Read more about it and understand each group in detail:

https://www.definedgesecurities.com/blog/products/explore-these-new-definedge-groups-to-spot-trend-stocks/

Pro User

Read more about it and understand each group in detail:

https://www.definedgesecurities.com/blog/products/explore-these-new-definedge-groups-to-spot-trend-stocks/

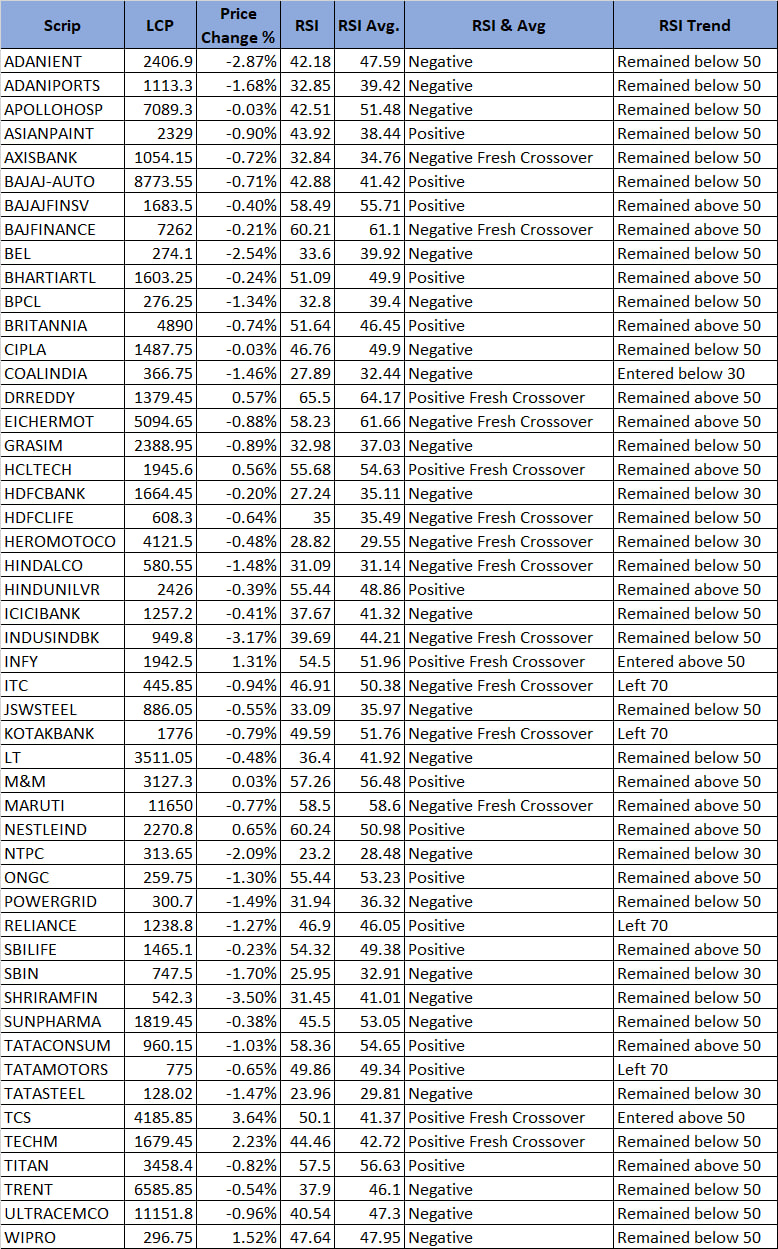

RSI

ADX

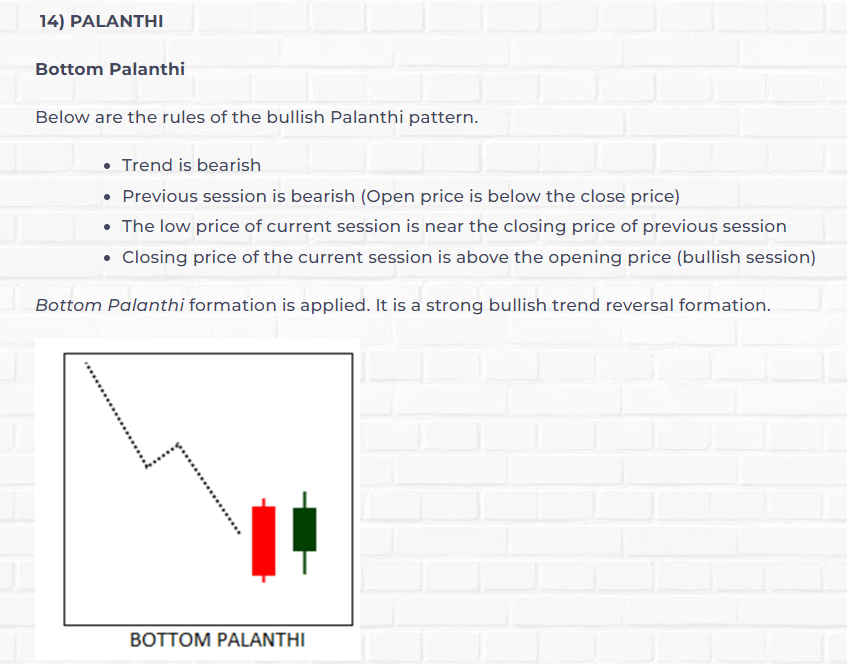

Check this Candlestick course and you will get to know the pattern. Click here

Nifty Pharma index is trending within a symmetrical triangle pattern on the daily chart, a classic formation that often precedes a breakout. What adds conviction to this pattern