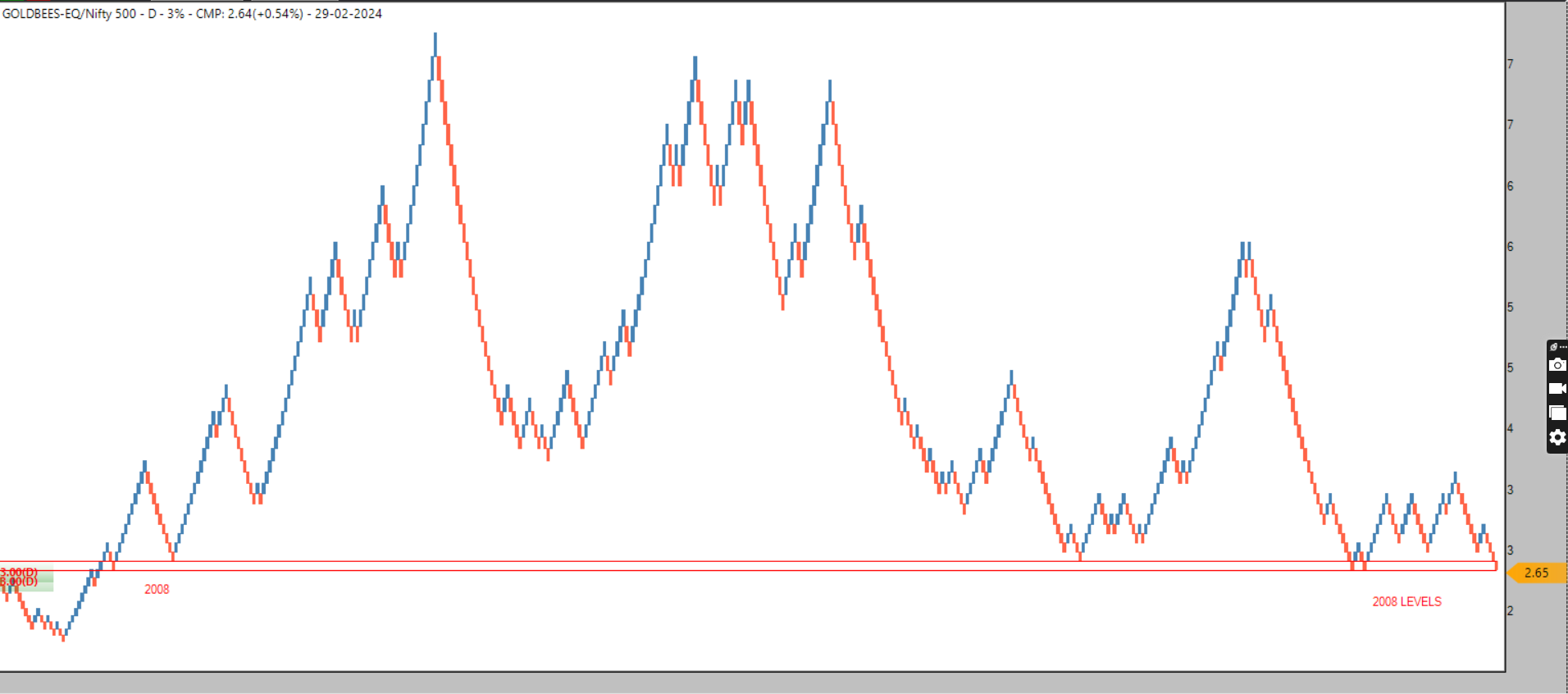

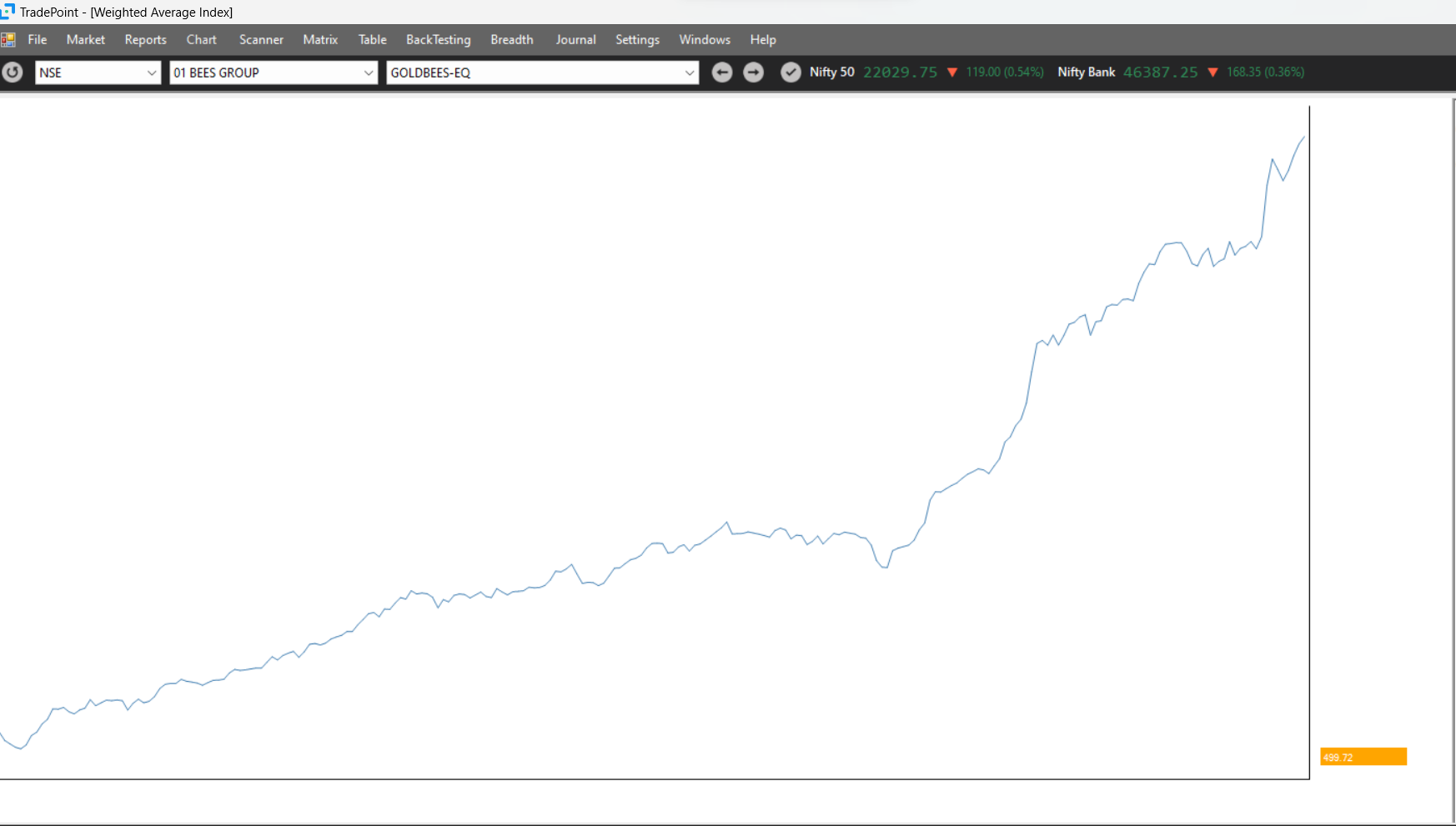

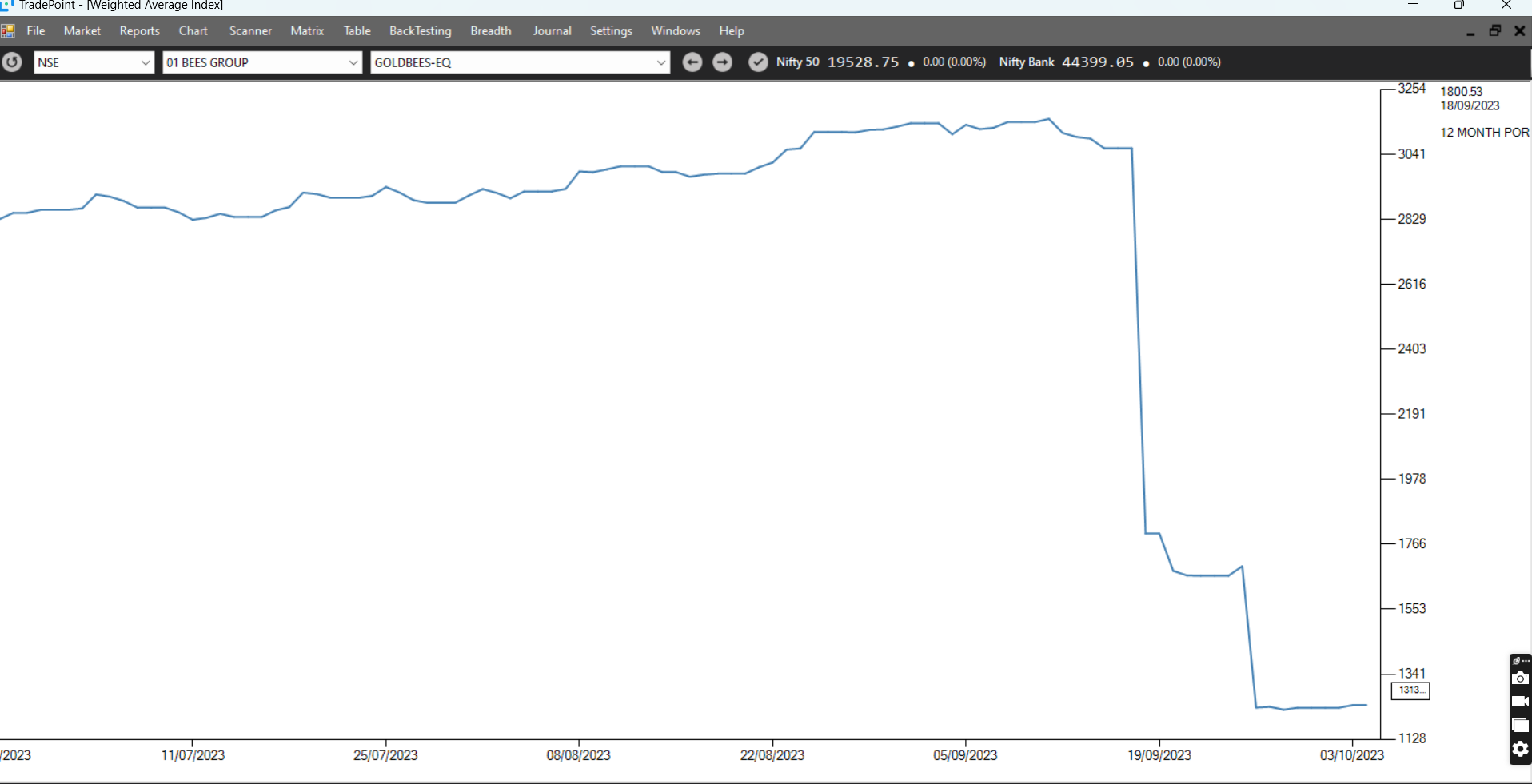

6️⃣ Demand for Gold – Relative performance of Gold vs Nifty (flight to safety)

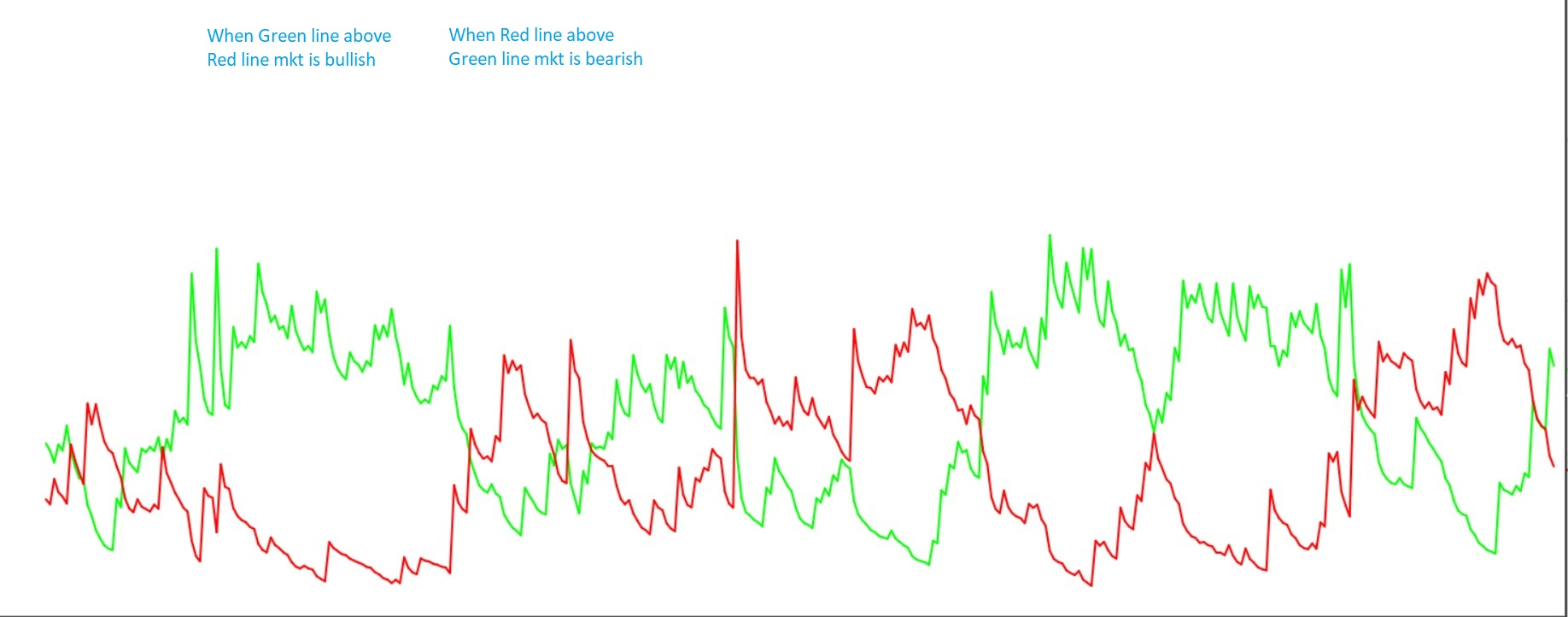

🟣 Current Situation:

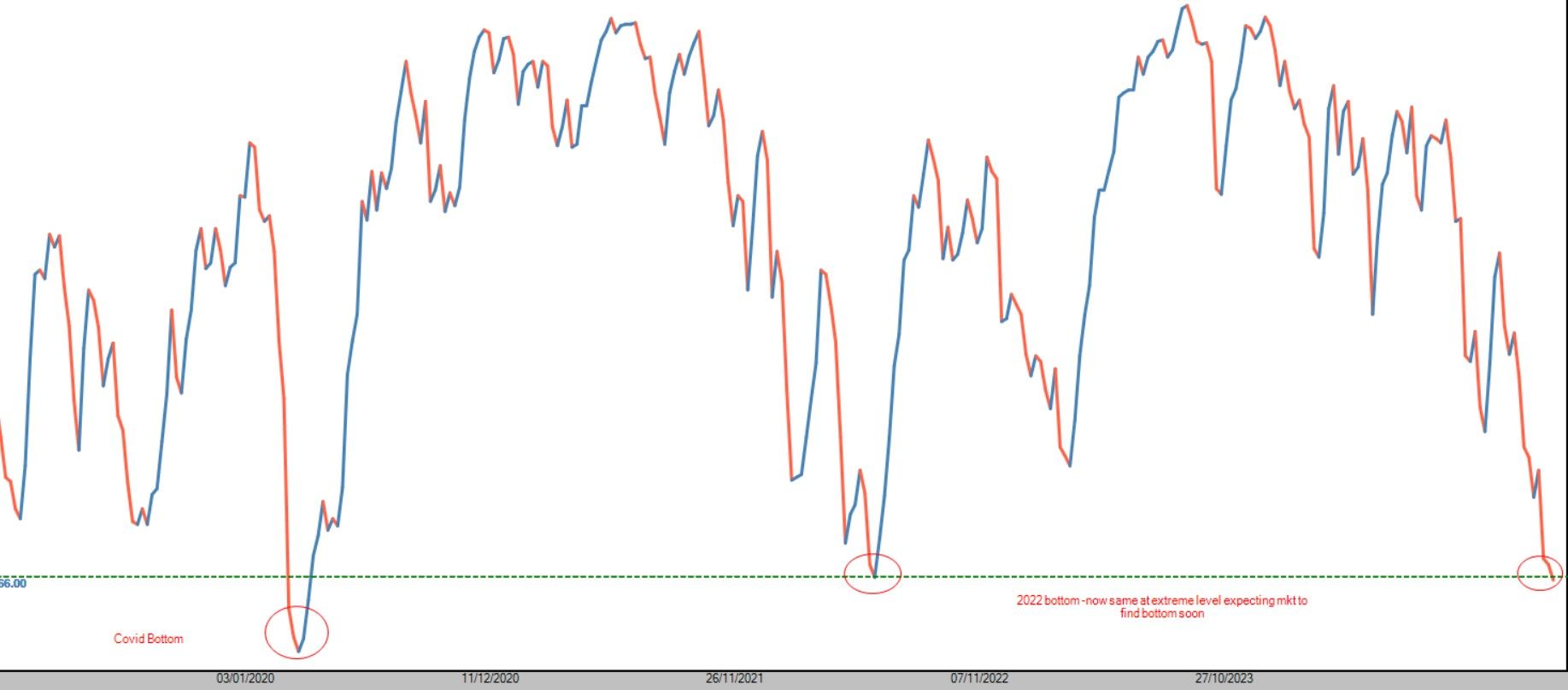

MMI has slipped into EXTREME FEAR territory.

Historical Behavior:

Historical Behavior:

Every previous dip into the extreme fear zone has aligned with market bottoms and led to positive forward returns as sentiment mean-reverted from fear → neutrality → optimism.

Why this matters:

Extreme pessimism often marks an exhaustion zone where selling pressure fades and value buyers emerge.

Takeaway for Investors & Traders:

Takeaway for Investors & Traders:

Fear-driven markets tend to create opportunities, not warnings — but timing & risk management remain essential.

Sentiment drives short-term moves. Fundamentals drive long-term outcomes.

Nishesh Jani,CFTe

#MarketMoodIndex #ExtremeFear #ContrarianSignals #Nifty50 #FIIData #VIX #MarketSentiment #IndiaMarkets #StockMarketIndia #Investing #Trading #MarketBottom #GoldVsEquity #nsiheshjani #AhmedabadNest

️

️

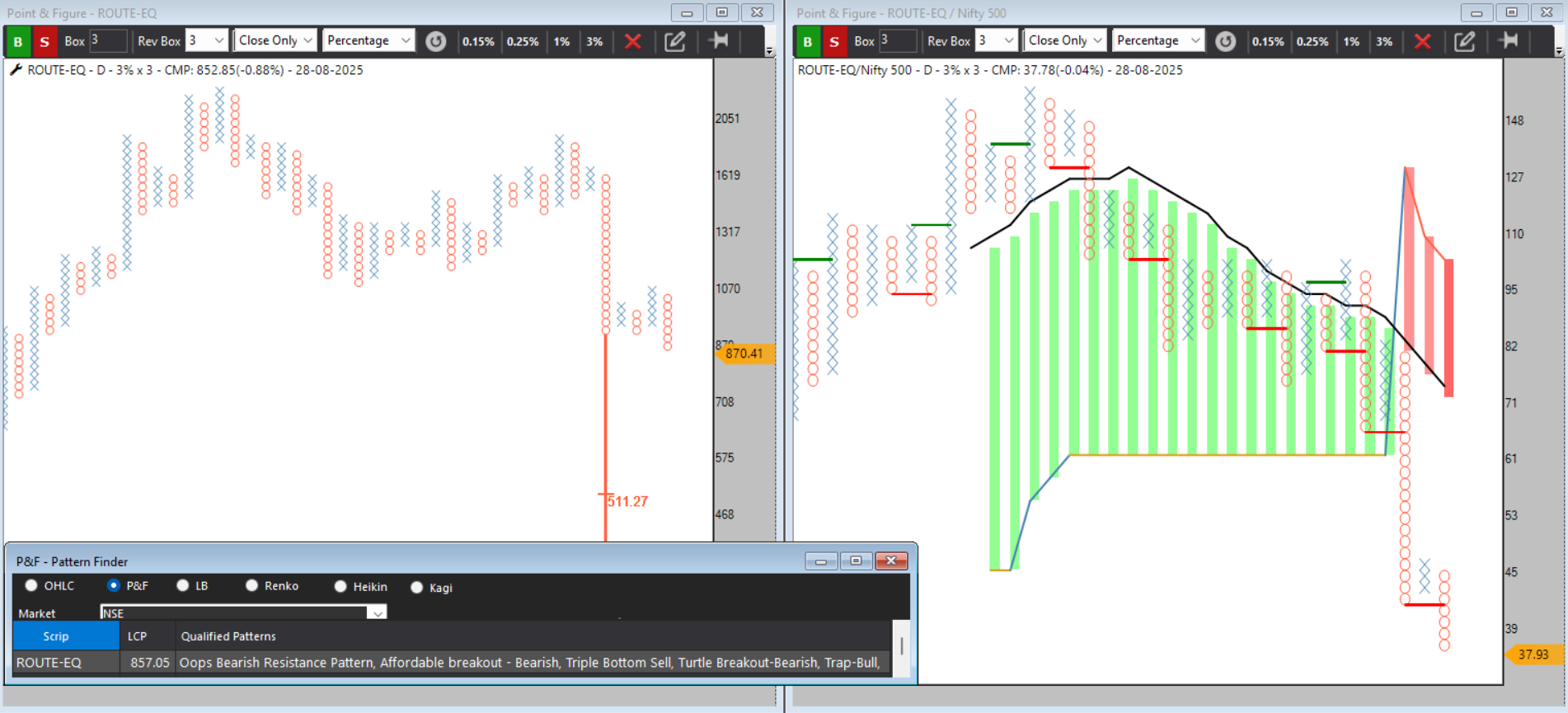

Market crash memes everywhere

Market crash memes everywhere ️ What happens next?

️ What happens next? Keeping fingers crossed for a reversal setup.

Keeping fingers crossed for a reversal setup.

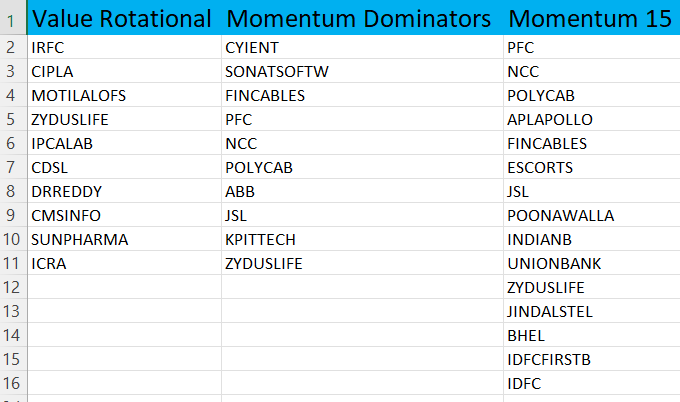

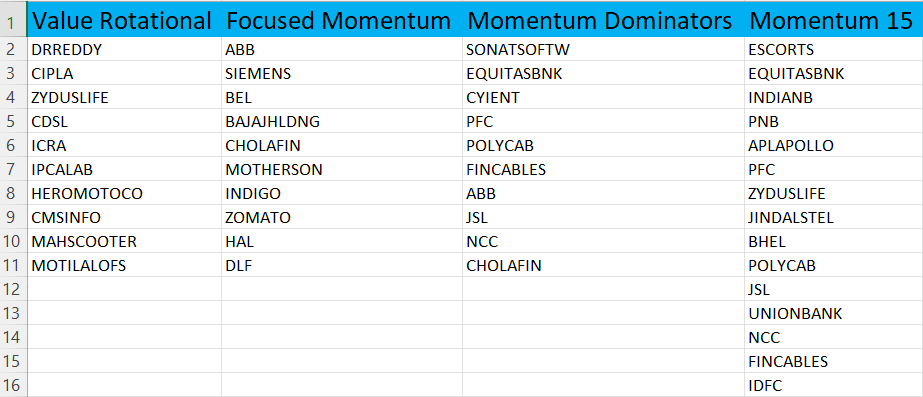

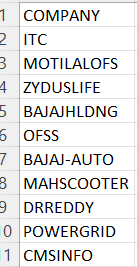

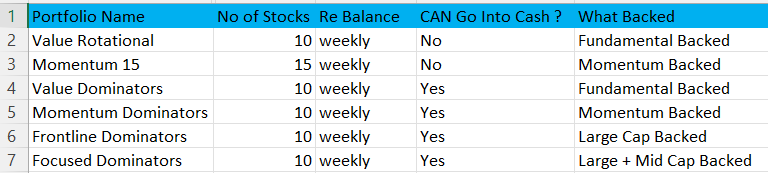

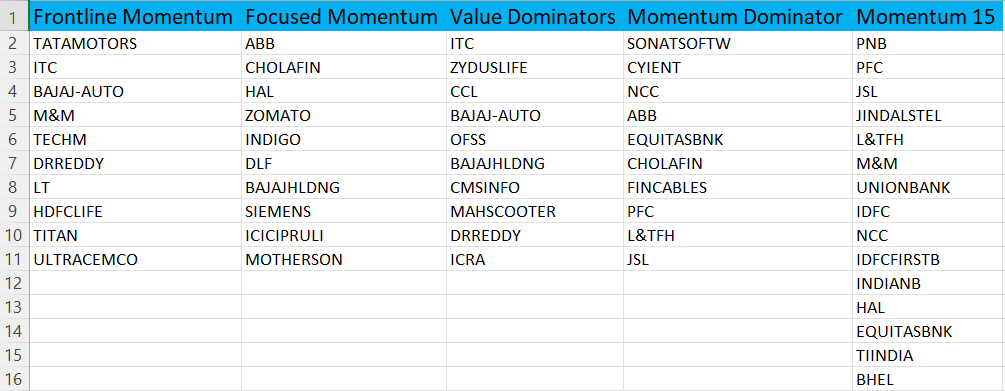

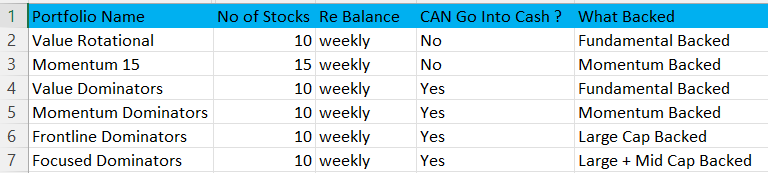

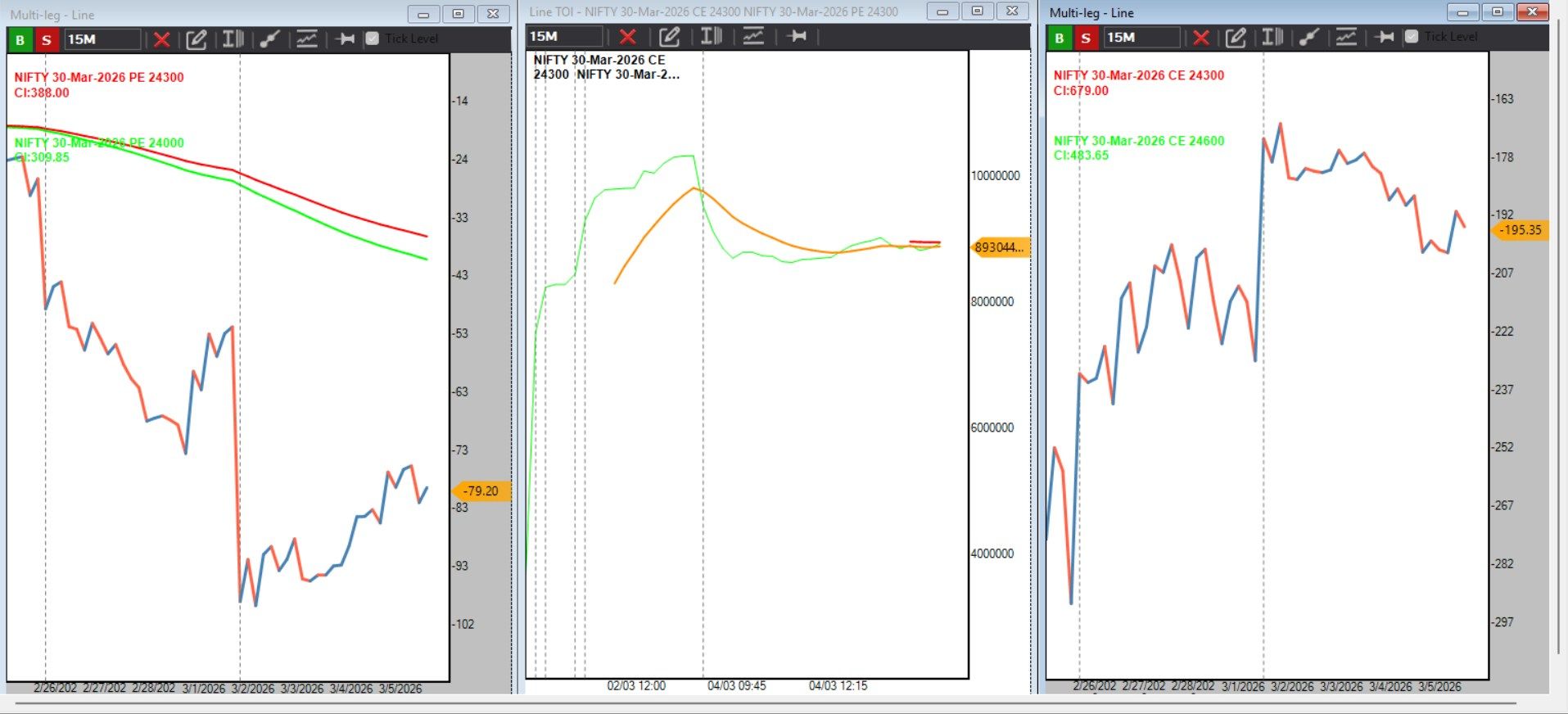

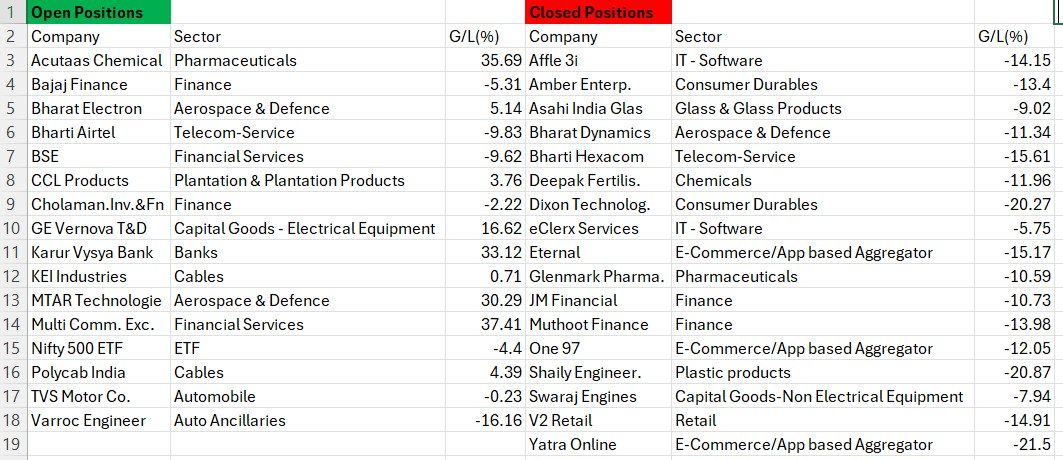

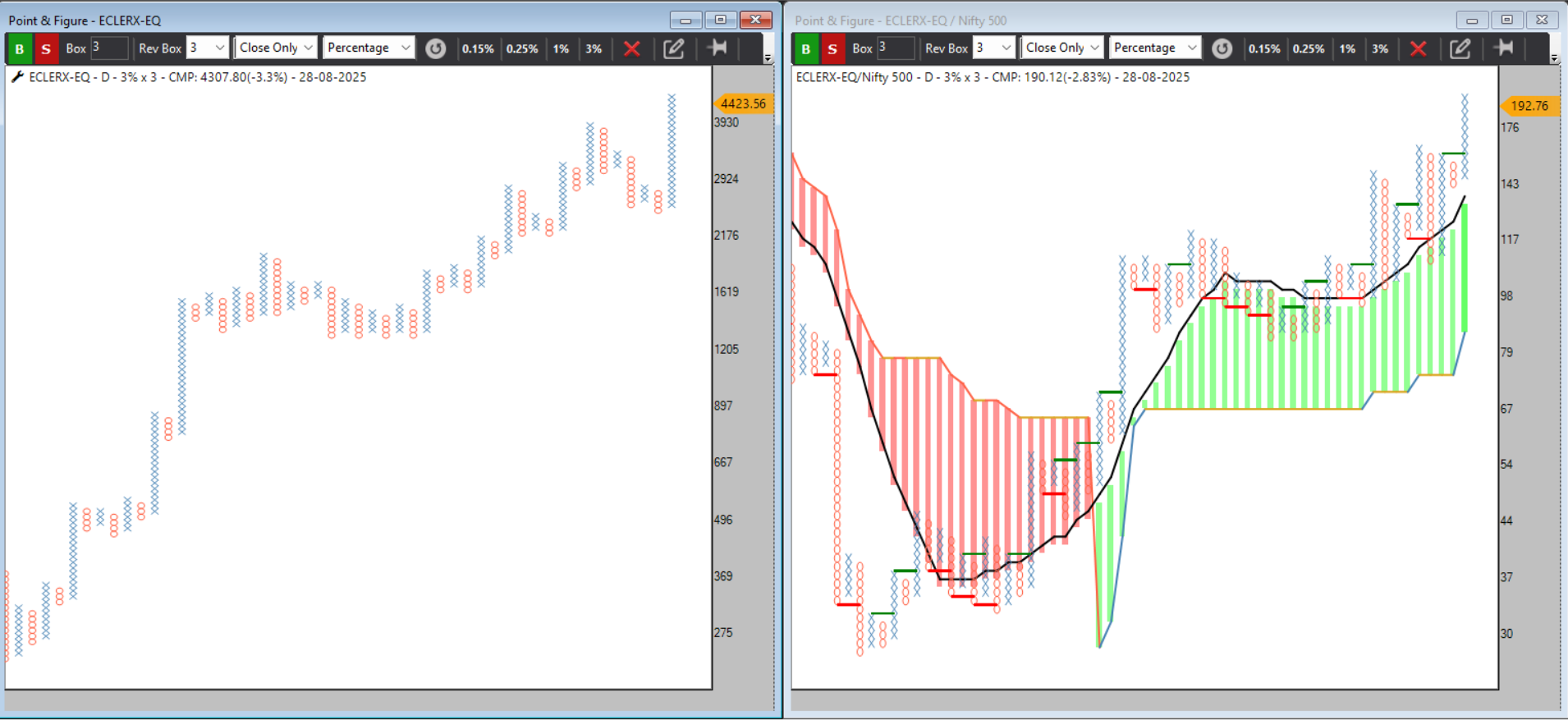

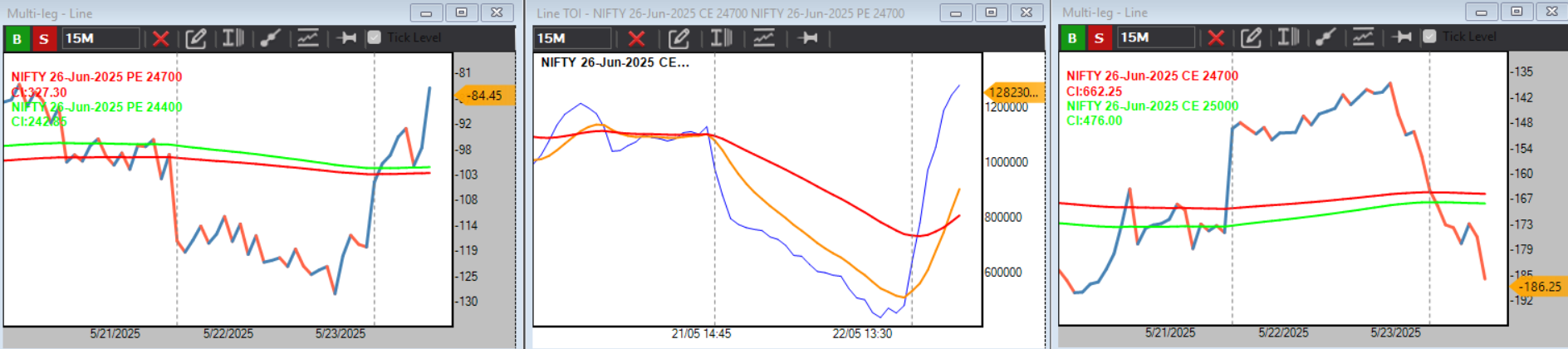

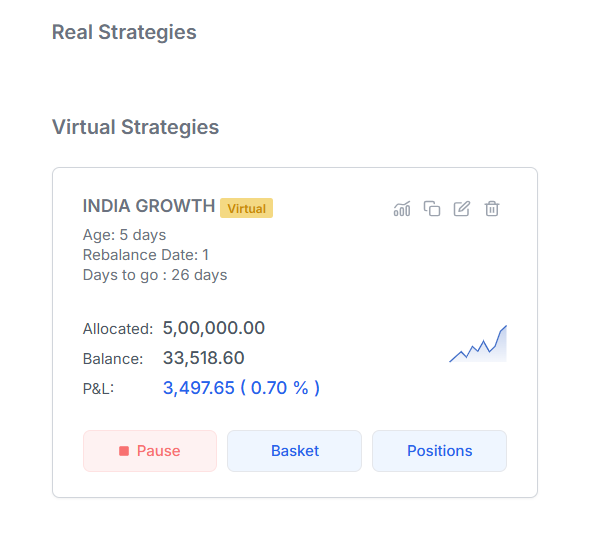

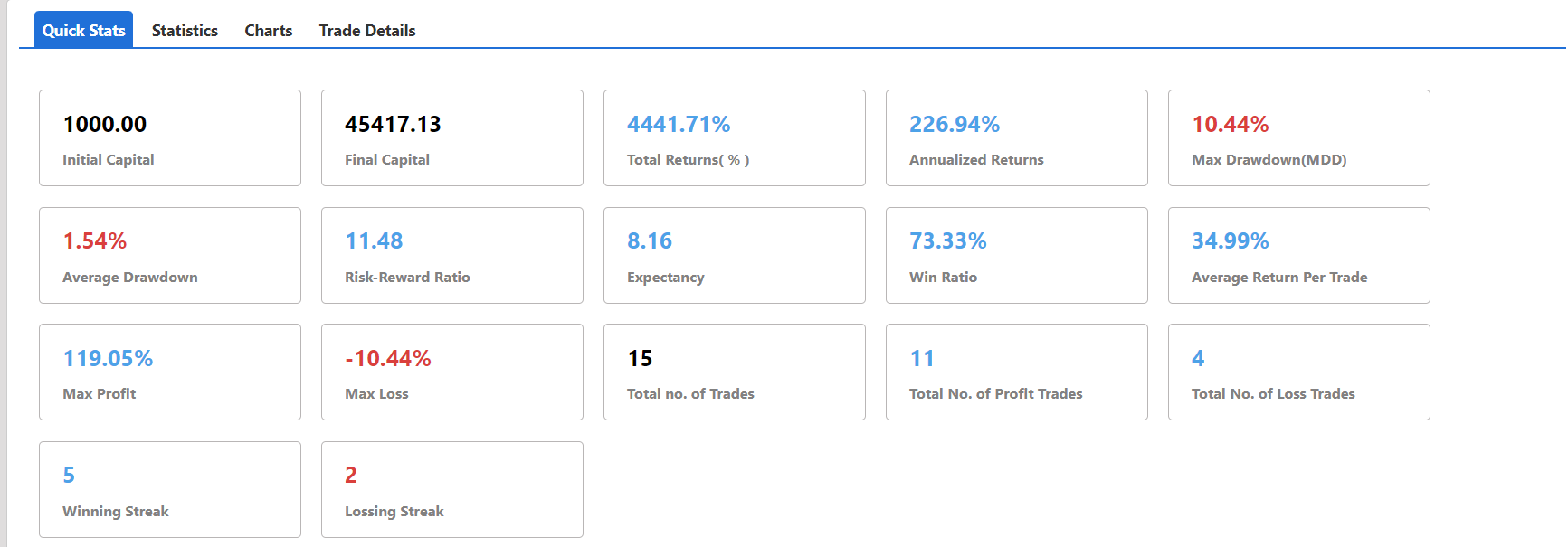

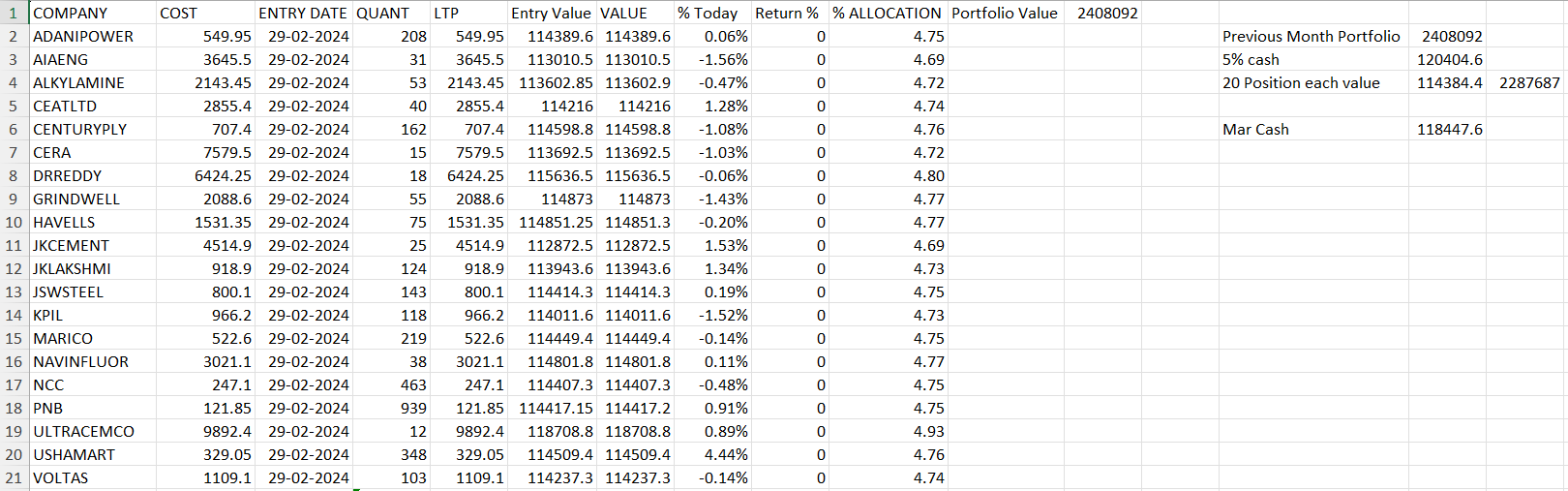

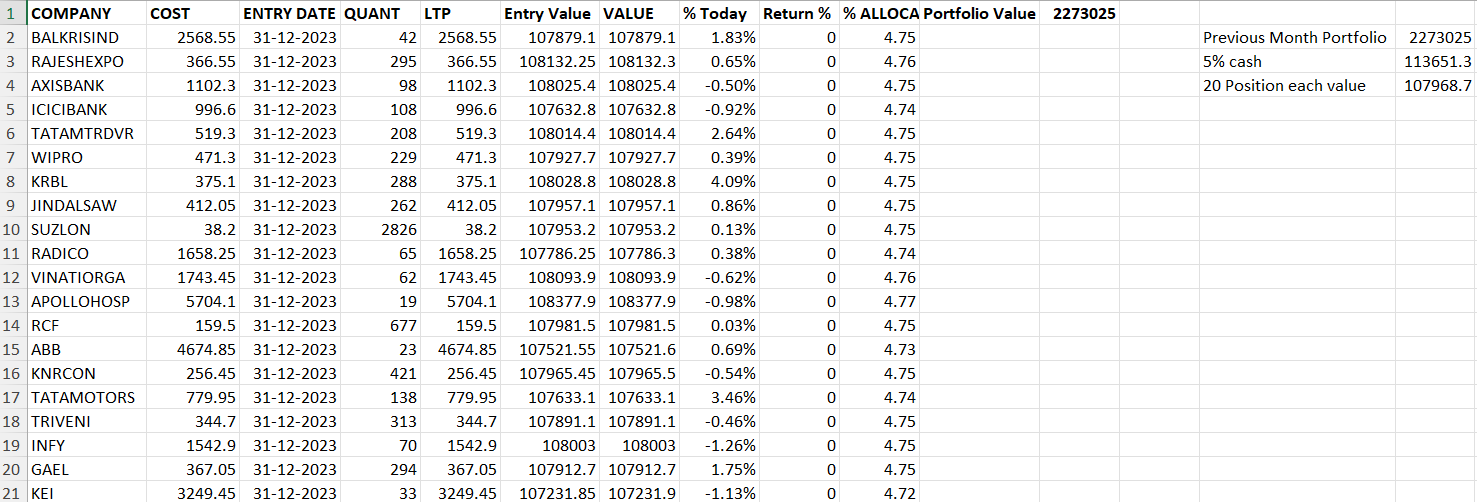

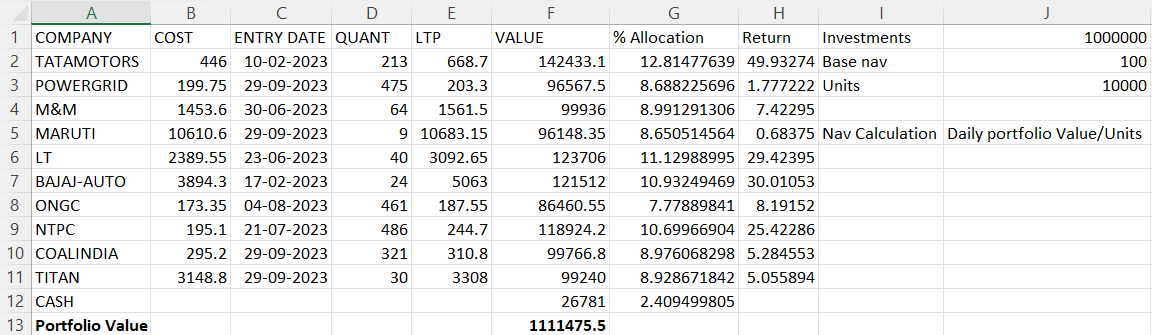

Closed Positions

Closed Positions Let winners run

Let winners run Collaborative Learning

Collaborative Learning

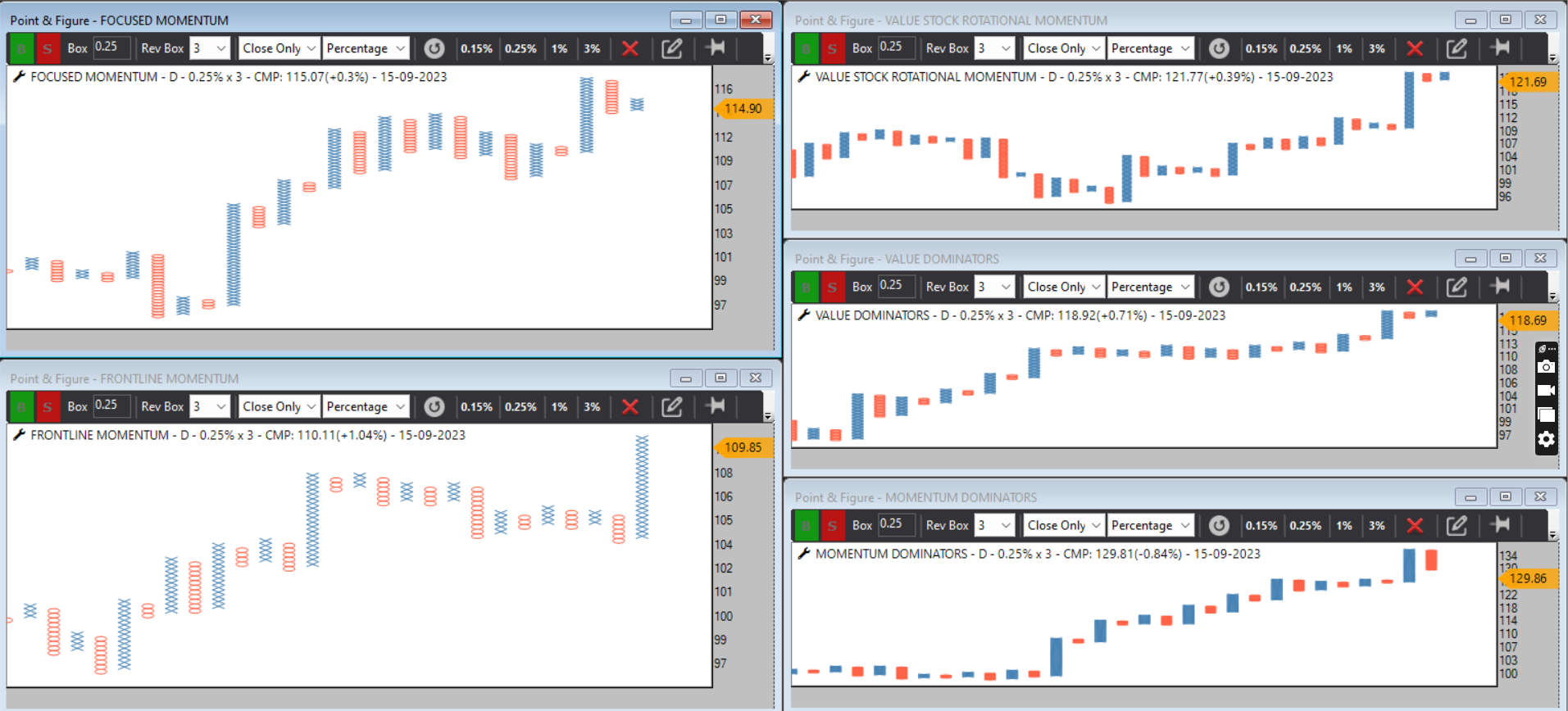

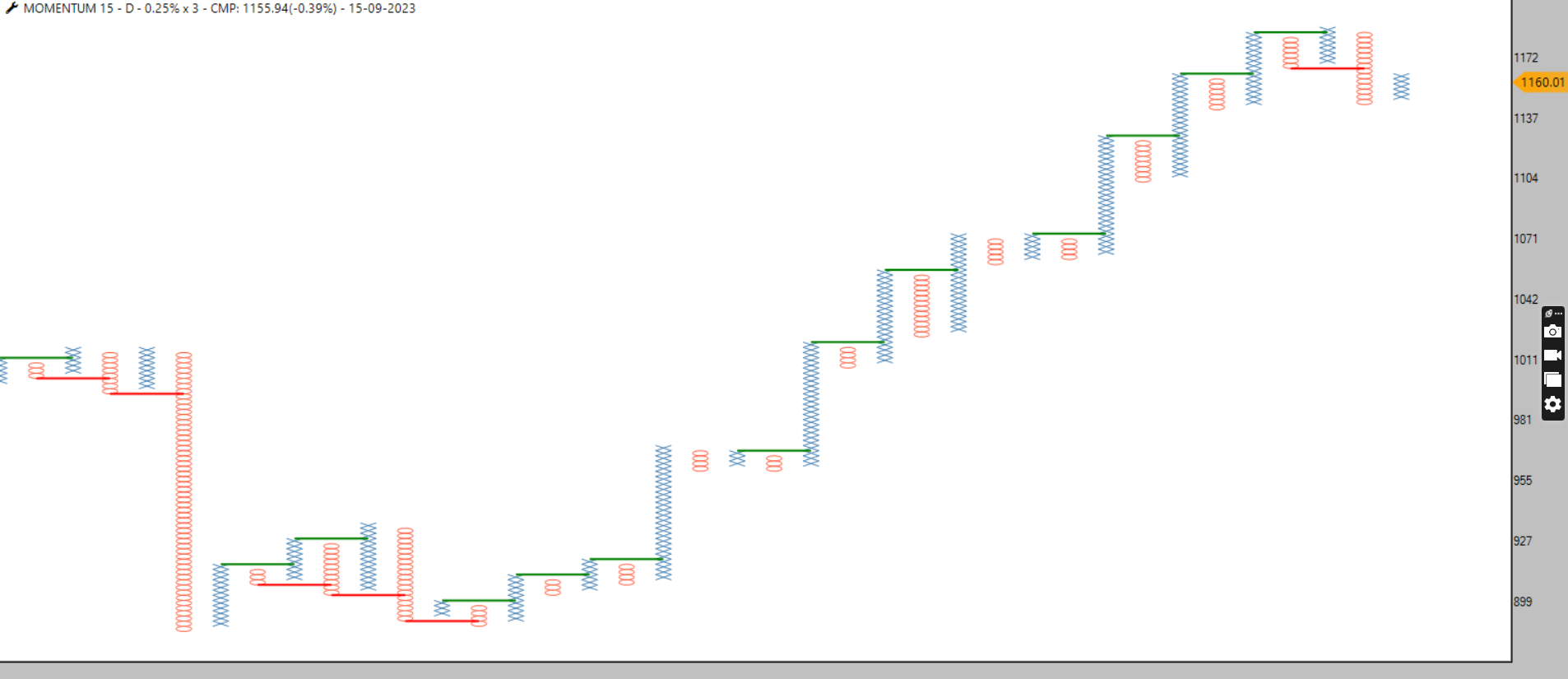

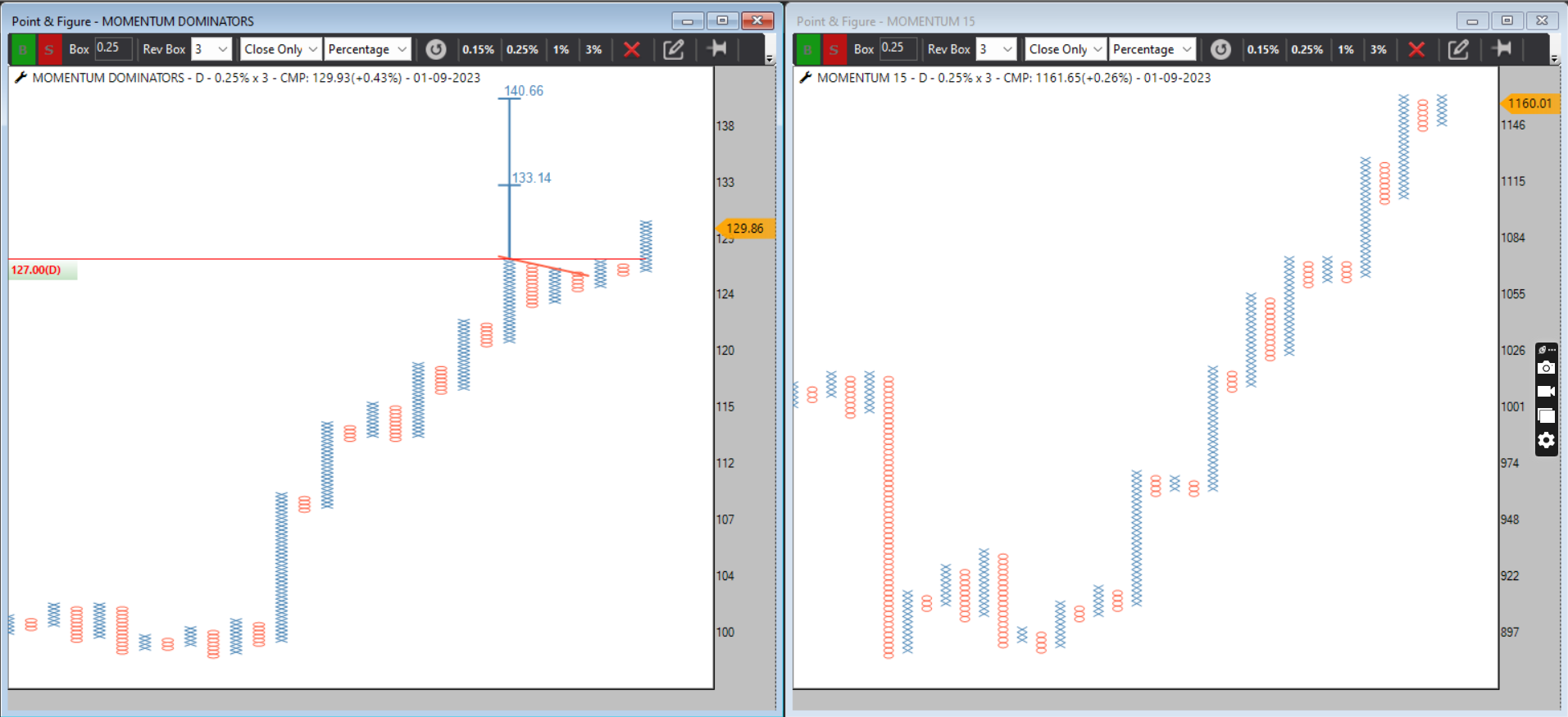

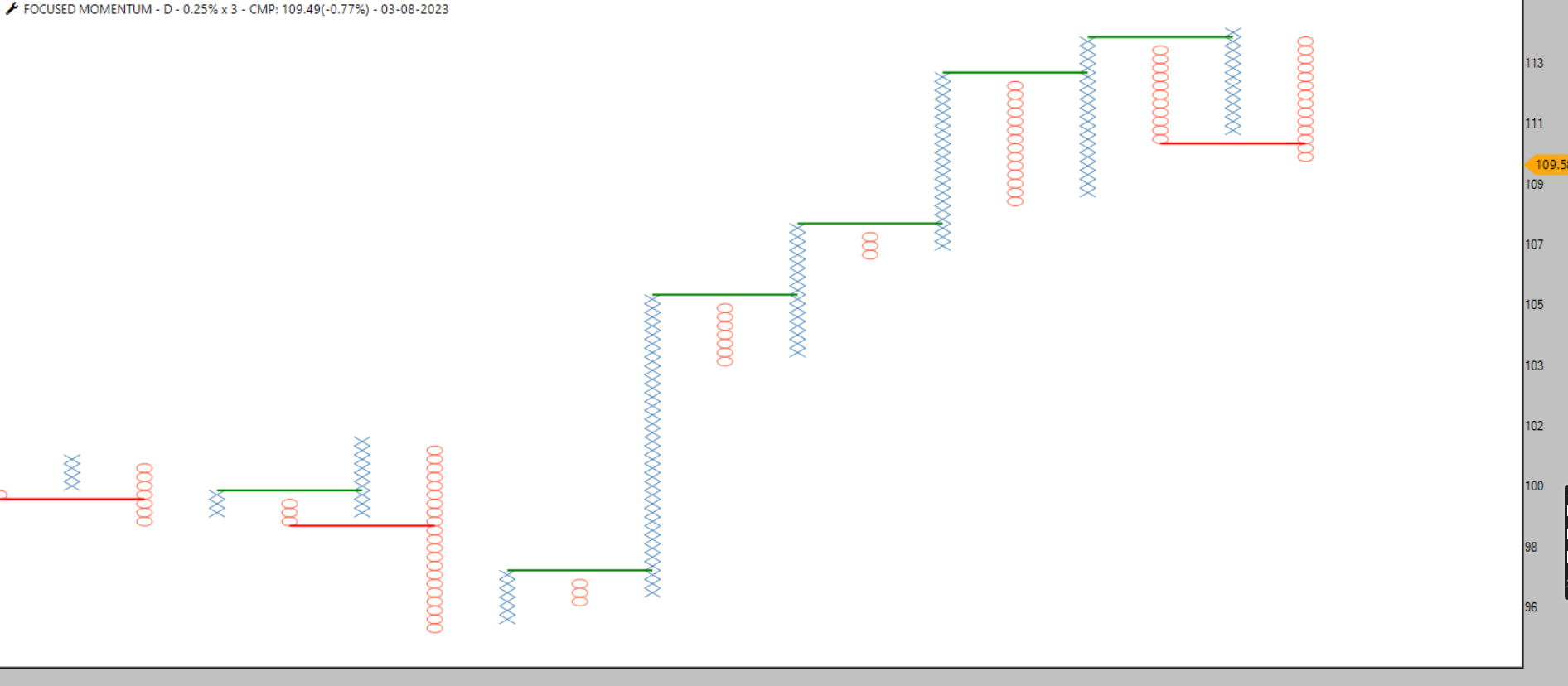

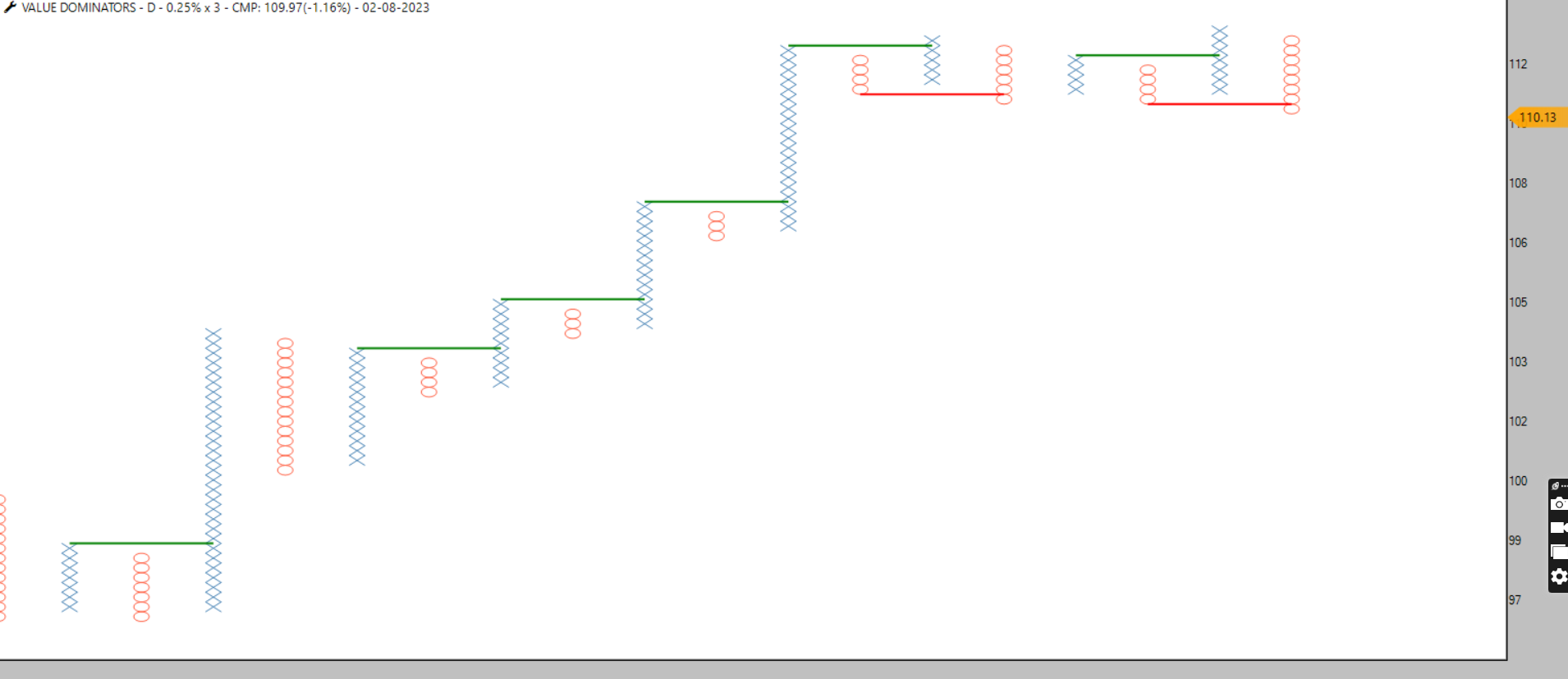

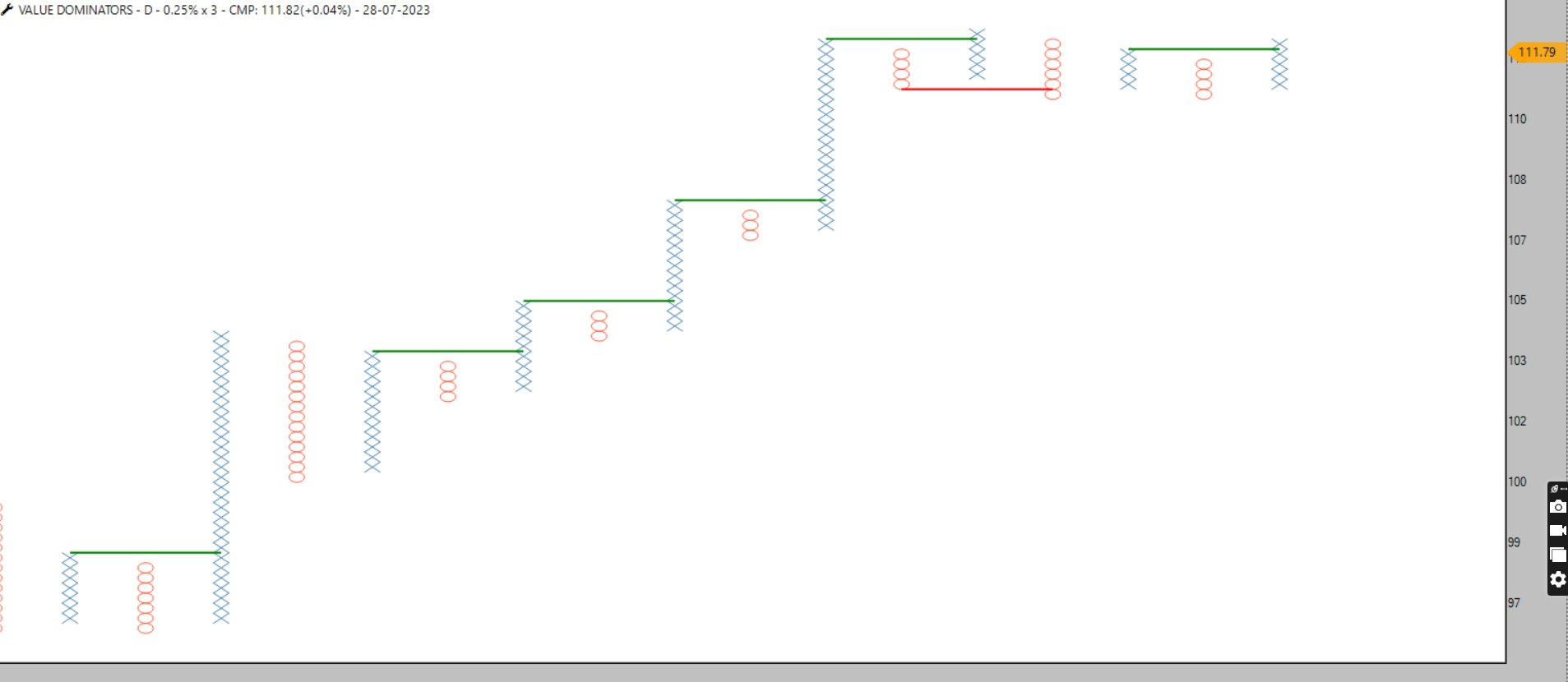

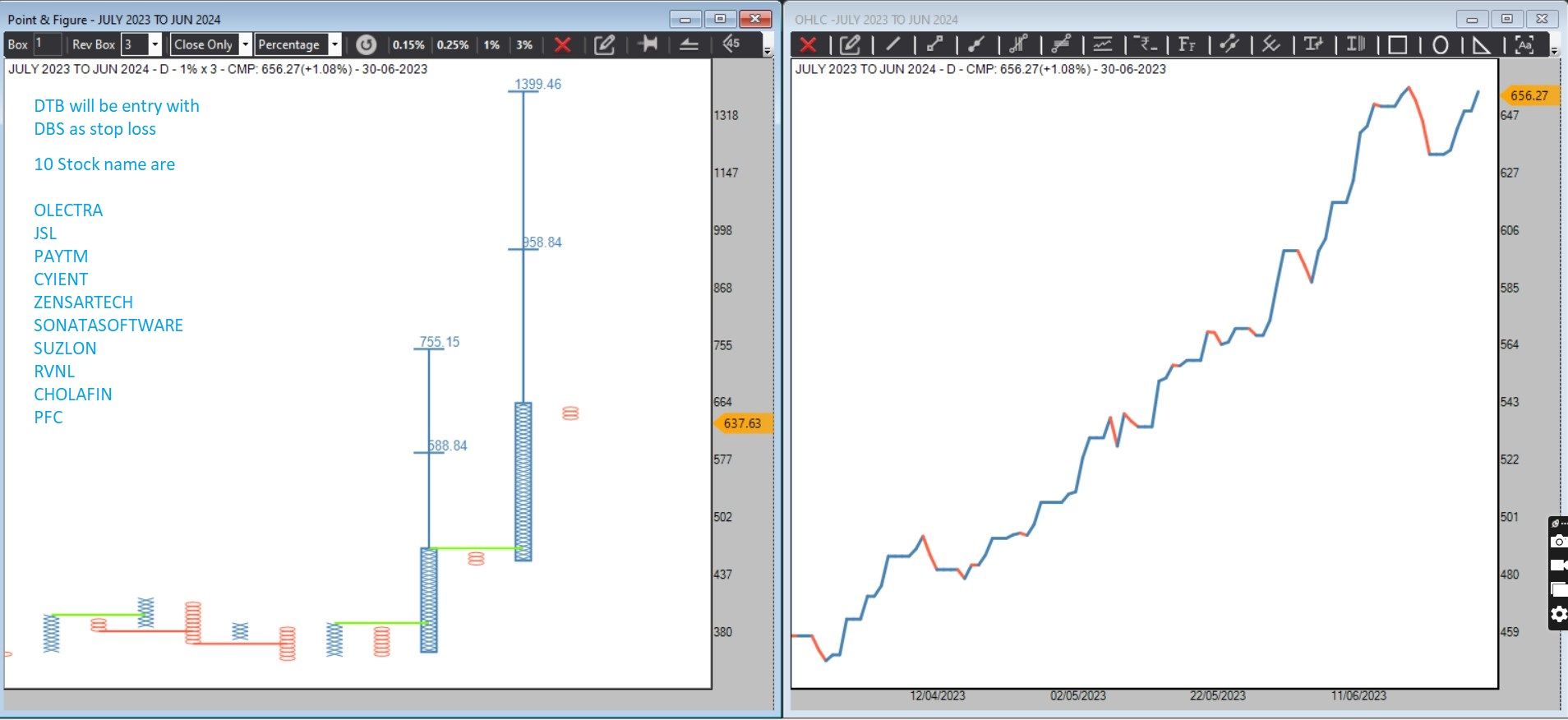

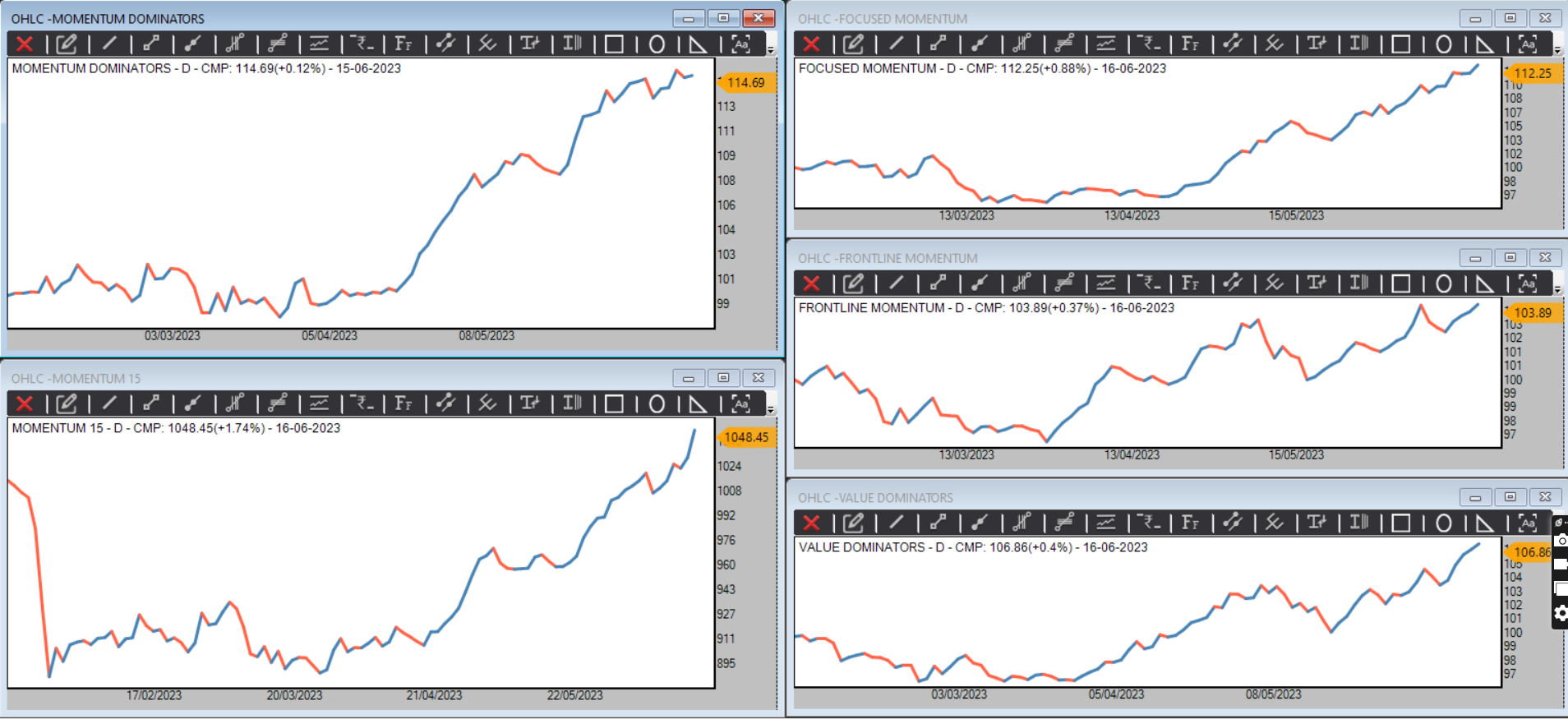

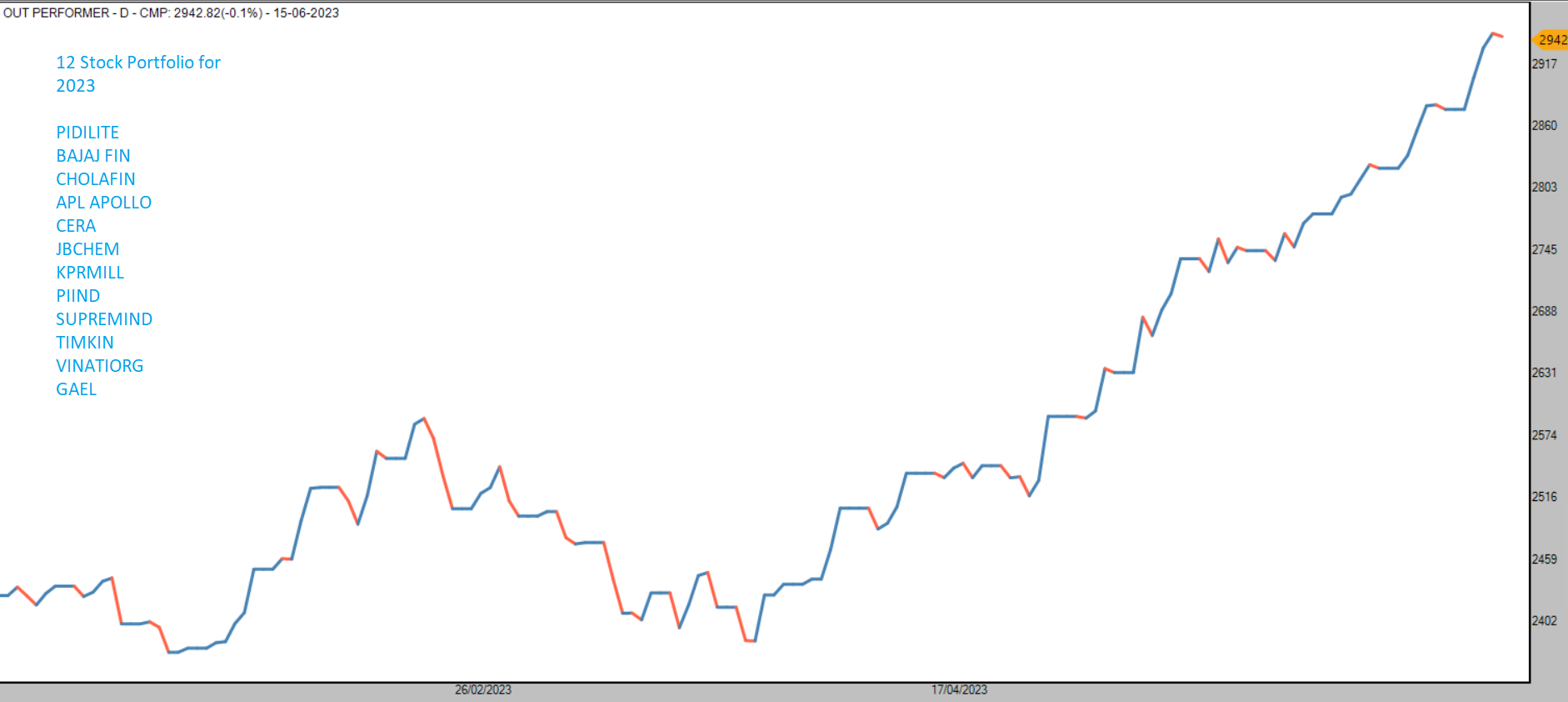

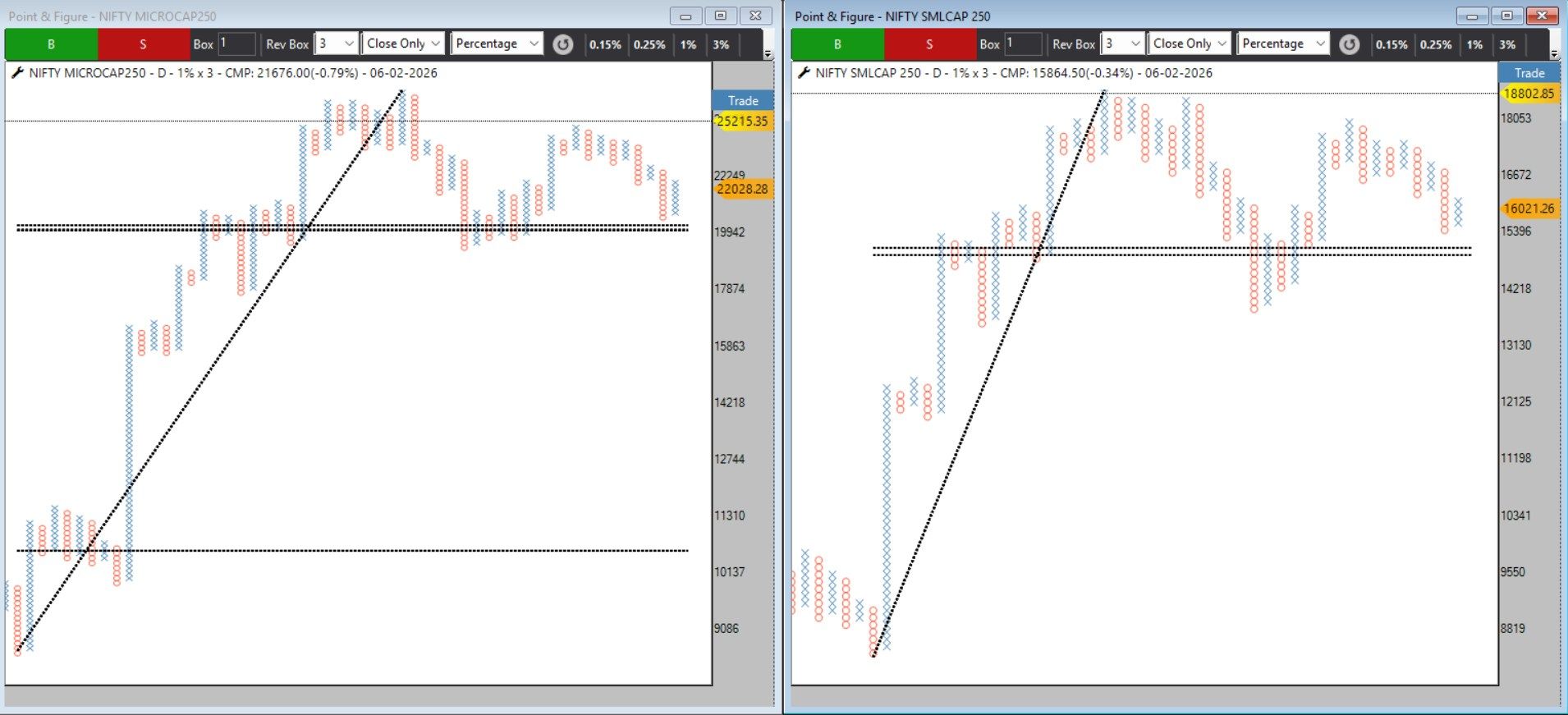

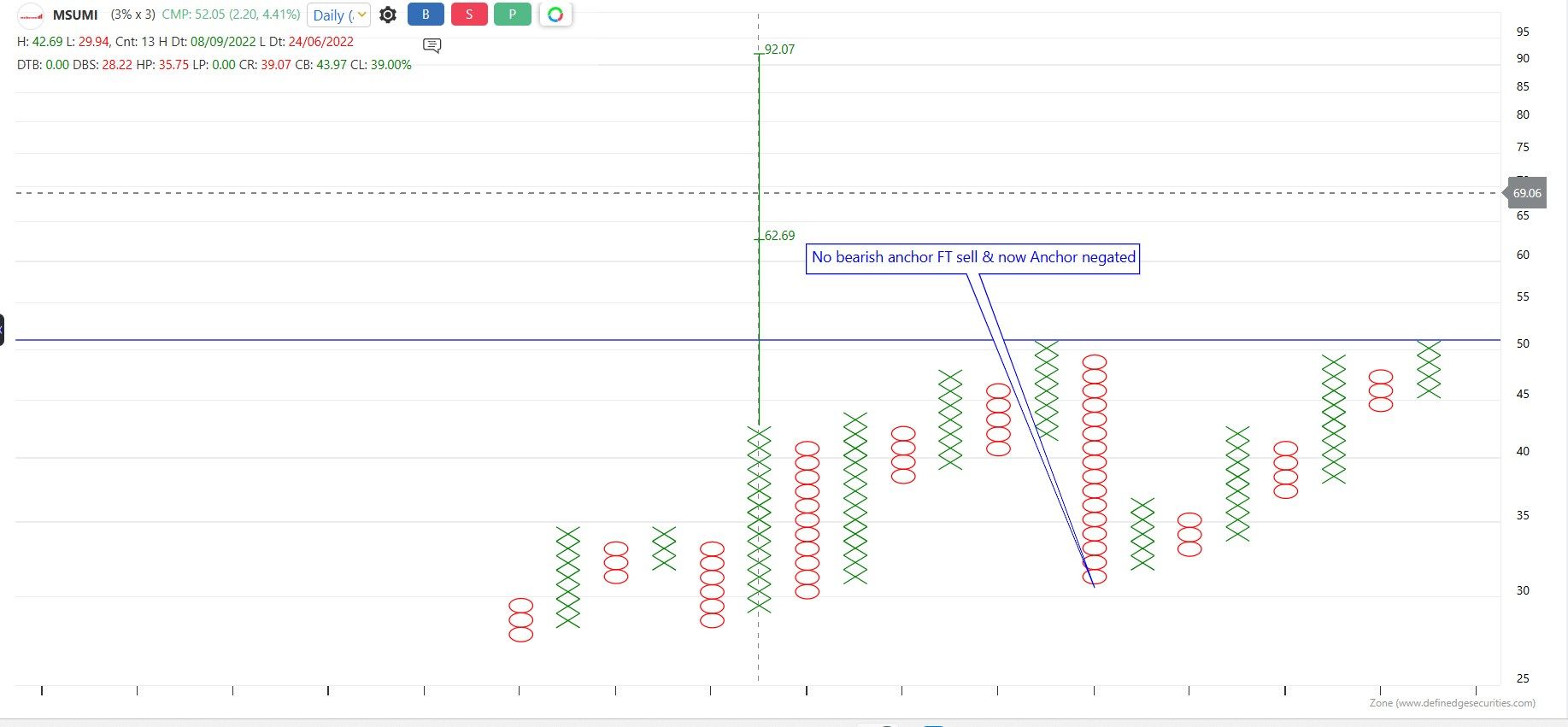

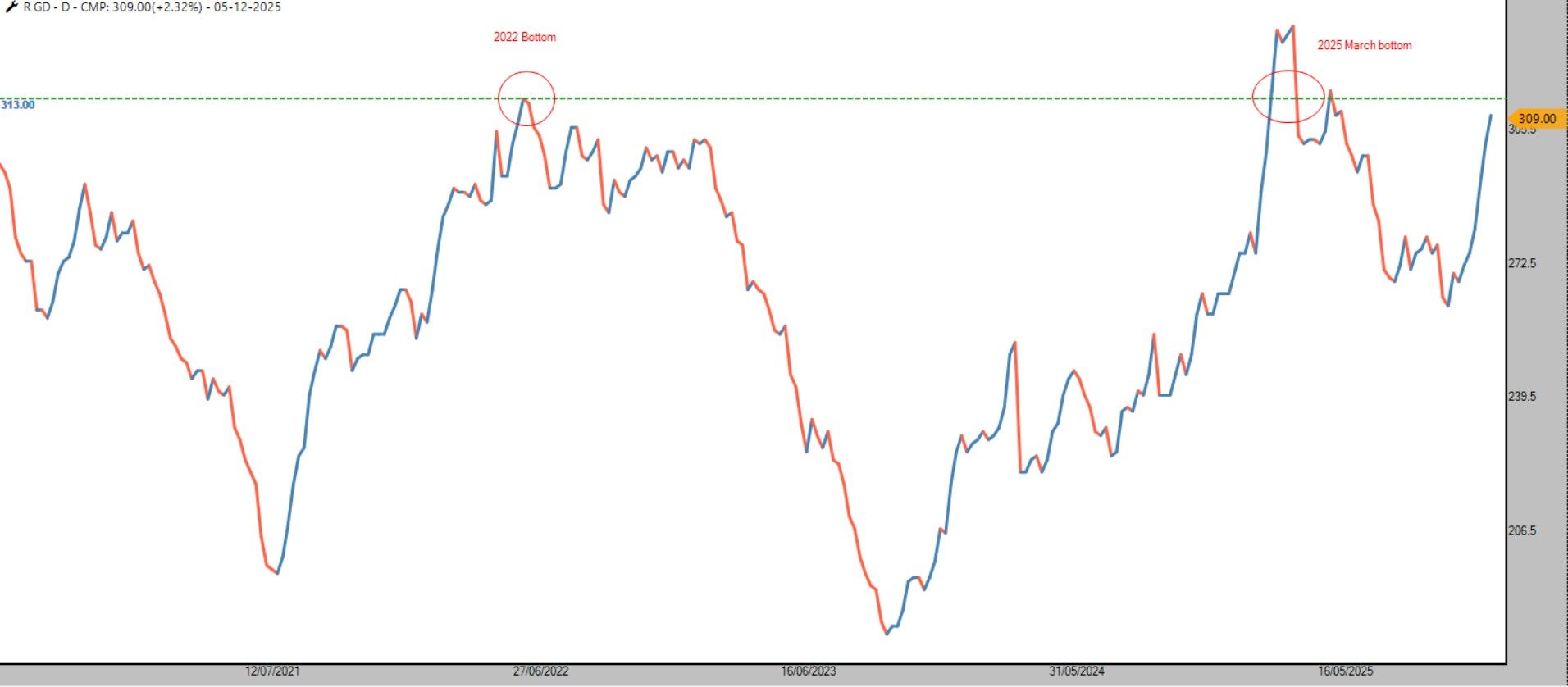

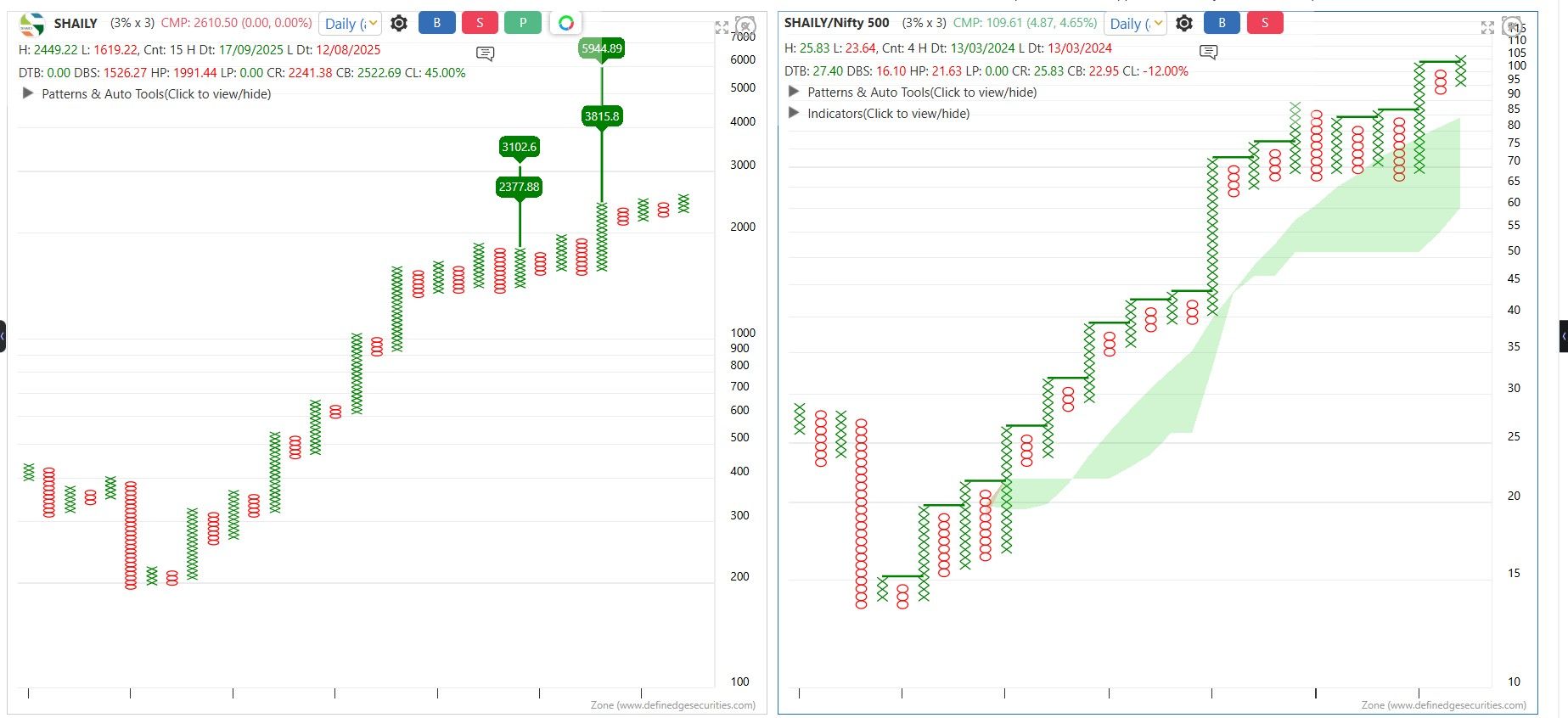

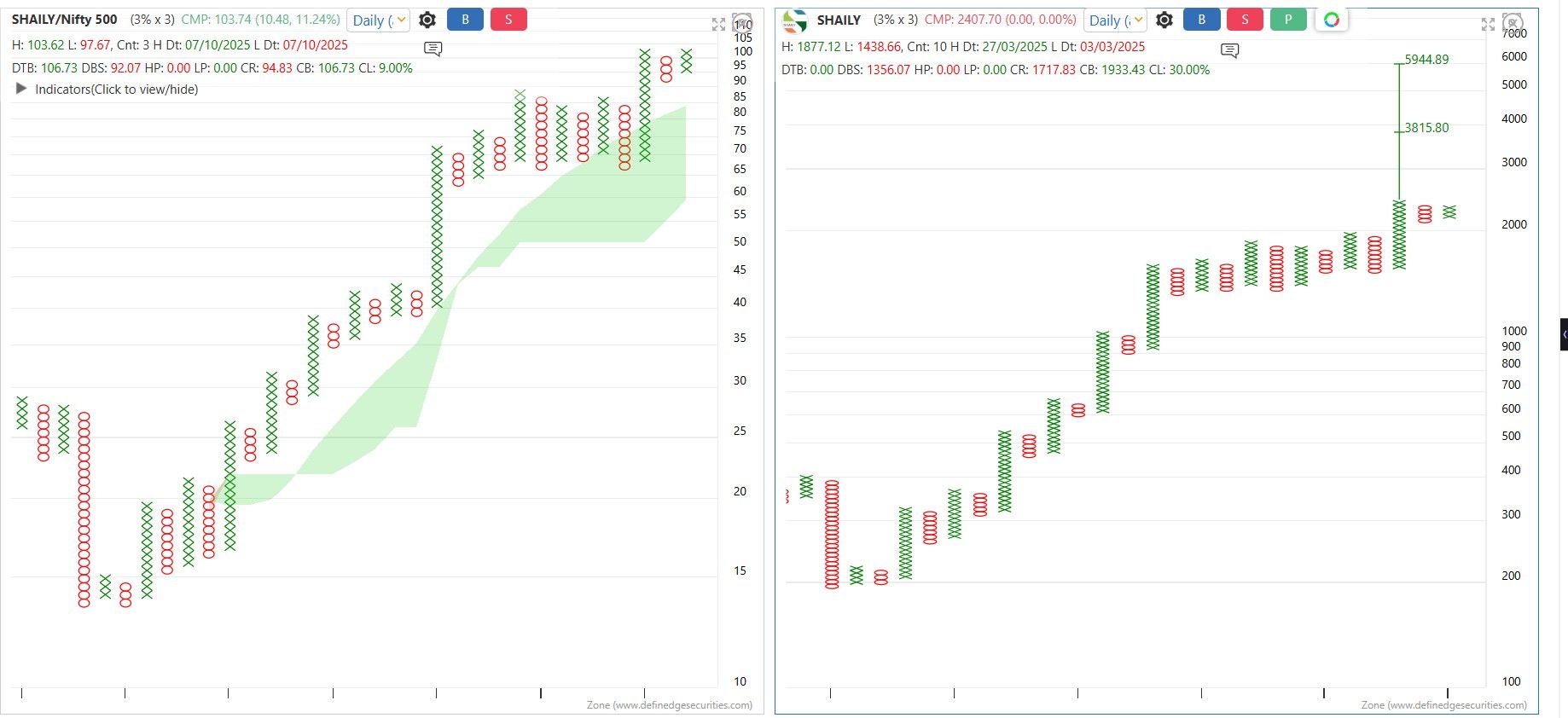

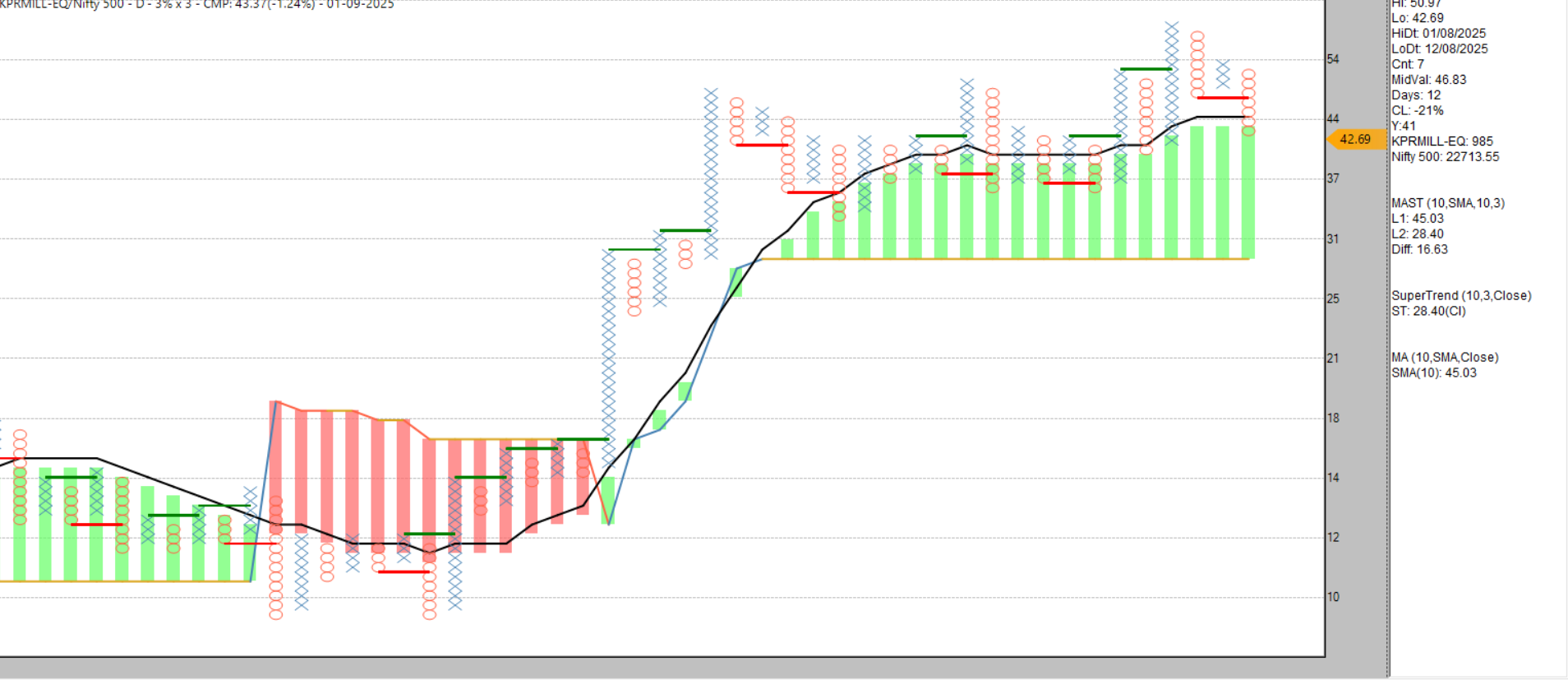

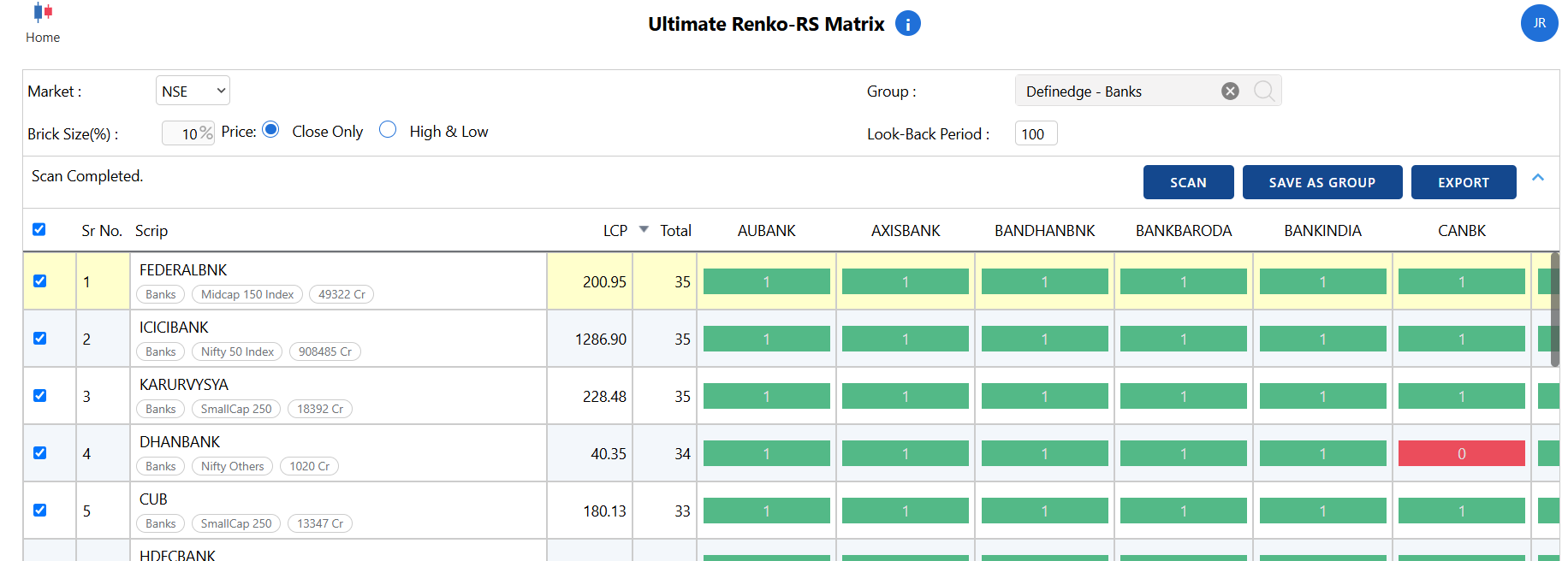

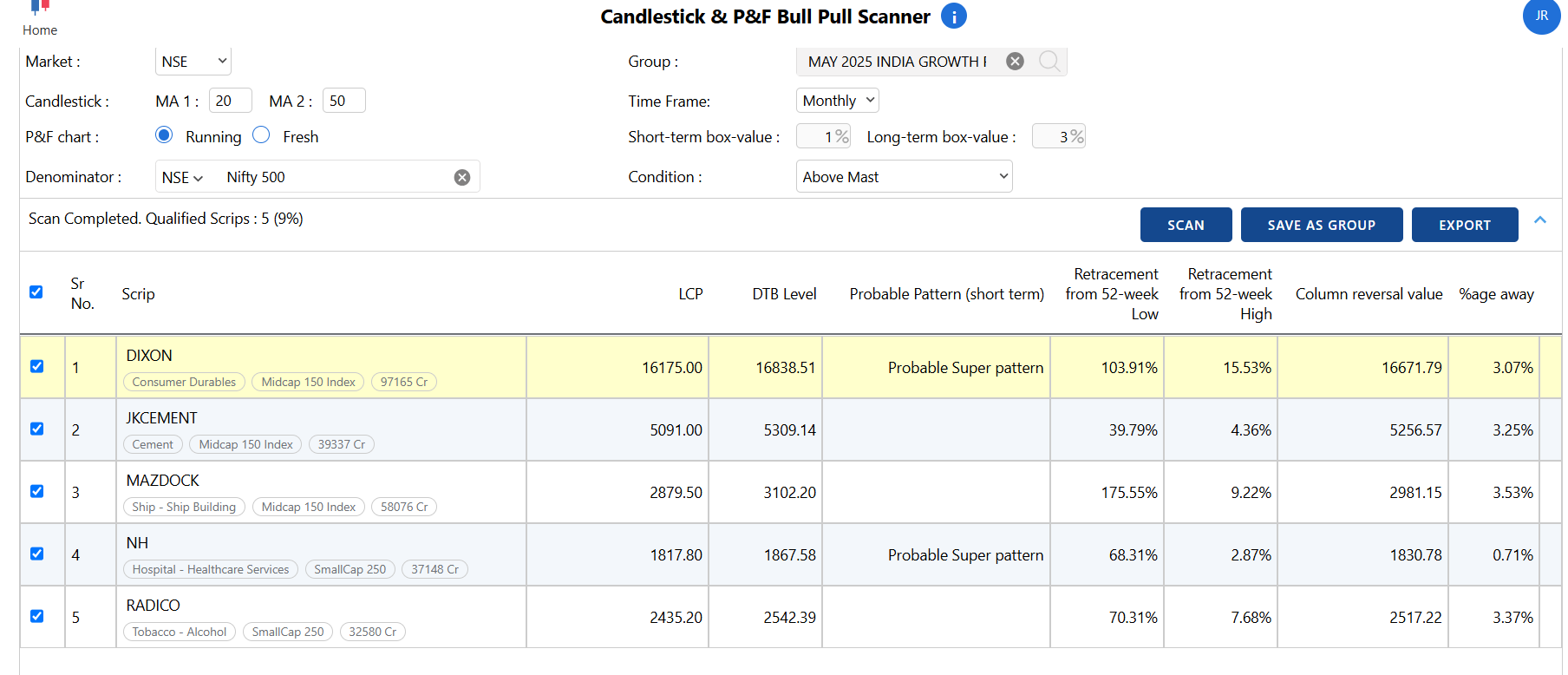

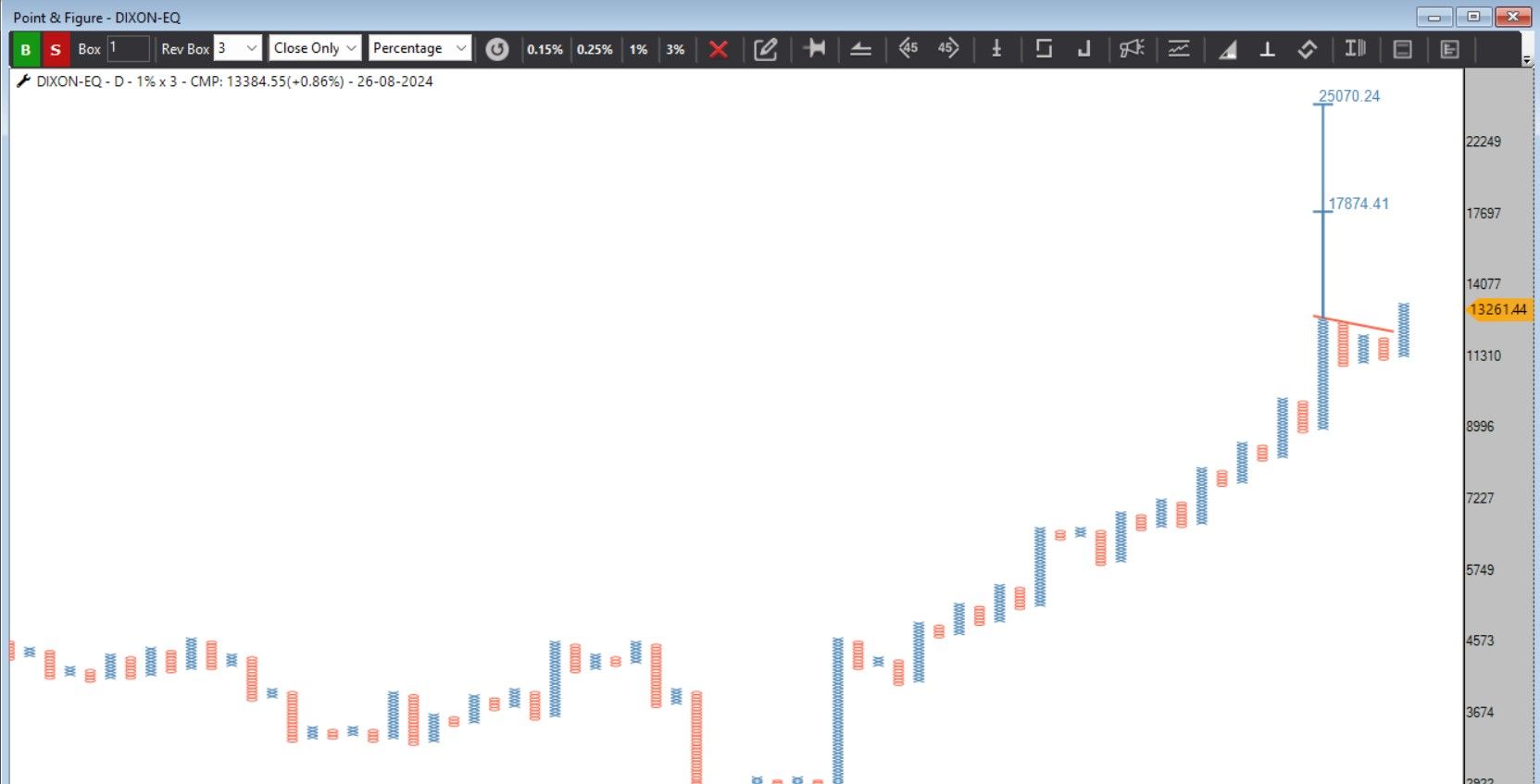

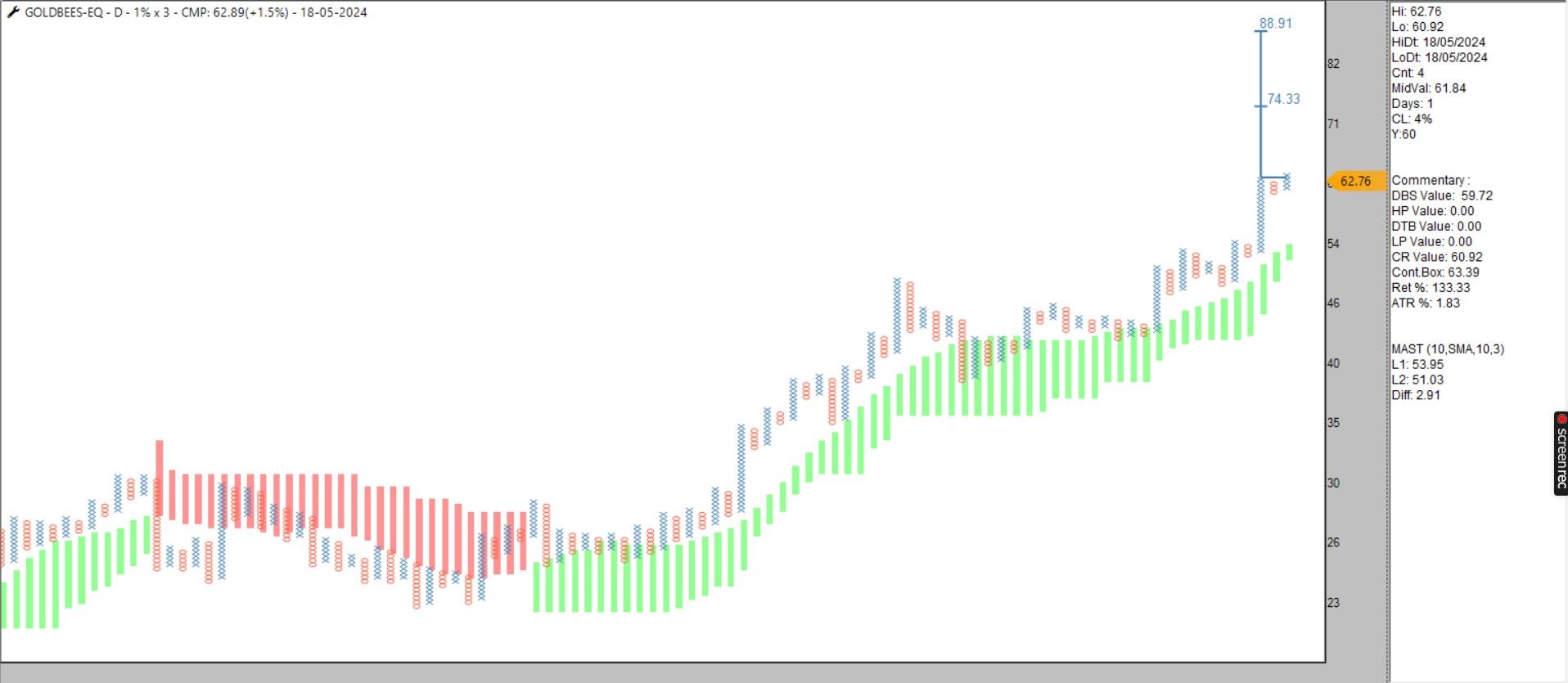

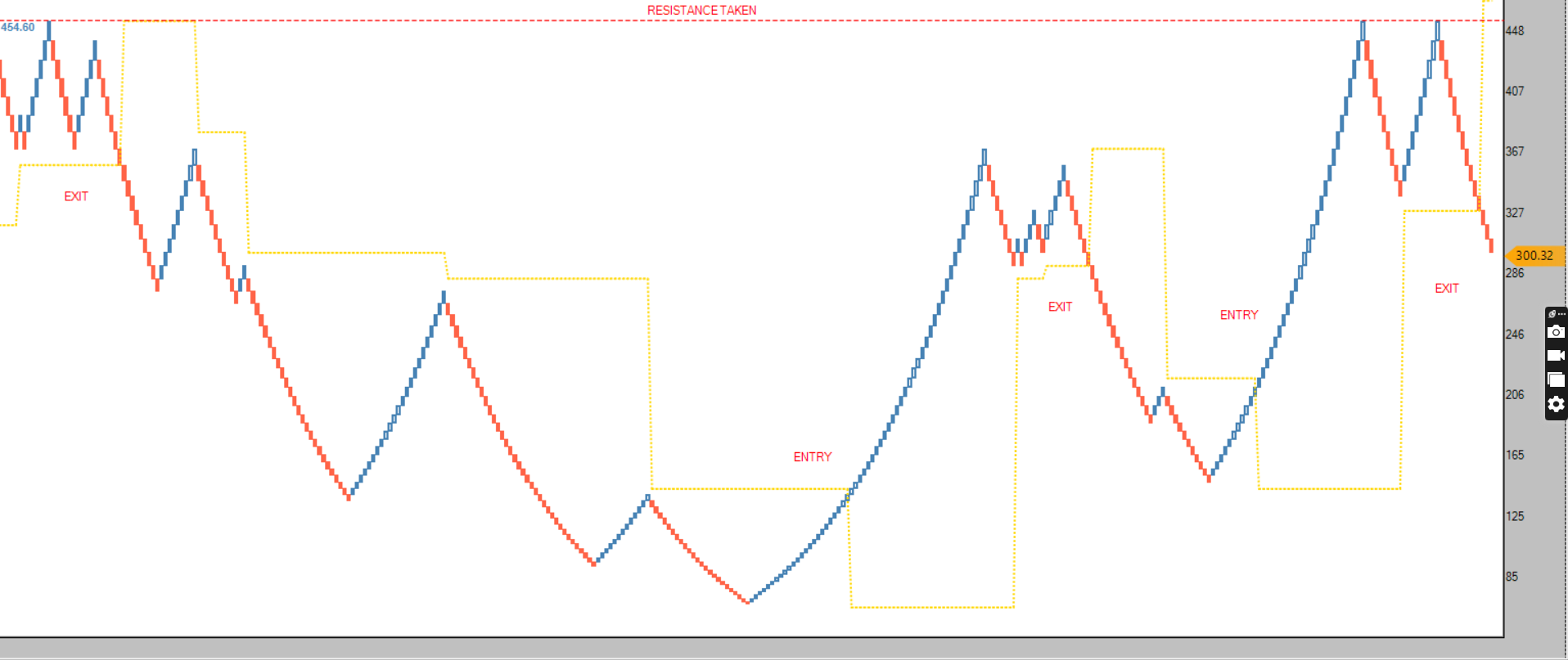

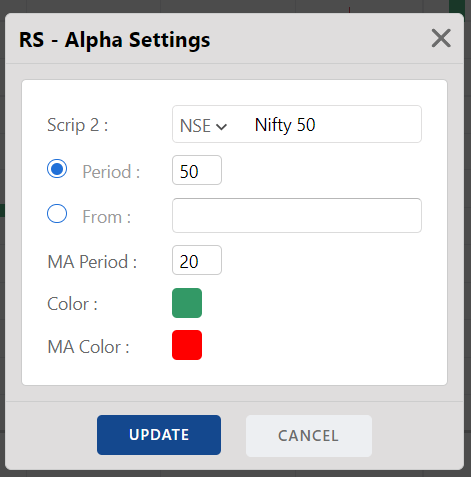

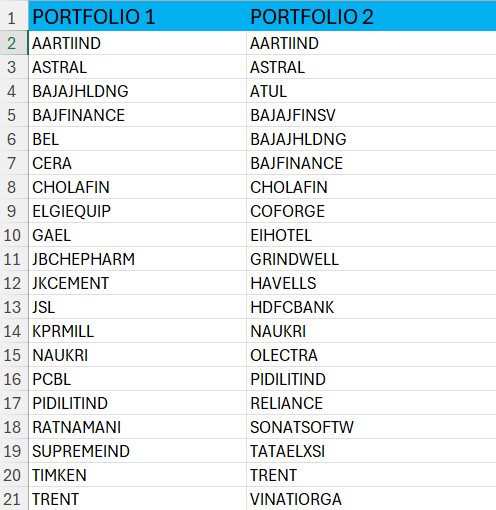

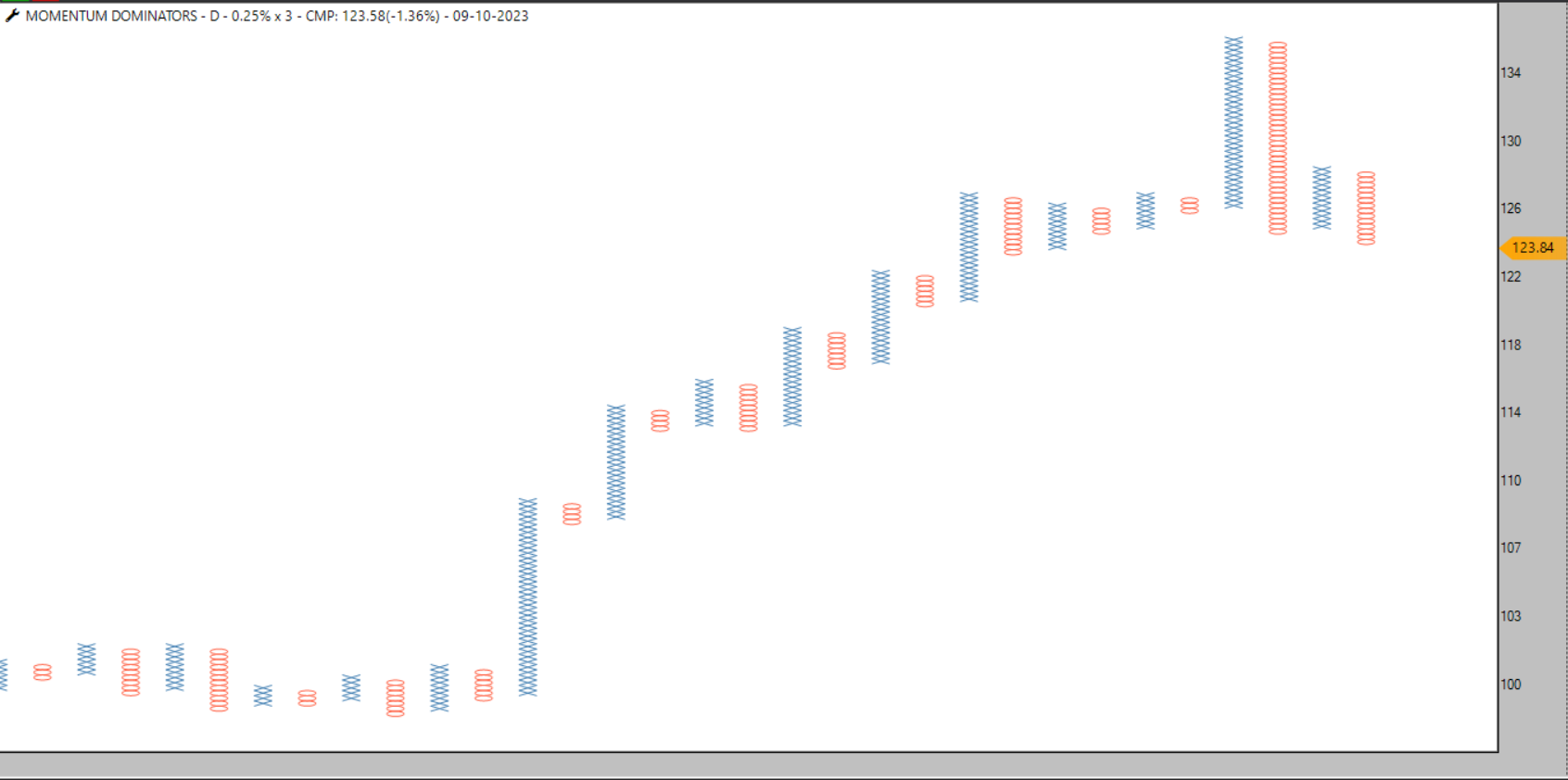

Bullish MAST Structure

Bullish MAST Structure

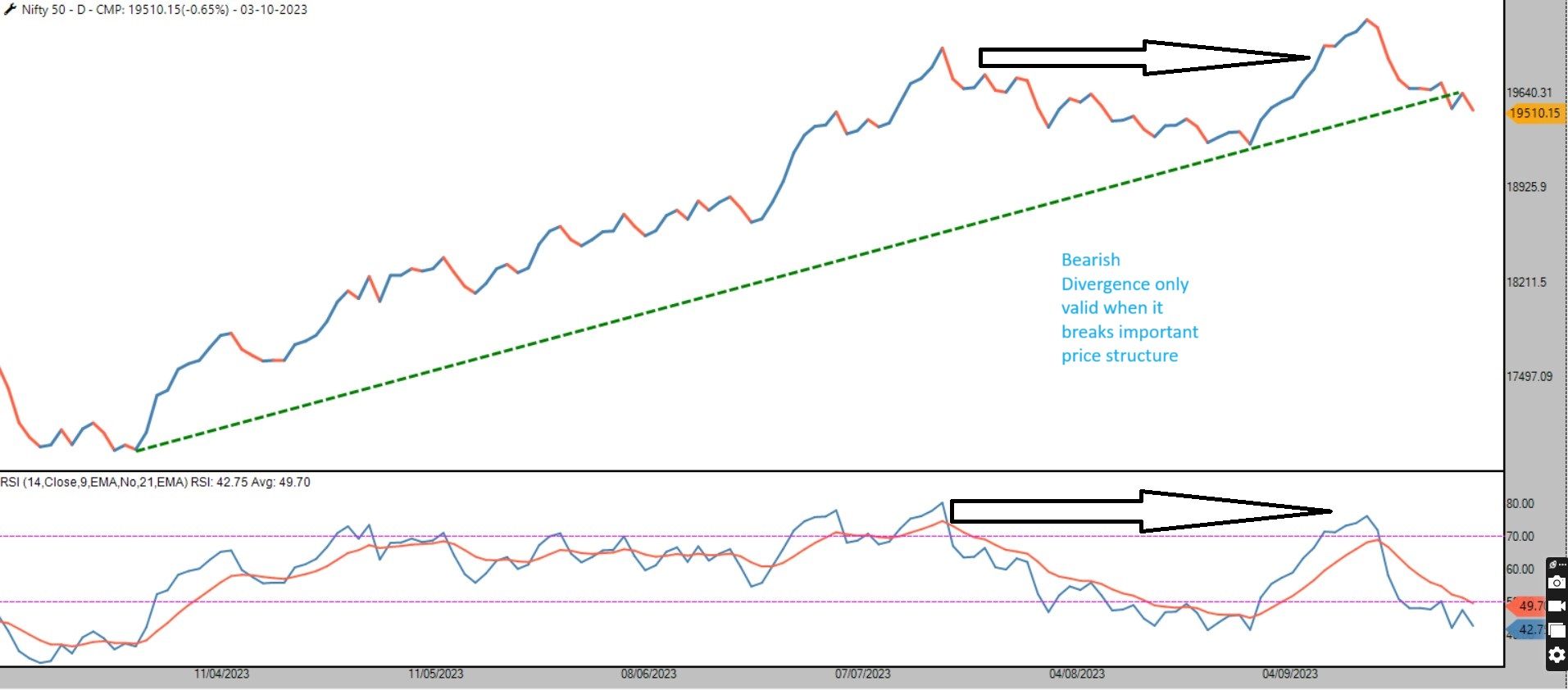

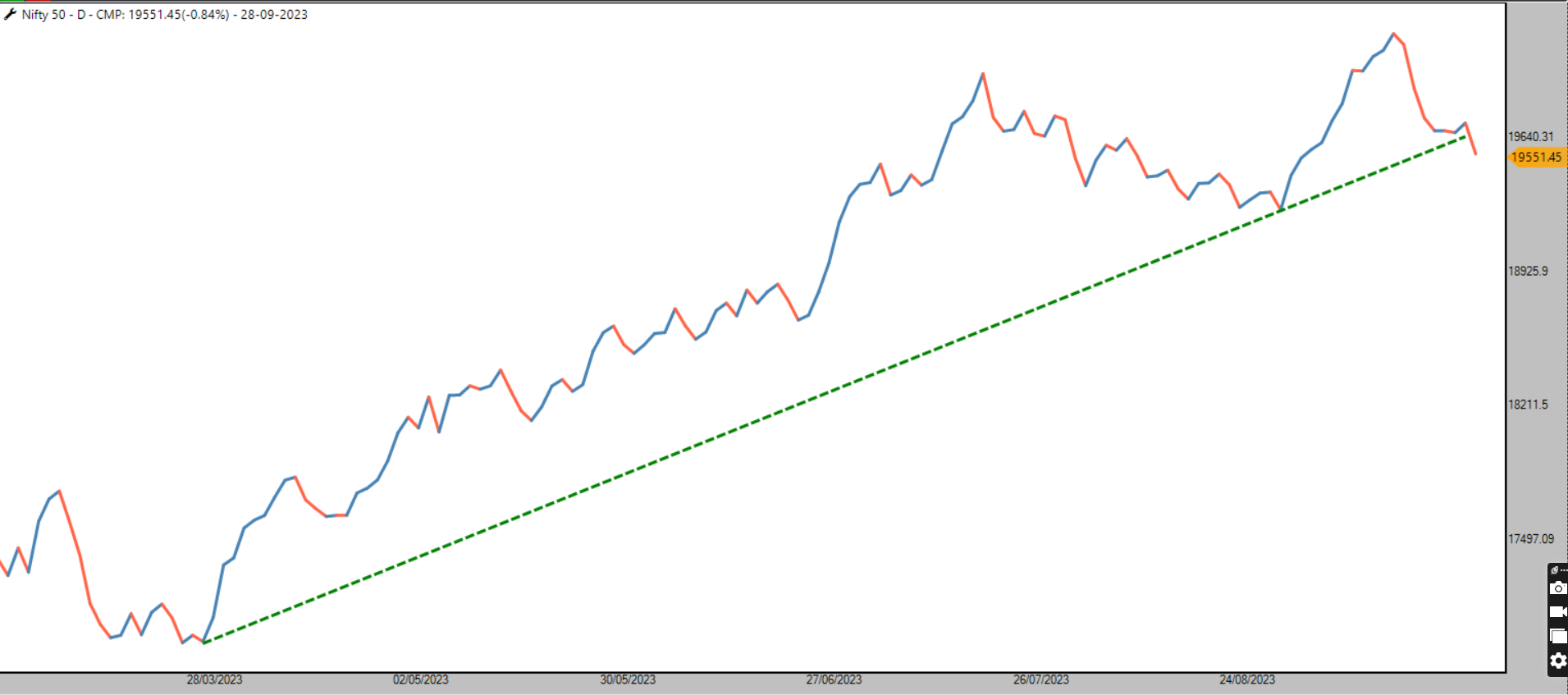

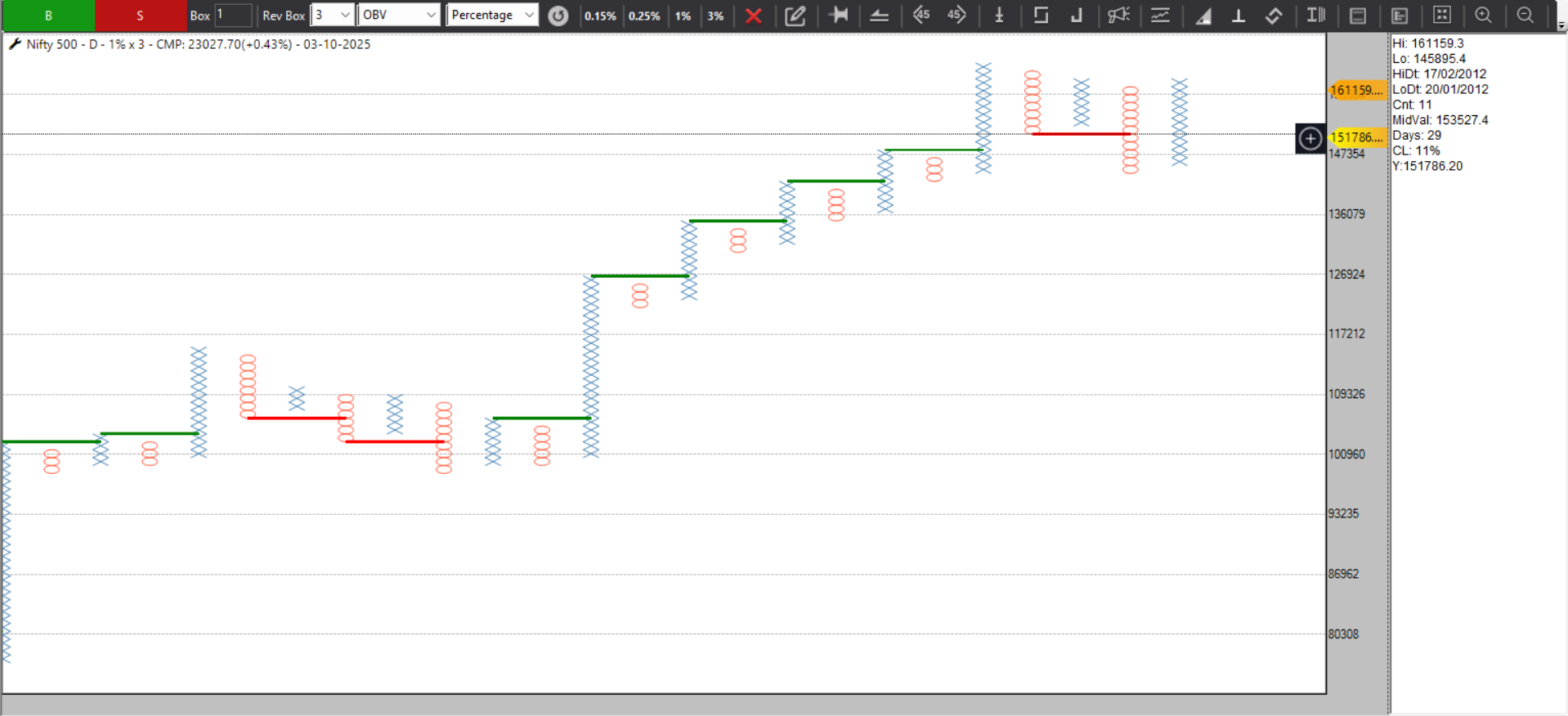

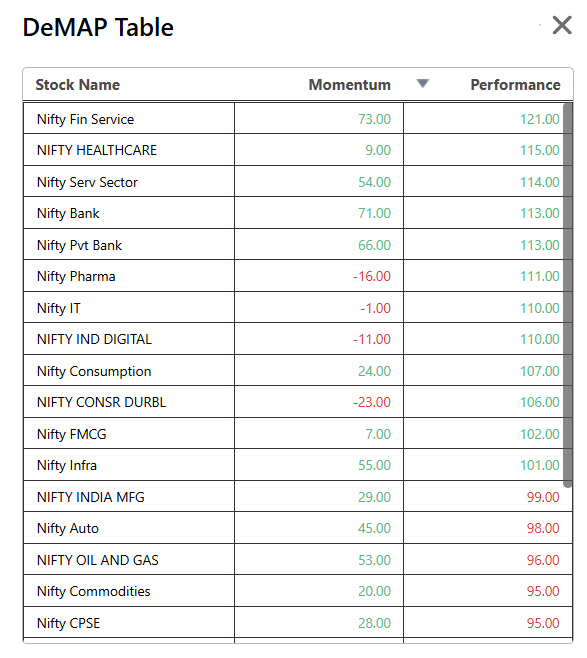

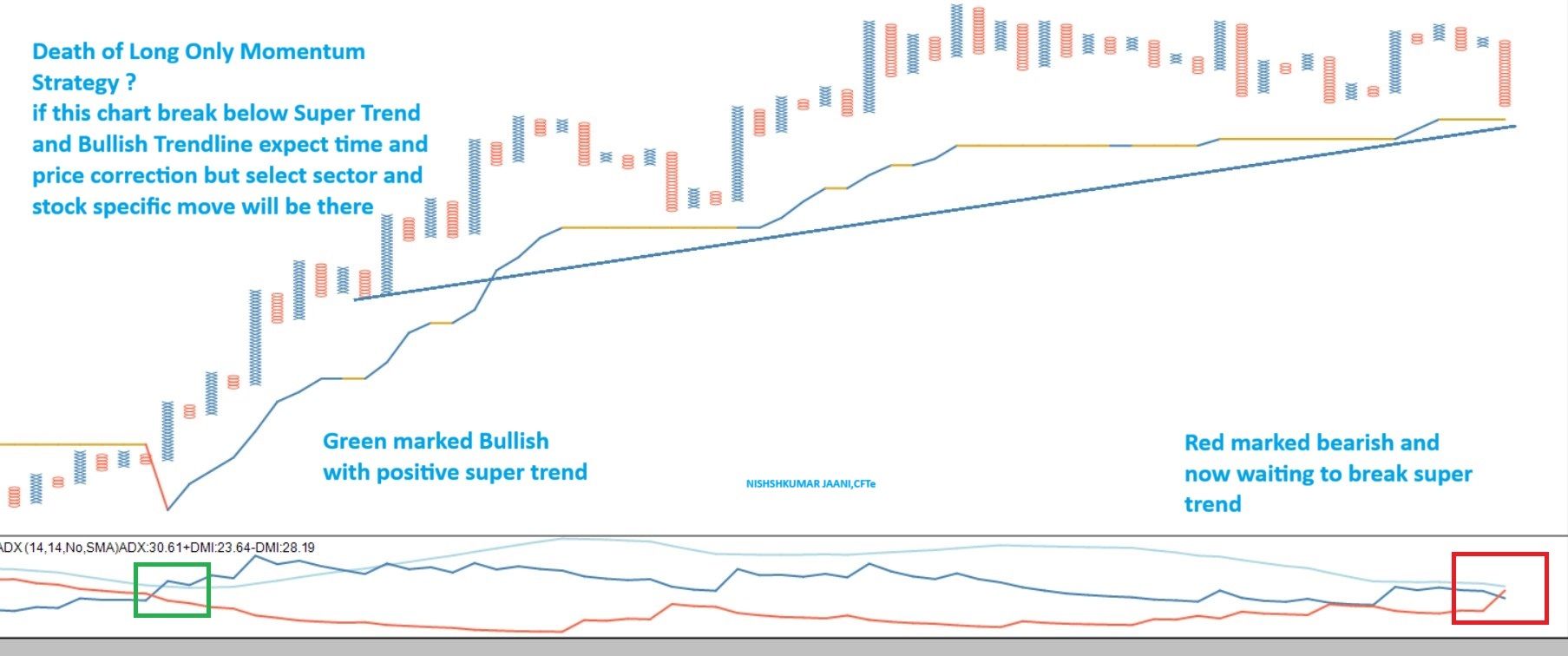

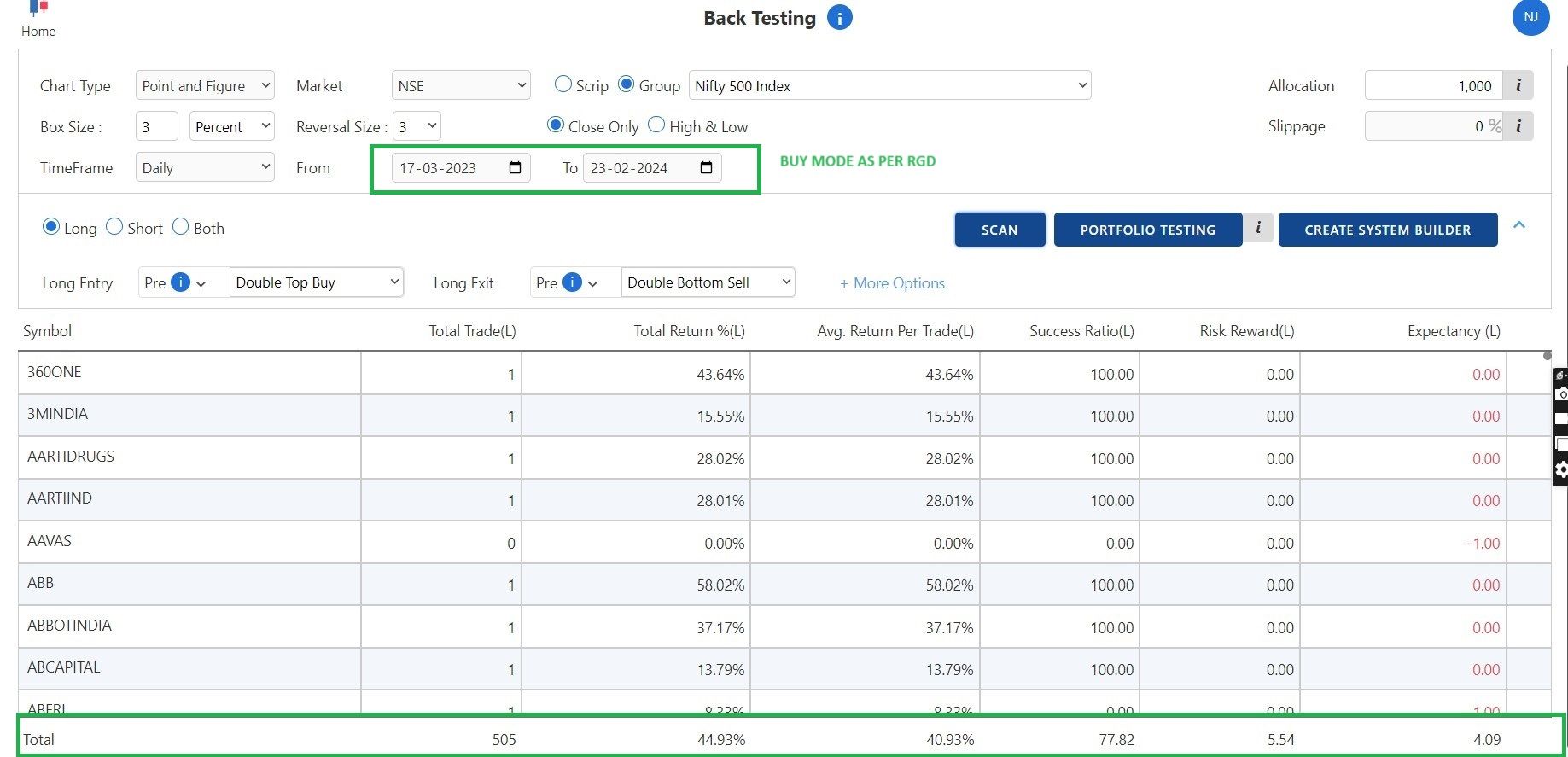

Broader Technical Picture:

Broader Technical Picture: Strategy Focus:

Strategy Focus:

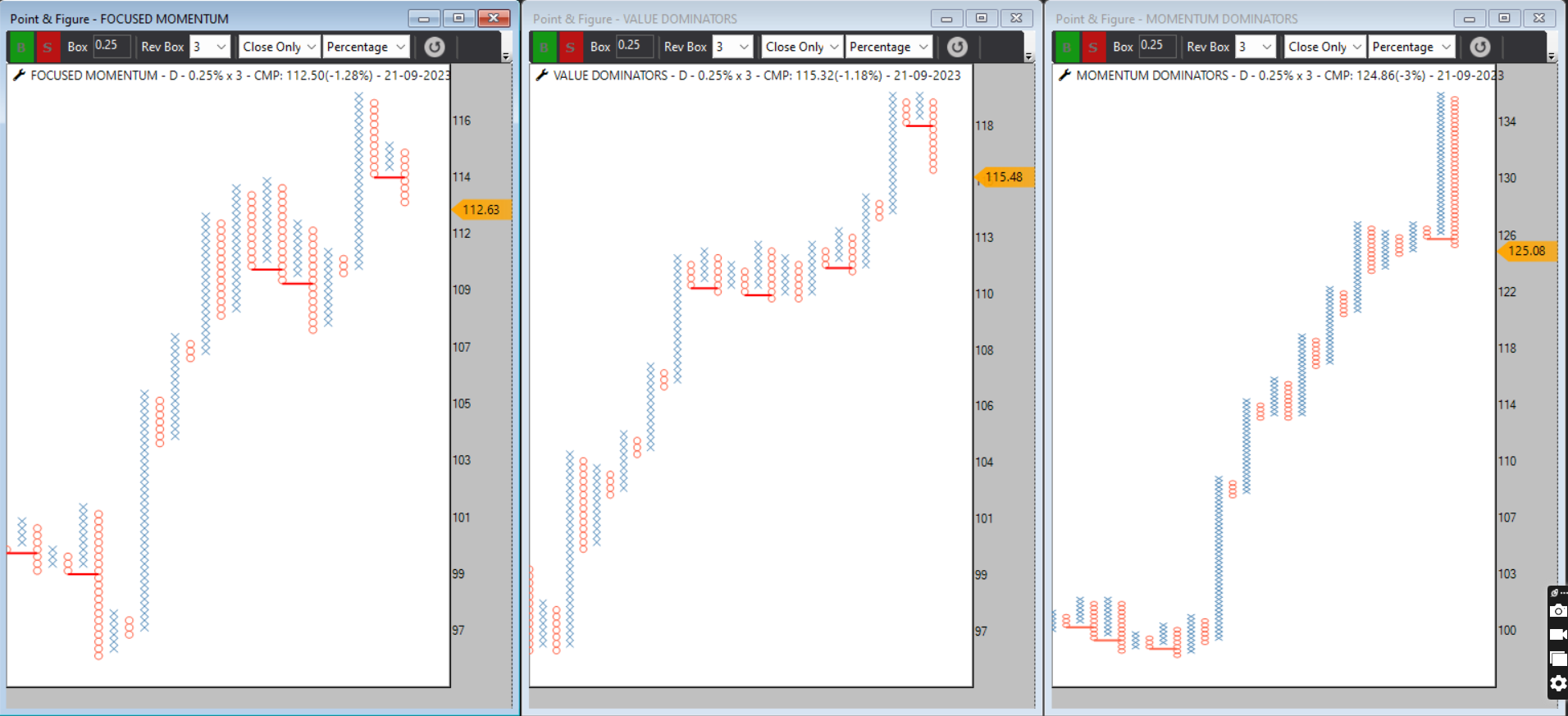

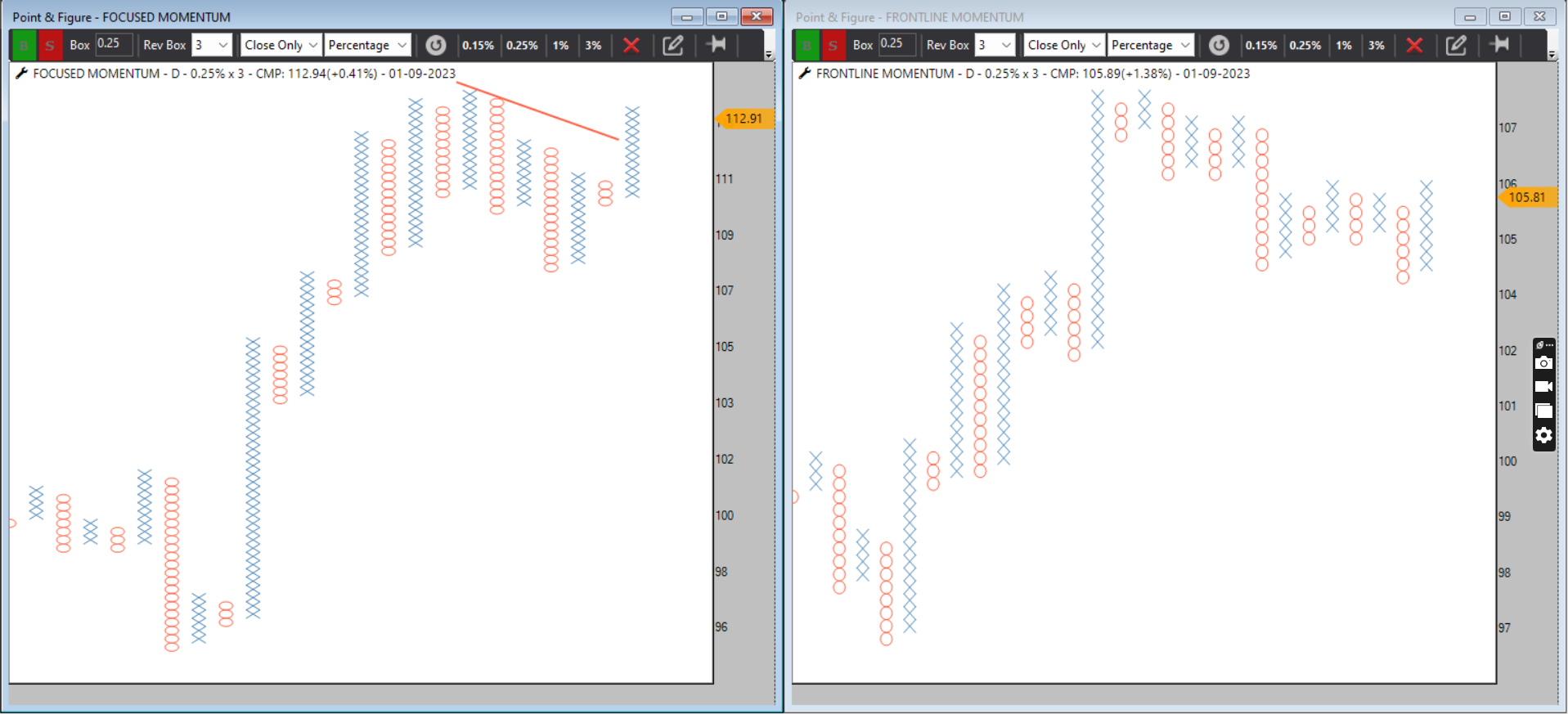

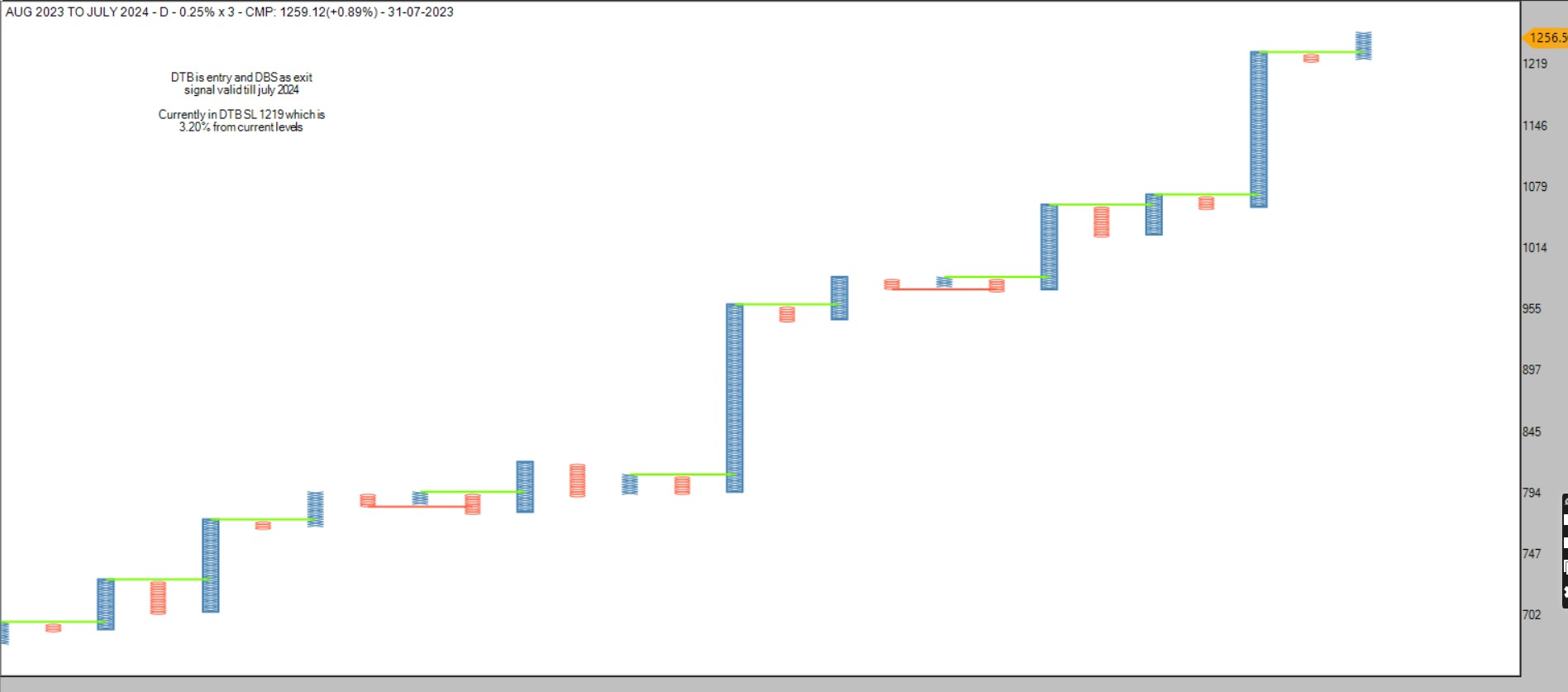

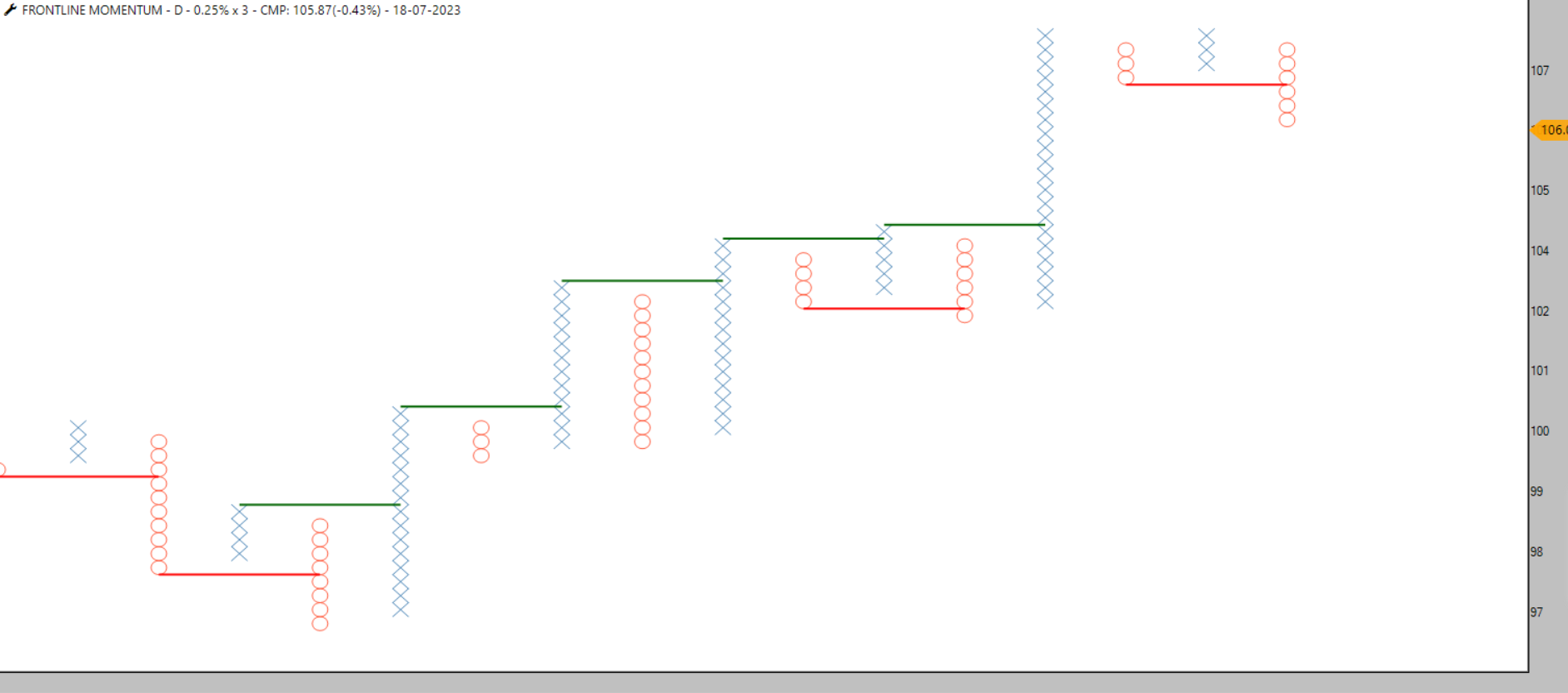

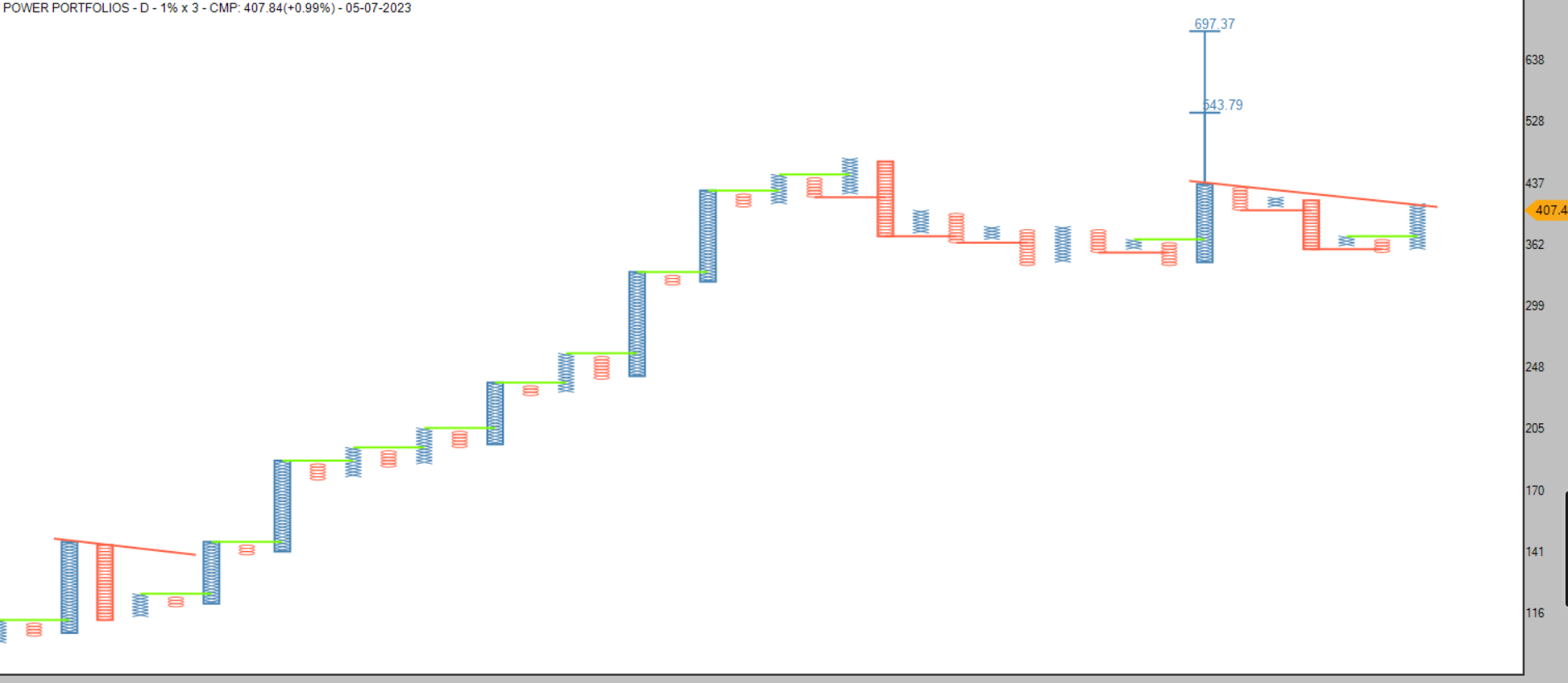

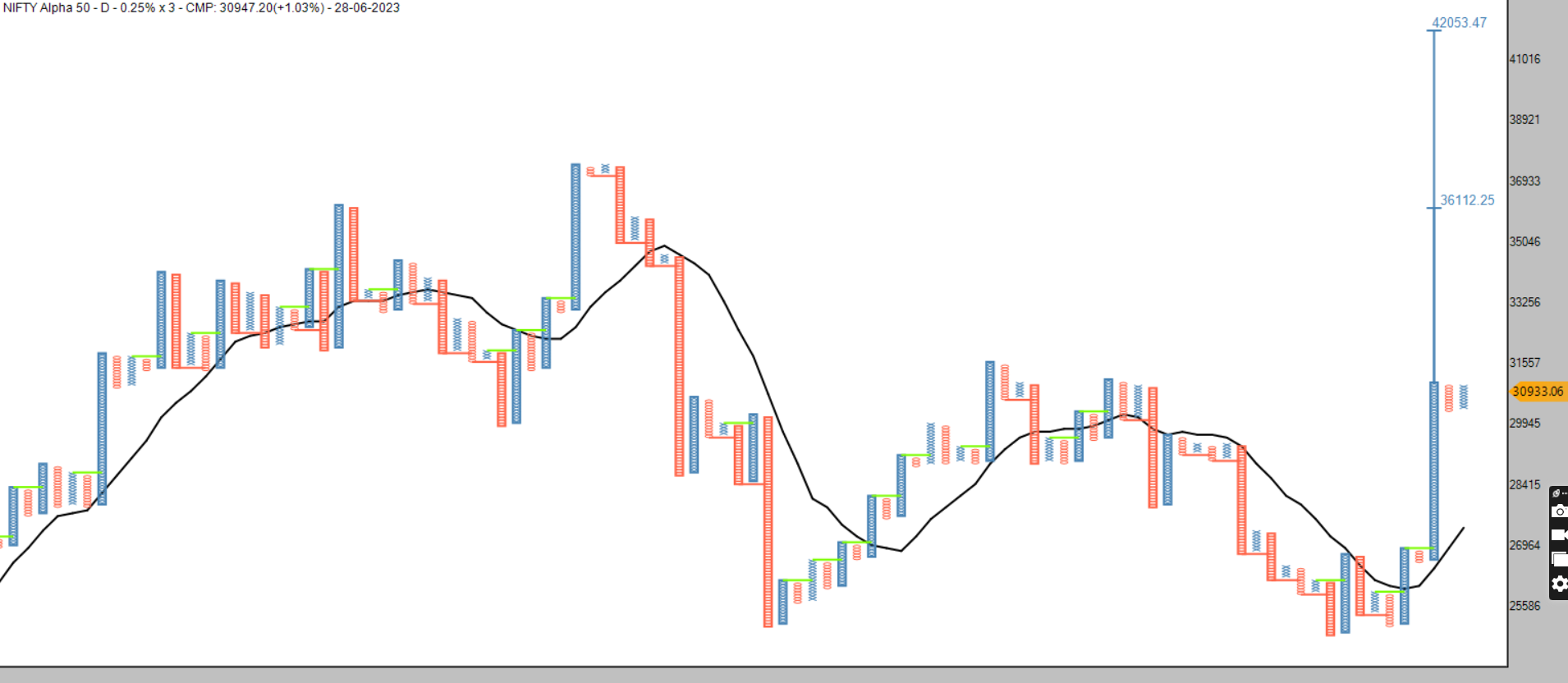

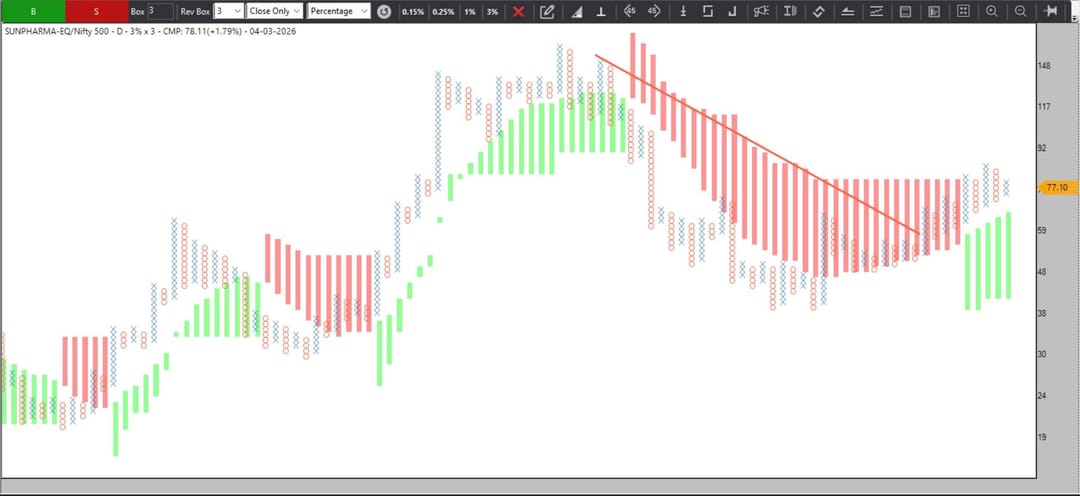

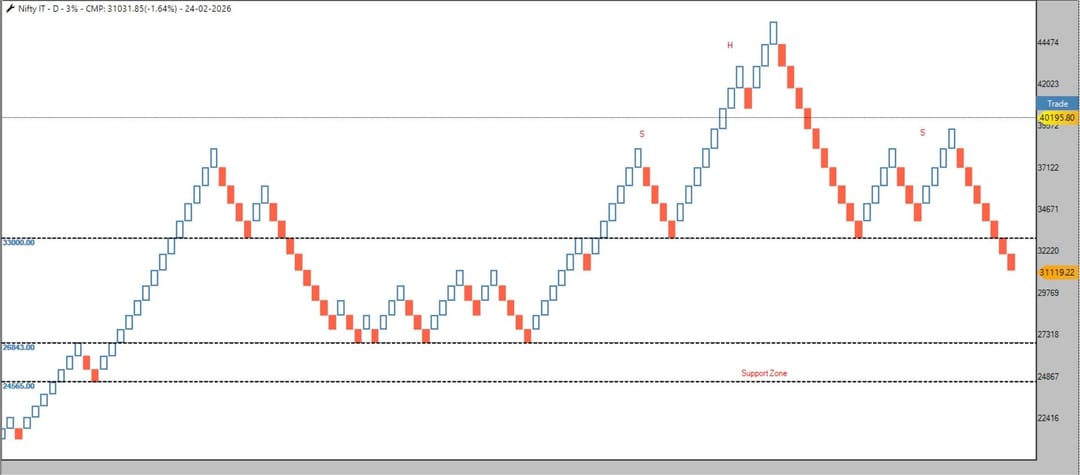

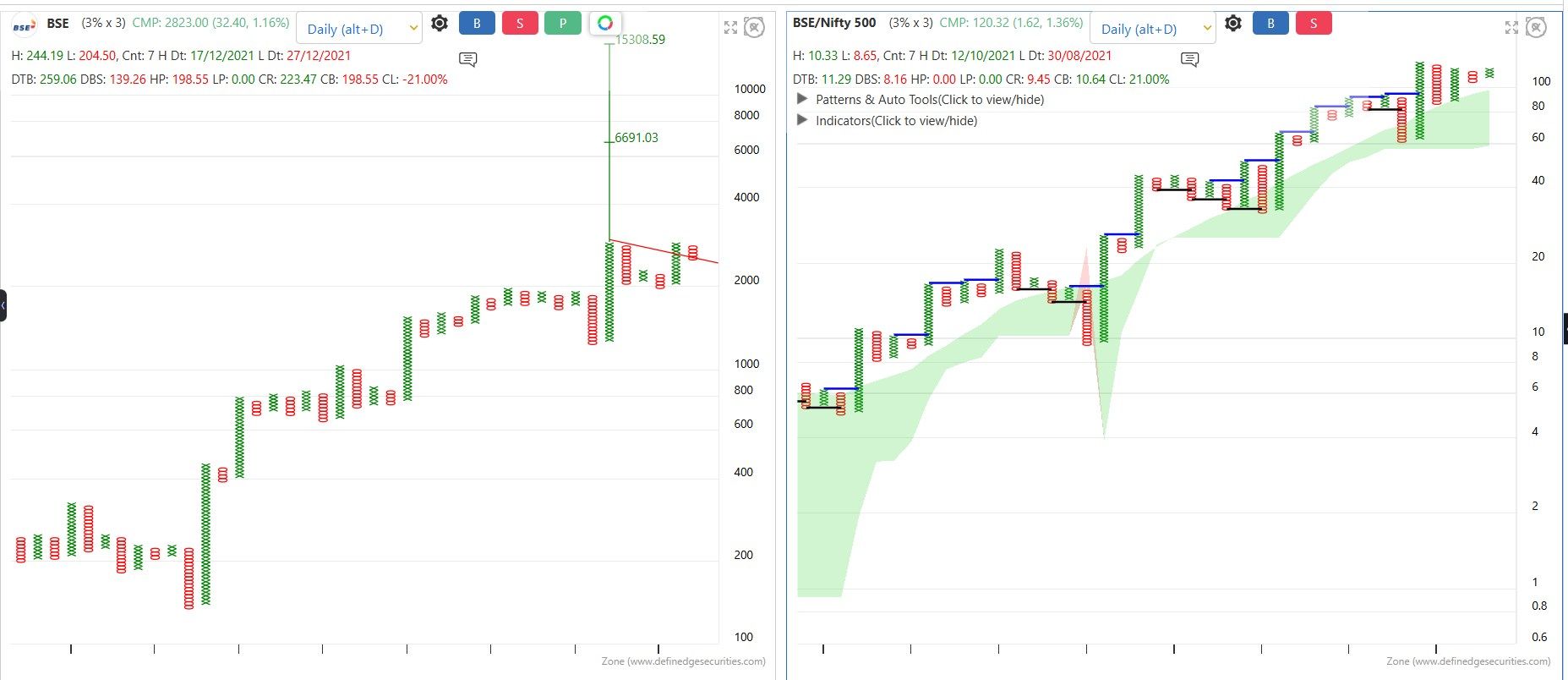

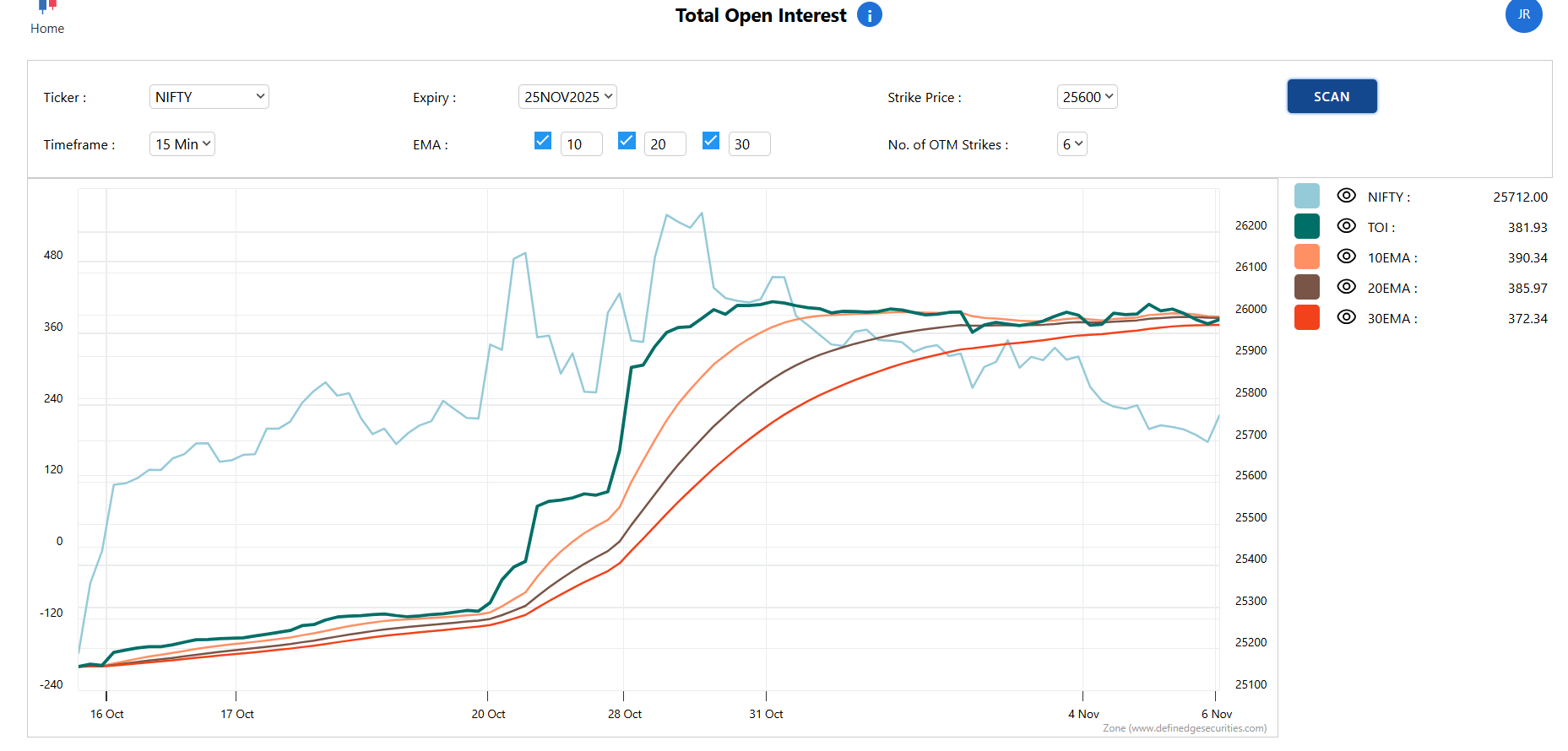

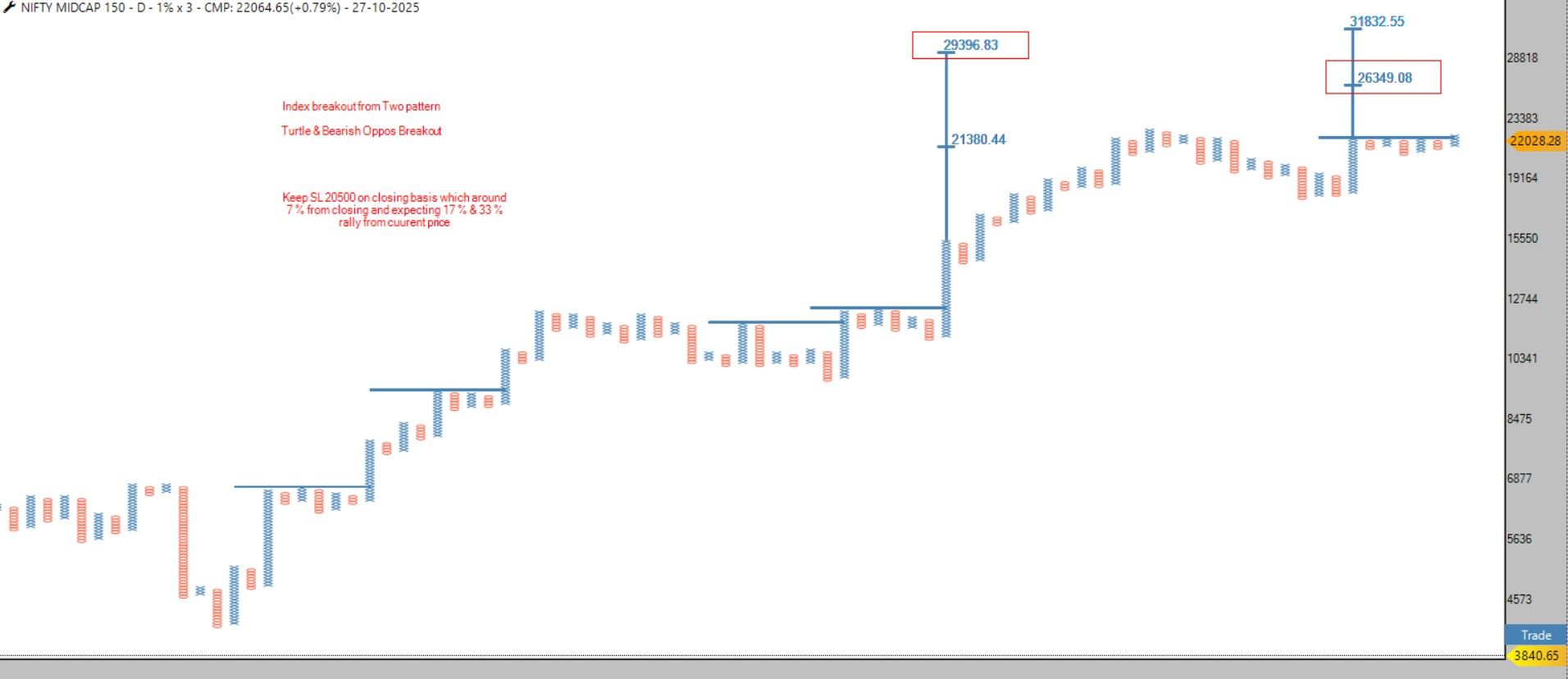

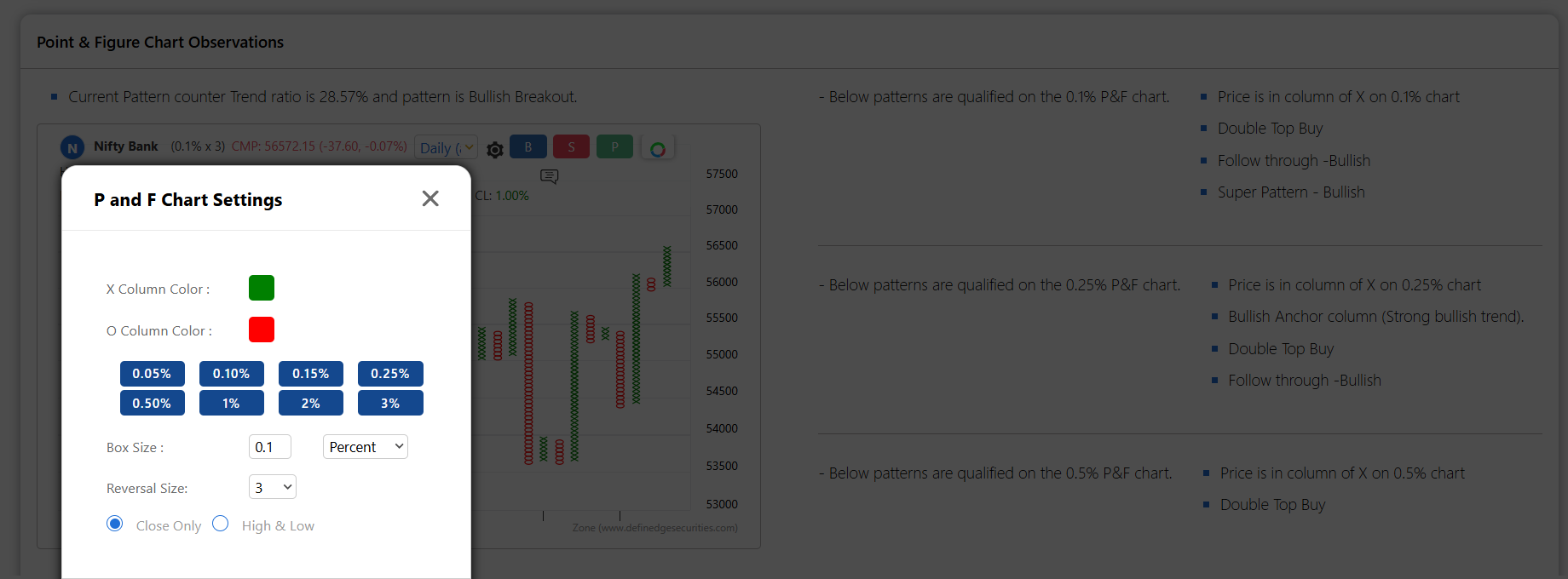

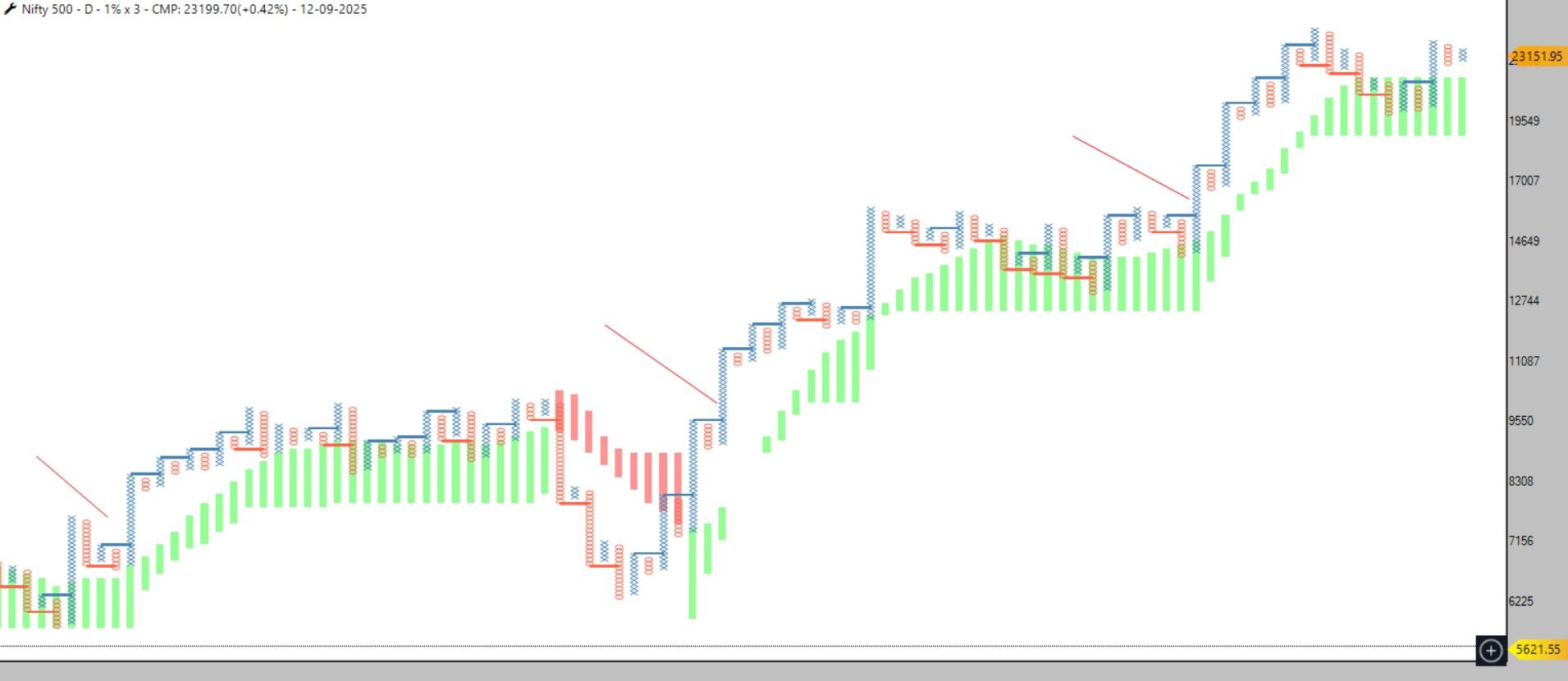

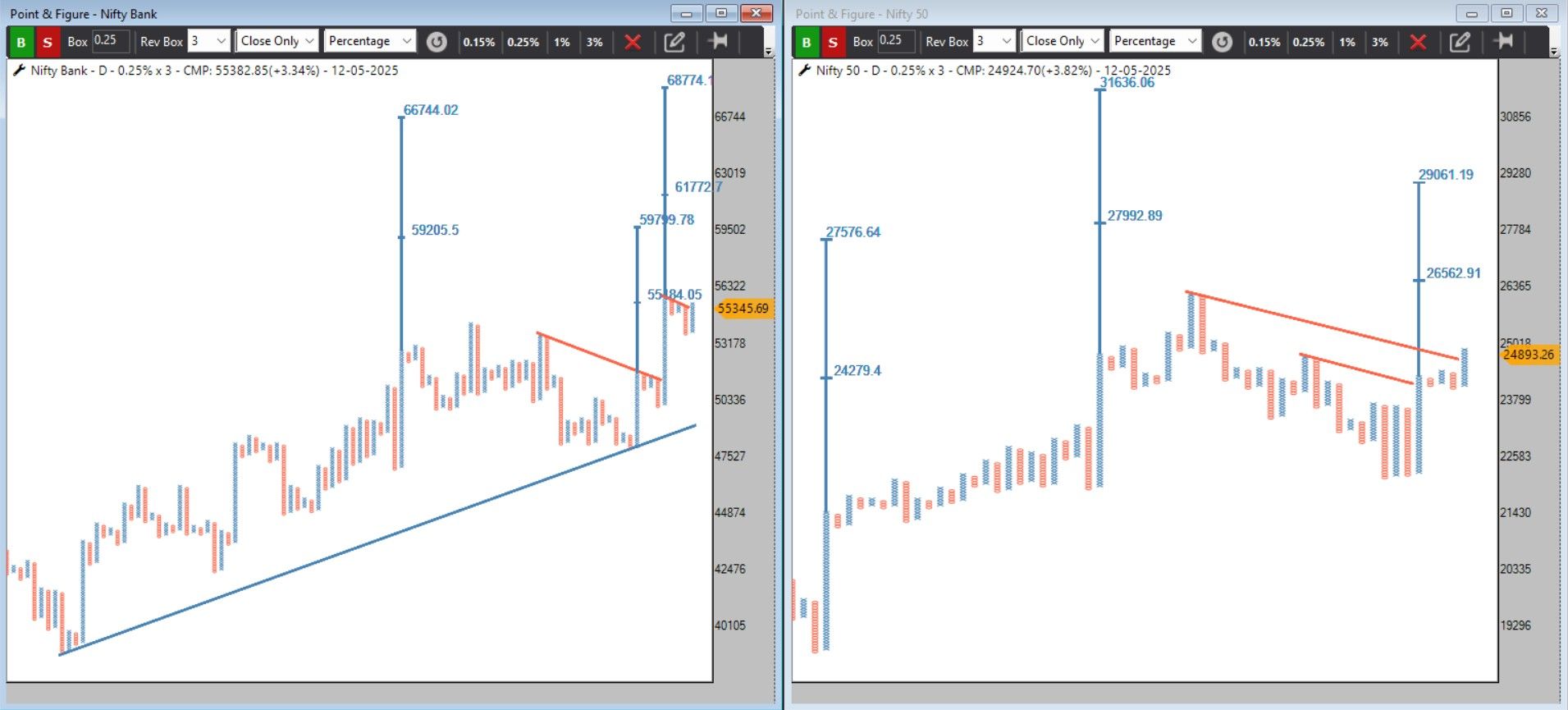

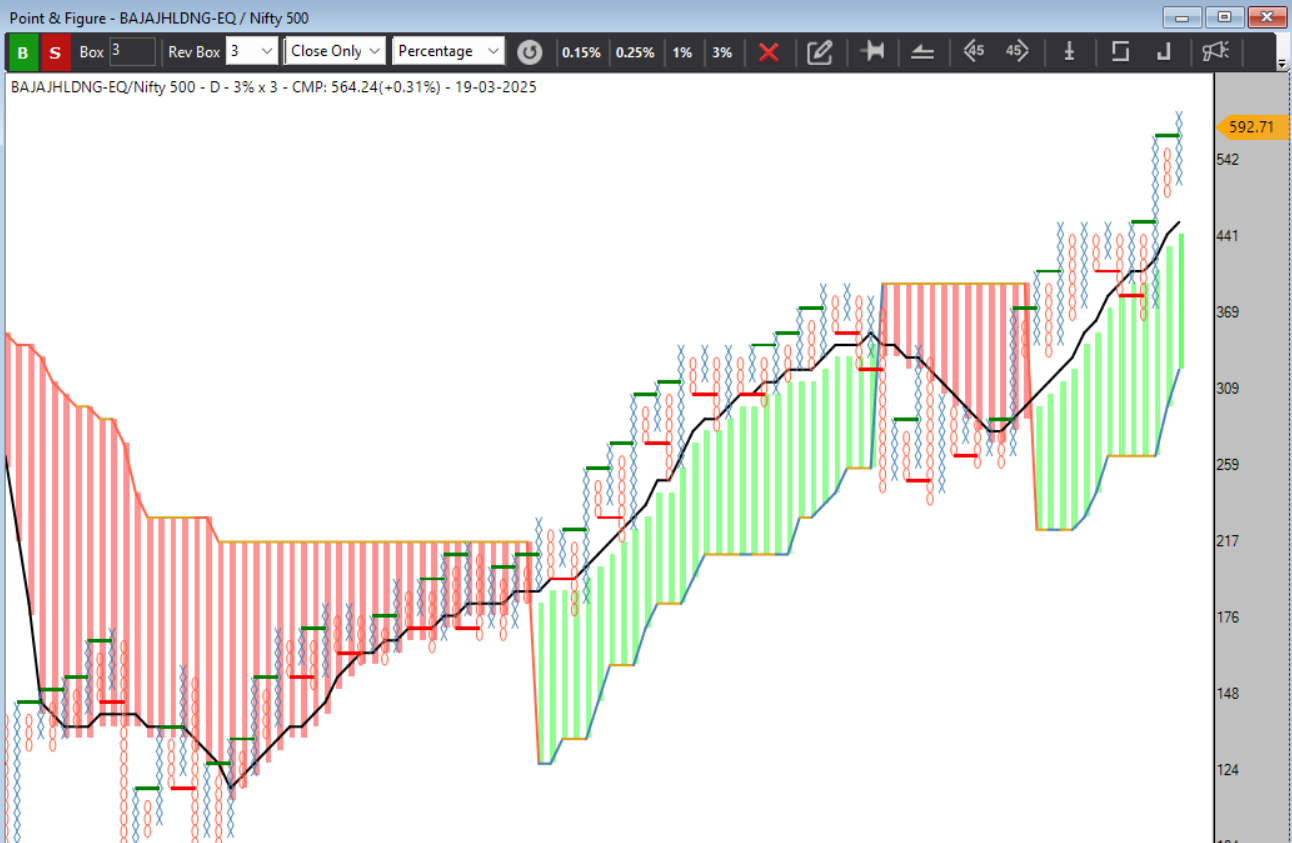

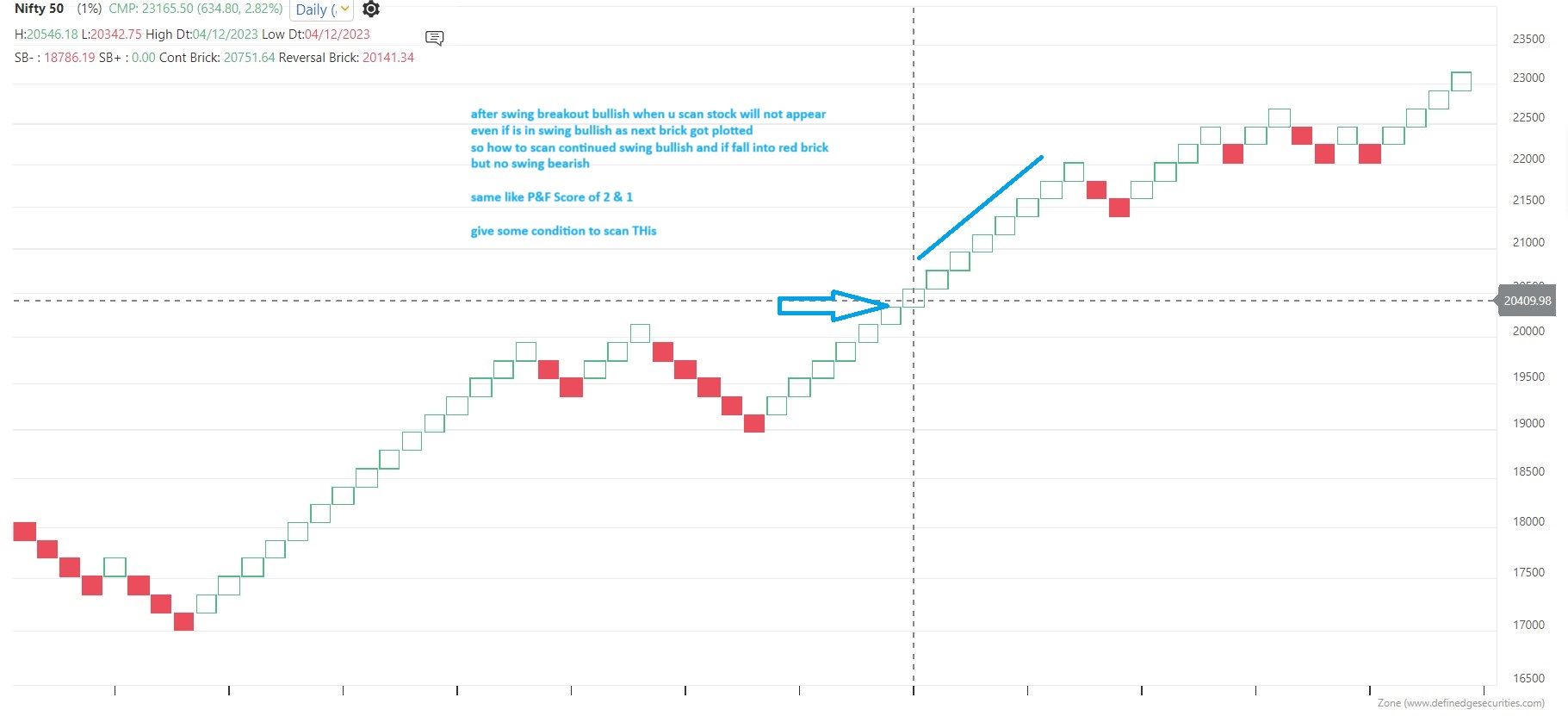

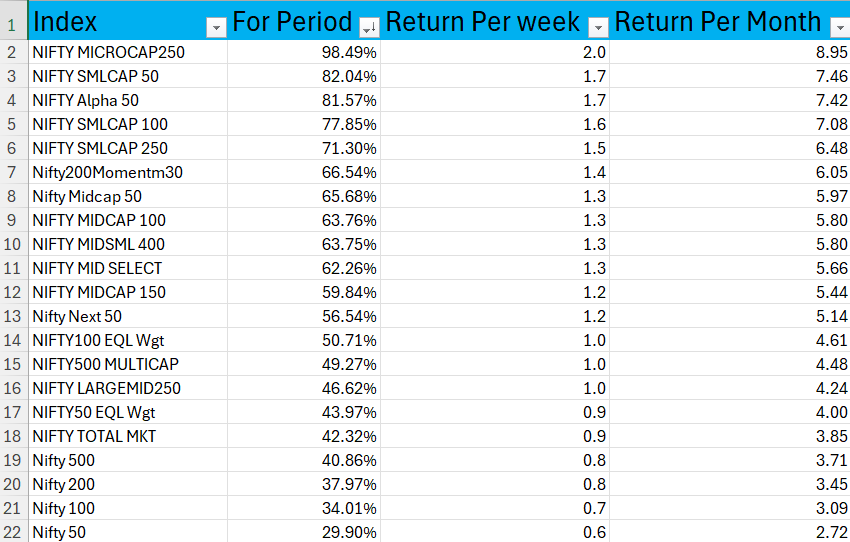

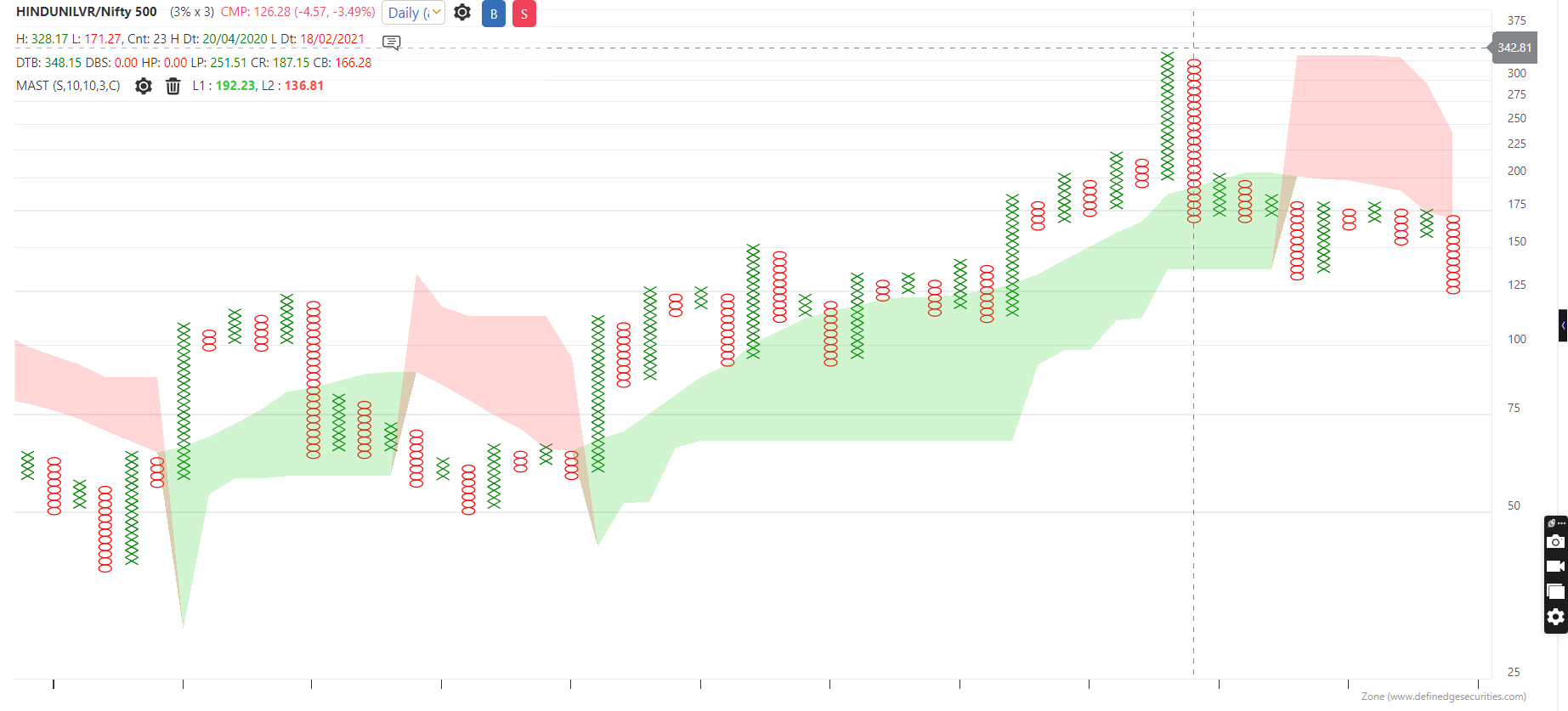

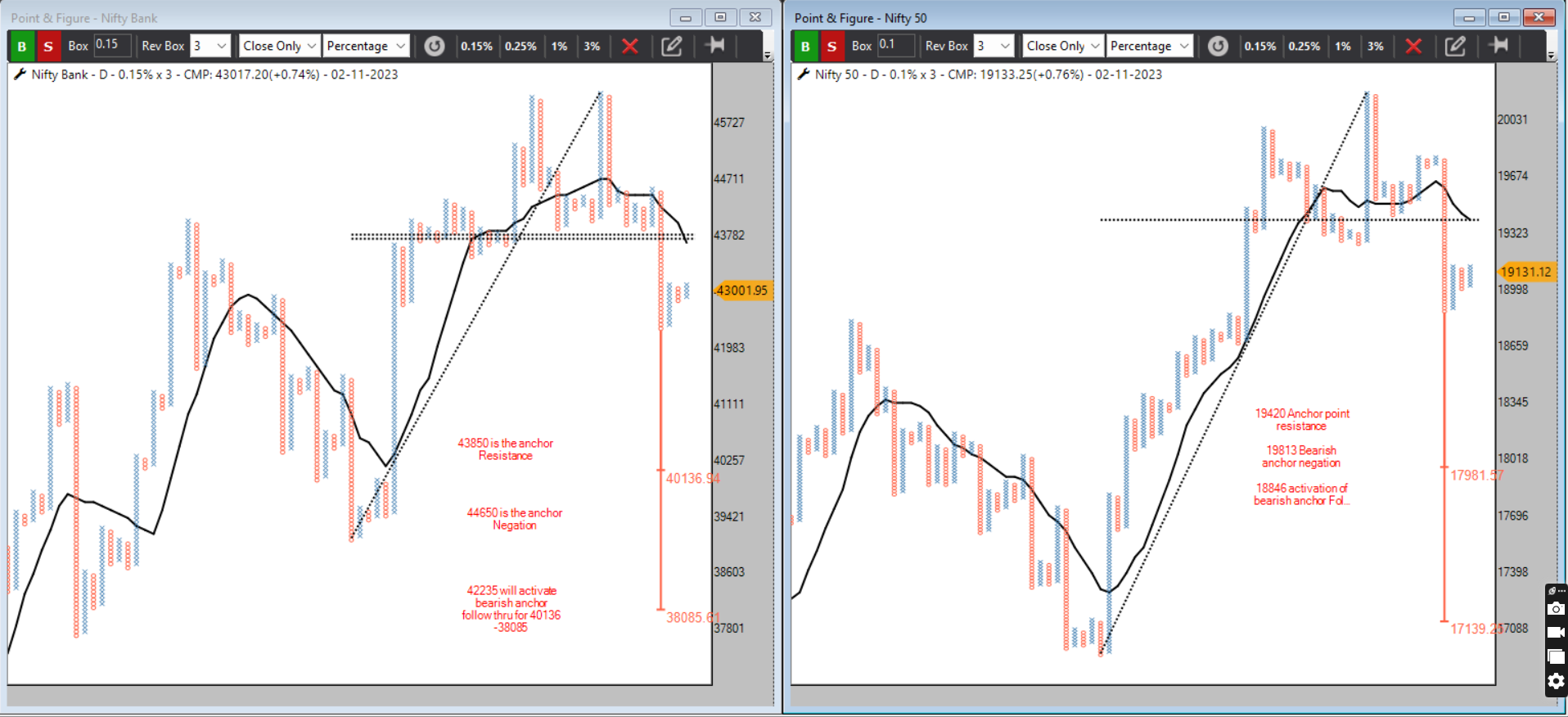

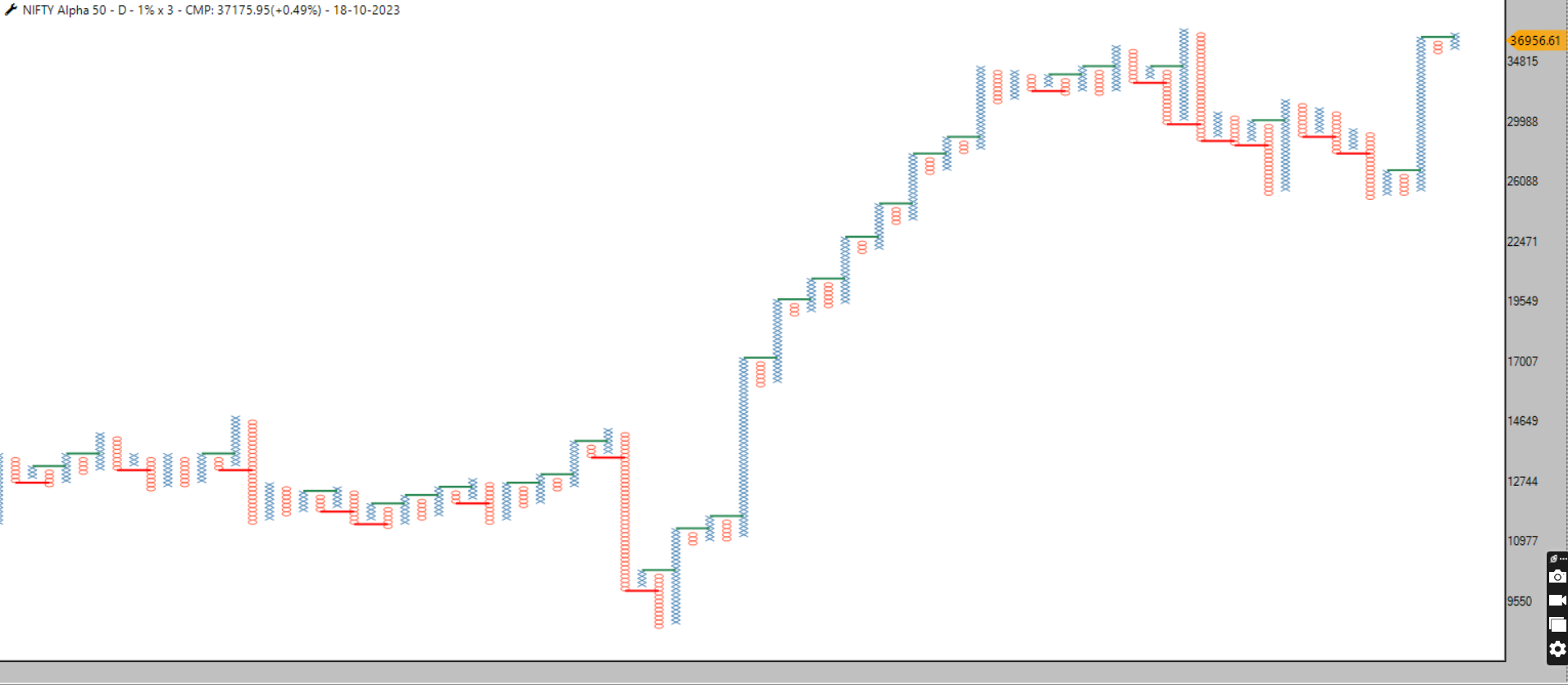

NIFTY – Dhamaka Move Loading? 5% Rally Setup in Play!

NIFTY – Dhamaka Move Loading? 5% Rally Setup in Play!

Trigger Level: 26,000 (Closing Basis)

Trigger Level: 26,000 (Closing Basis)

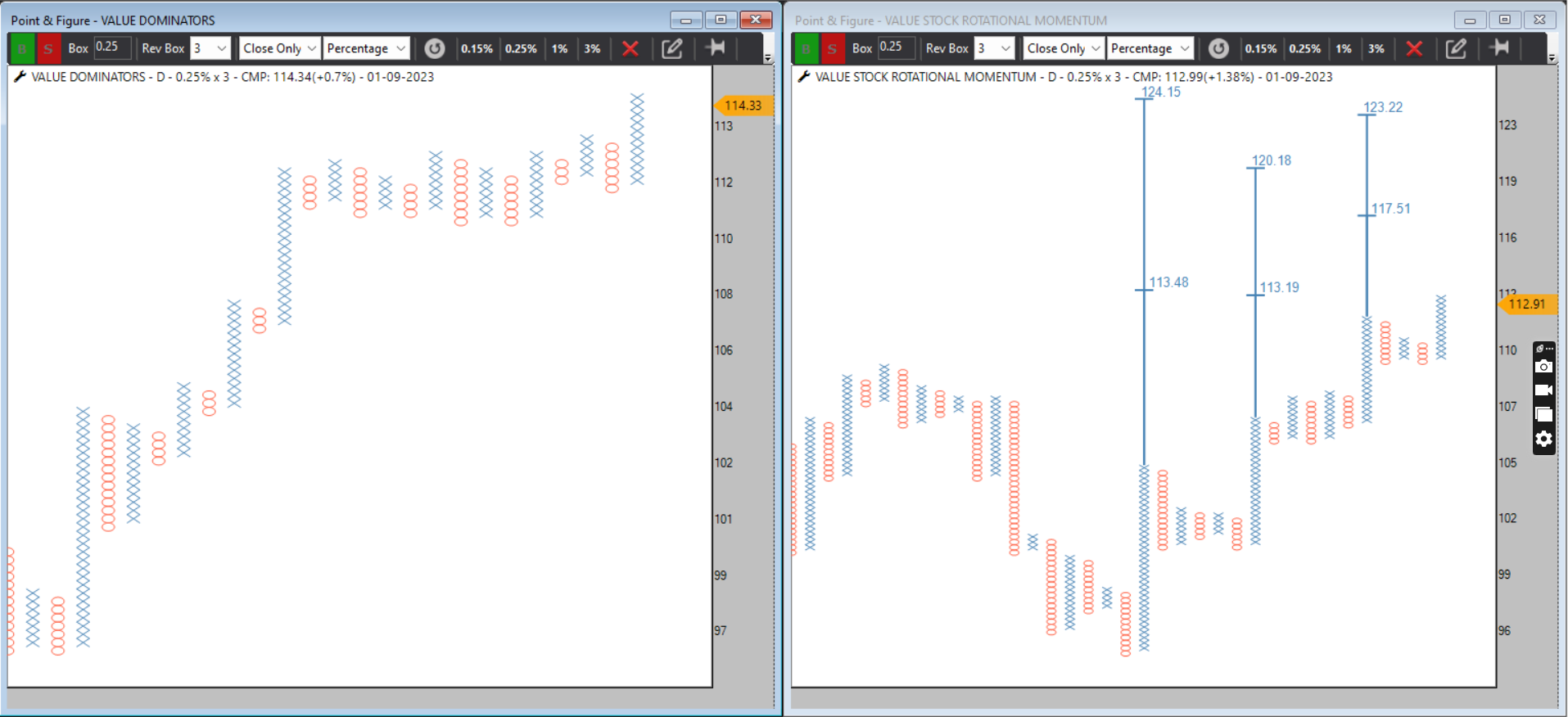

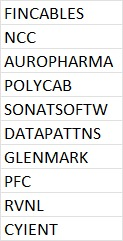

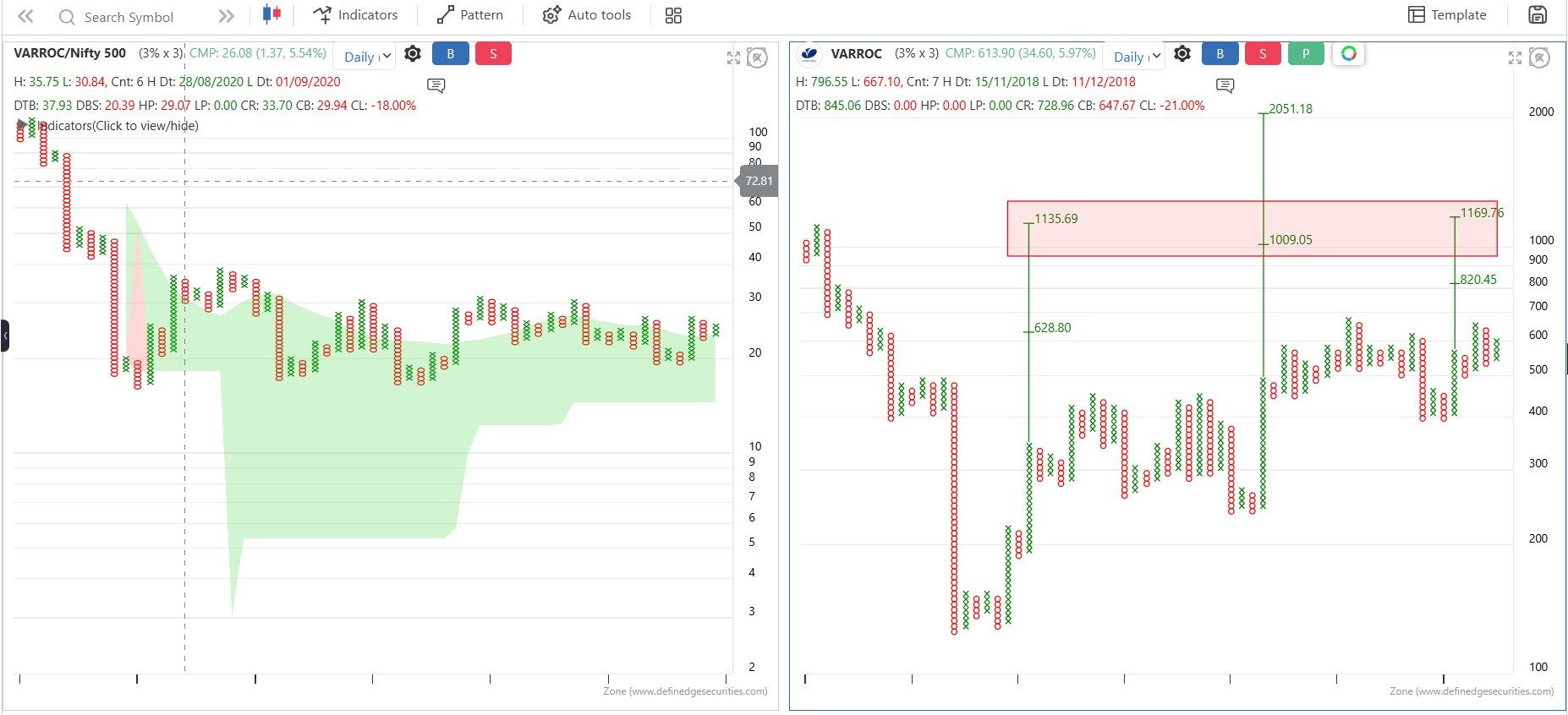

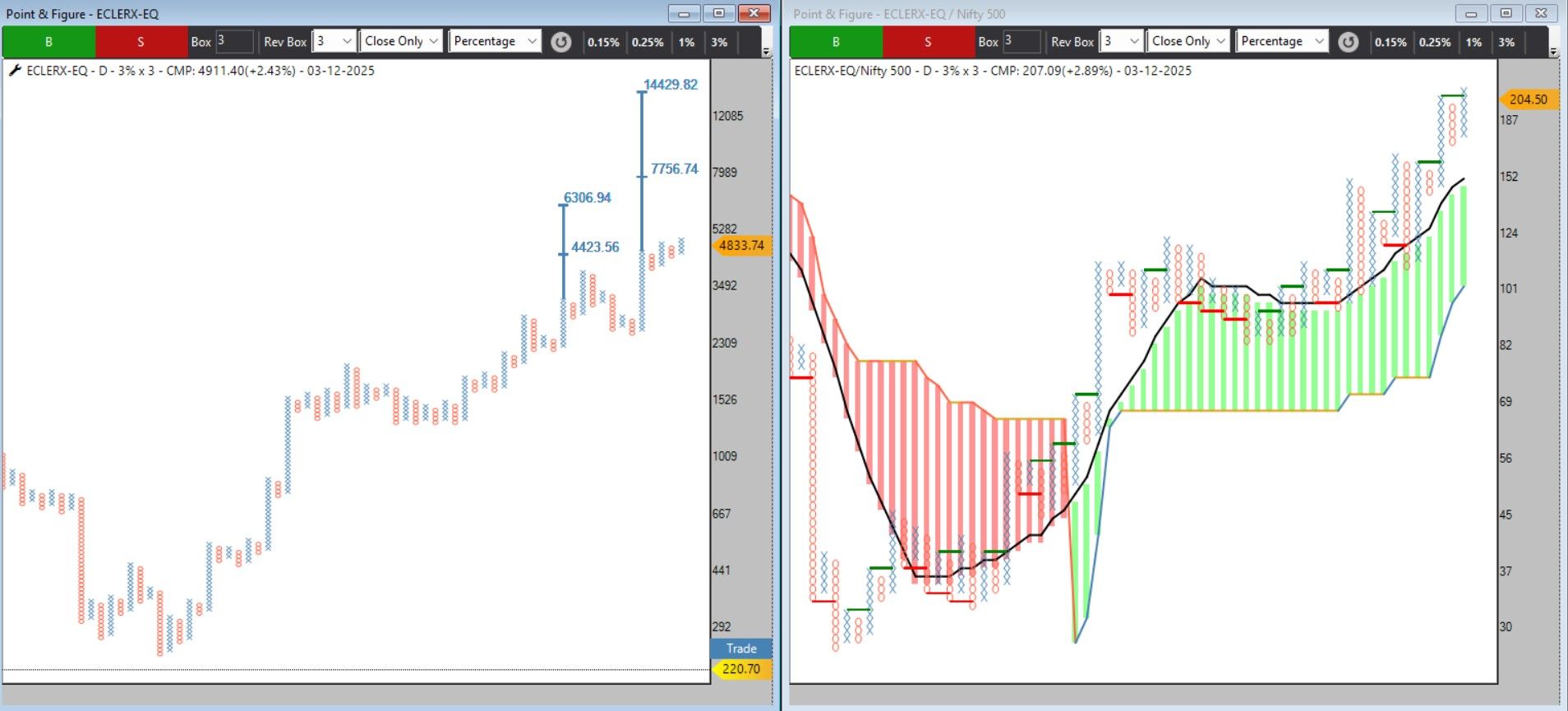

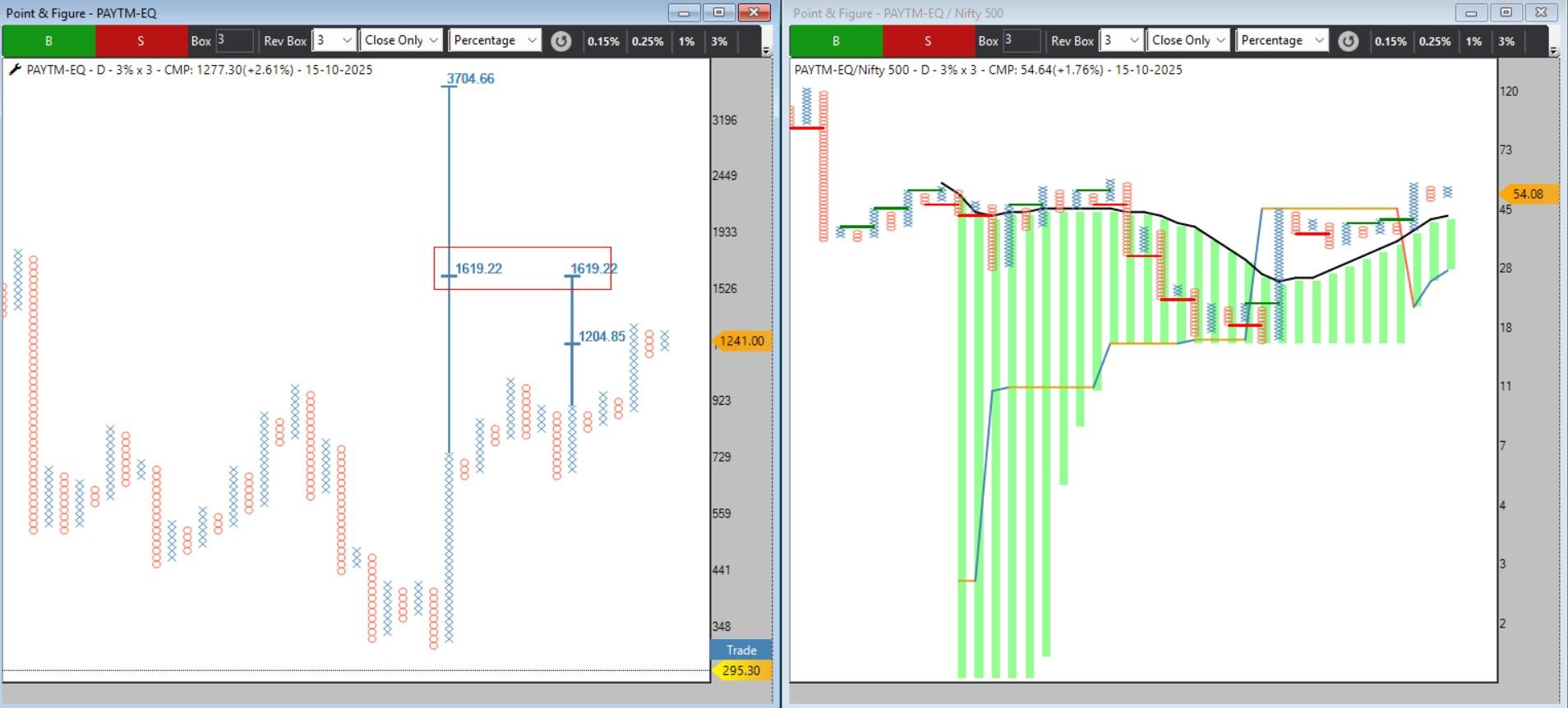

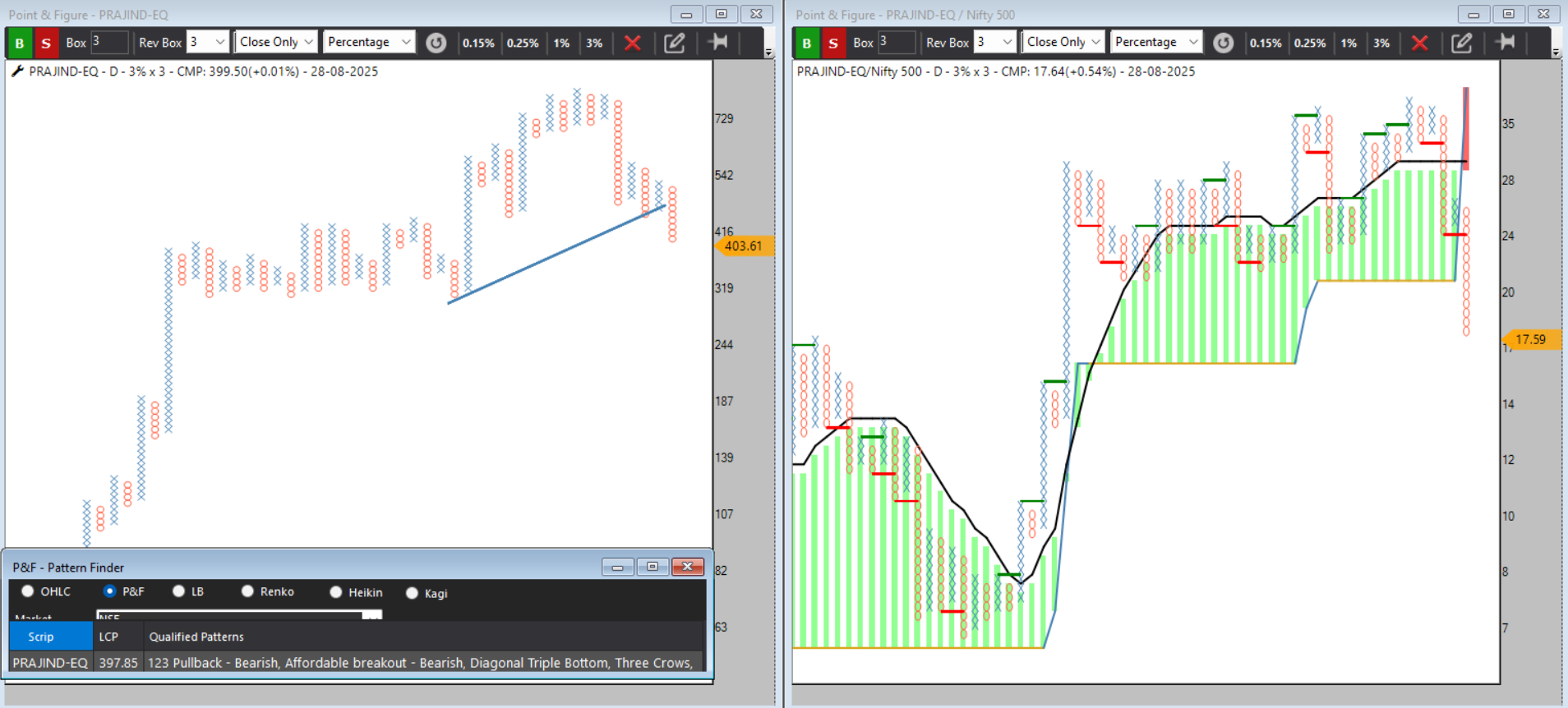

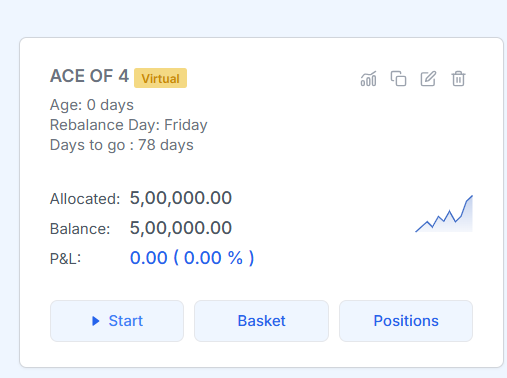

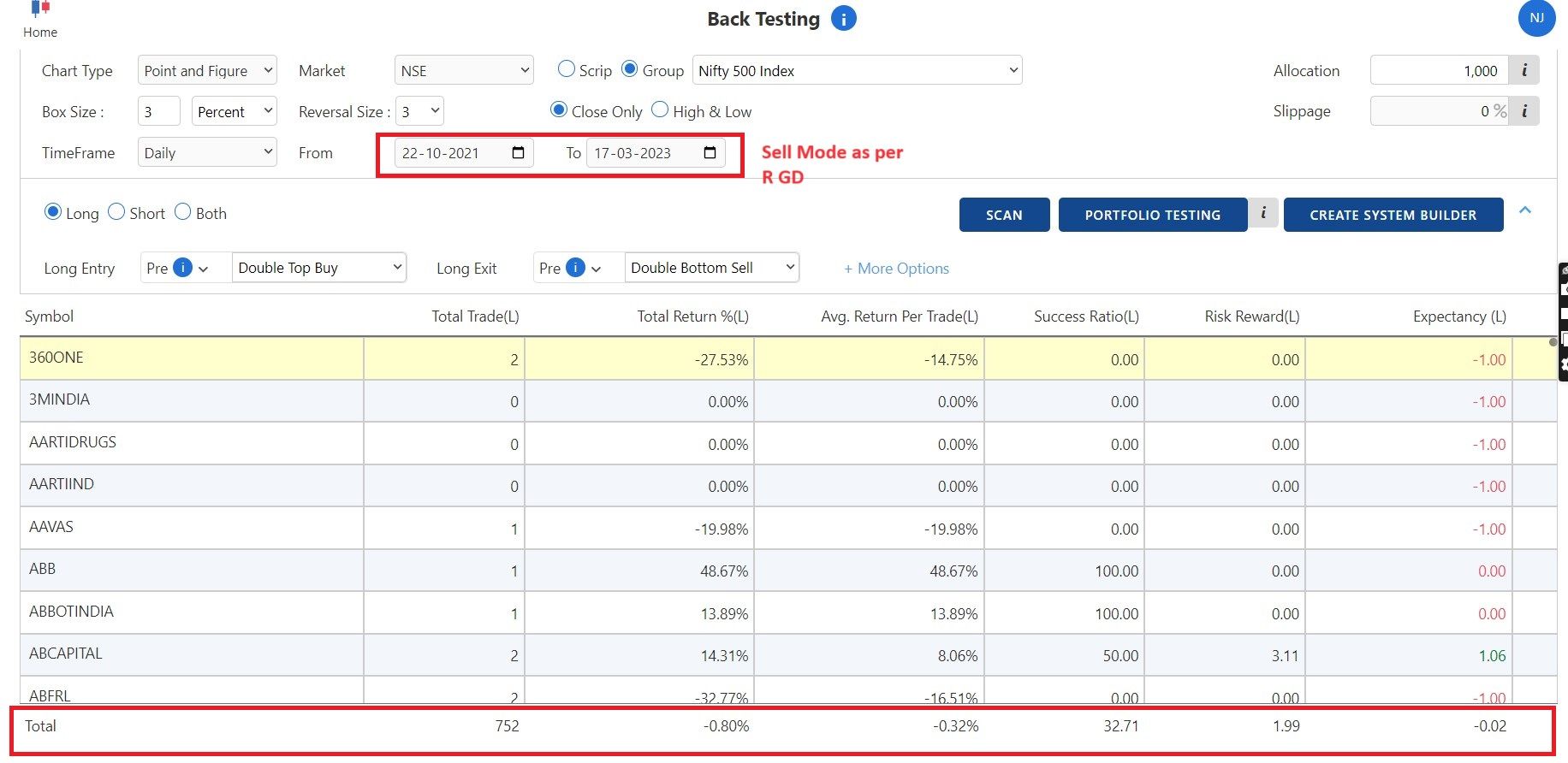

Remaining 50% on Double Top Buy

Remaining 50% on Double Top Buy ️ Risk Management: Double Bottom Sell as exit

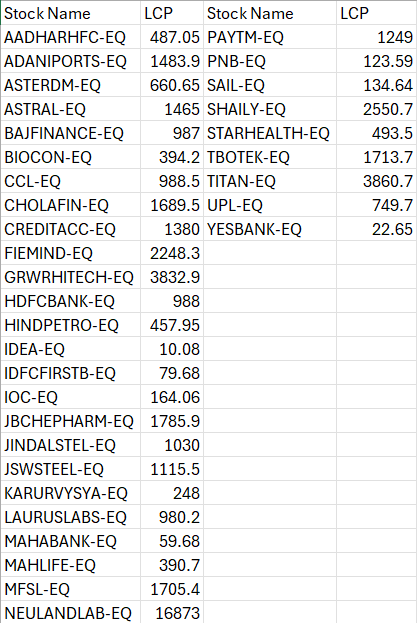

️ Risk Management: Double Bottom Sell as exit Business Snapshot

Business Snapshot

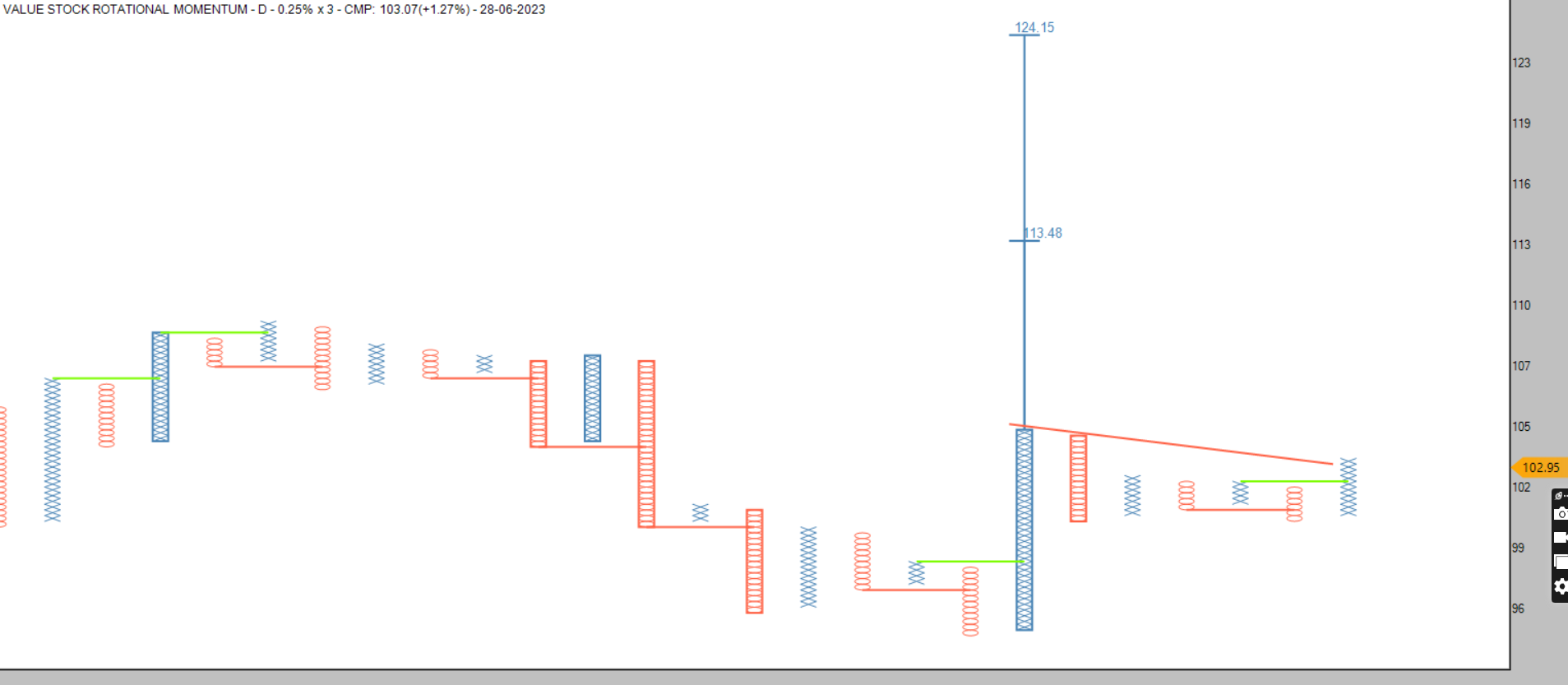

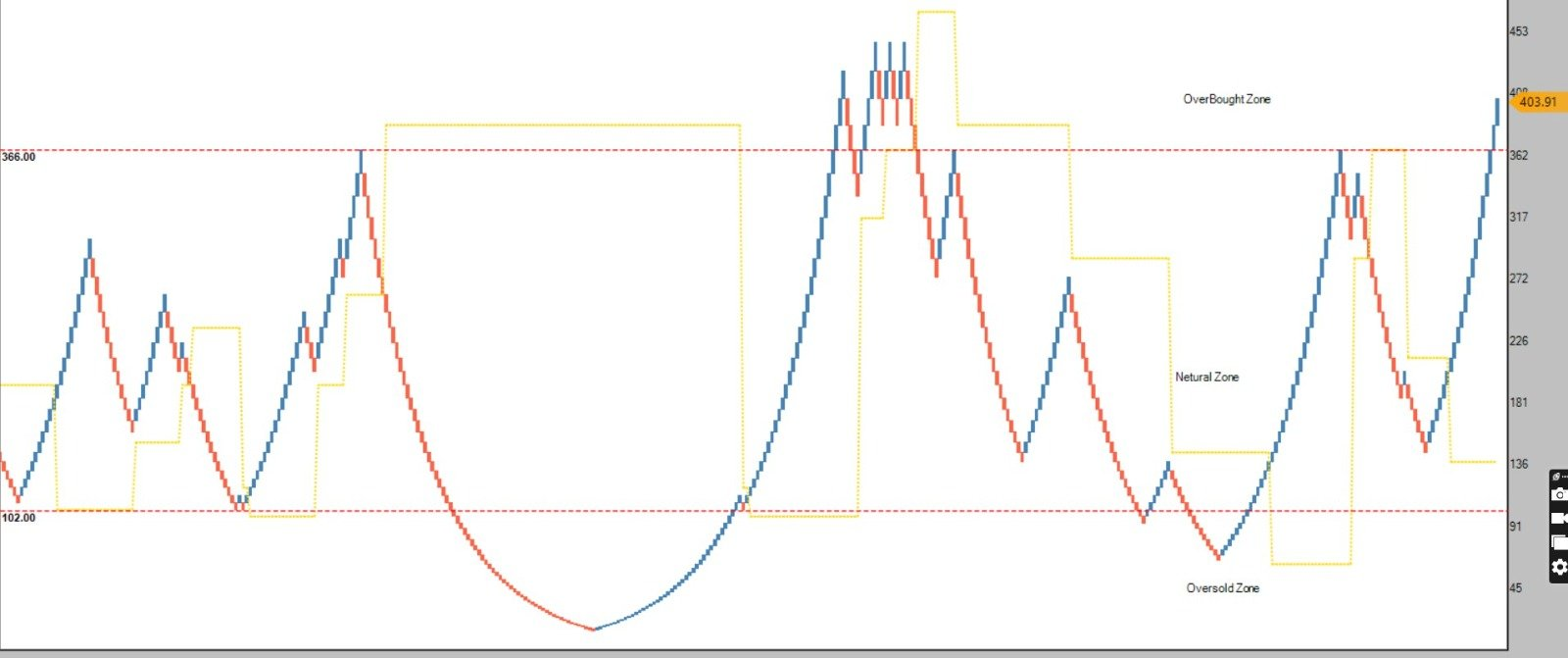

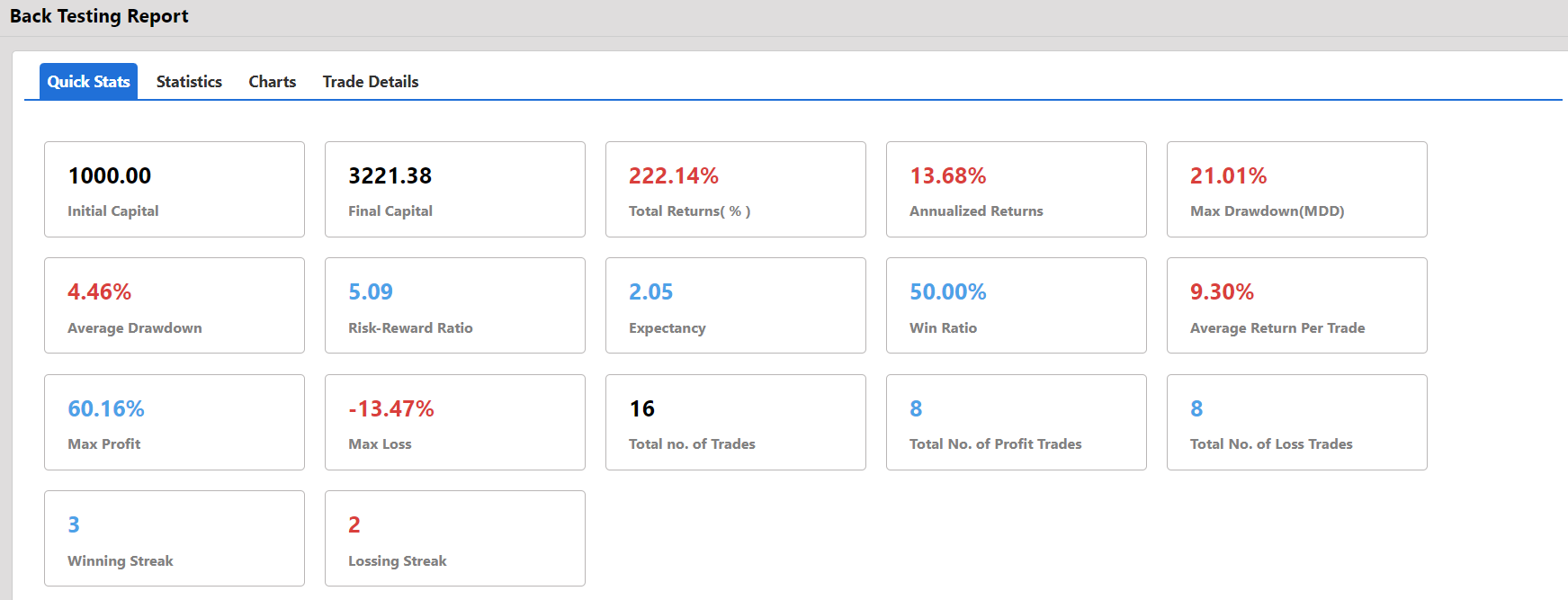

What a Selling Climax typically tells us

What a Selling Climax typically tells us

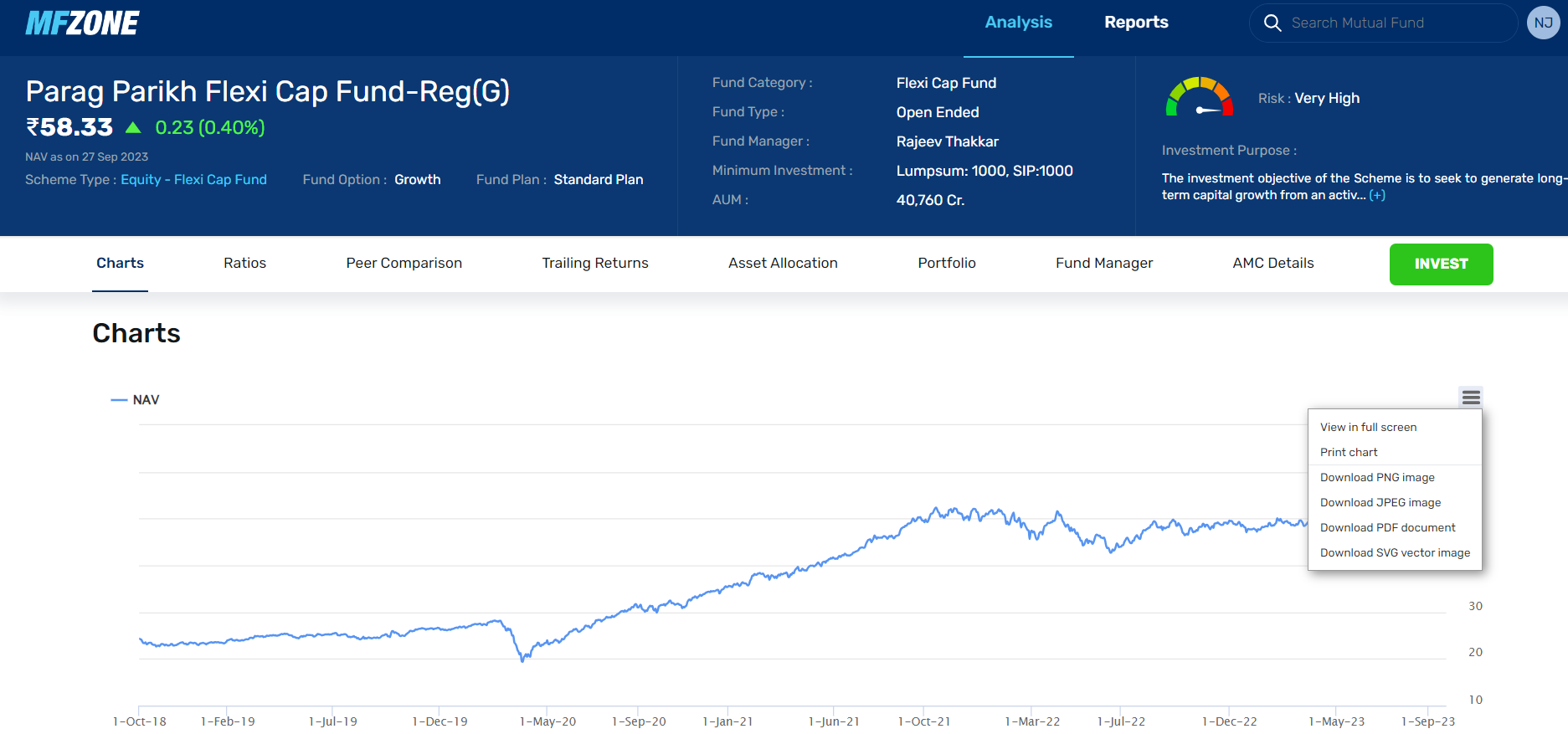

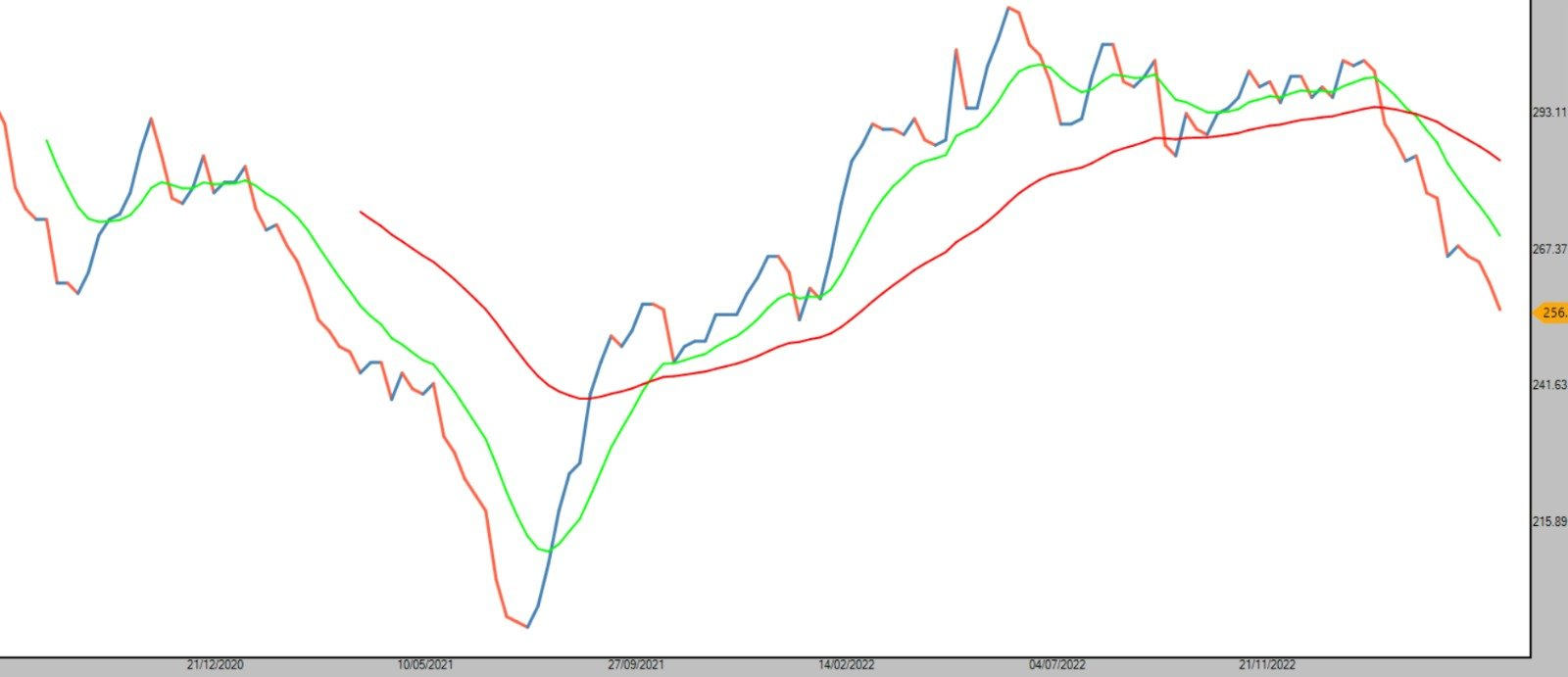

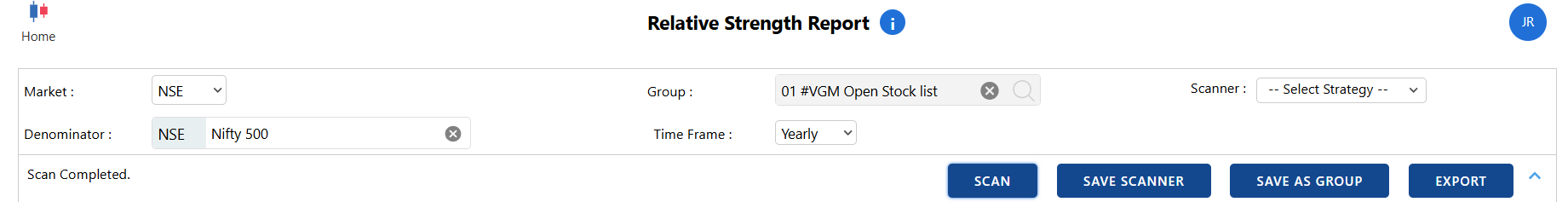

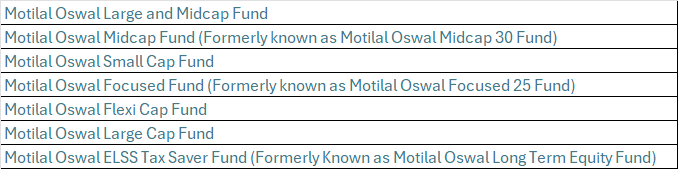

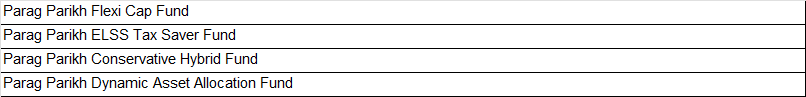

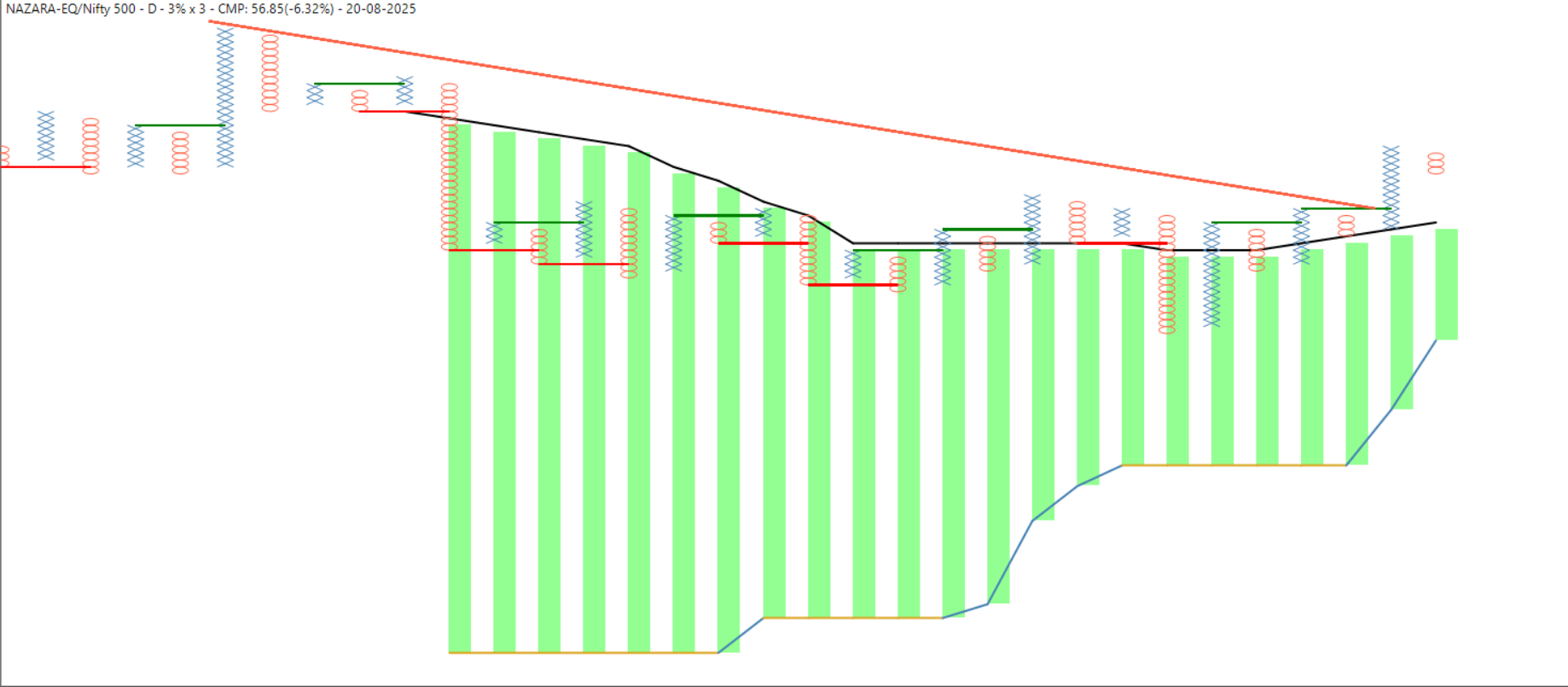

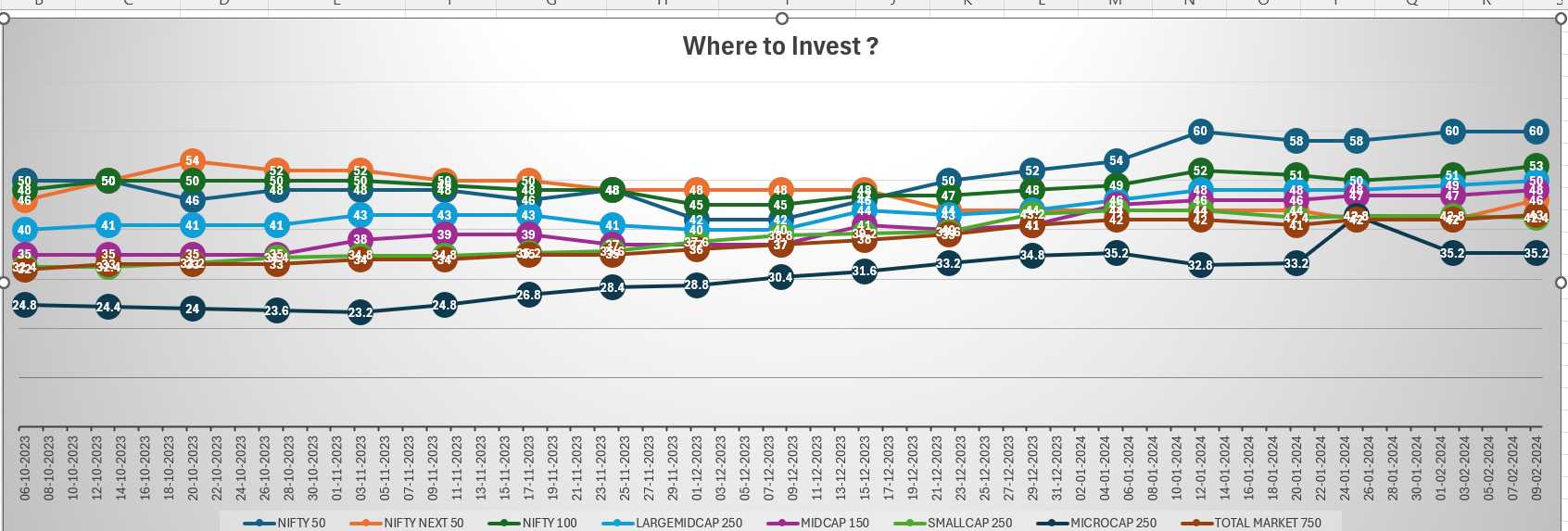

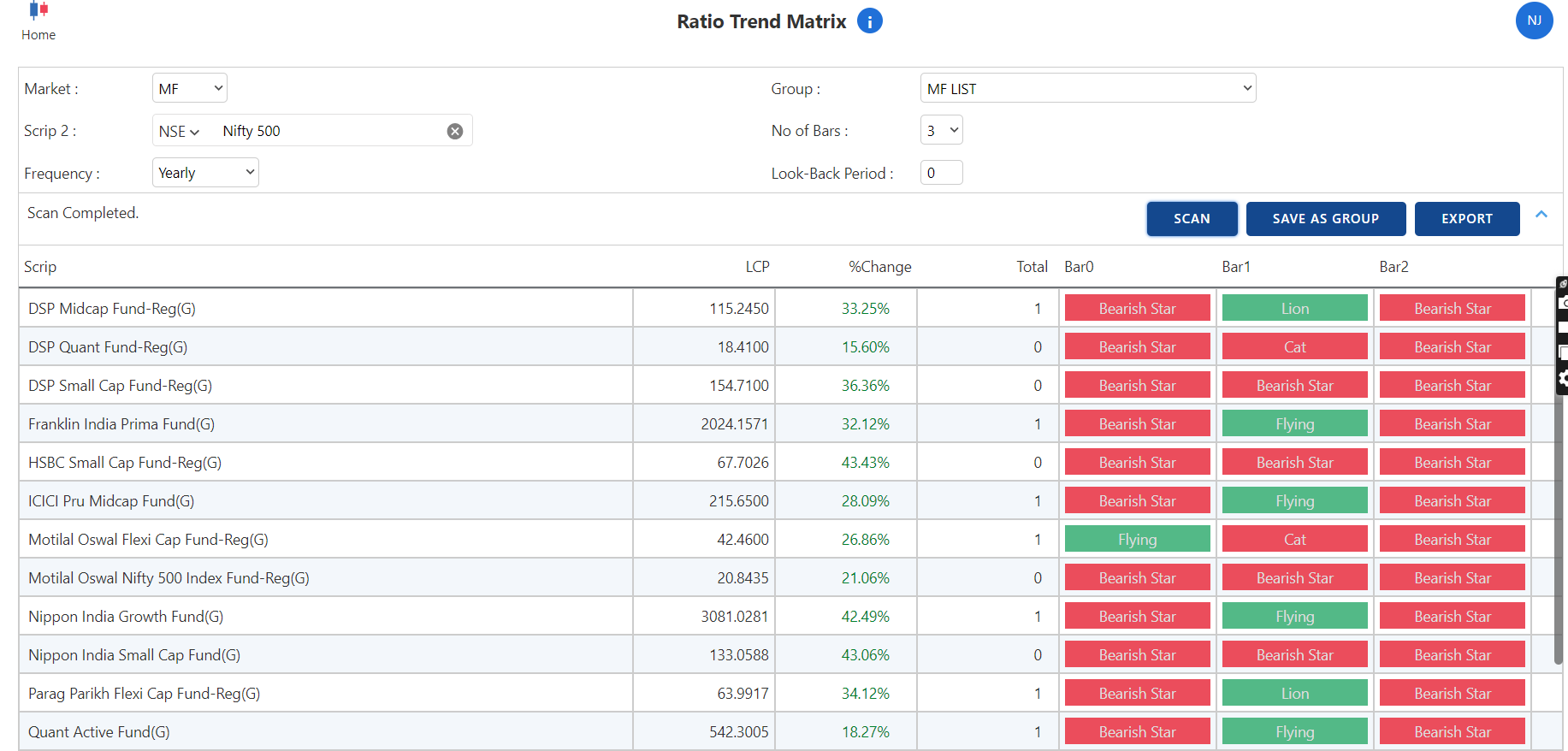

Broader Market Turning Point? Small-Cap Funds Reopen After 22 Months

Broader Market Turning Point? Small-Cap Funds Reopen After 22 Months

Trigger Watch:

Trigger Watch:

2009, 2012 & 2020

2009, 2012 & 2020

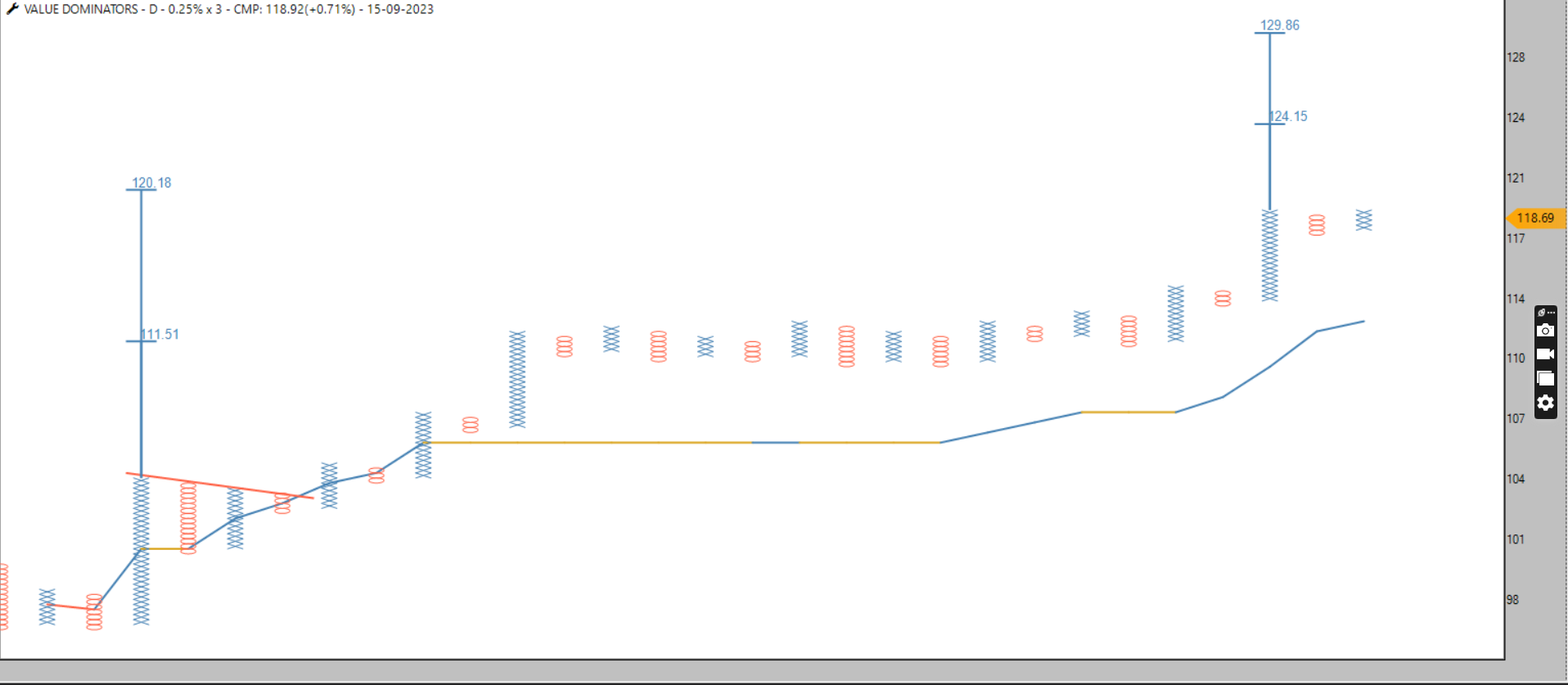

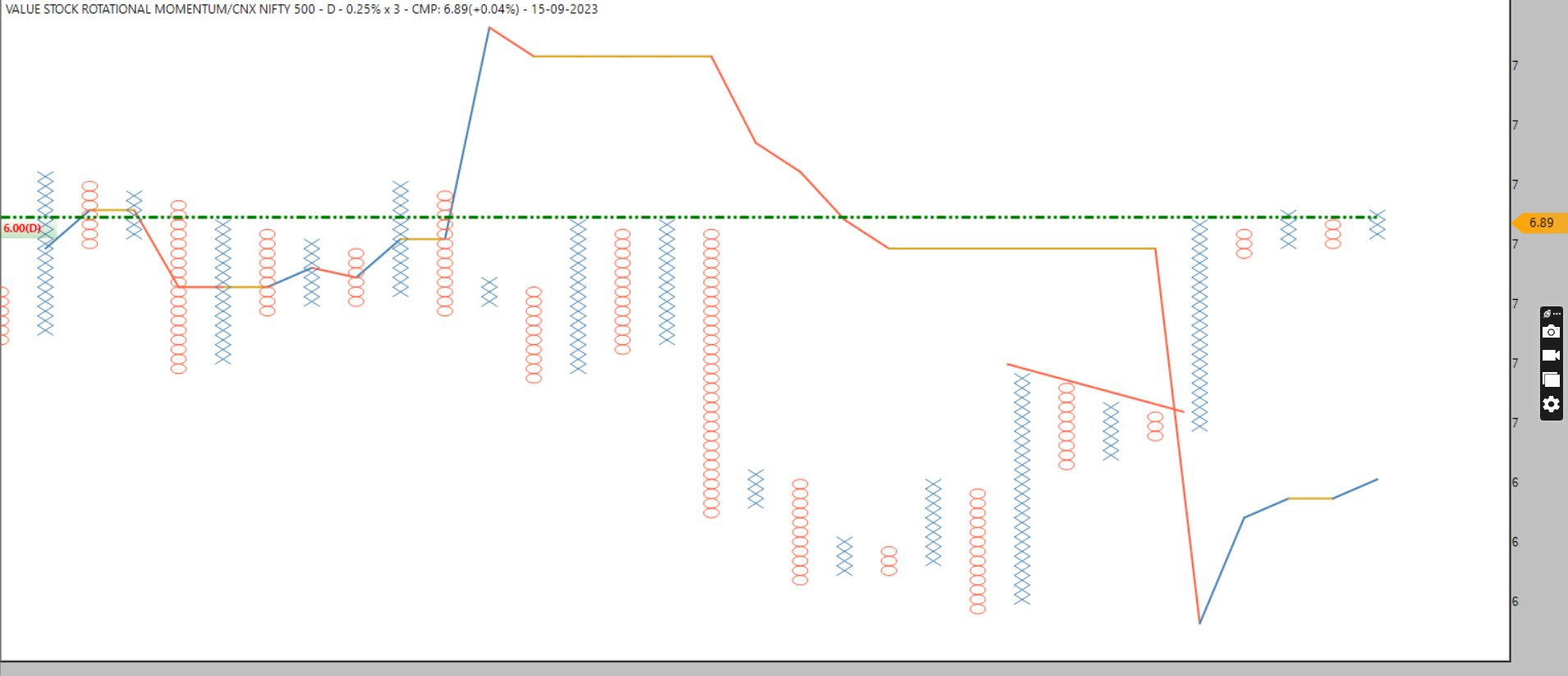

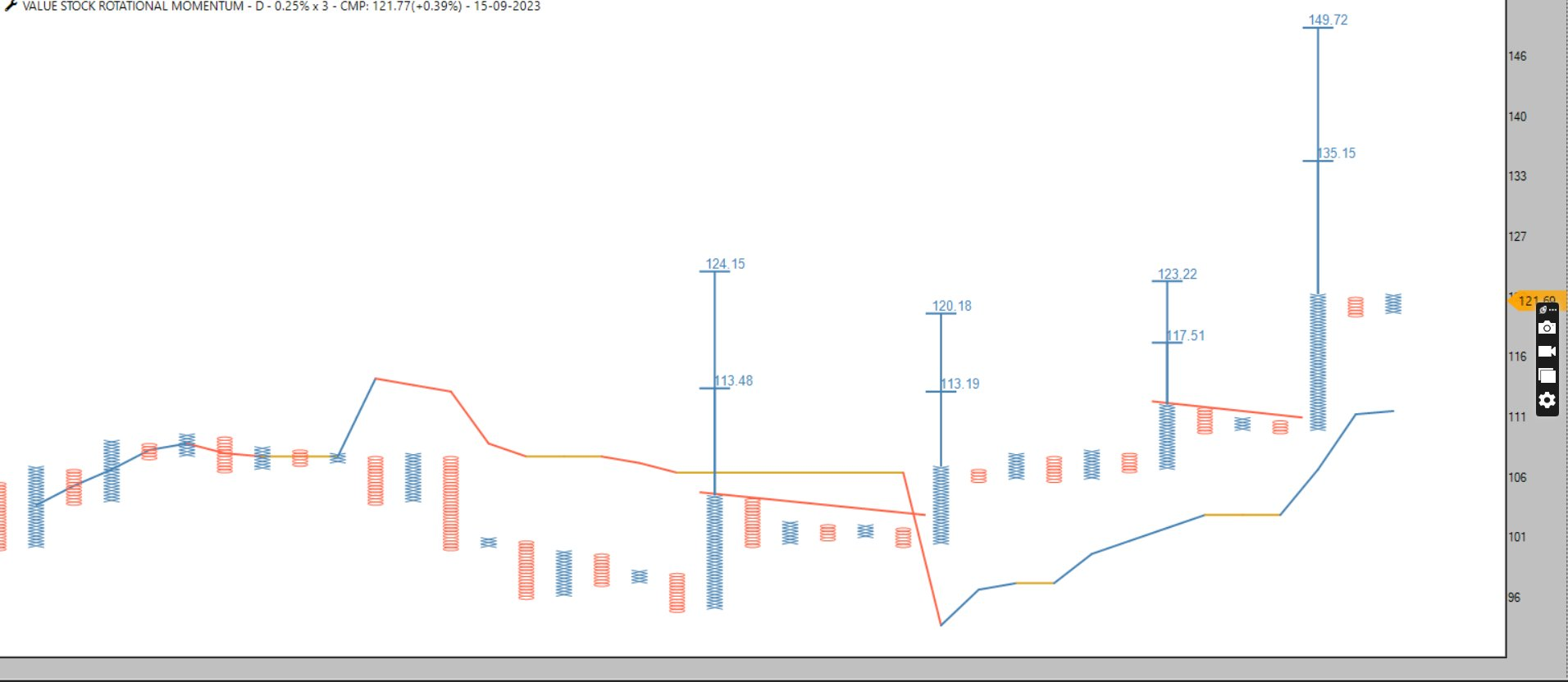

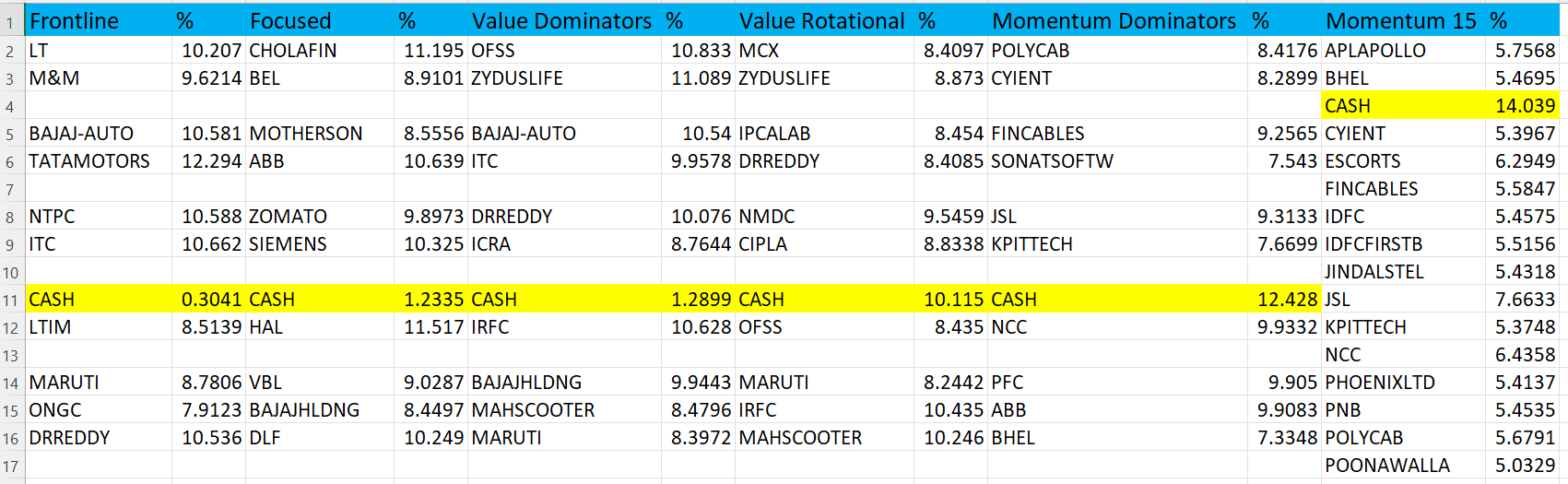

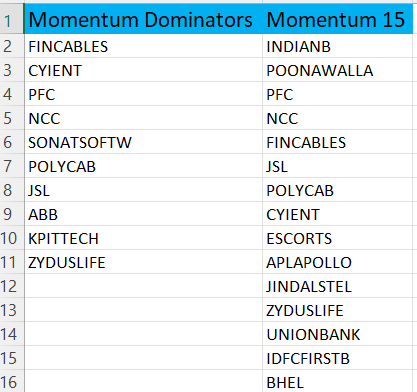

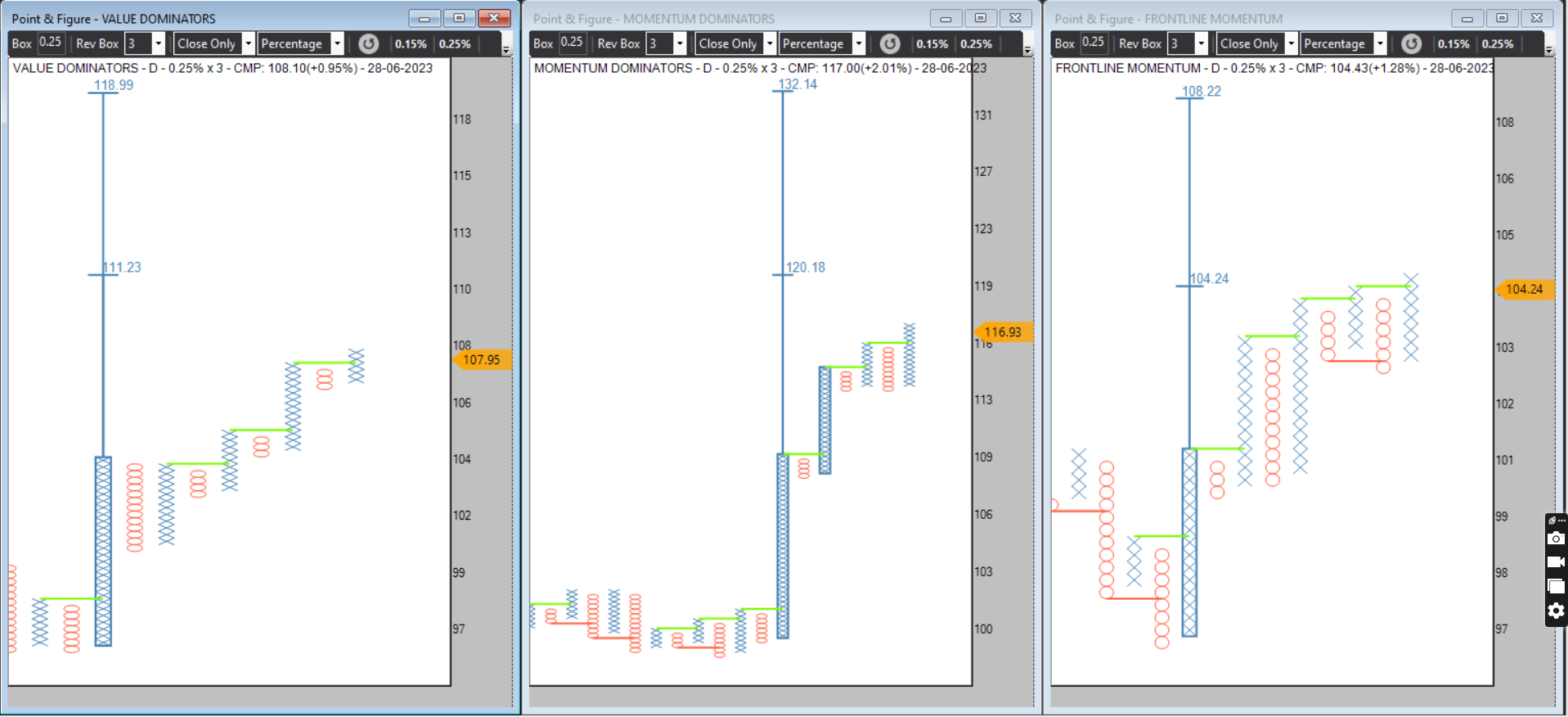

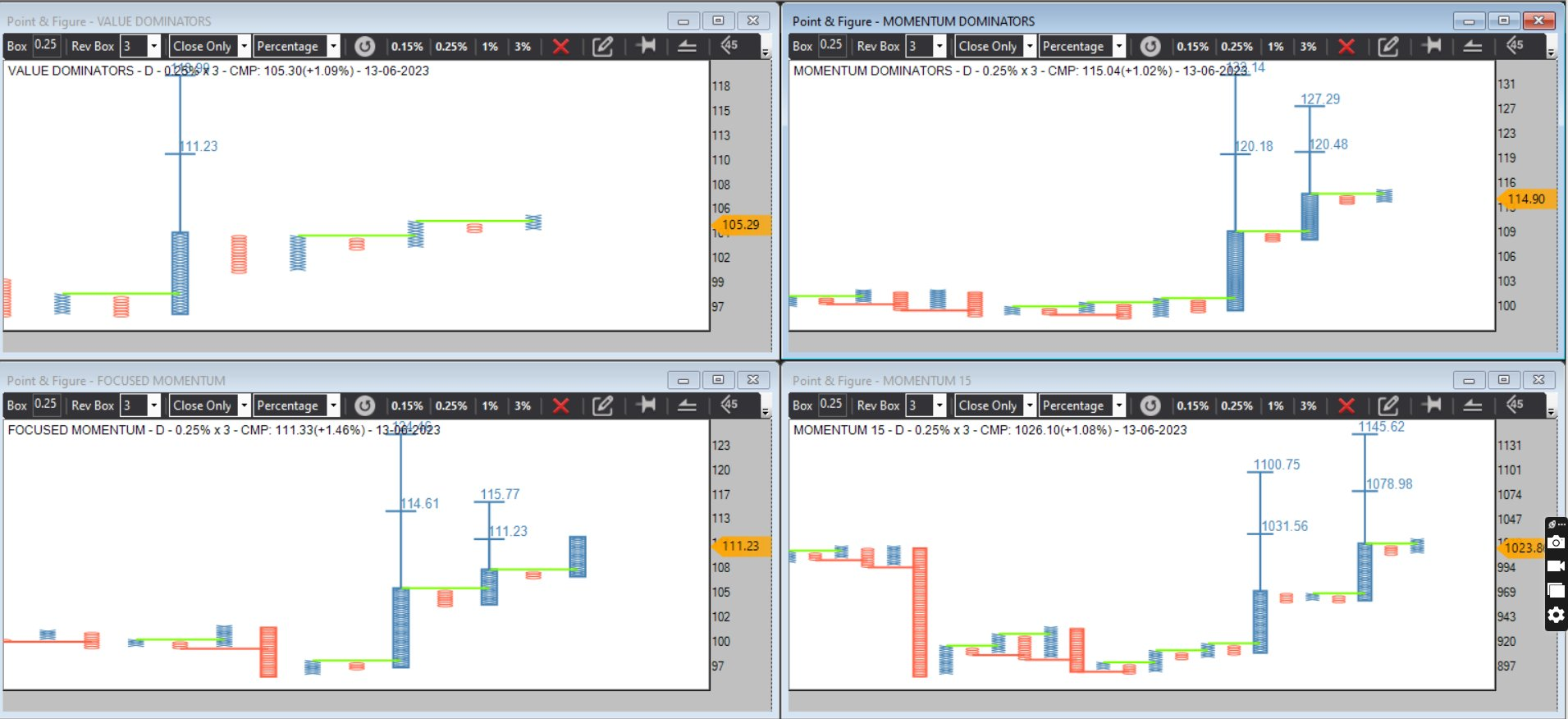

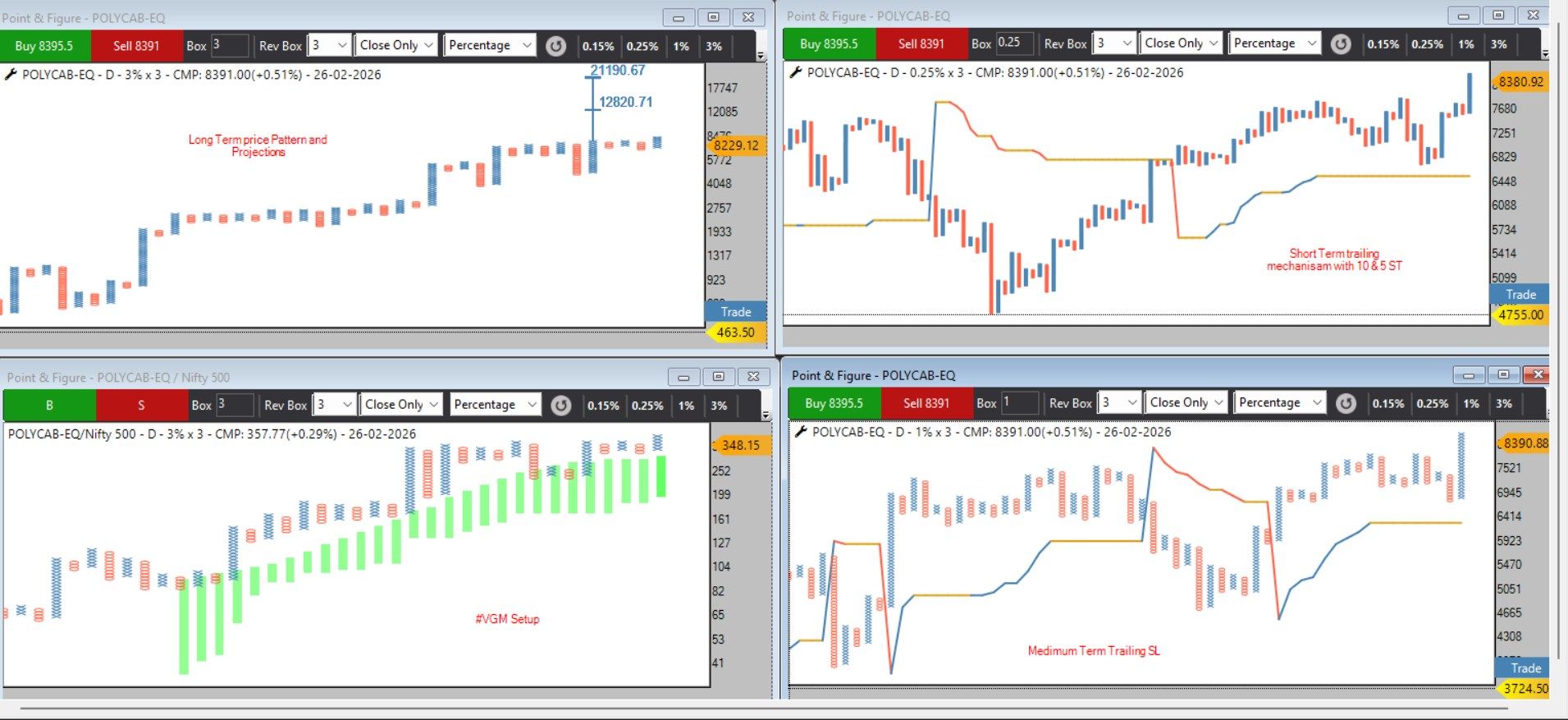

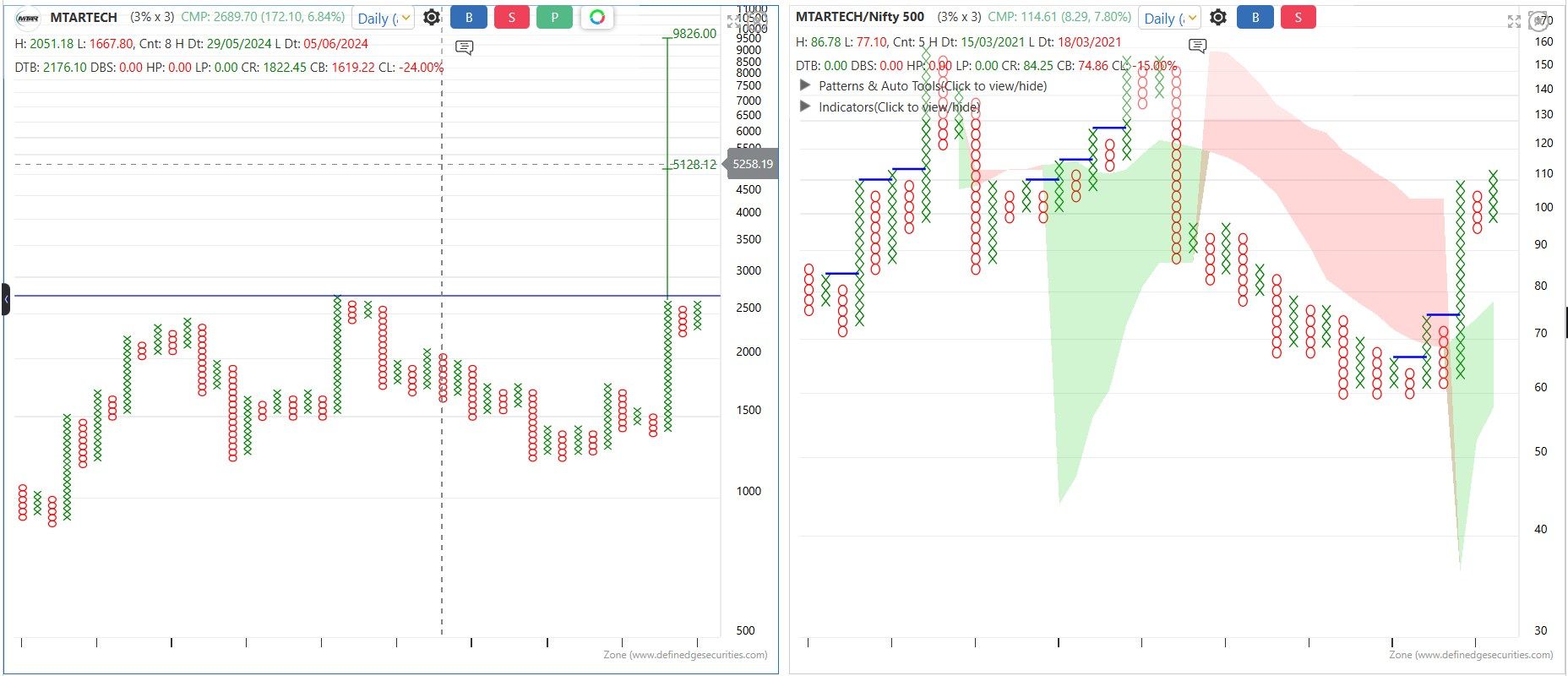

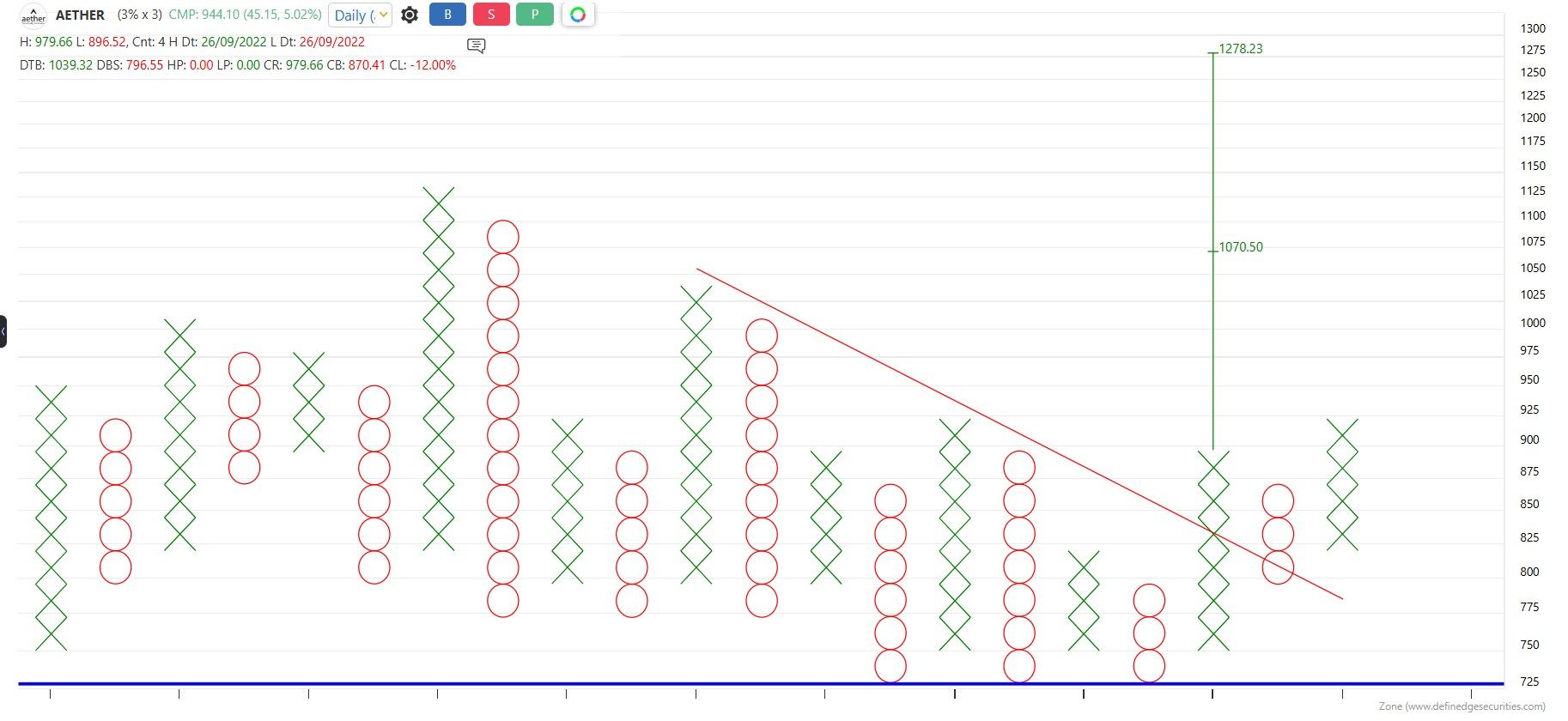

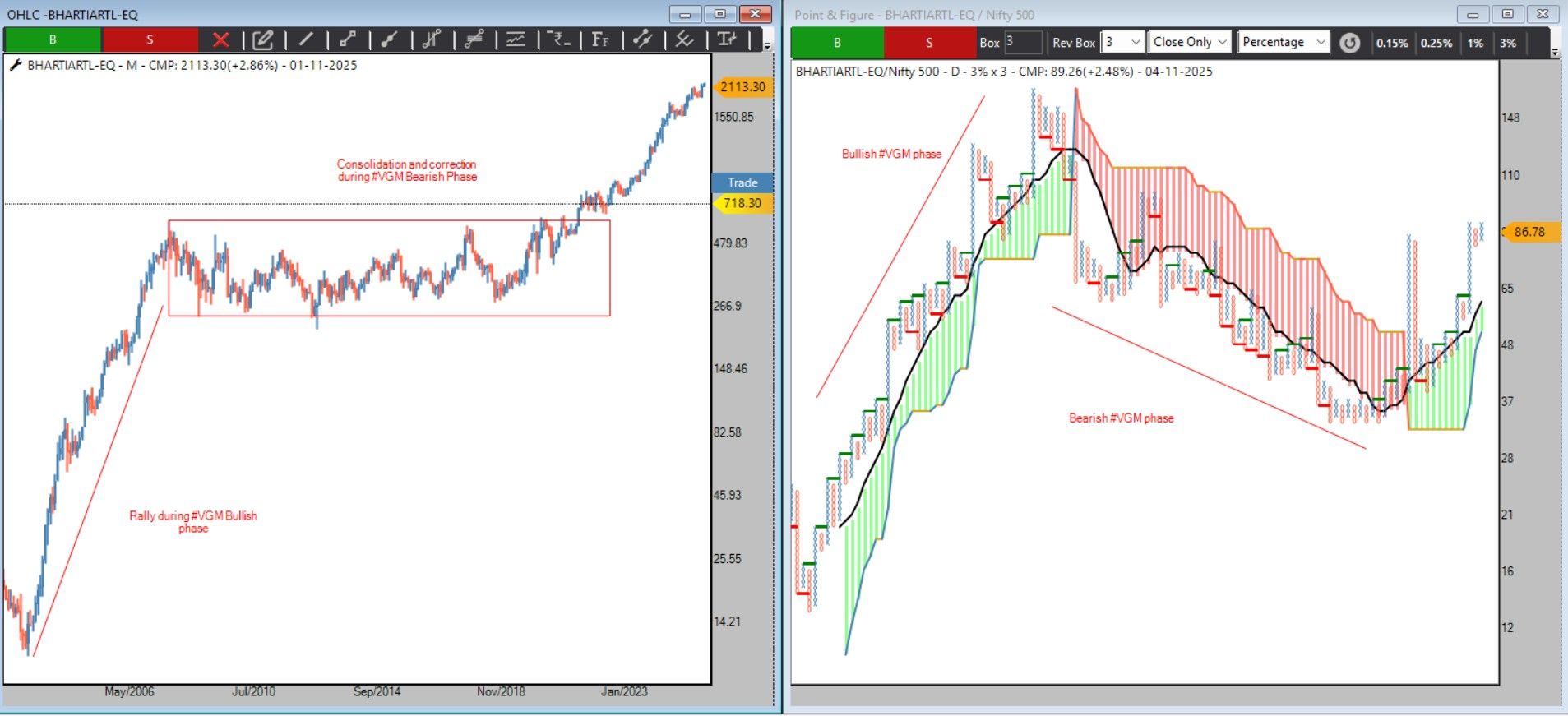

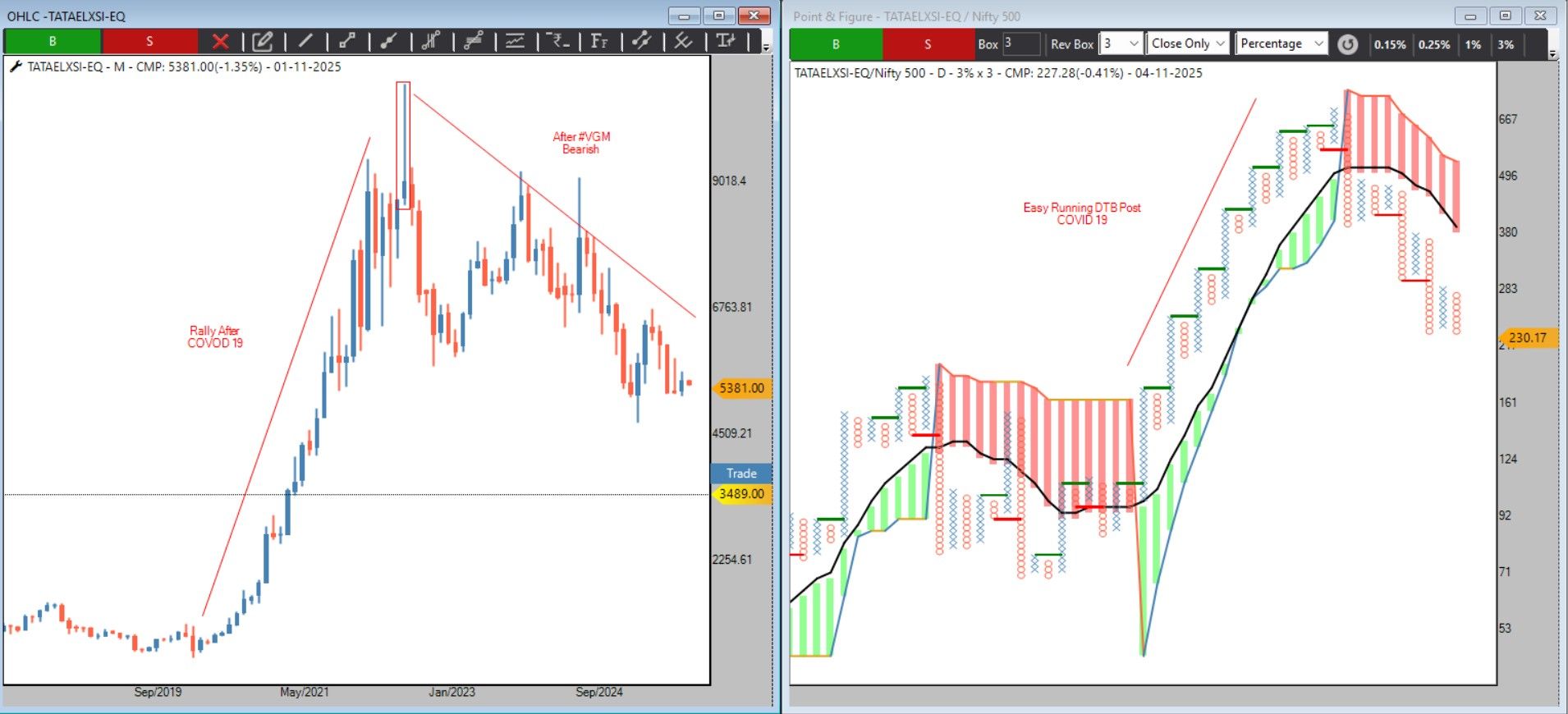

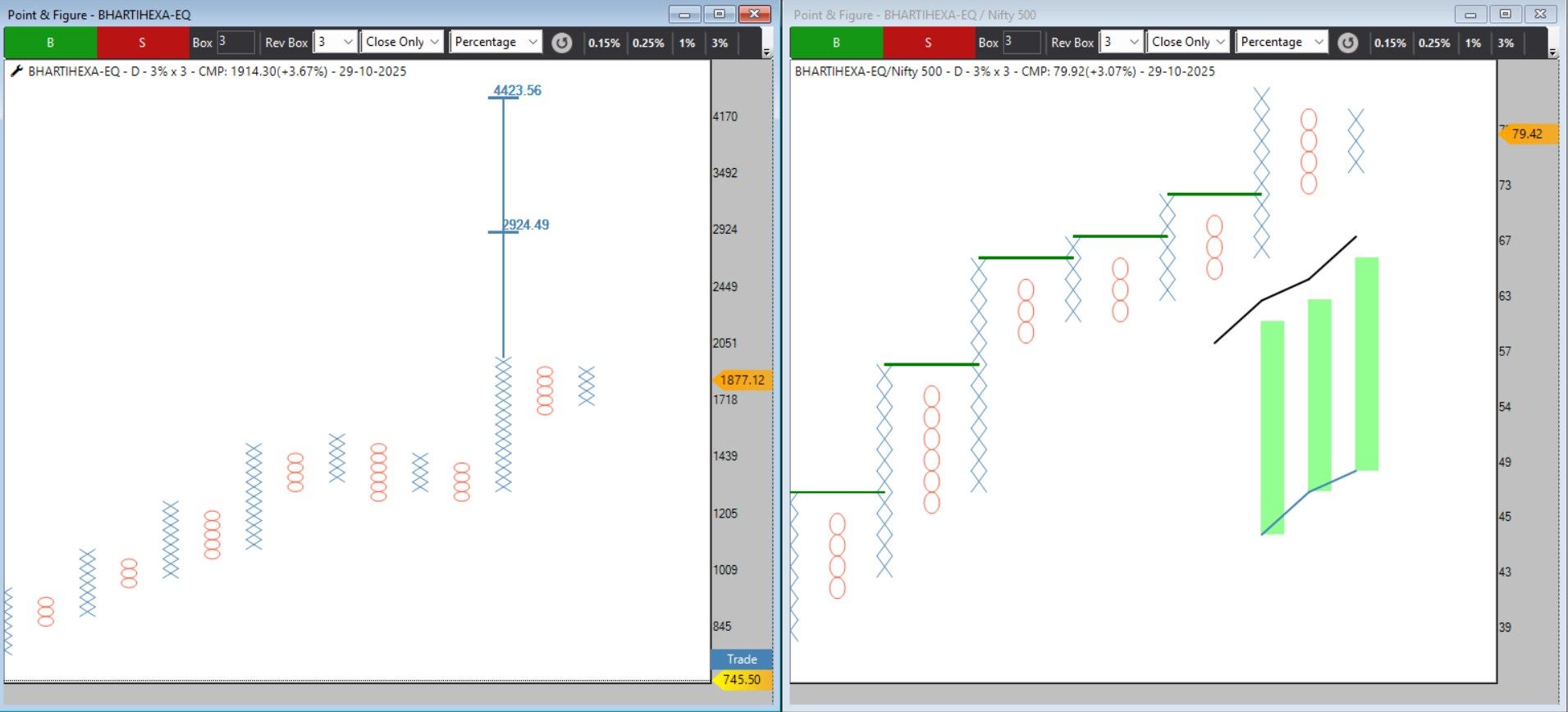

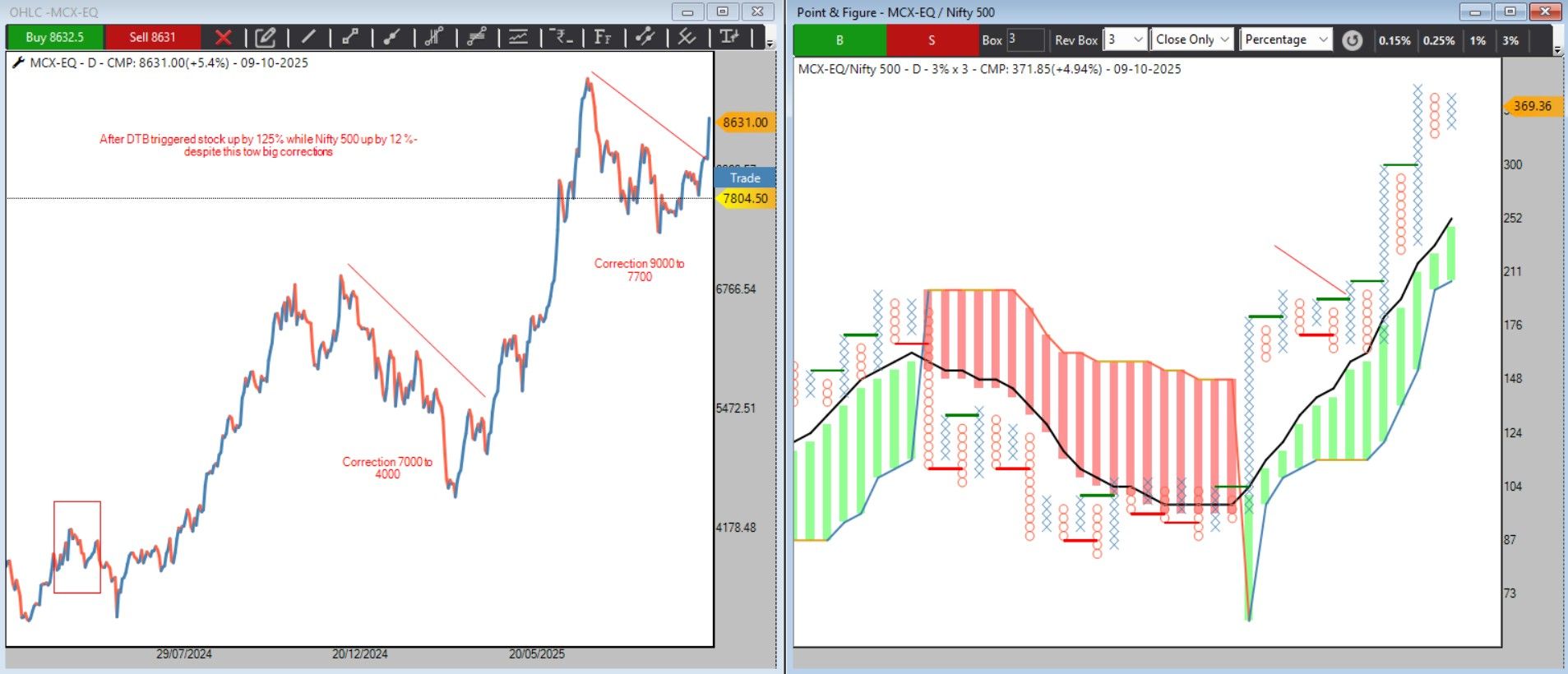

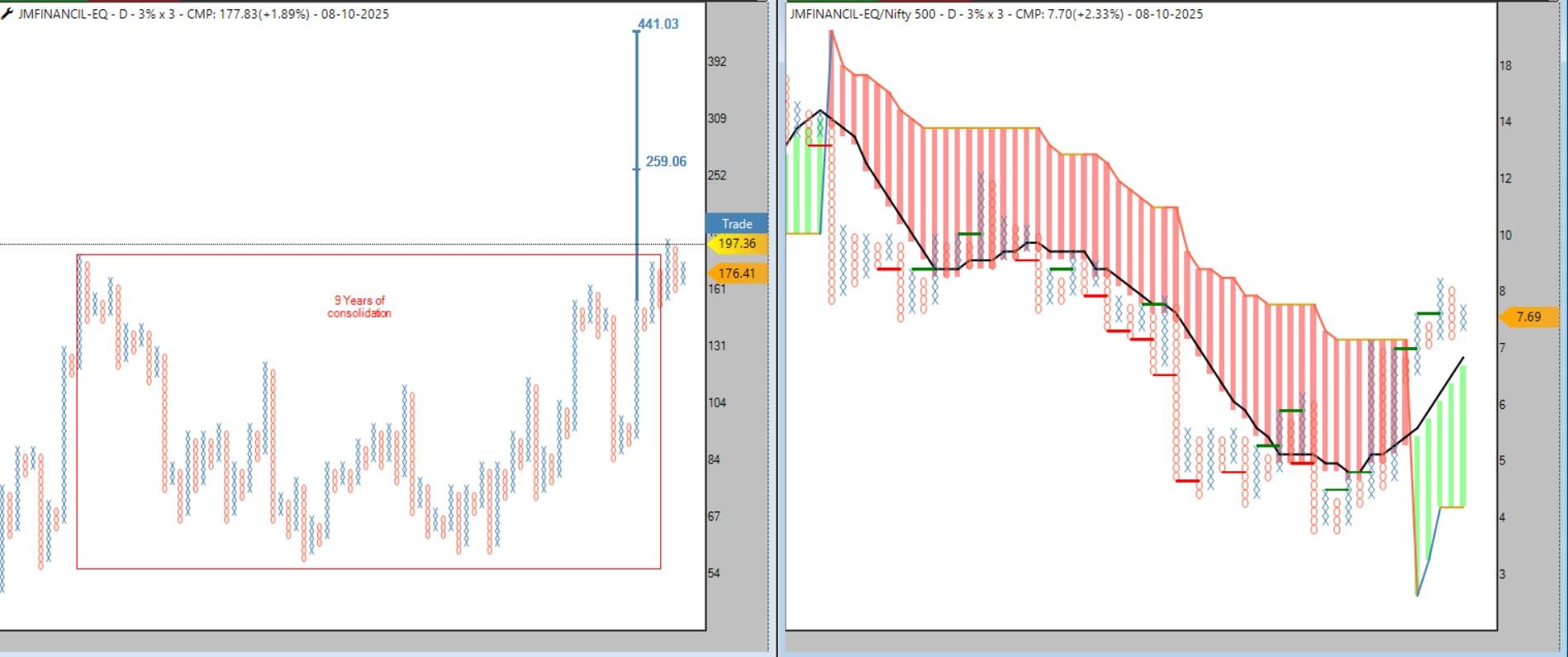

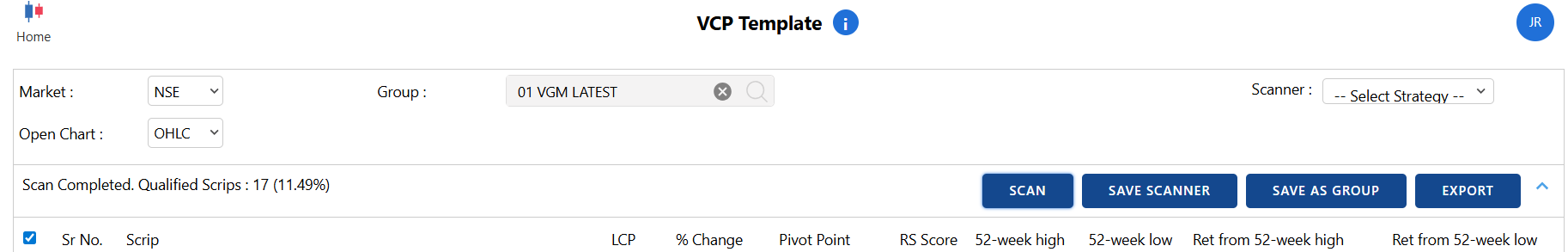

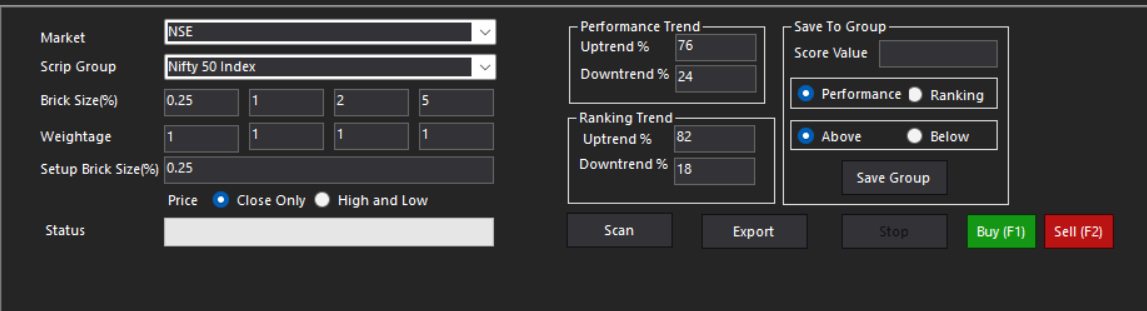

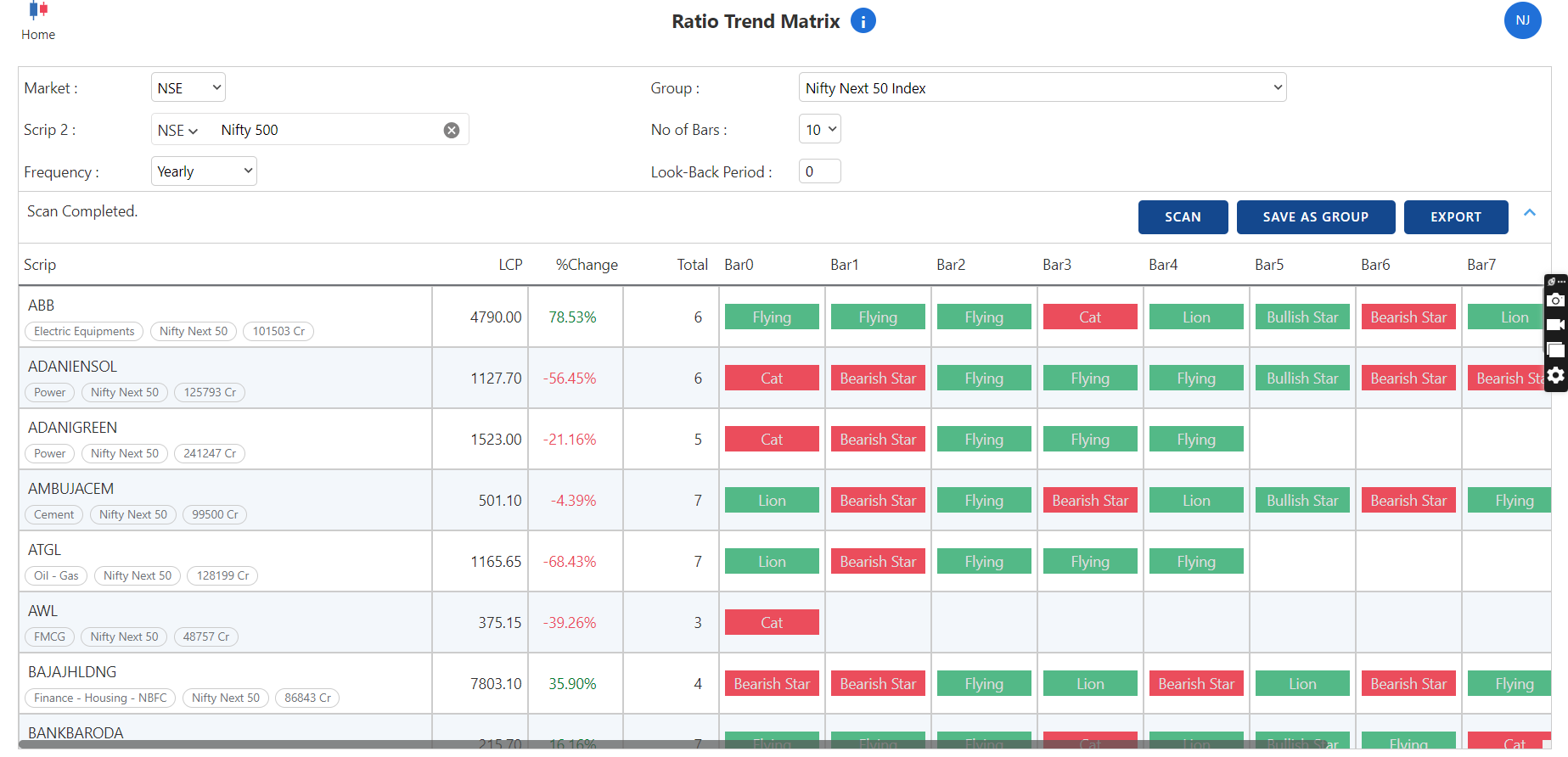

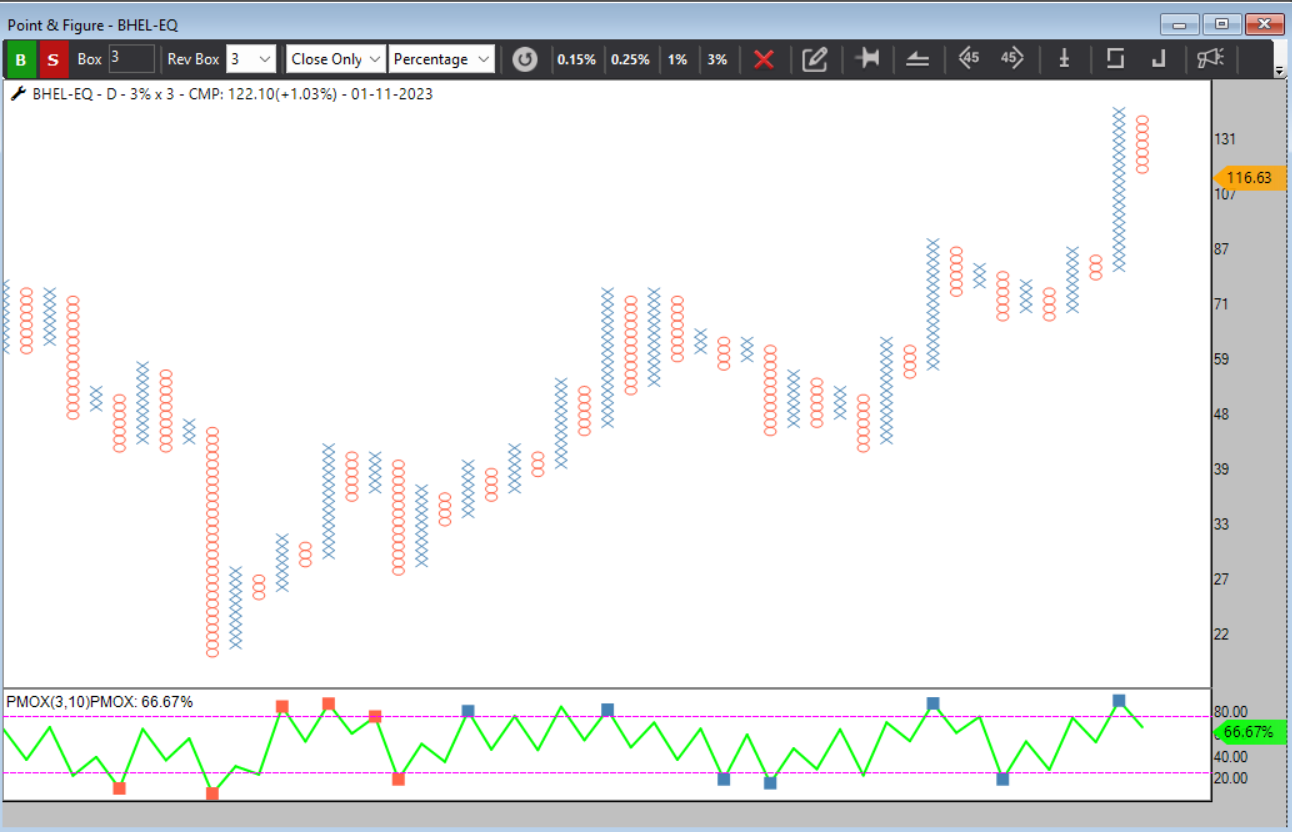

VGM Technical Highlights

VGM Technical Highlights

️ Want to spot such setups early?

️ Want to spot such setups early?

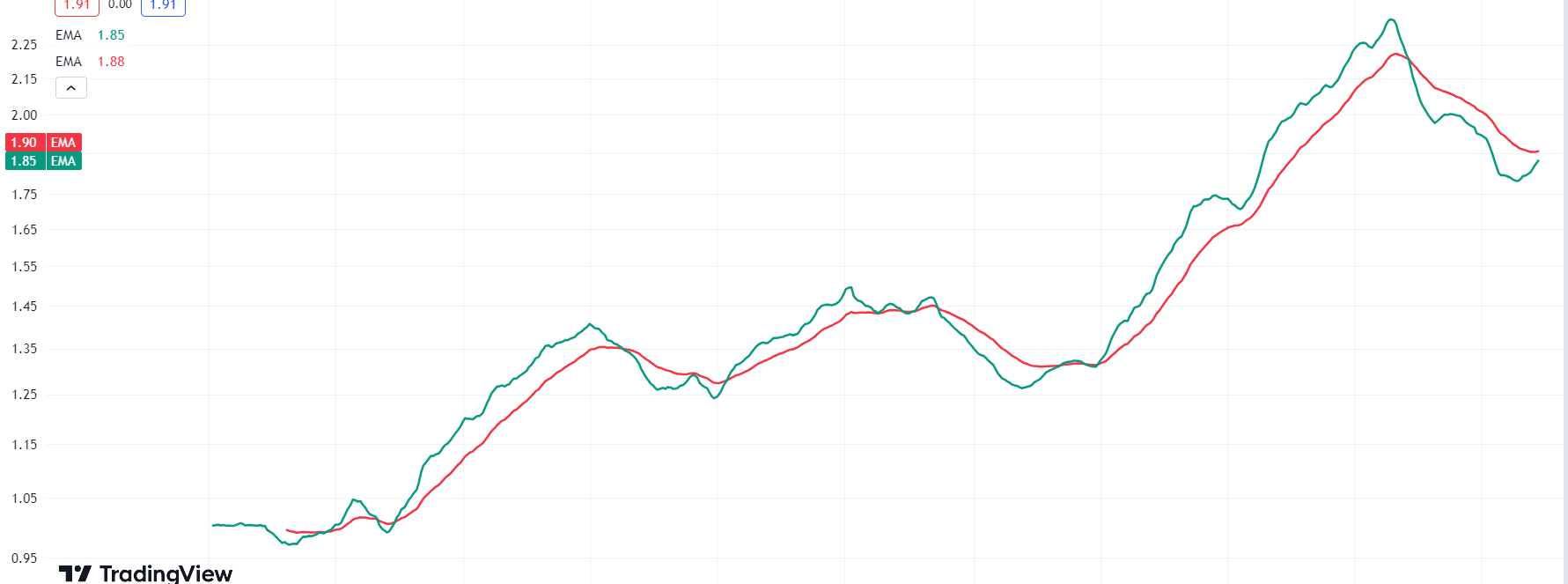

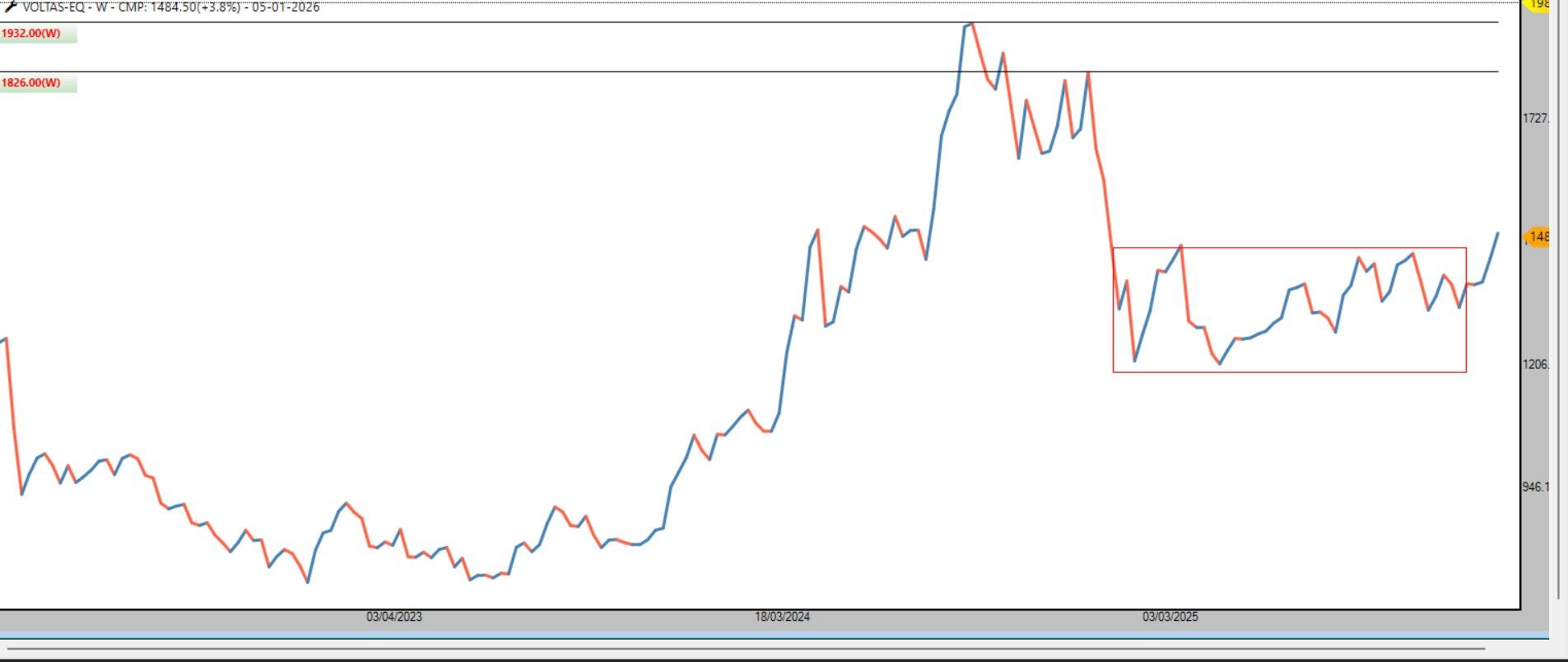

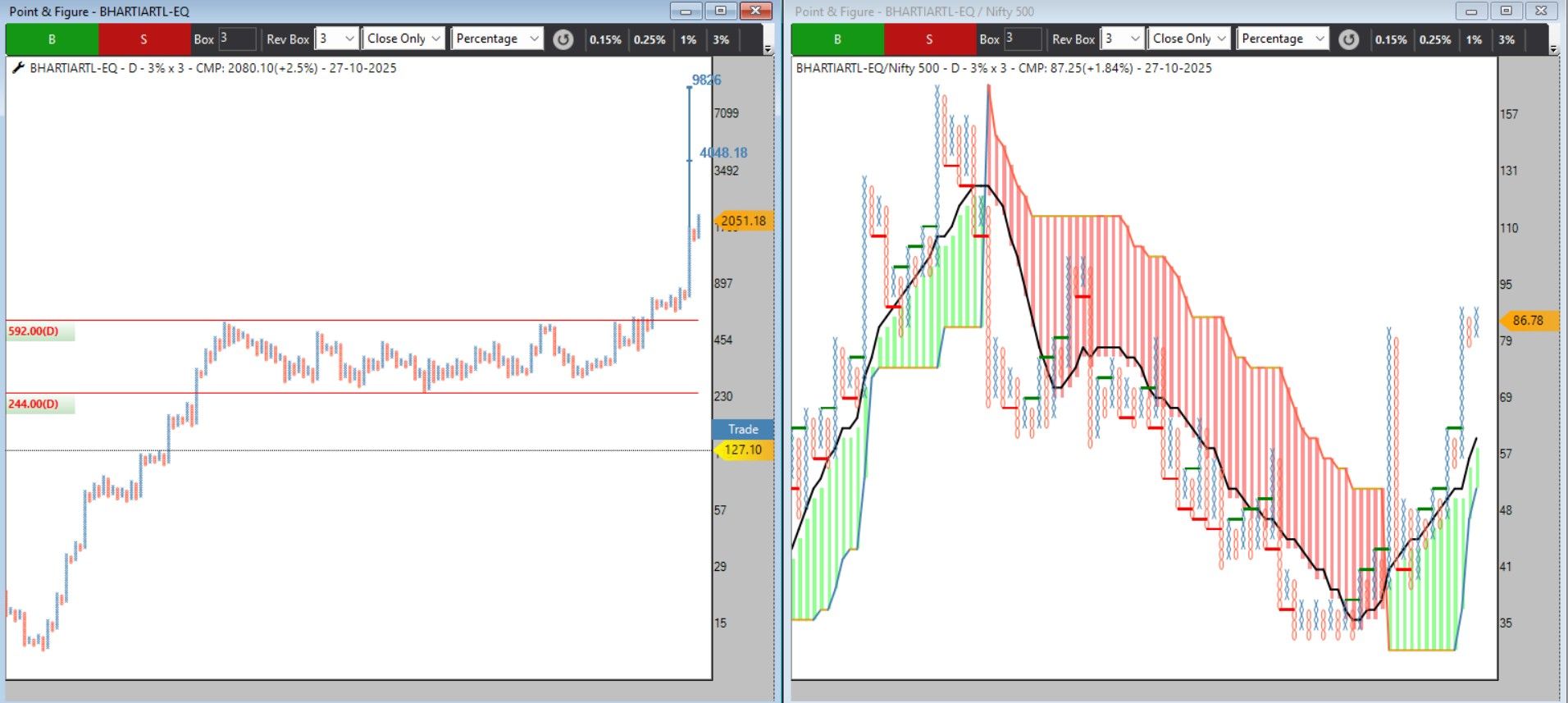

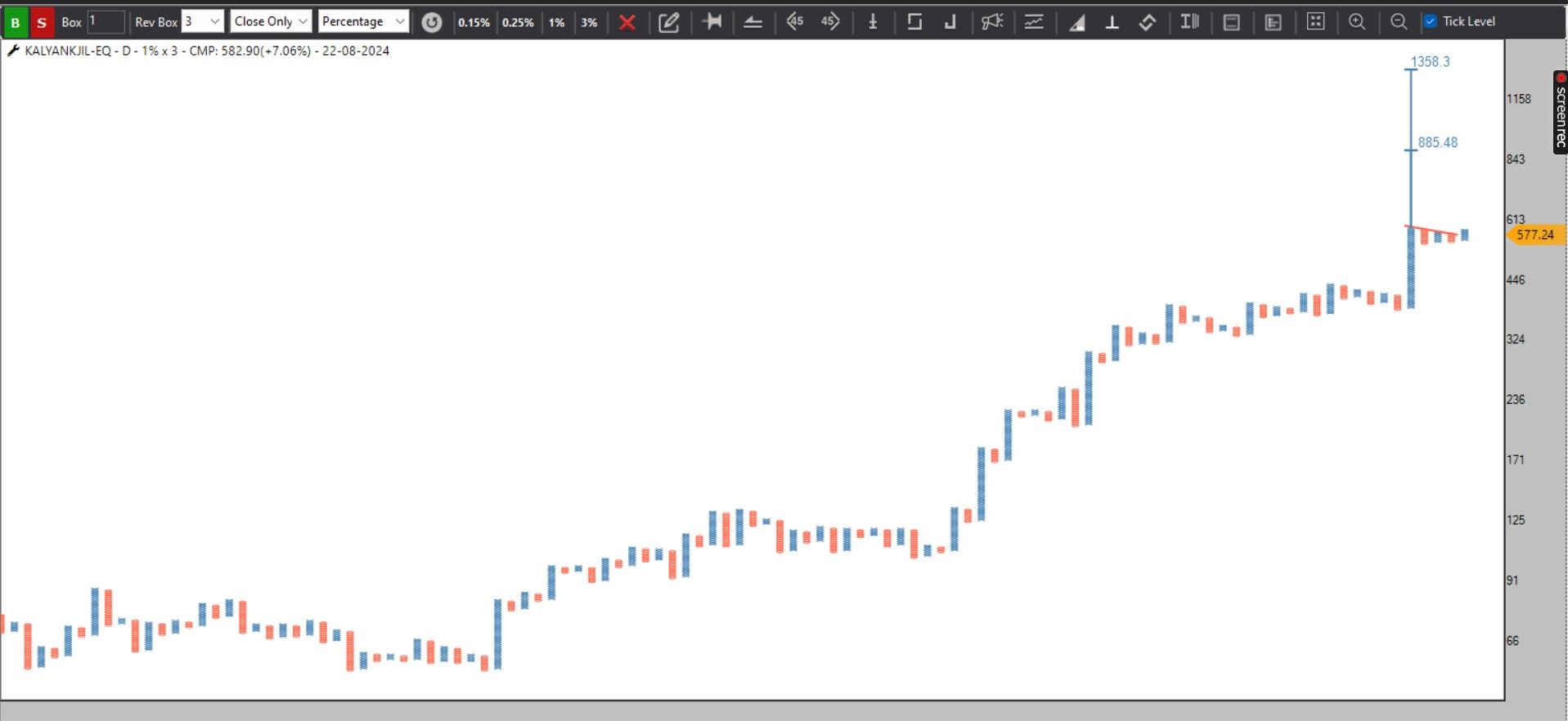

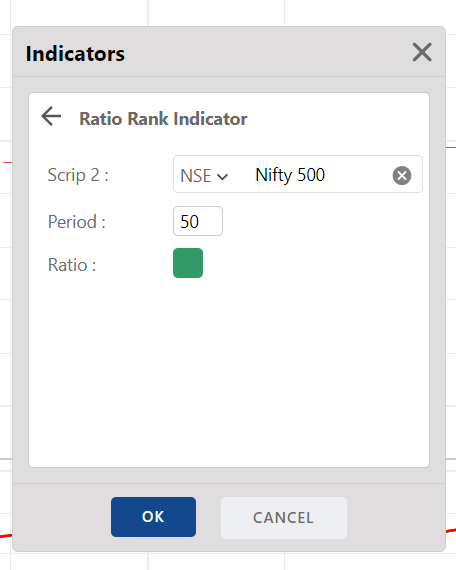

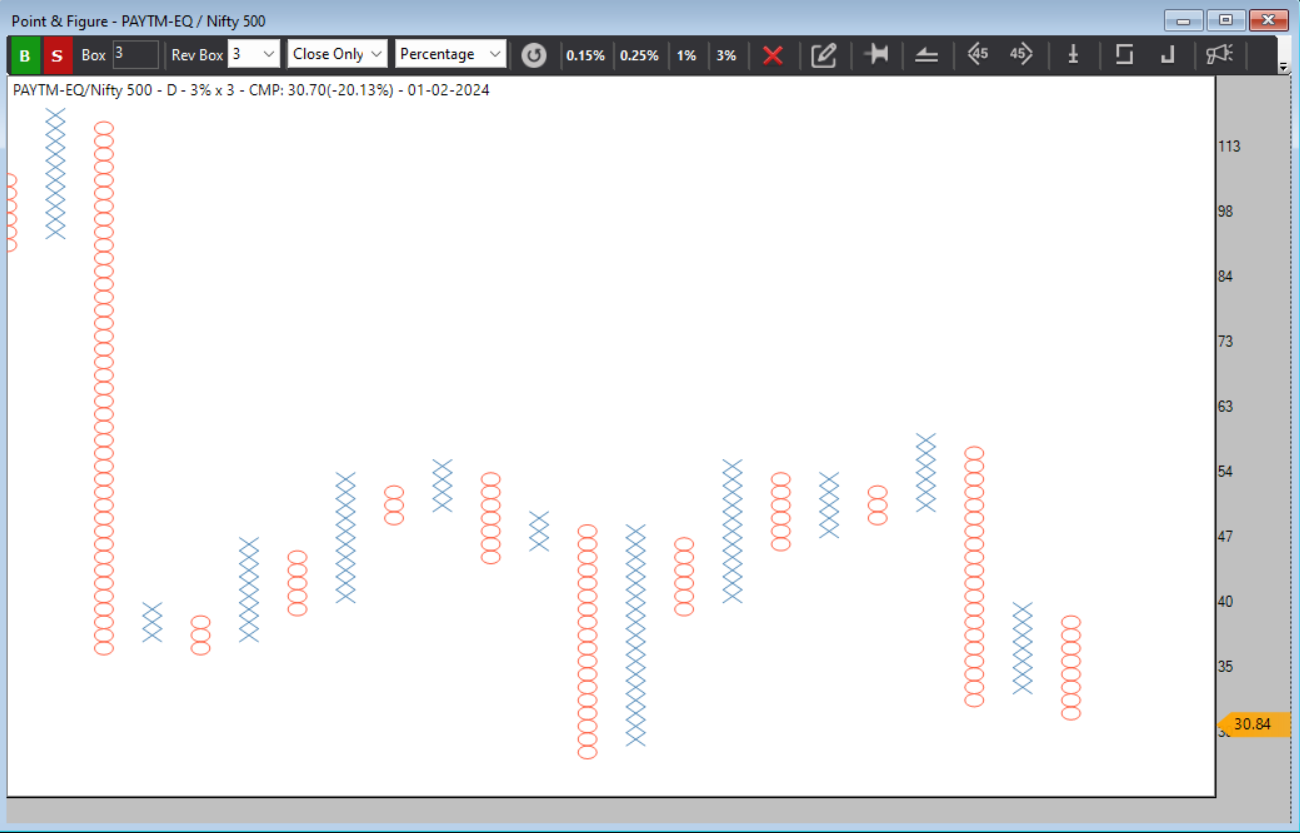

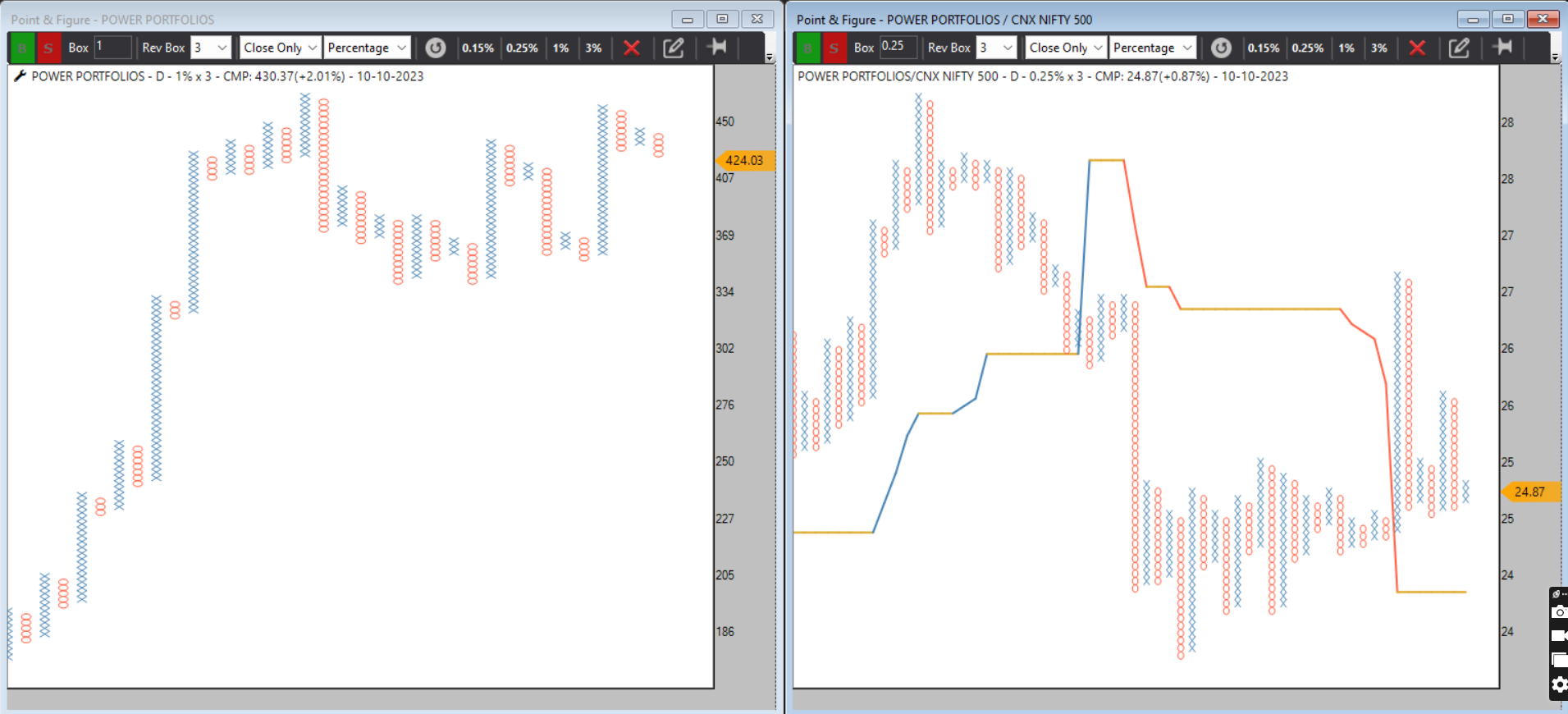

Theme: Auto Ancillaries | EV Play | Relative Strength Improving

Theme: Auto Ancillaries | EV Play | Relative Strength Improving

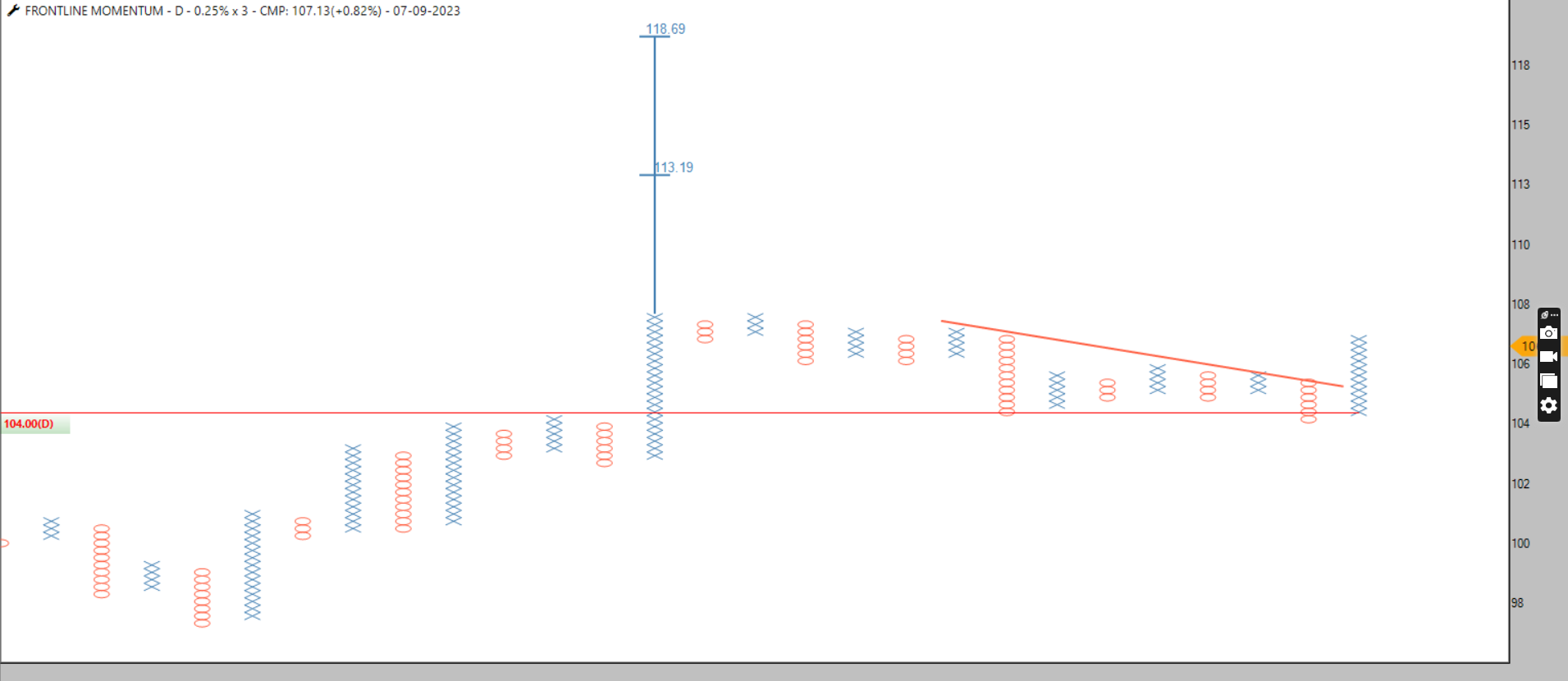

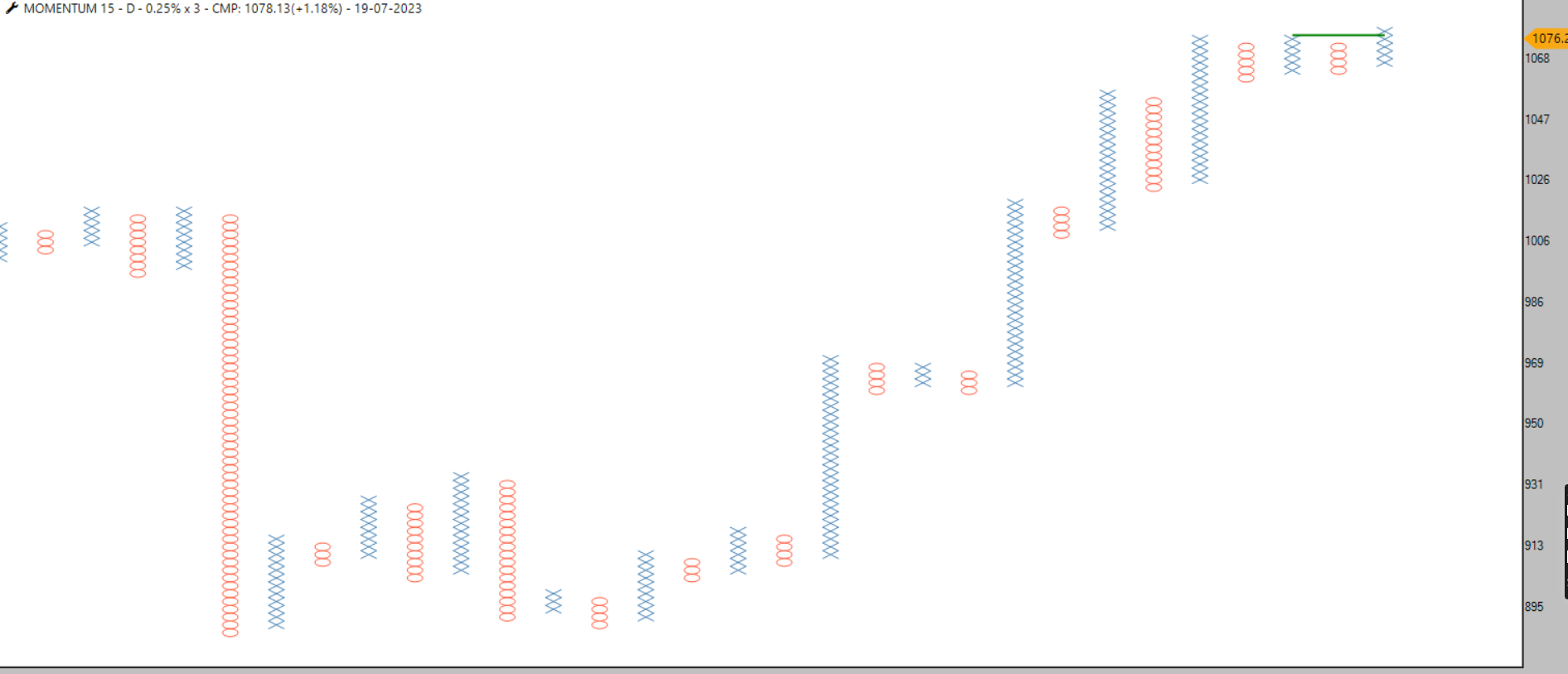

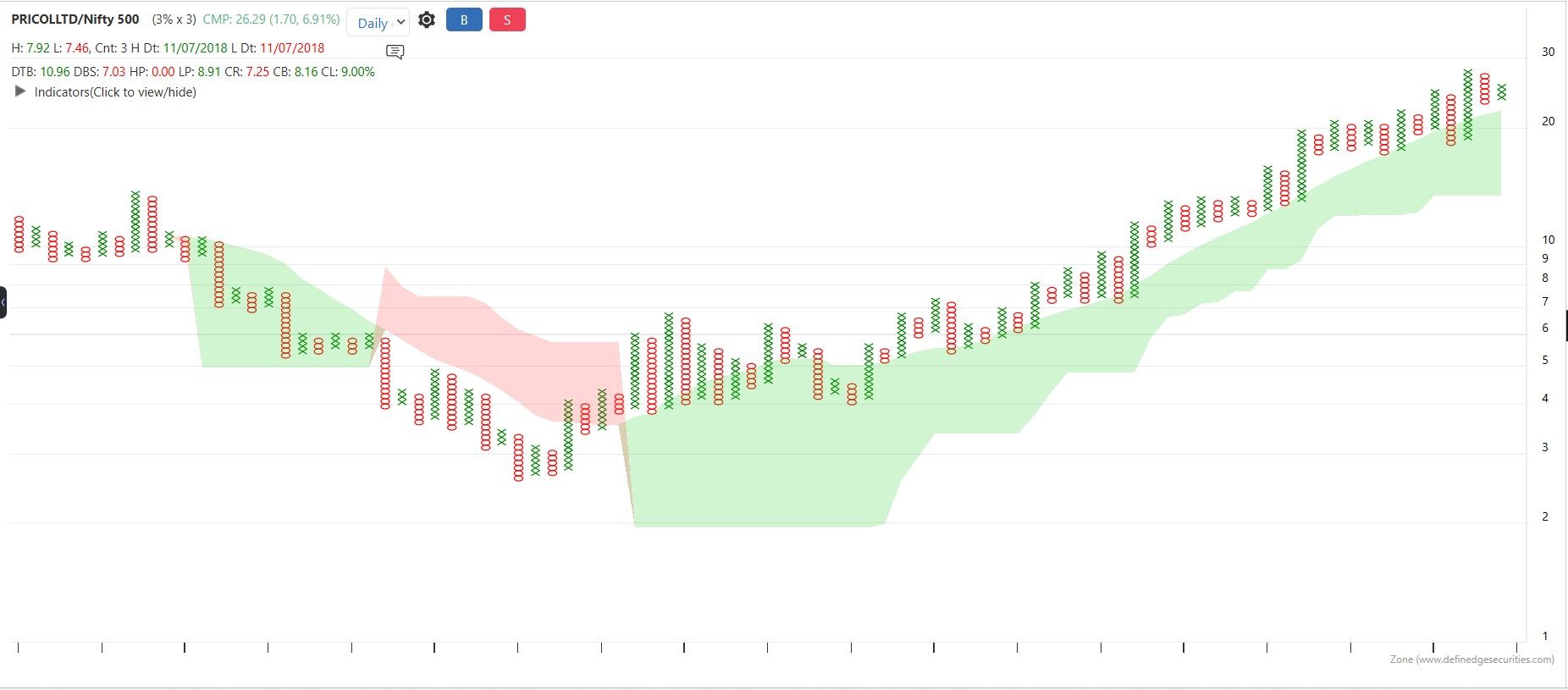

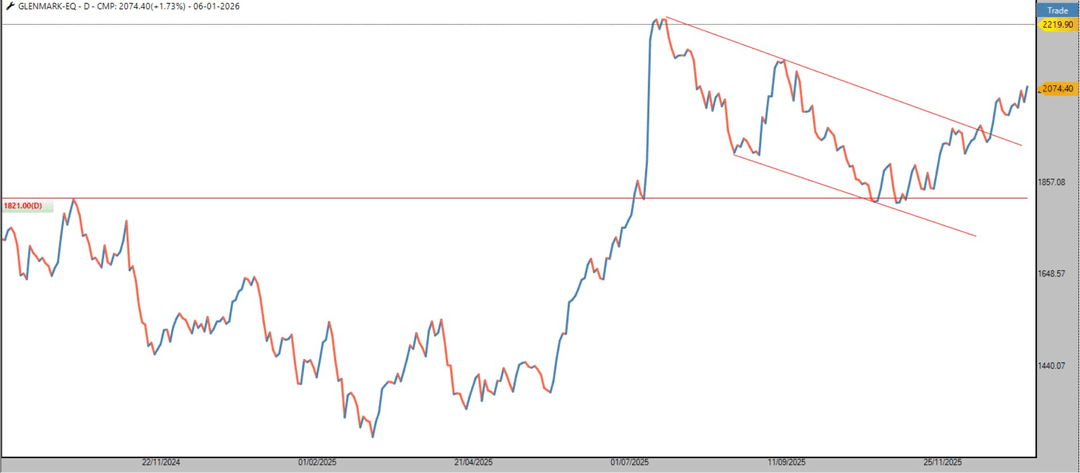

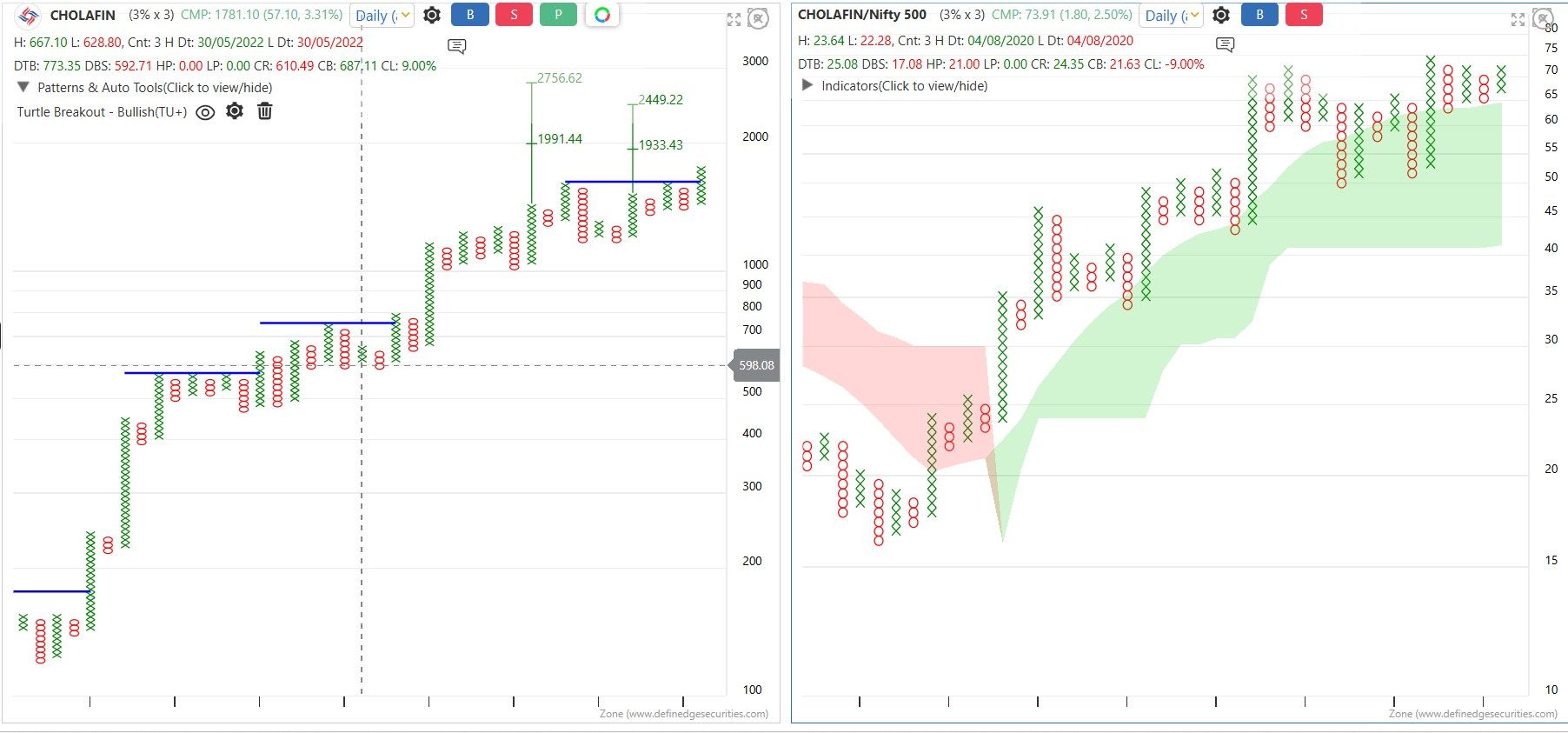

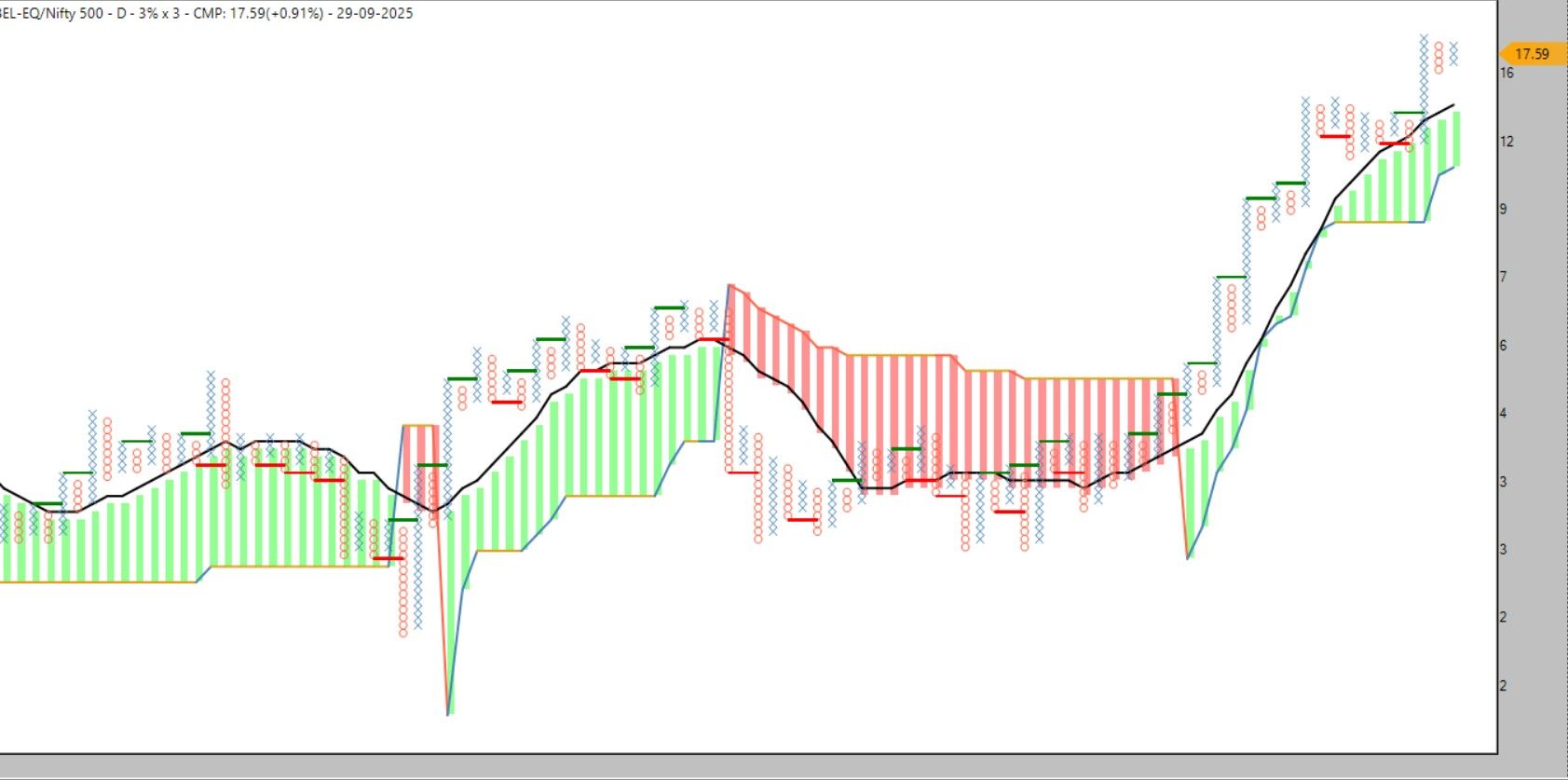

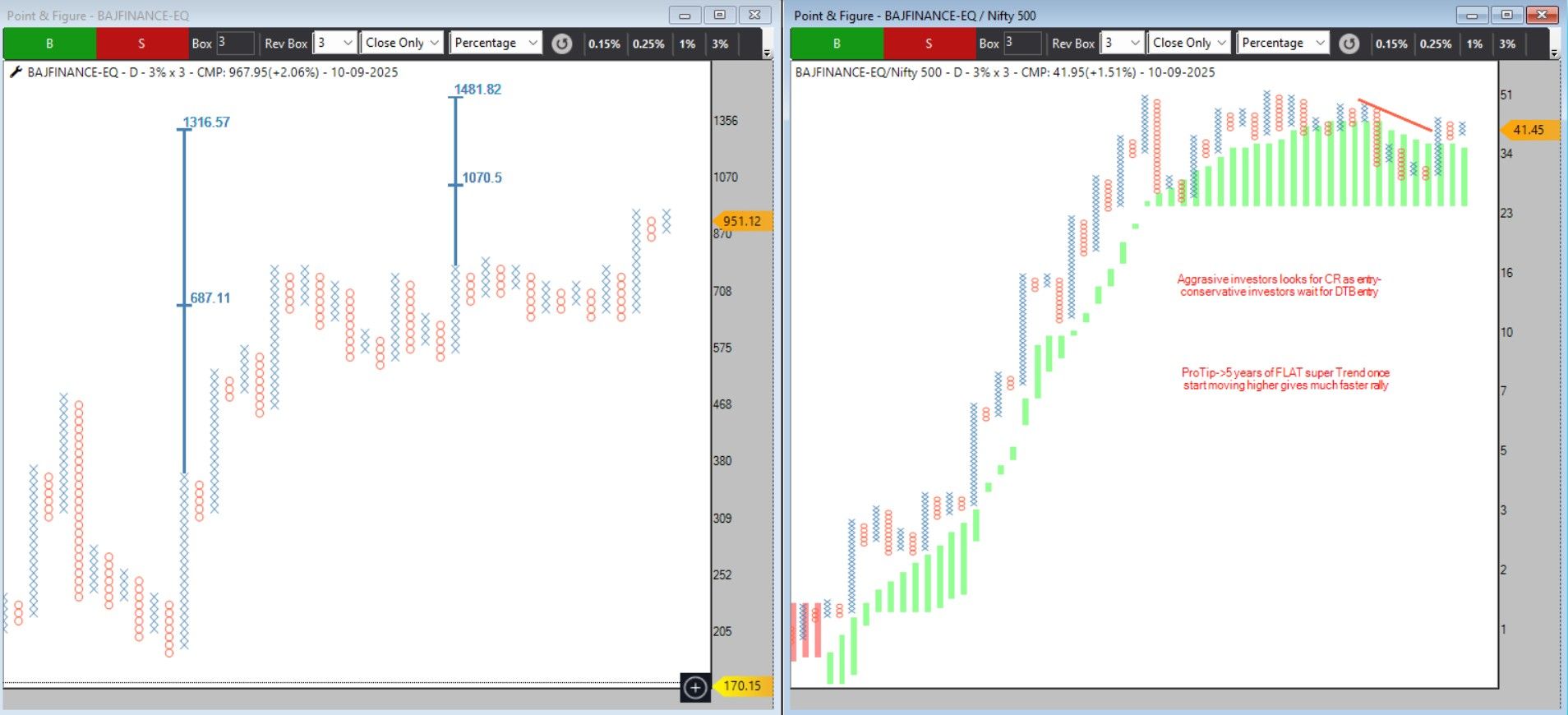

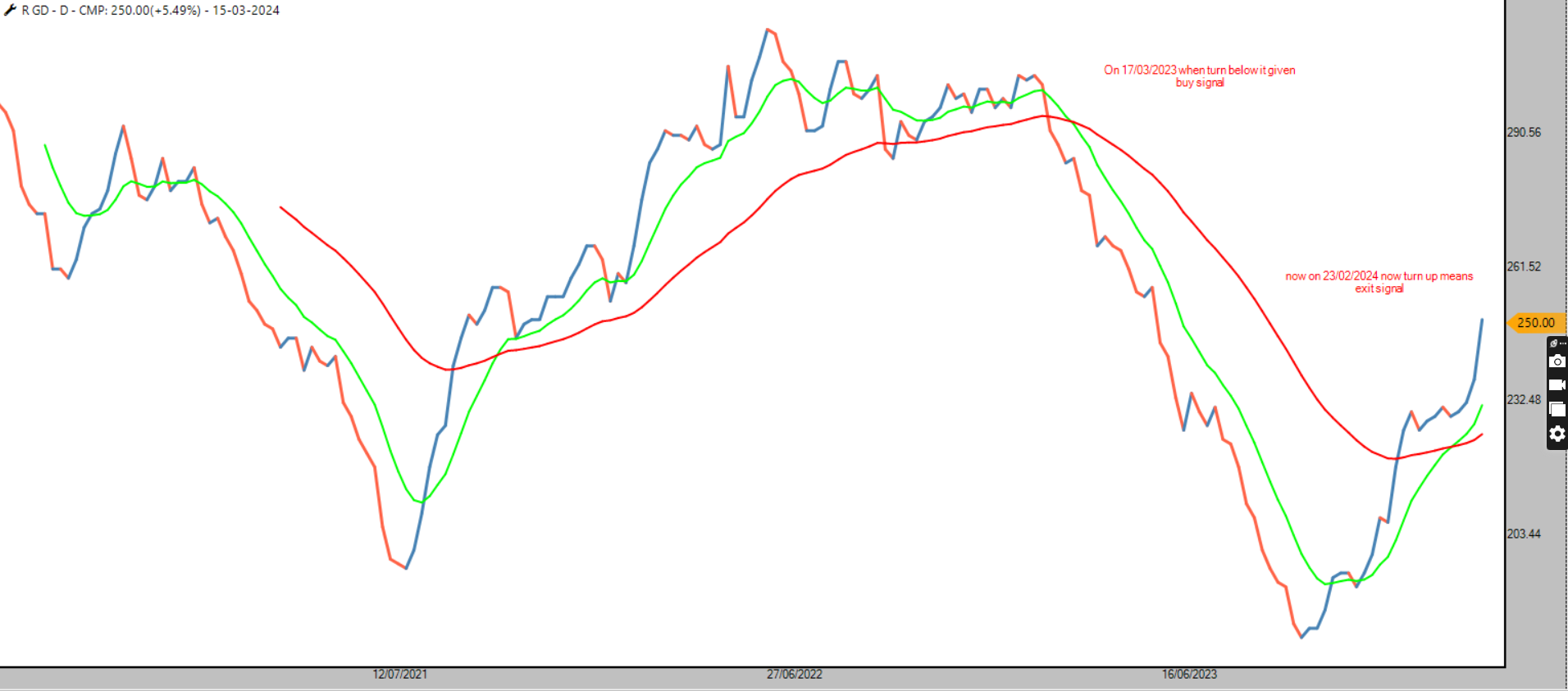

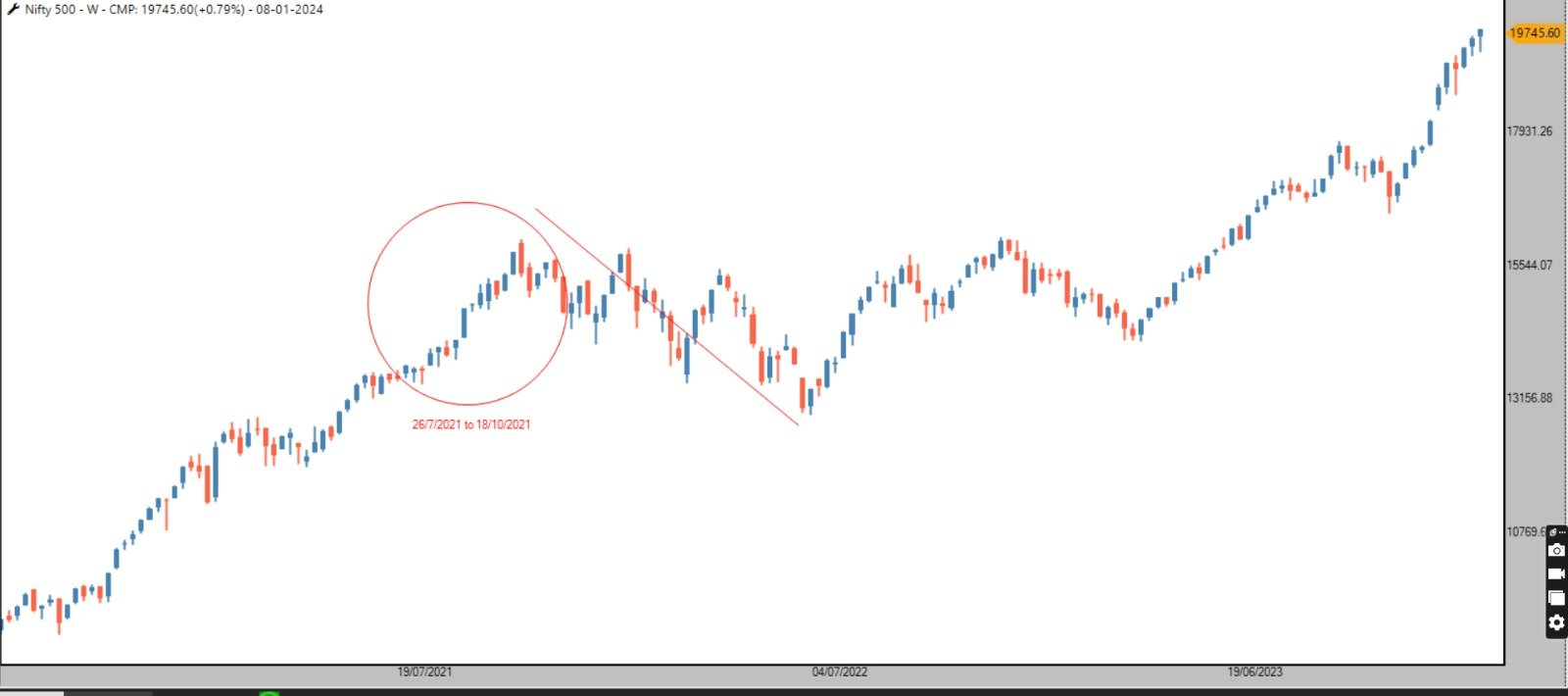

#VGM Update | CHOLAFIN – Momentum Re-ignites

#VGM Update | CHOLAFIN – Momentum Re-ignites

Key Observation

Key Observation

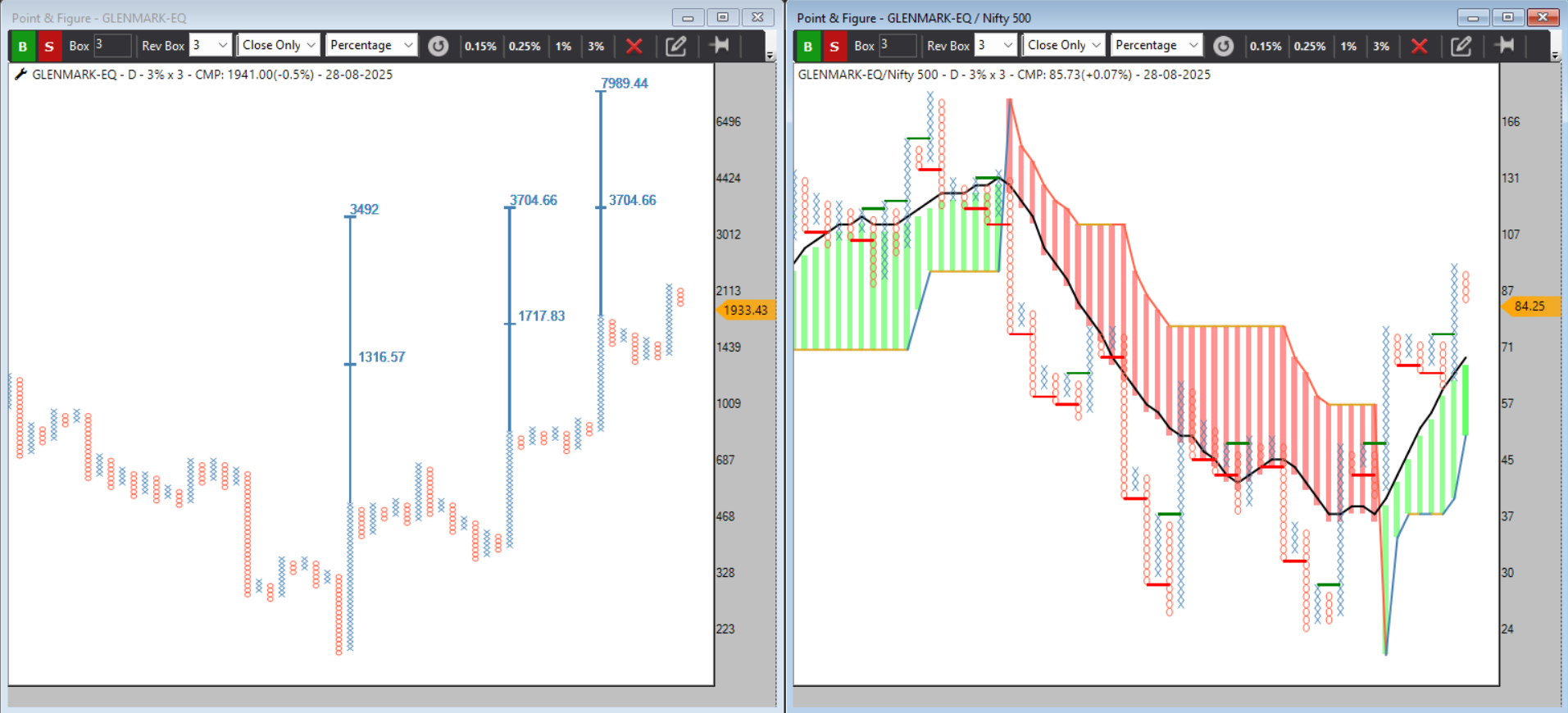

️ GMRAIRPORT – Ready for Takeoff?

️ GMRAIRPORT – Ready for Takeoff?

Bigger Picture:

Bigger Picture:

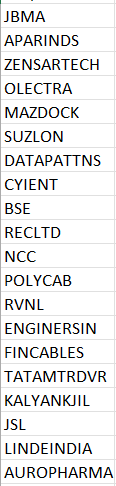

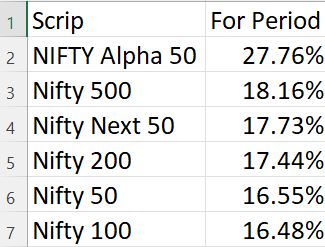

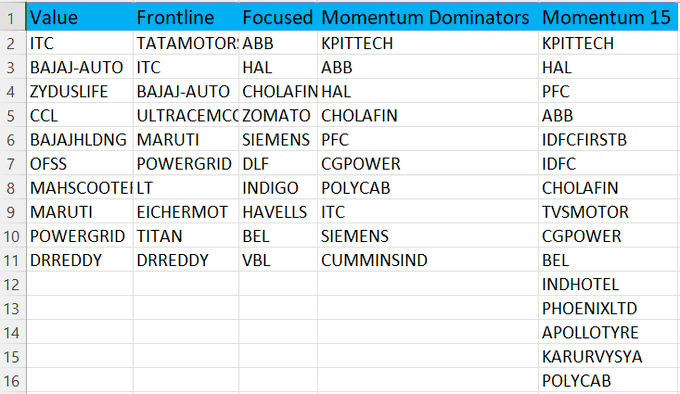

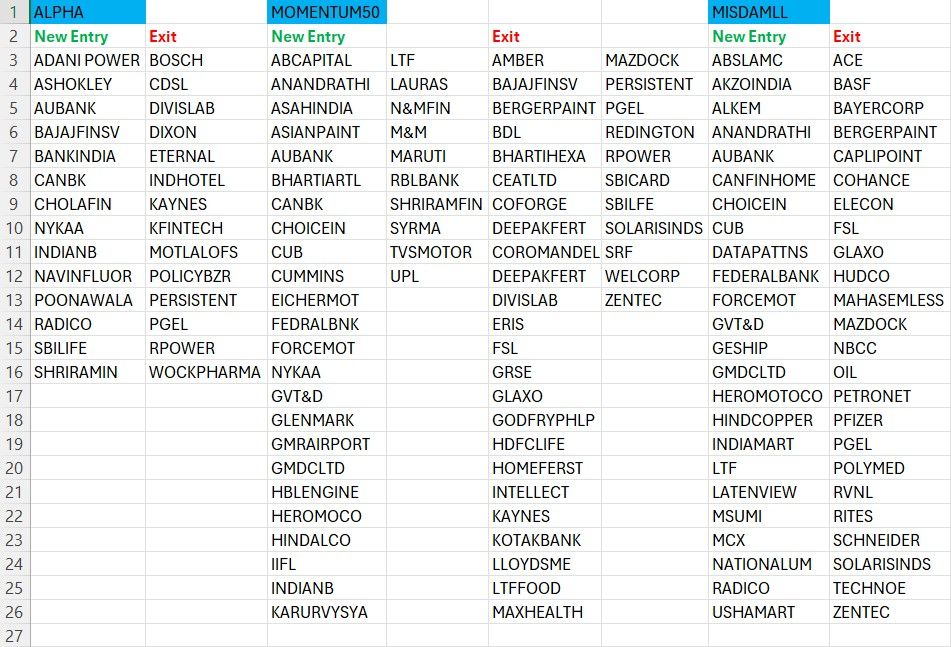

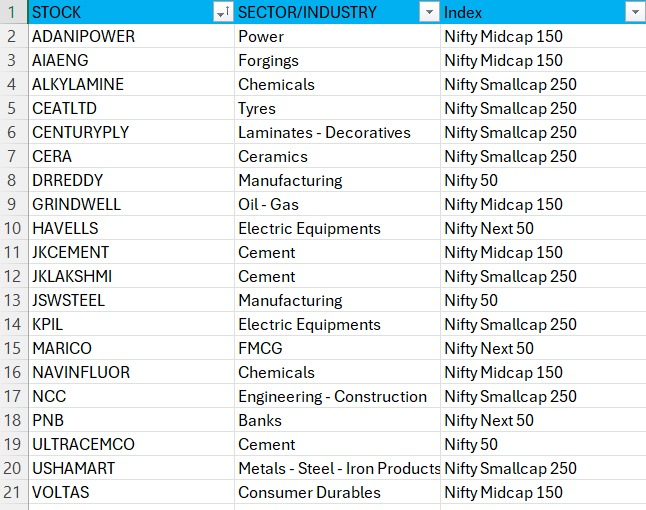

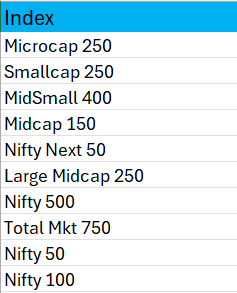

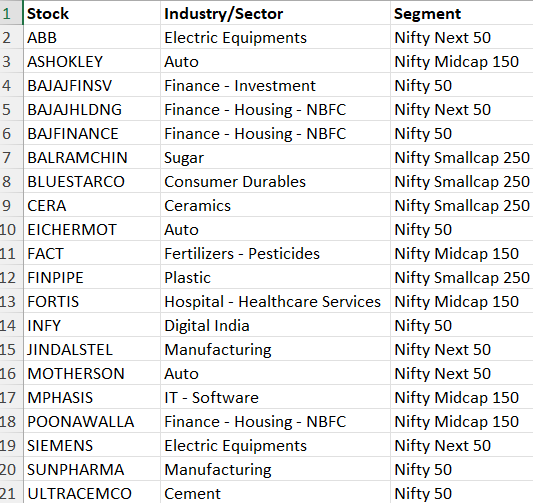

NSE has announced major index rebalancing:

NSE has announced major index rebalancing:

YOUR TURN

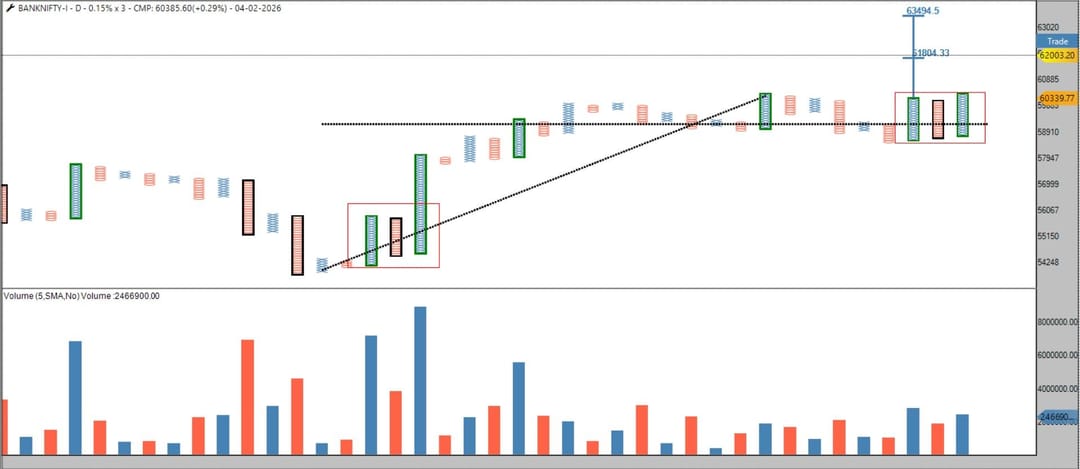

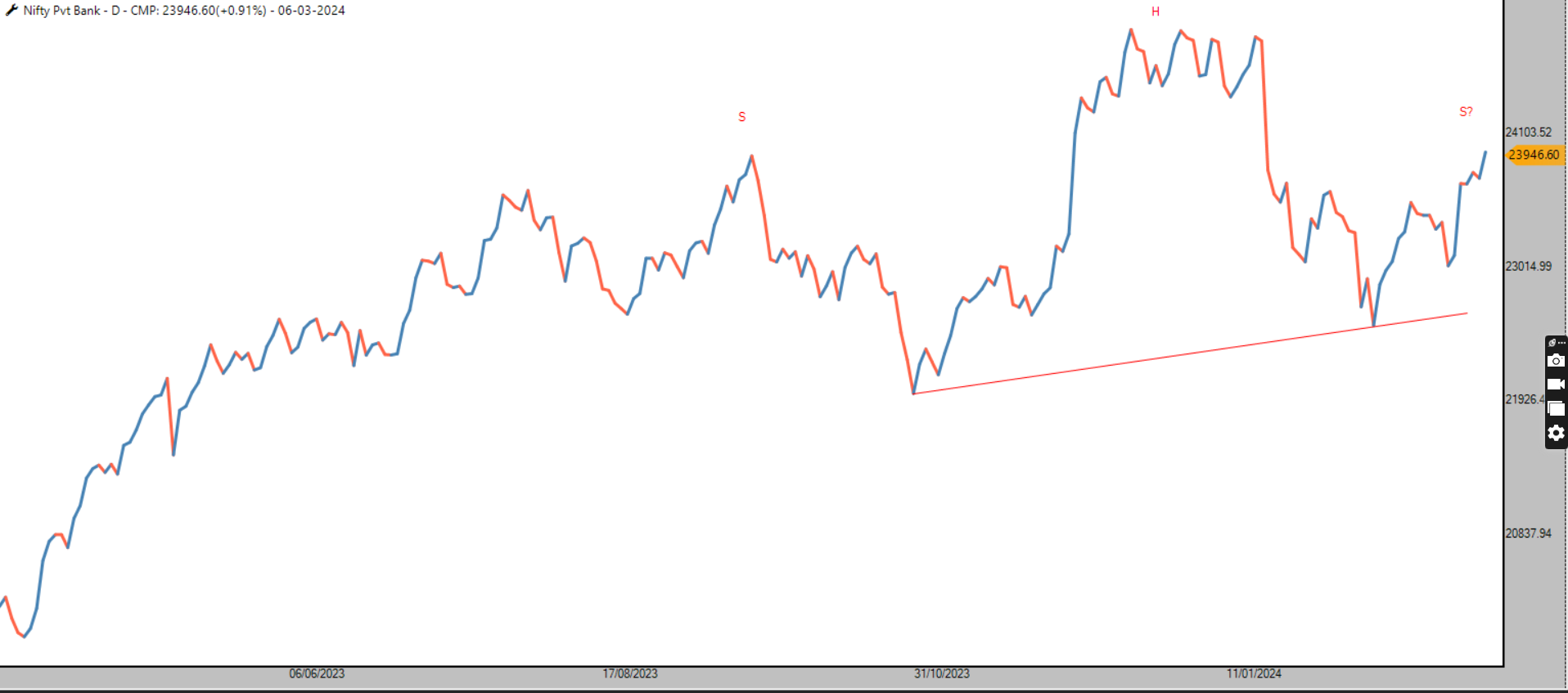

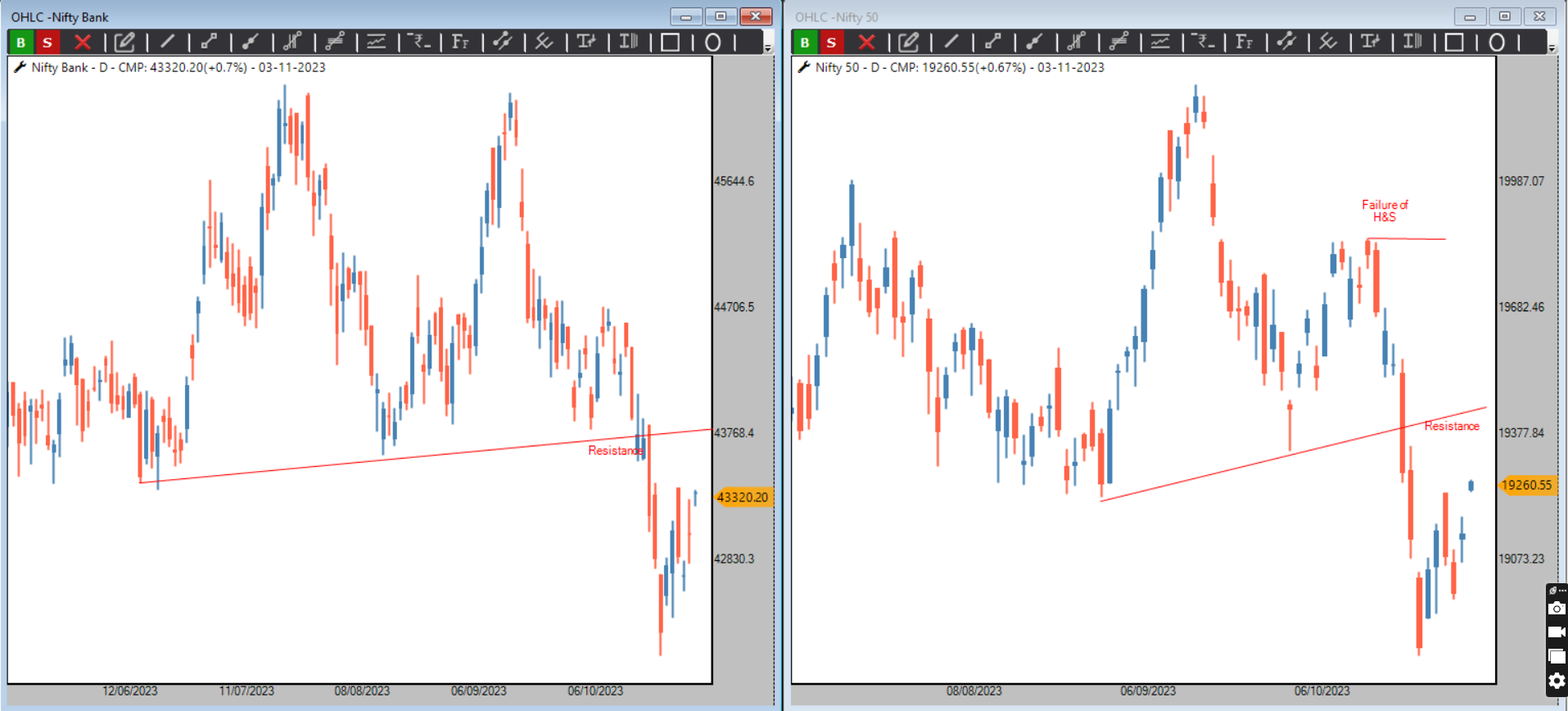

YOUR TURN Bank Nifty Bear Trap → Bullish Breakout in the Offing!

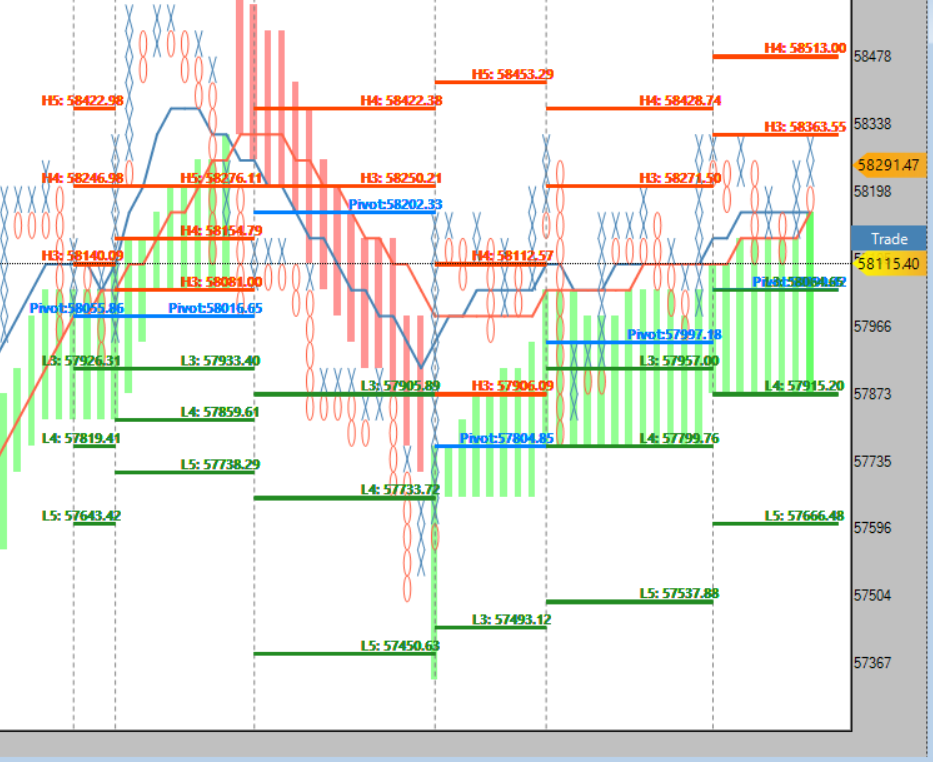

Bank Nifty Bear Trap → Bullish Breakout in the Offing!

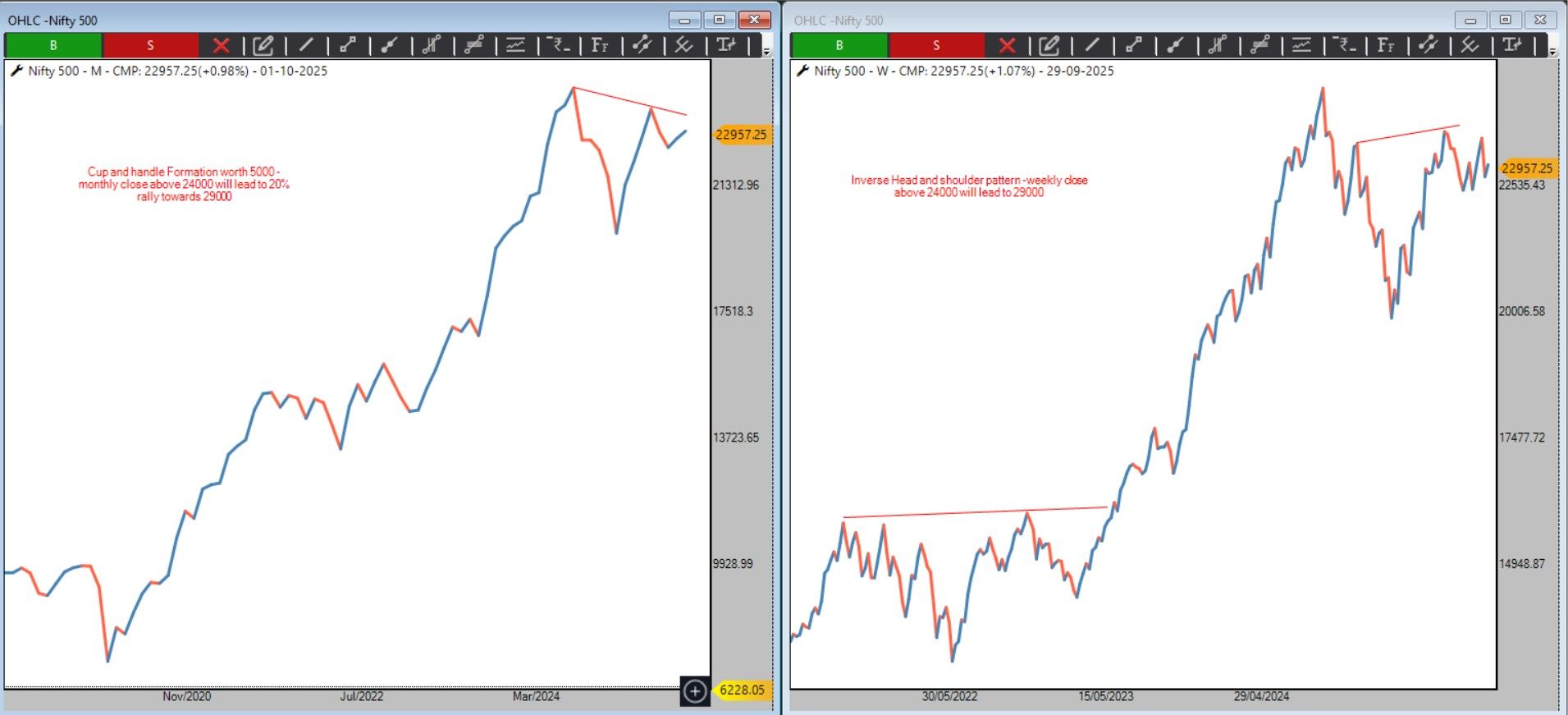

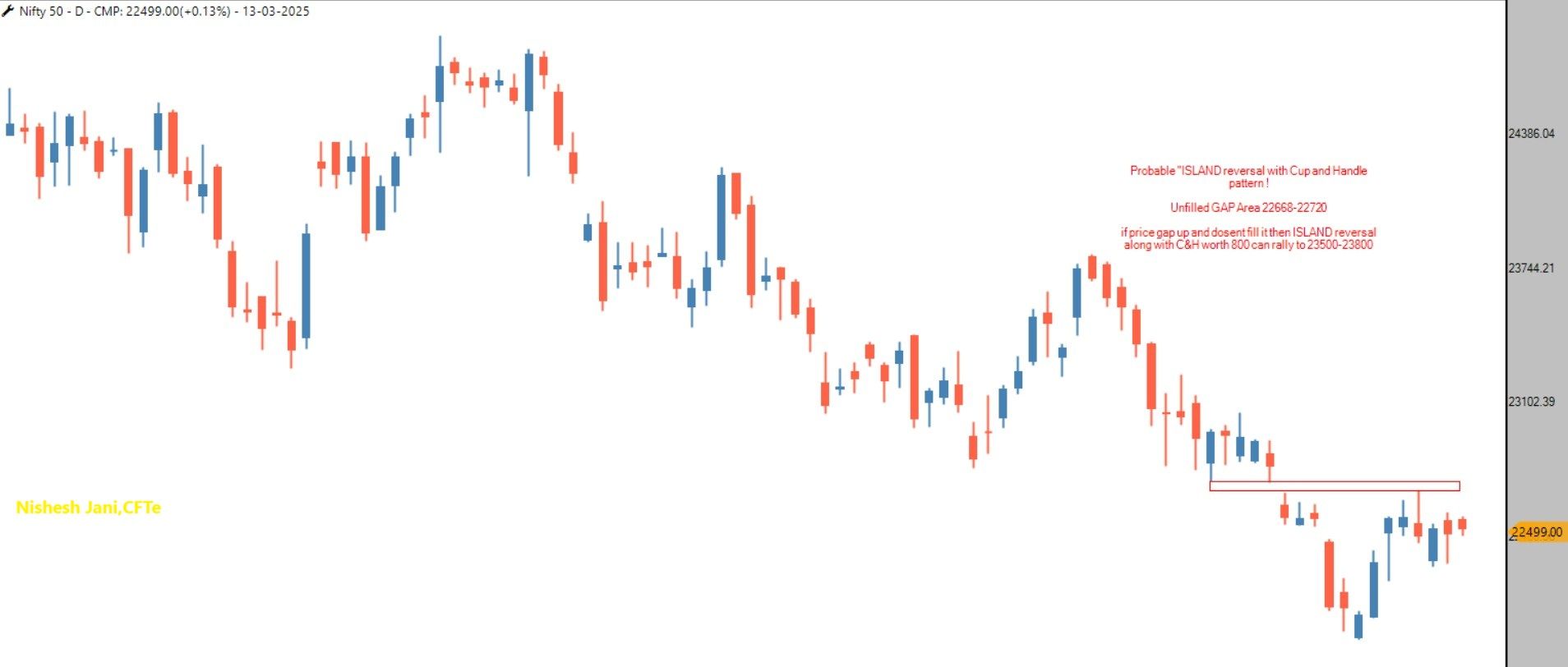

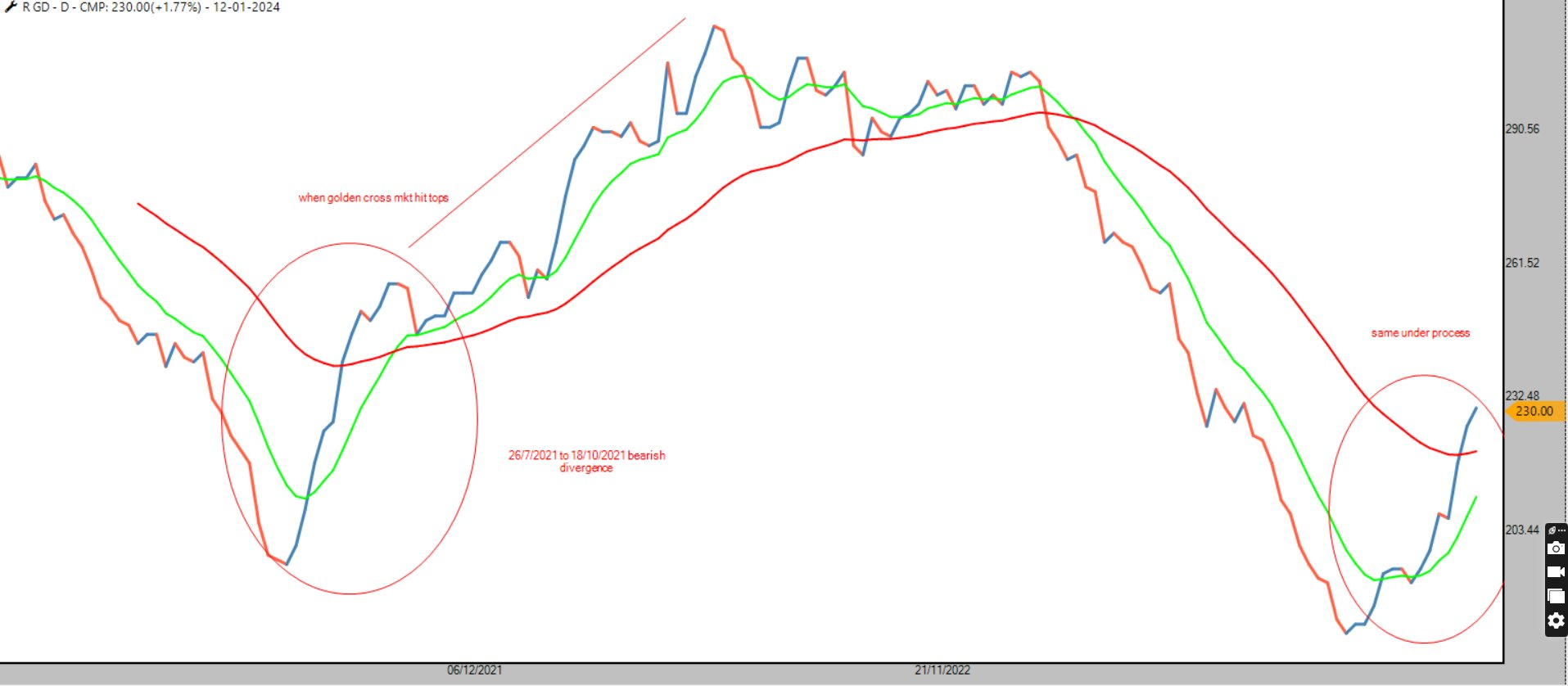

Nifty Probable Bullish ABC Breakout Setup: Short-Term Trend Turning Constructive

Nifty Probable Bullish ABC Breakout Setup: Short-Term Trend Turning Constructive

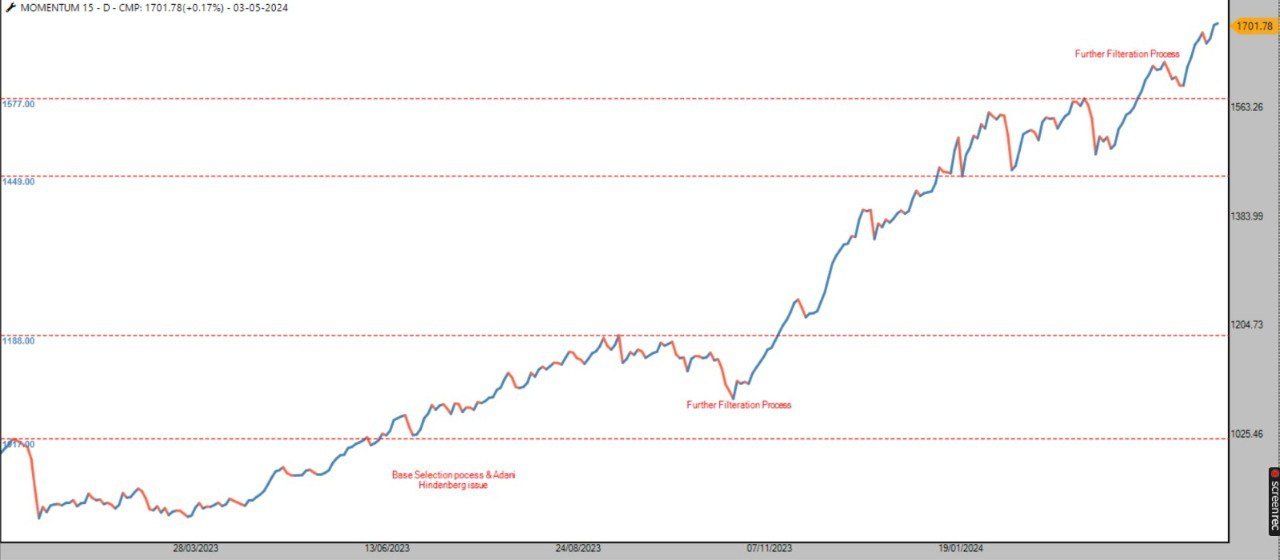

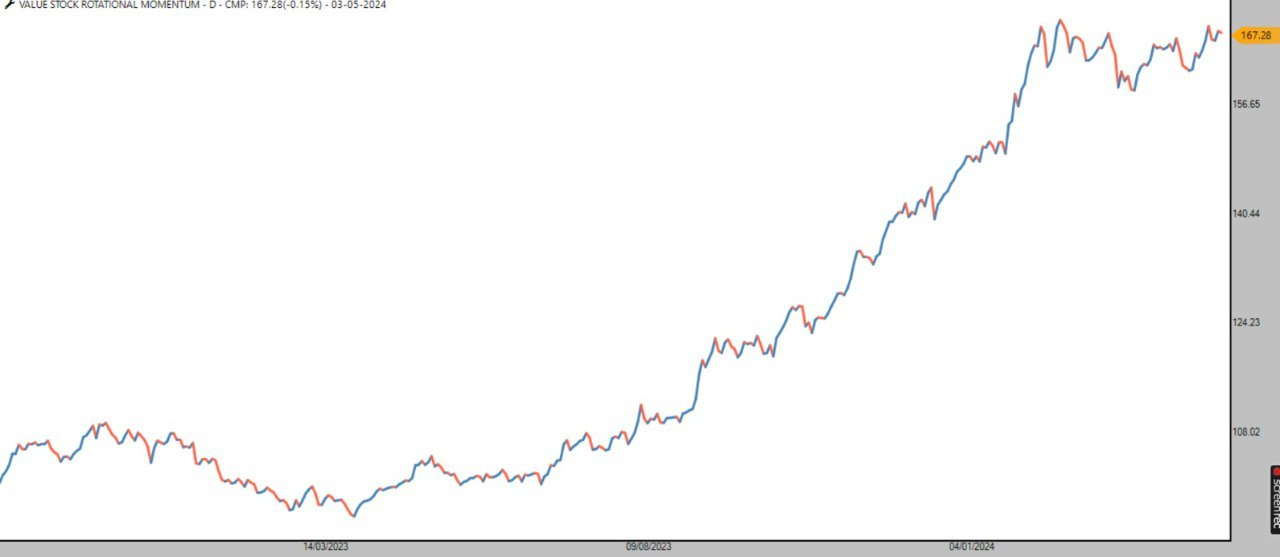

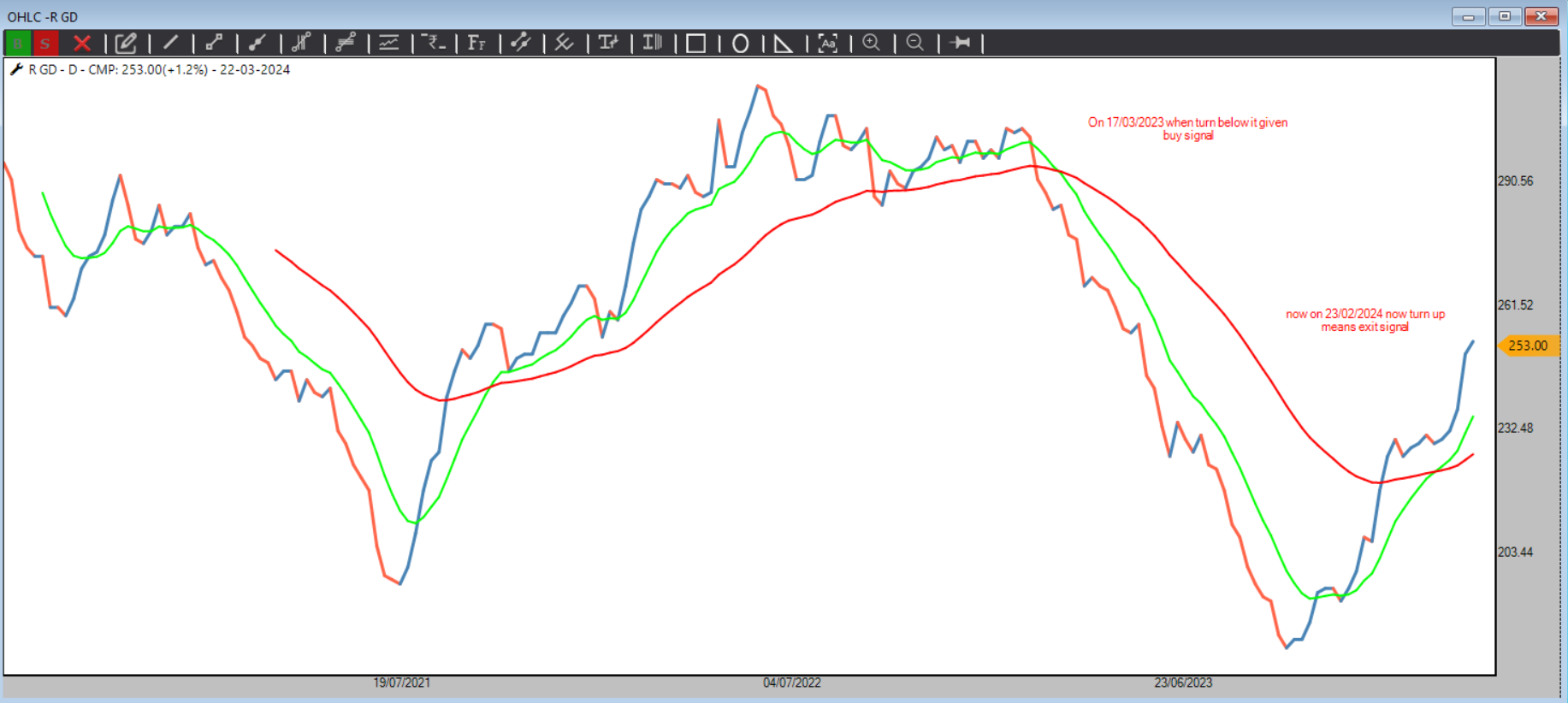

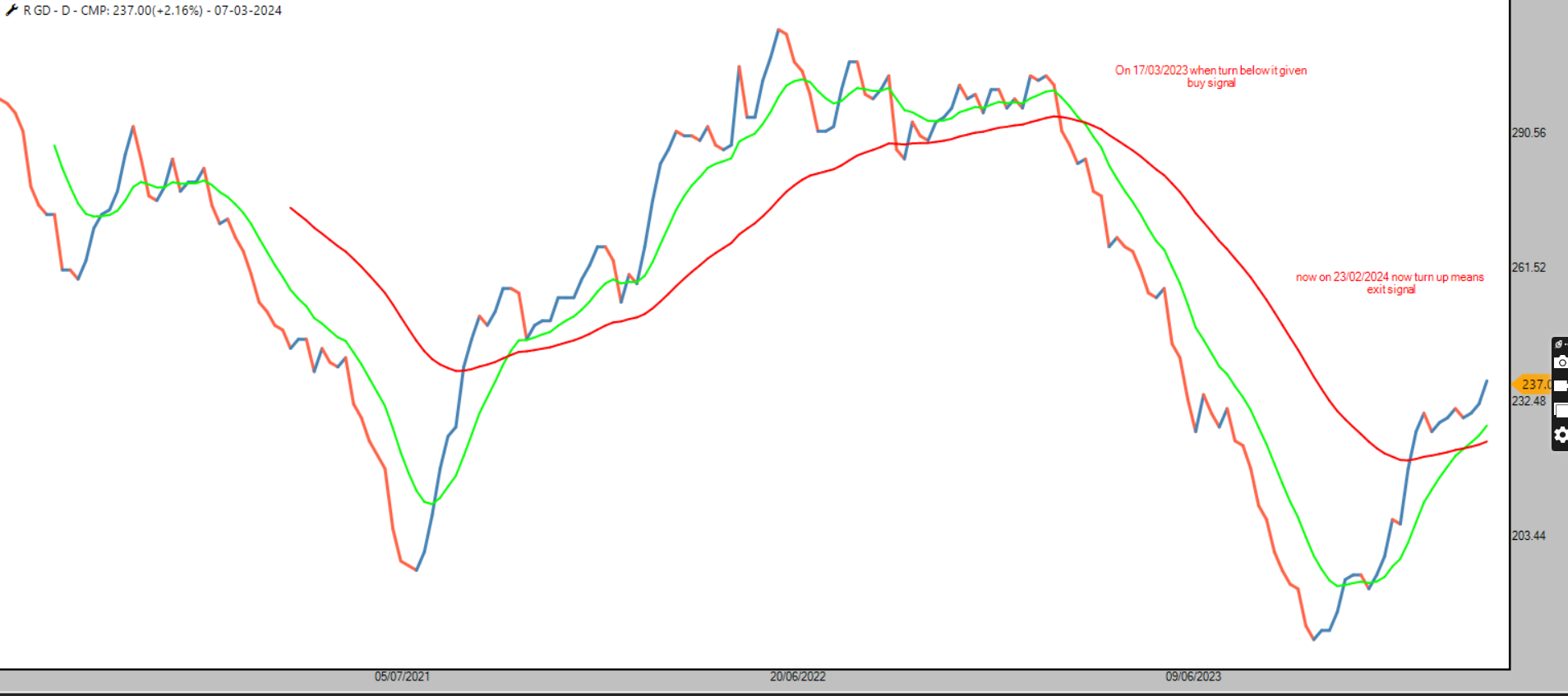

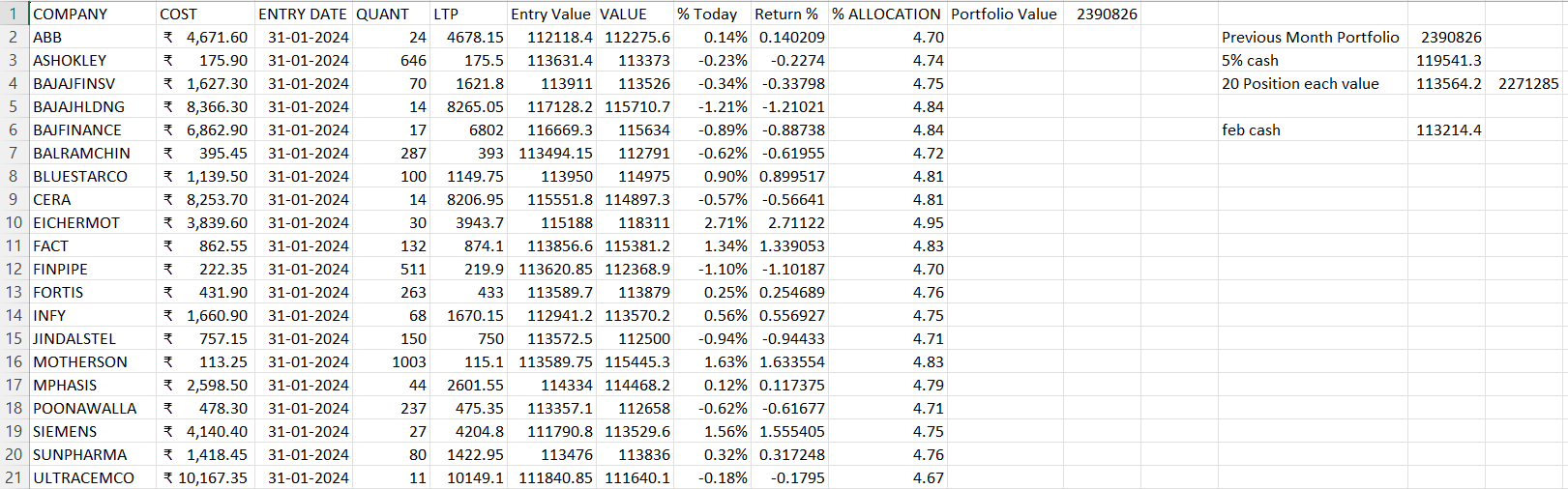

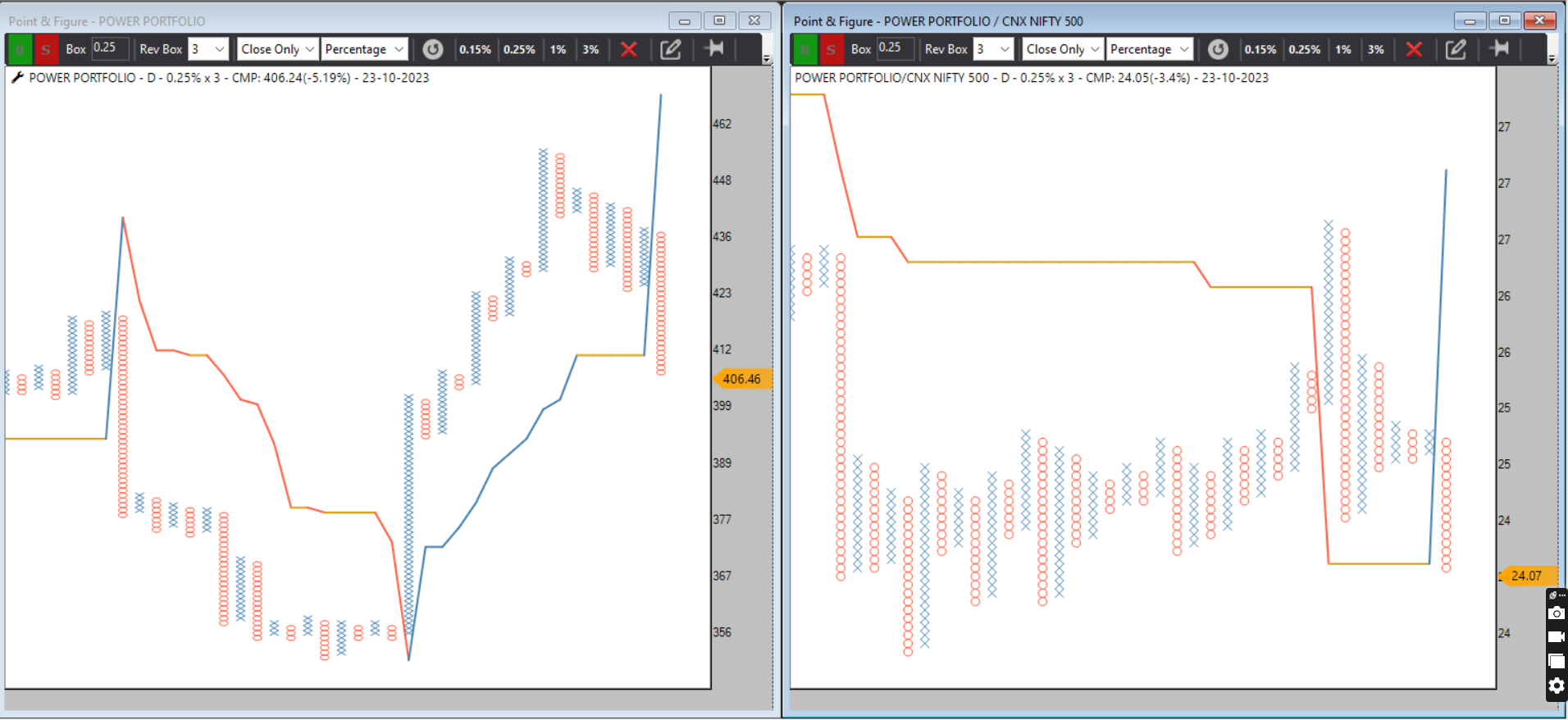

Exiting when the trend structure reverses

Exiting when the trend structure reverses

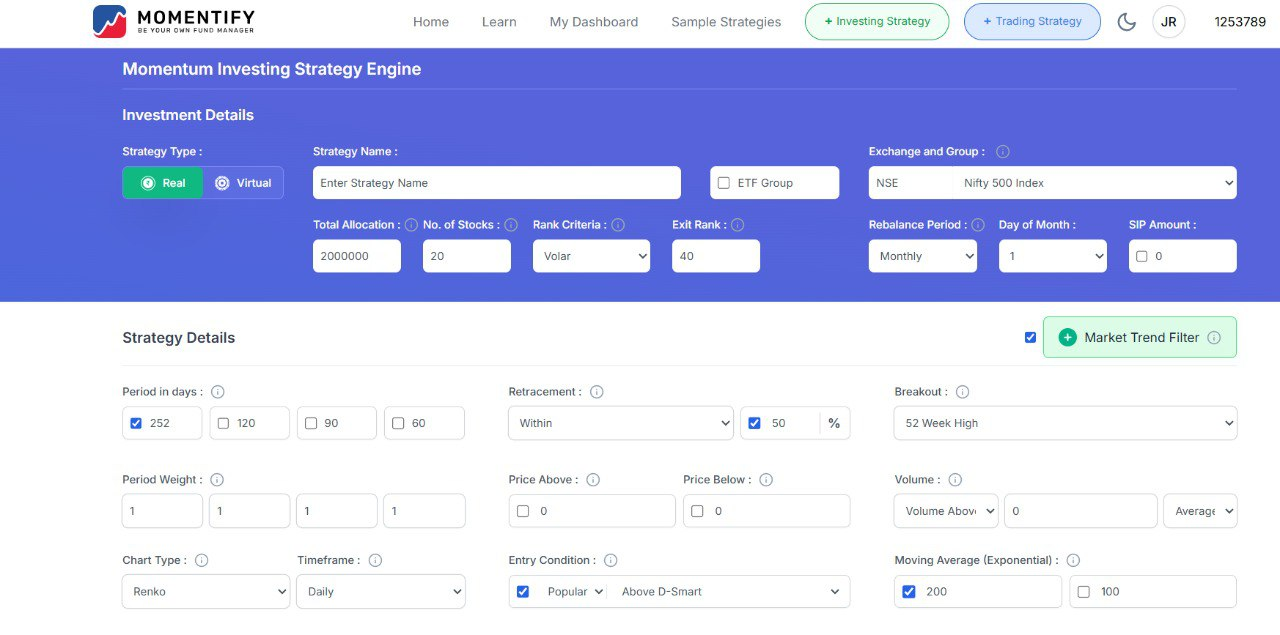

Suitable for systematic investors & disciplined traders.

Suitable for systematic investors & disciplined traders.

Price-wise:

Price-wise:

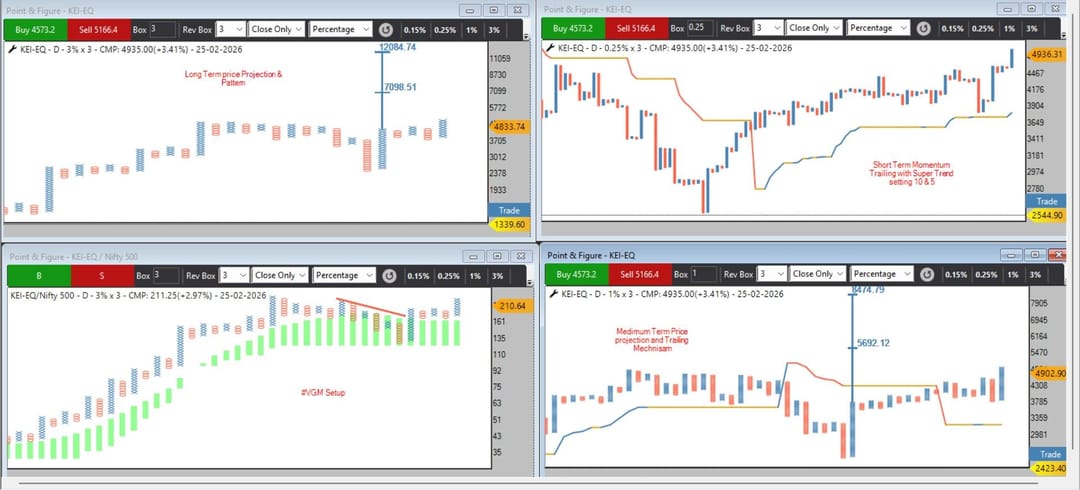

Cup & Handle

Cup & Handle Inverse Head & Shoulder

Inverse Head & Shoulder ️ Head & Shoulder

️ Head & Shoulder Stay sharp. Stay ready. This chart could become the talk of the town in the stock market community.

Stay sharp. Stay ready. This chart could become the talk of the town in the stock market community.

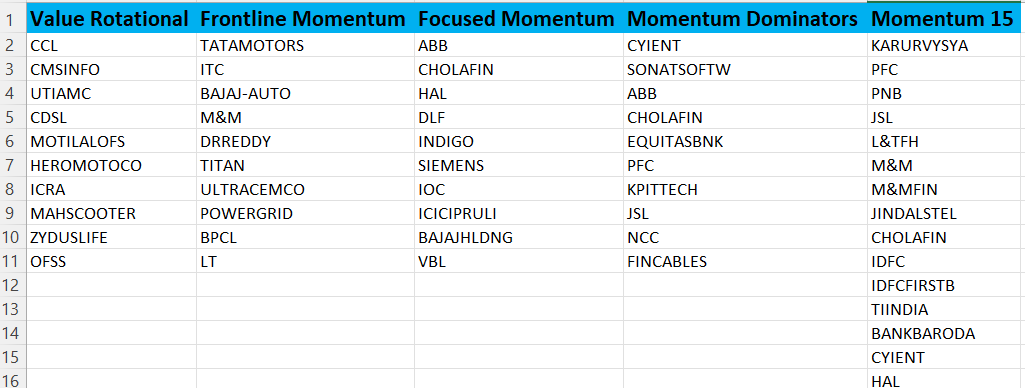

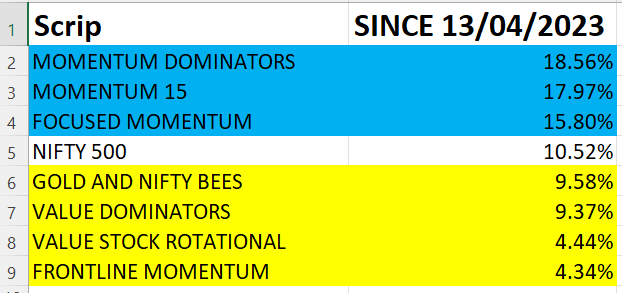

#MomentumInvesting #ETFStrategy #SmartBeta #FactorInvesting #AlphaGeneration #MarketCorrection #BuyTheDip #StayInvested #LongTermWealth #PatiencePays #nisheshjani #AhmedabadNest

#MomentumInvesting #ETFStrategy #SmartBeta #FactorInvesting #AlphaGeneration #MarketCorrection #BuyTheDip #StayInvested #LongTermWealth #PatiencePays #nisheshjani #AhmedabadNest

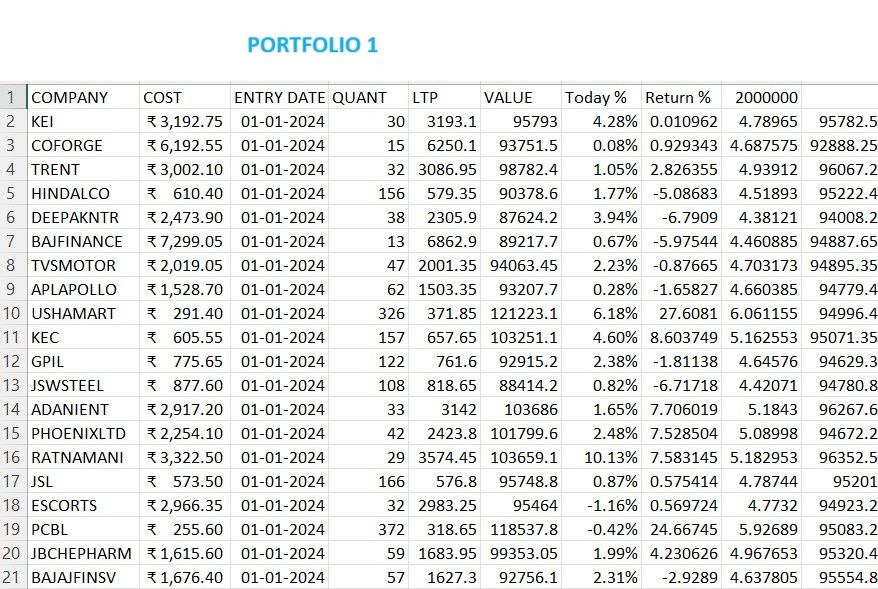

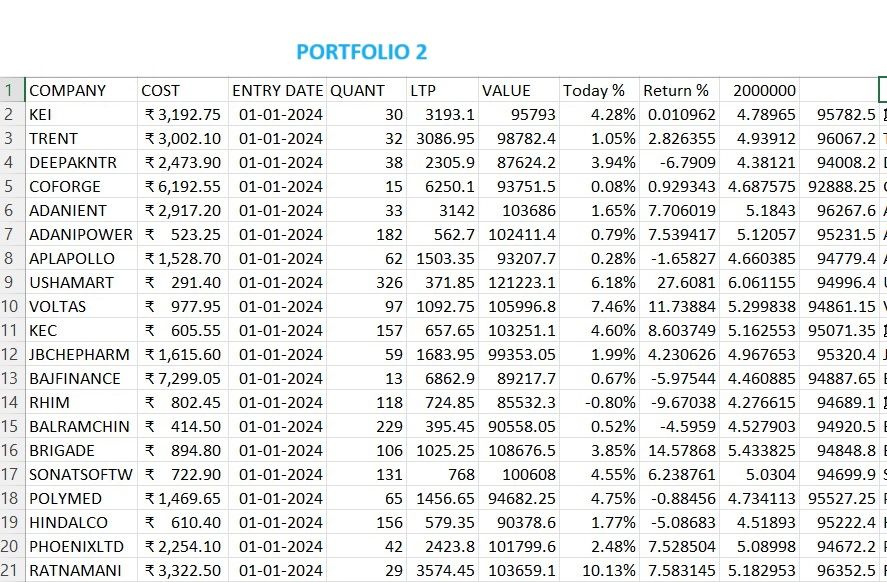

Deploy 50% now

Deploy 50% now

Shubh Navratri to all my Stock Market Warriors!

Shubh Navratri to all my Stock Market Warriors!  May Maa Durga bless you with the strength to hold your conviction, the wisdom to manage risks, and the courage to overcome market volatility.

May Maa Durga bless you with the strength to hold your conviction, the wisdom to manage risks, and the courage to overcome market volatility.

Wishing you Profitable Trades & Peaceful Investments!

Wishing you Profitable Trades & Peaceful Investments!

Fear is peaking... Opportunity is knocking!

Fear is peaking... Opportunity is knocking! Past data shows strong rebounds from such fear levels — making this a contrarian's sweet spot.

Past data shows strong rebounds from such fear levels — making this a contrarian's sweet spot. Poll for You:

Poll for You: Comment your strategy below!

Comment your strategy below!

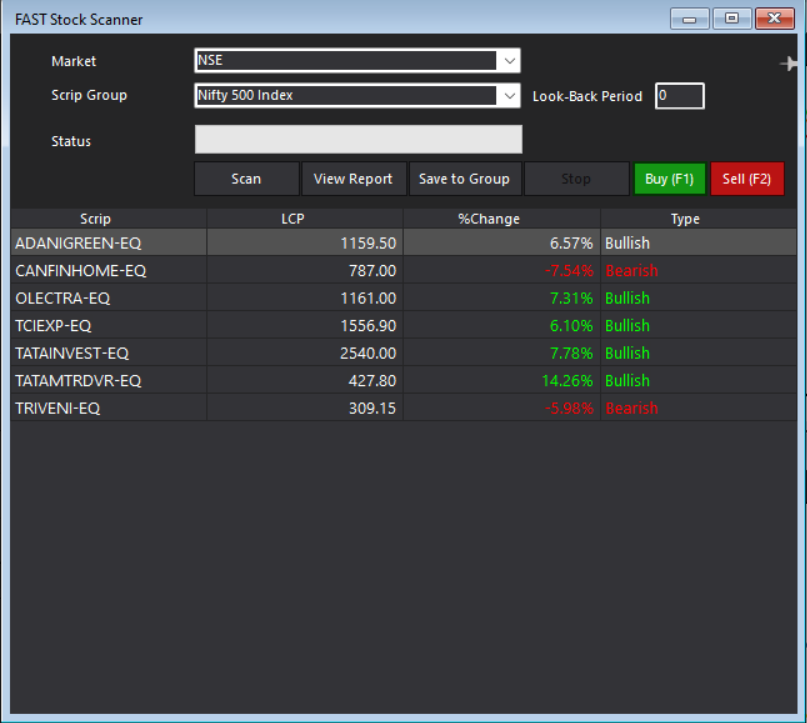

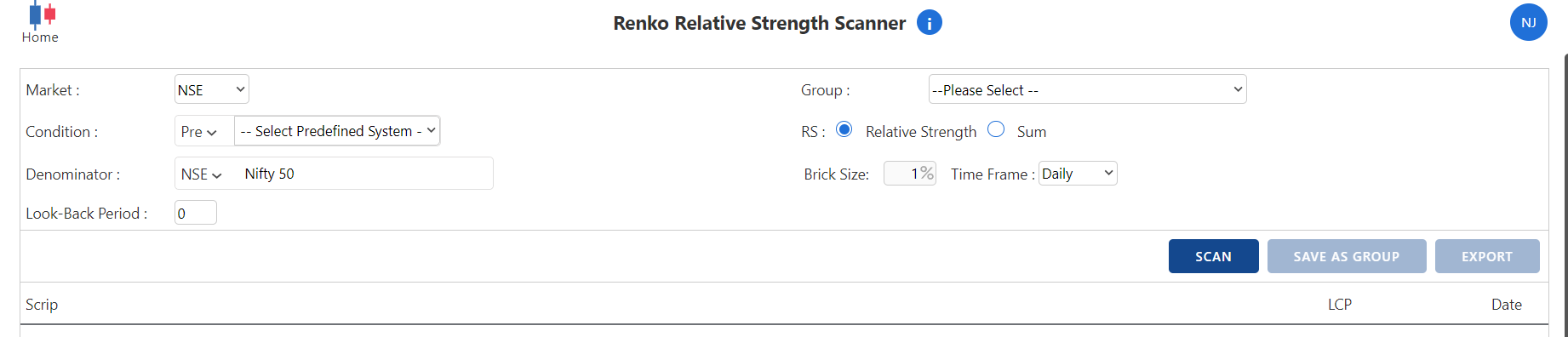

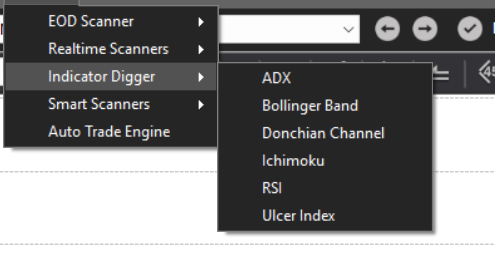

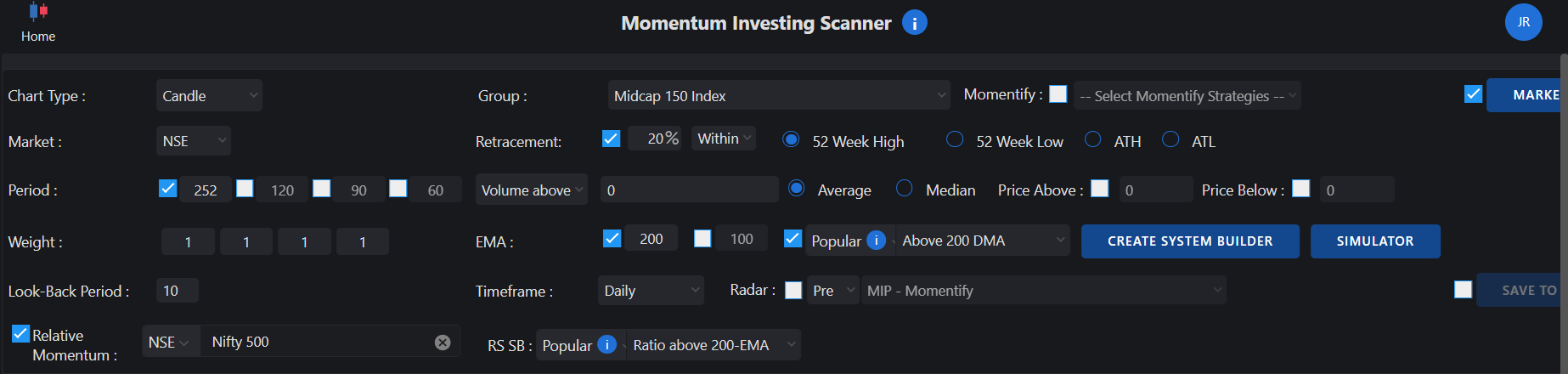

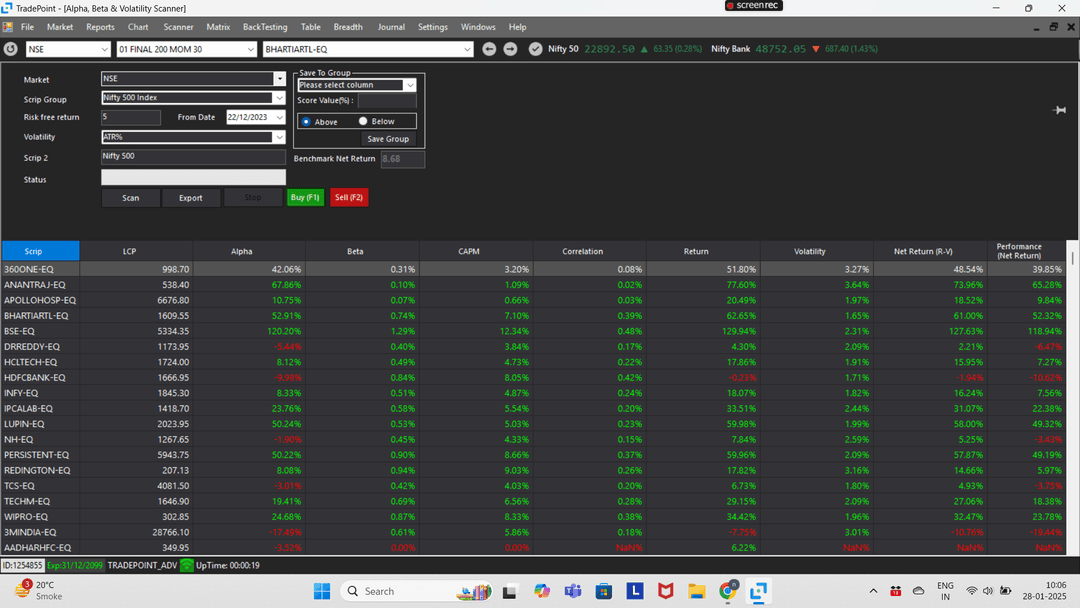

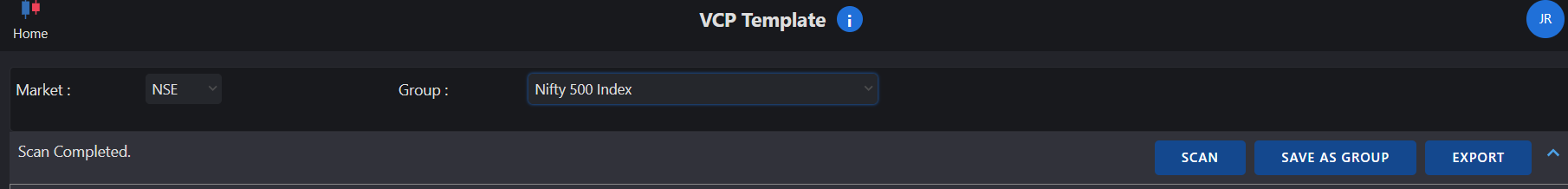

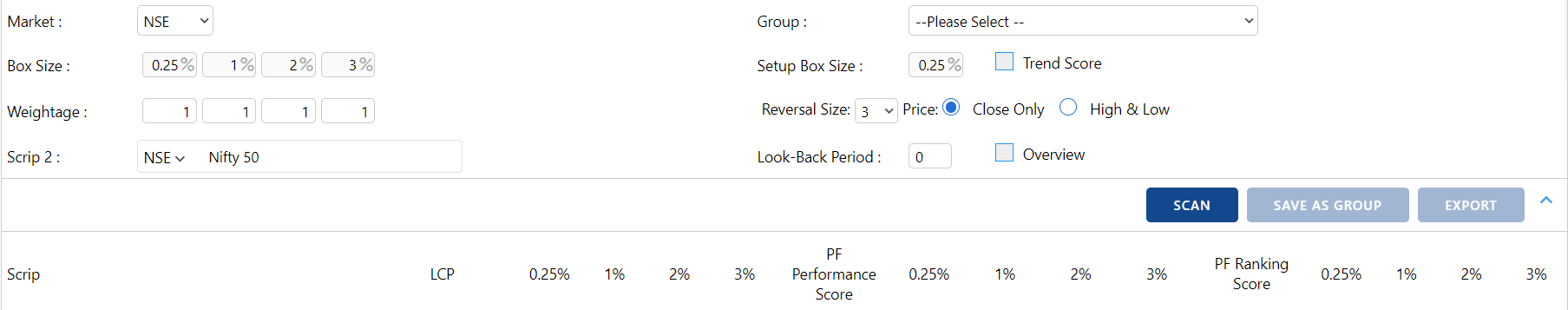

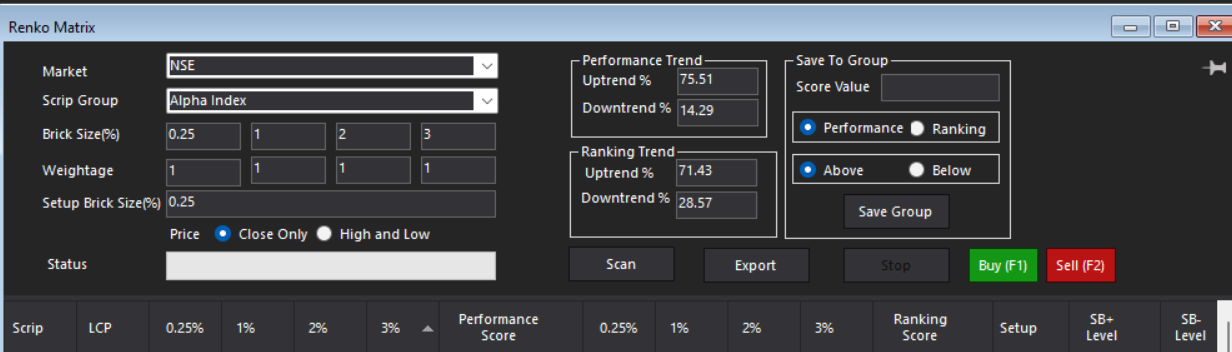

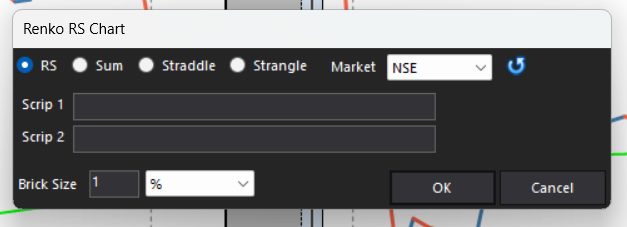

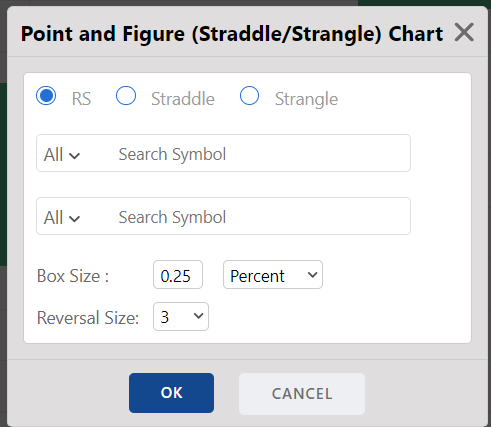

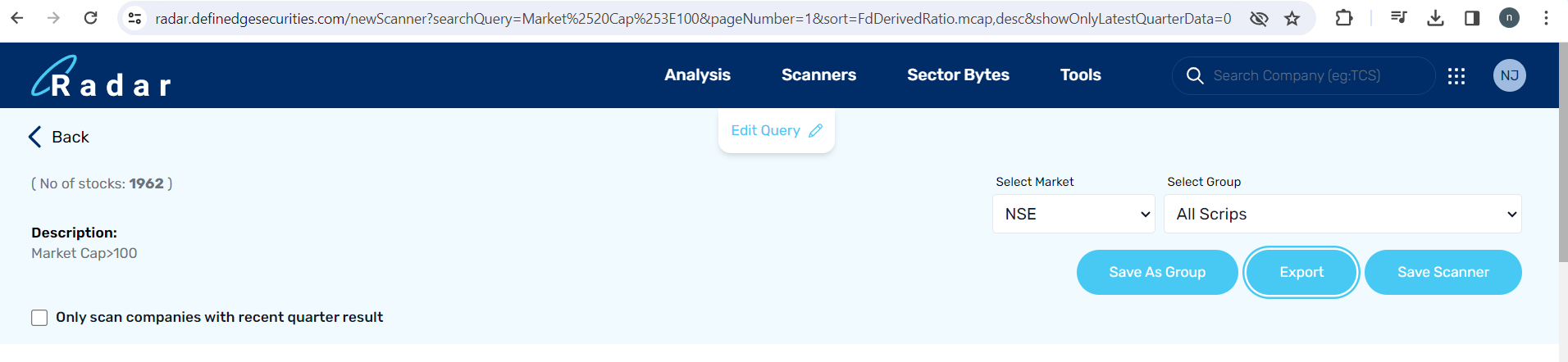

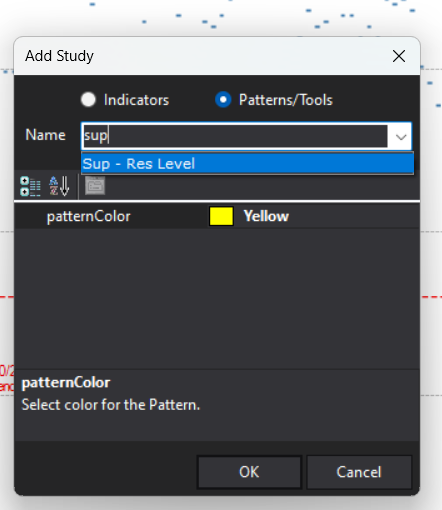

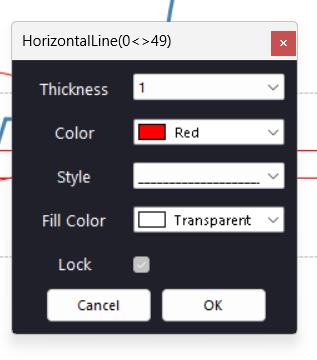

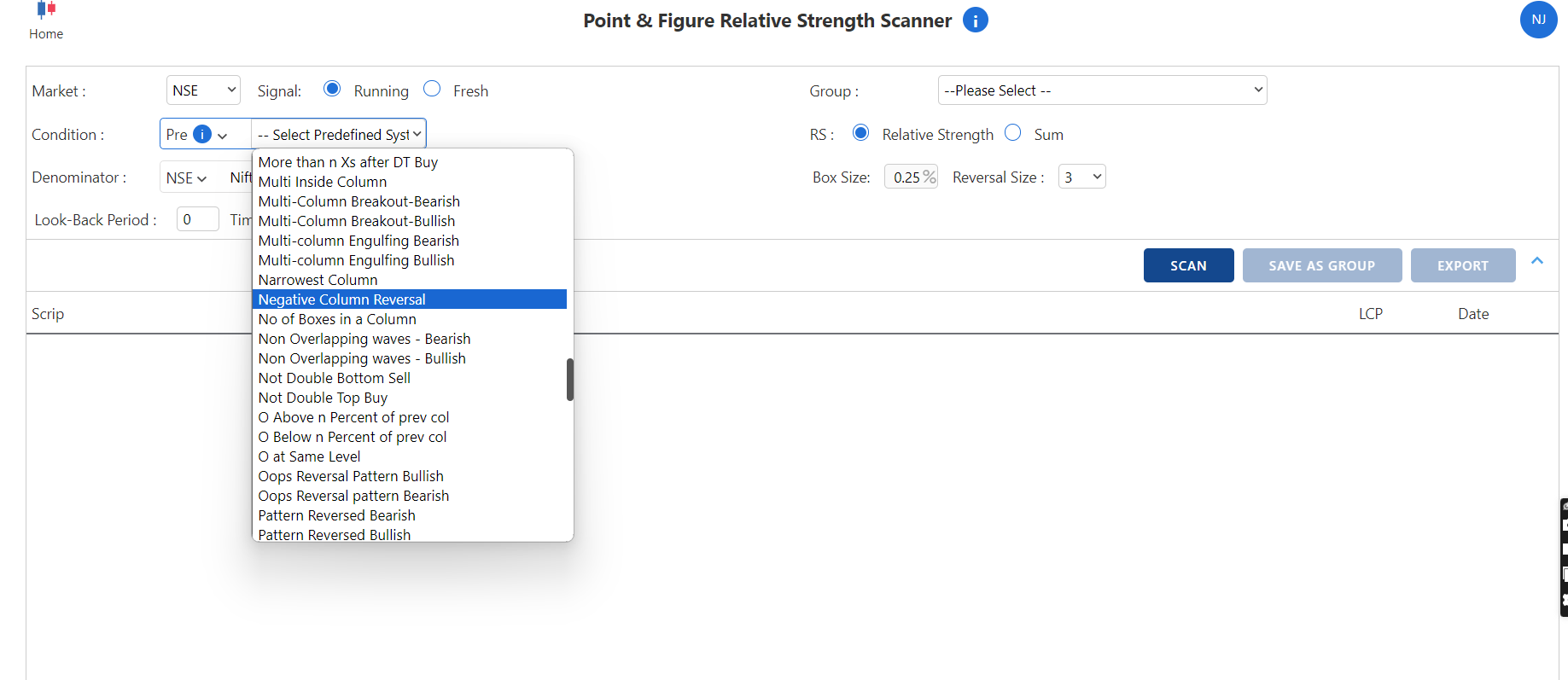

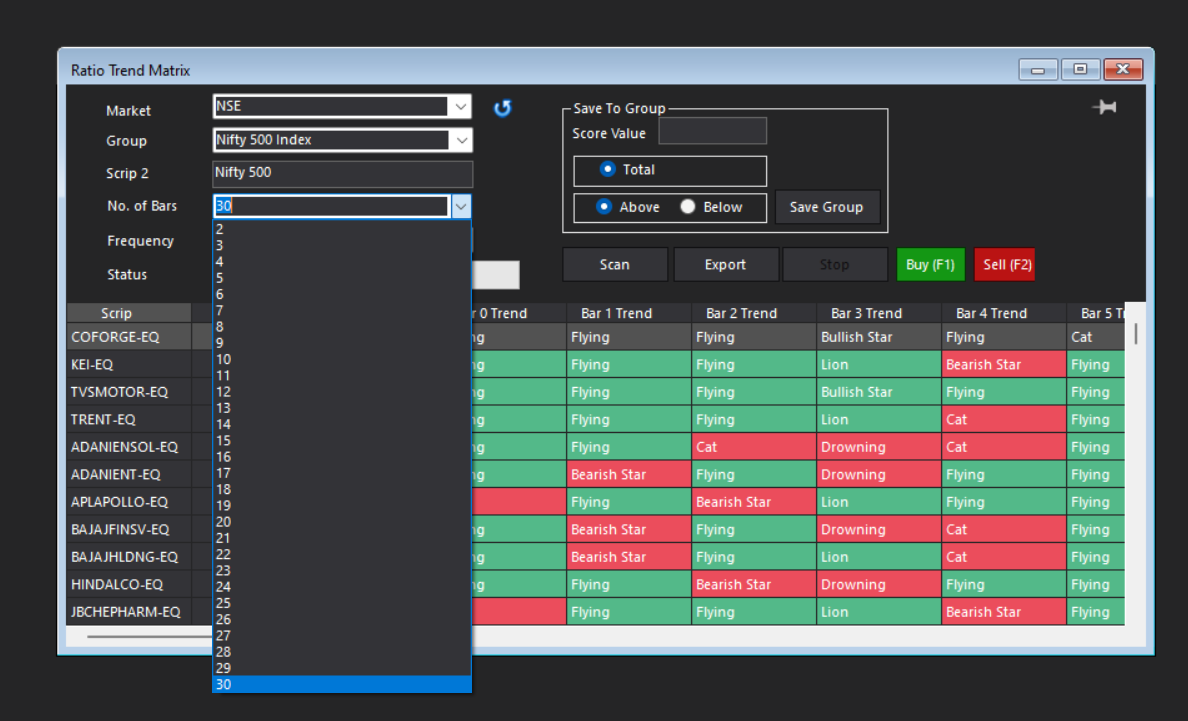

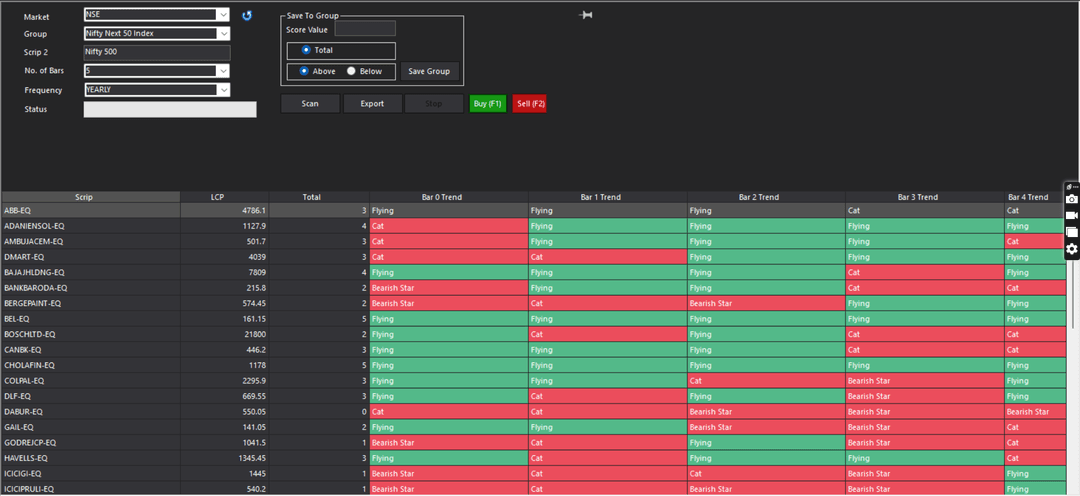

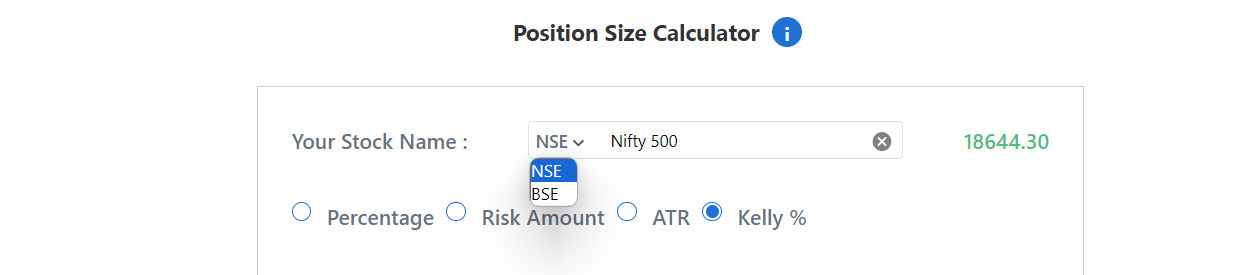

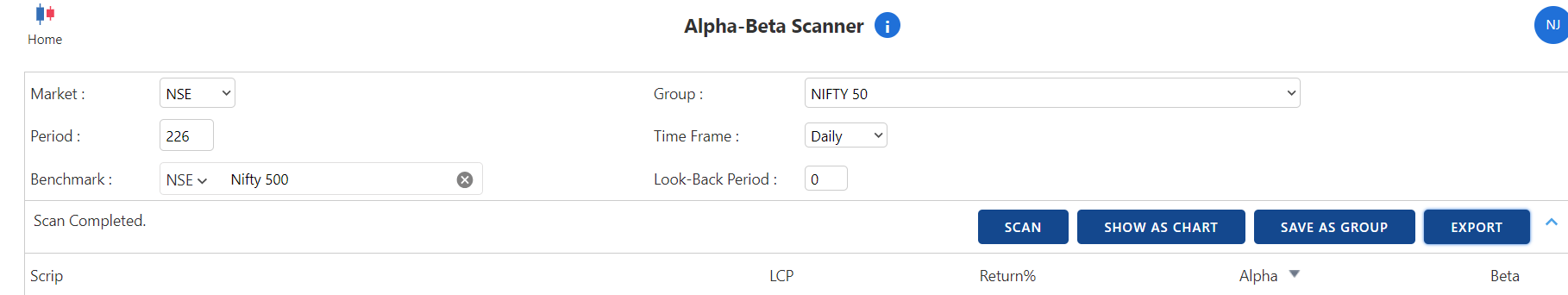

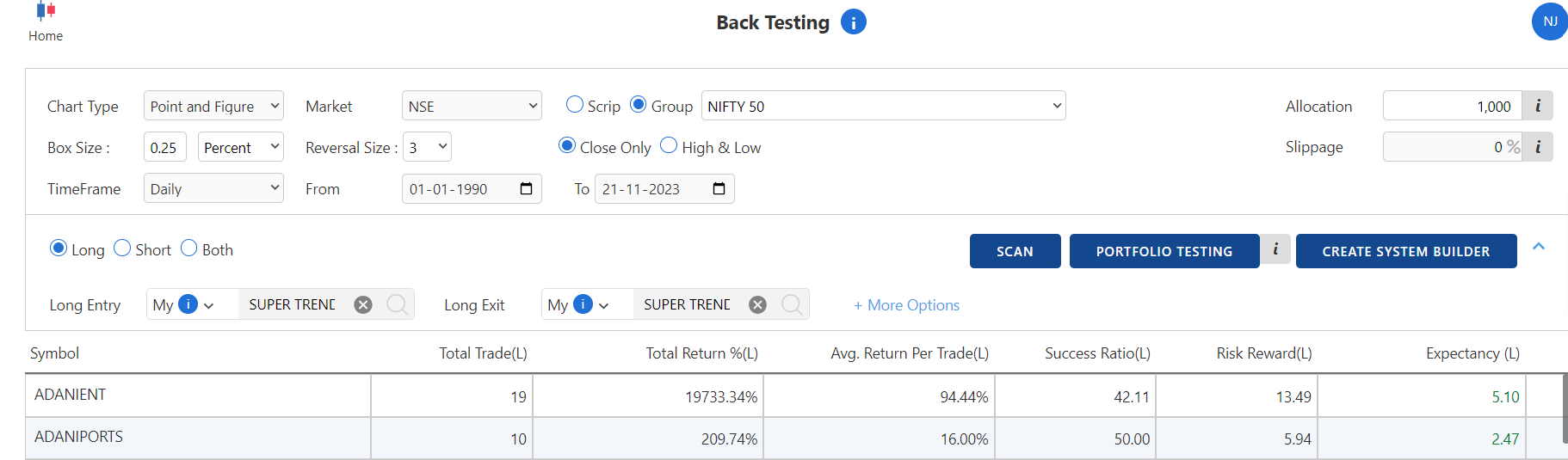

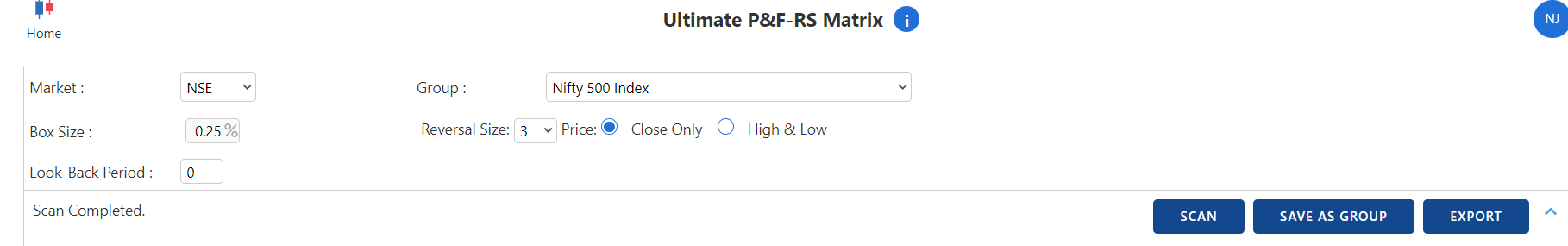

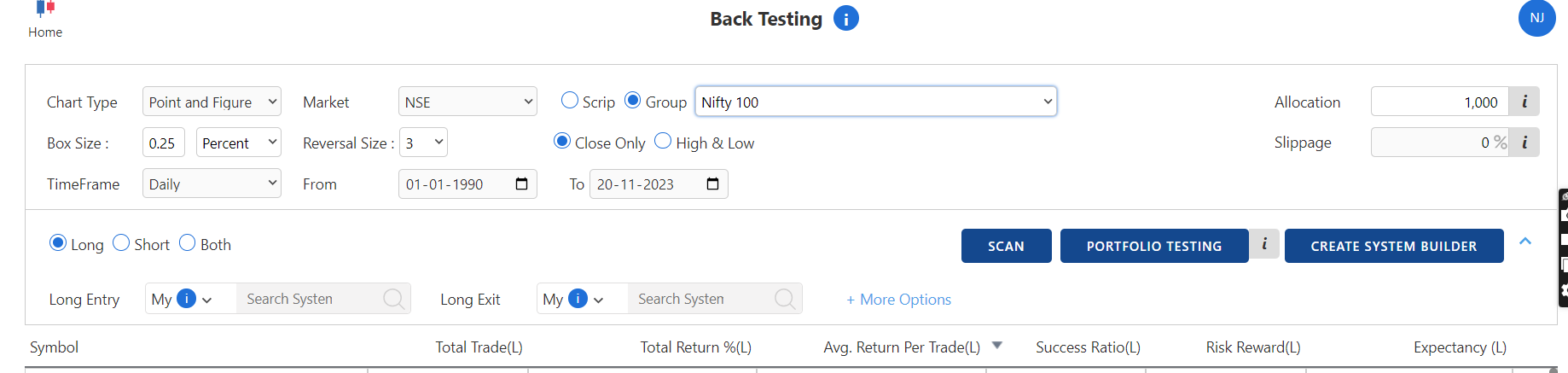

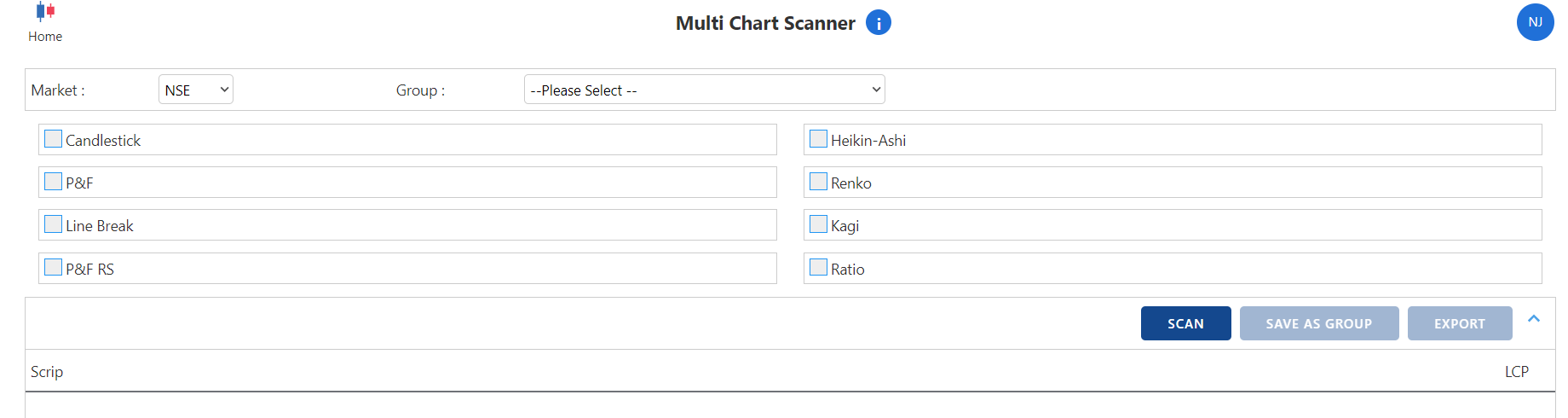

️ Scanners are just tools for speed.

️ Scanners are just tools for speed. Drop a YES in the comments if you’re committing to this practice this month.

Drop a YES in the comments if you’re committing to this practice this month. add

add

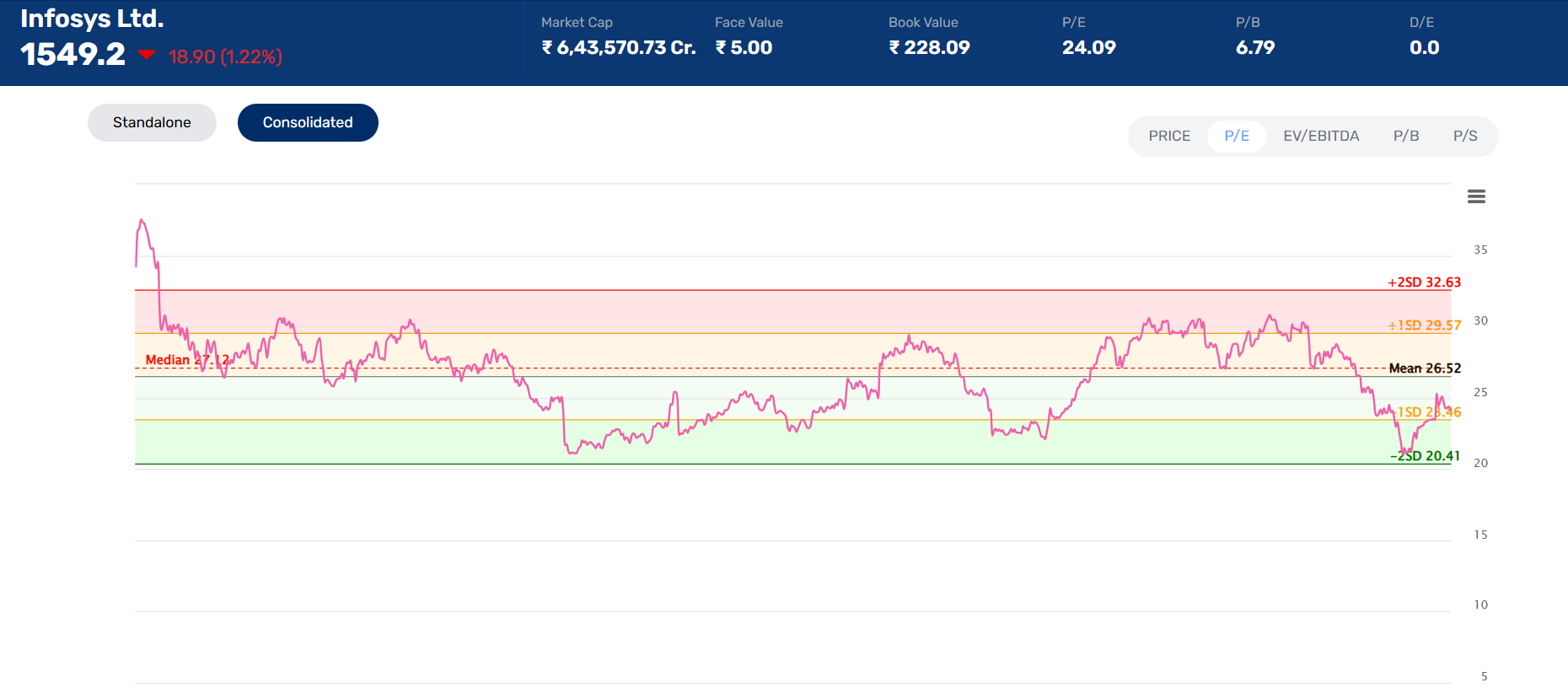

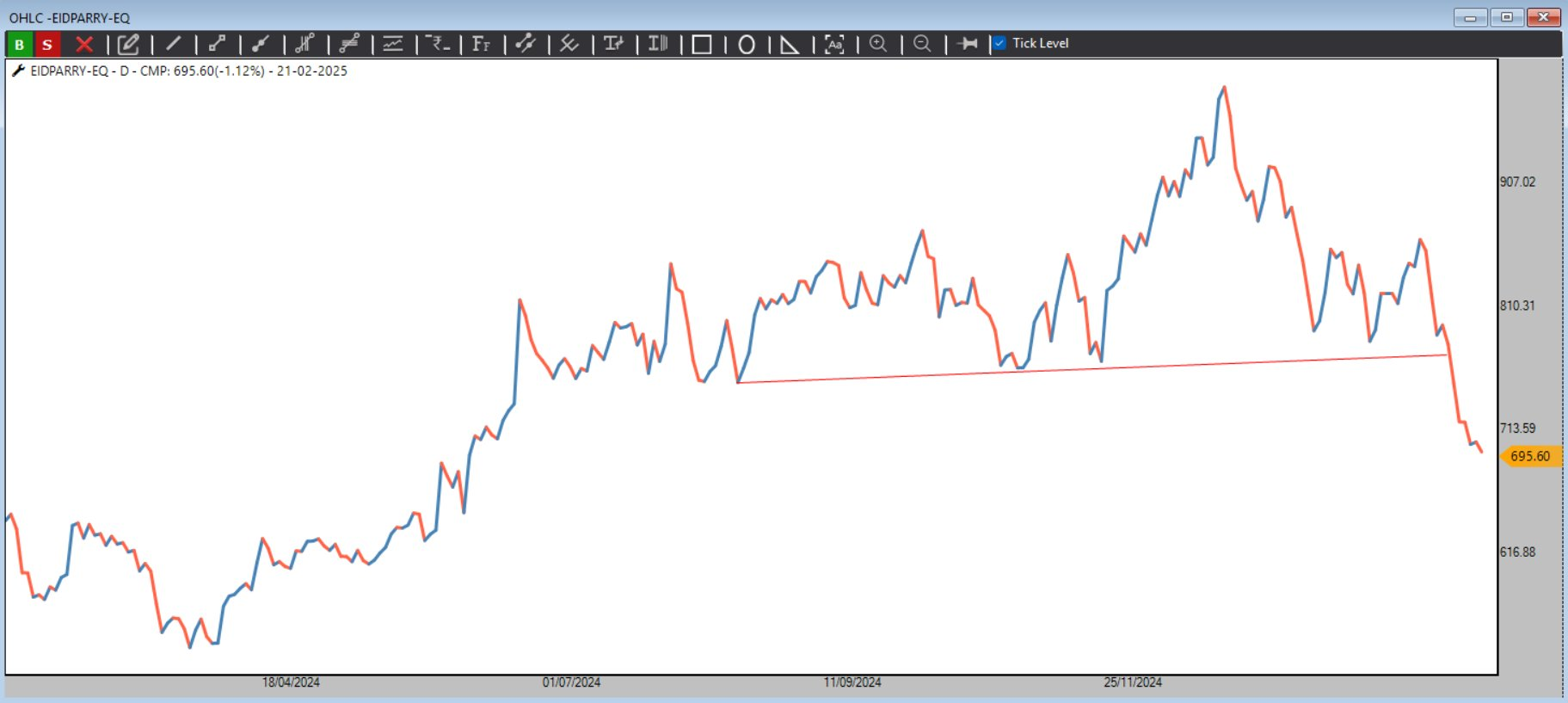

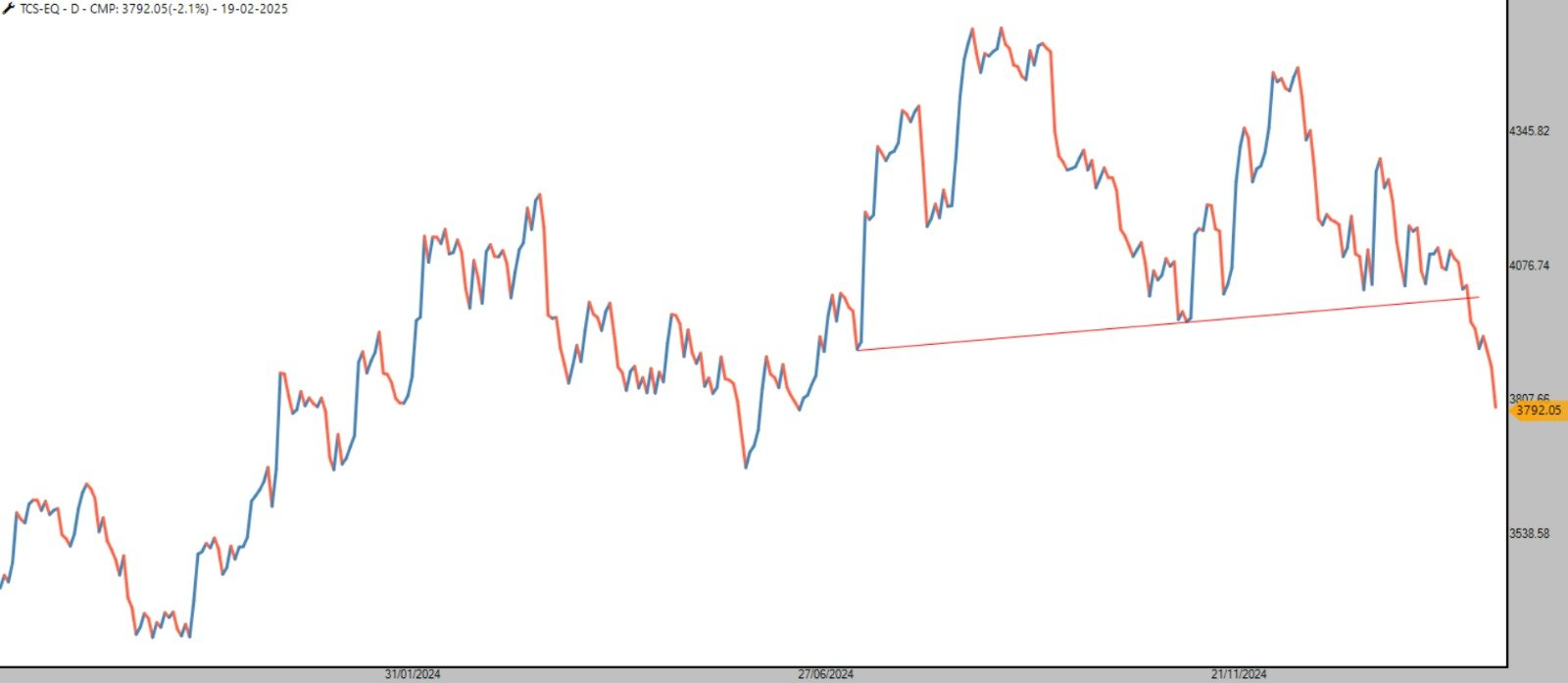

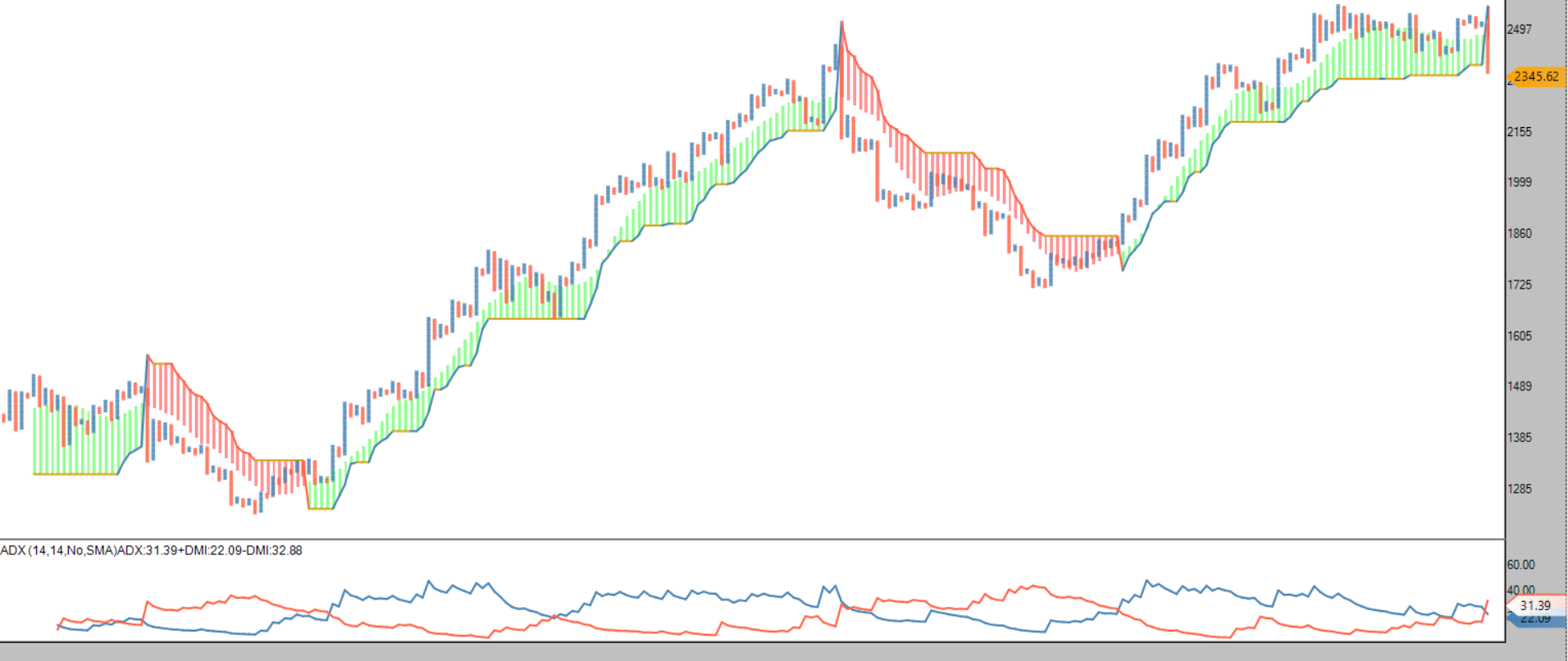

Weakening DXY could impact export-heavy IT companies despite the bullish chart.

Weakening DXY could impact export-heavy IT companies despite the bullish chart. Large-cap or mid-cap IT? Stock-specific trends will lead – manage risk, follow the chart, ignore the noise.

Large-cap or mid-cap IT? Stock-specific trends will lead – manage risk, follow the chart, ignore the noise.

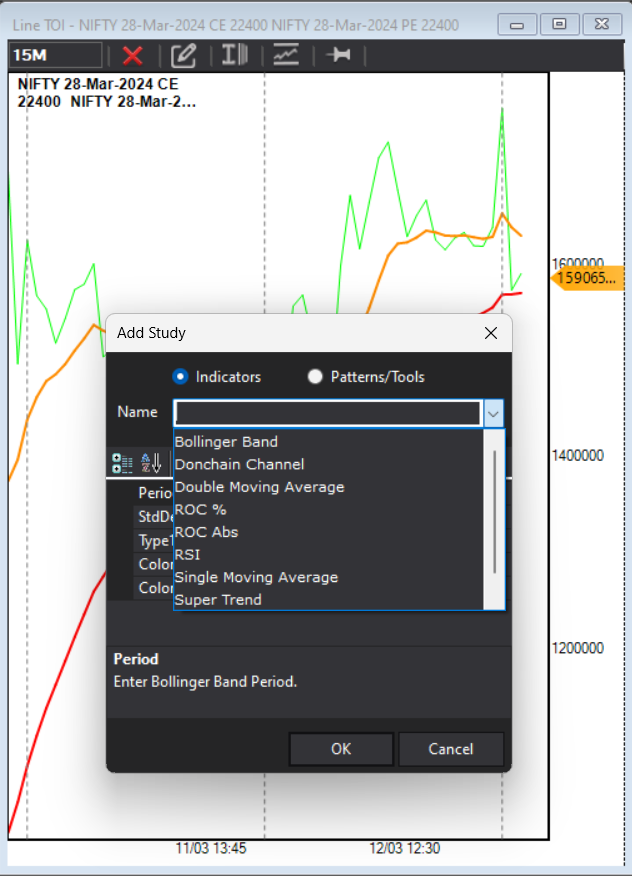

Caution Zone: A close below Super Trend could reverse the bullish tone.

Caution Zone: A close below Super Trend could reverse the bullish tone.

@Prashant-Shah

@Prashant-Shah