is the base of the triangle forming above the 200-day Exponential Moving Average (200DEMA), a key long-term support indicator that signals strength in the underlying trend.

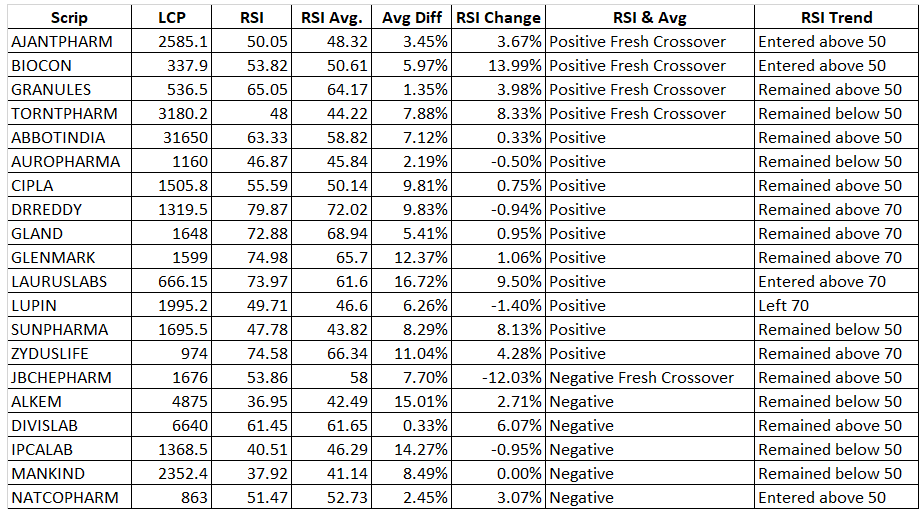

What truly caught my eye is the Relative Strength Index (RSI) performance of the index’s components. Using Indicator Digger, I analysed the RSI values across all 20 constituent stocks of the Nifty Pharma Index. Interestingly, 15 out of 20 stocks show a bullish RSI structure in the daily timeframe. This widespread strength beneath the surface suggests that there is accumulation happening across the sector — a potential precursor to a broader move.

Nifty - X% Breadth

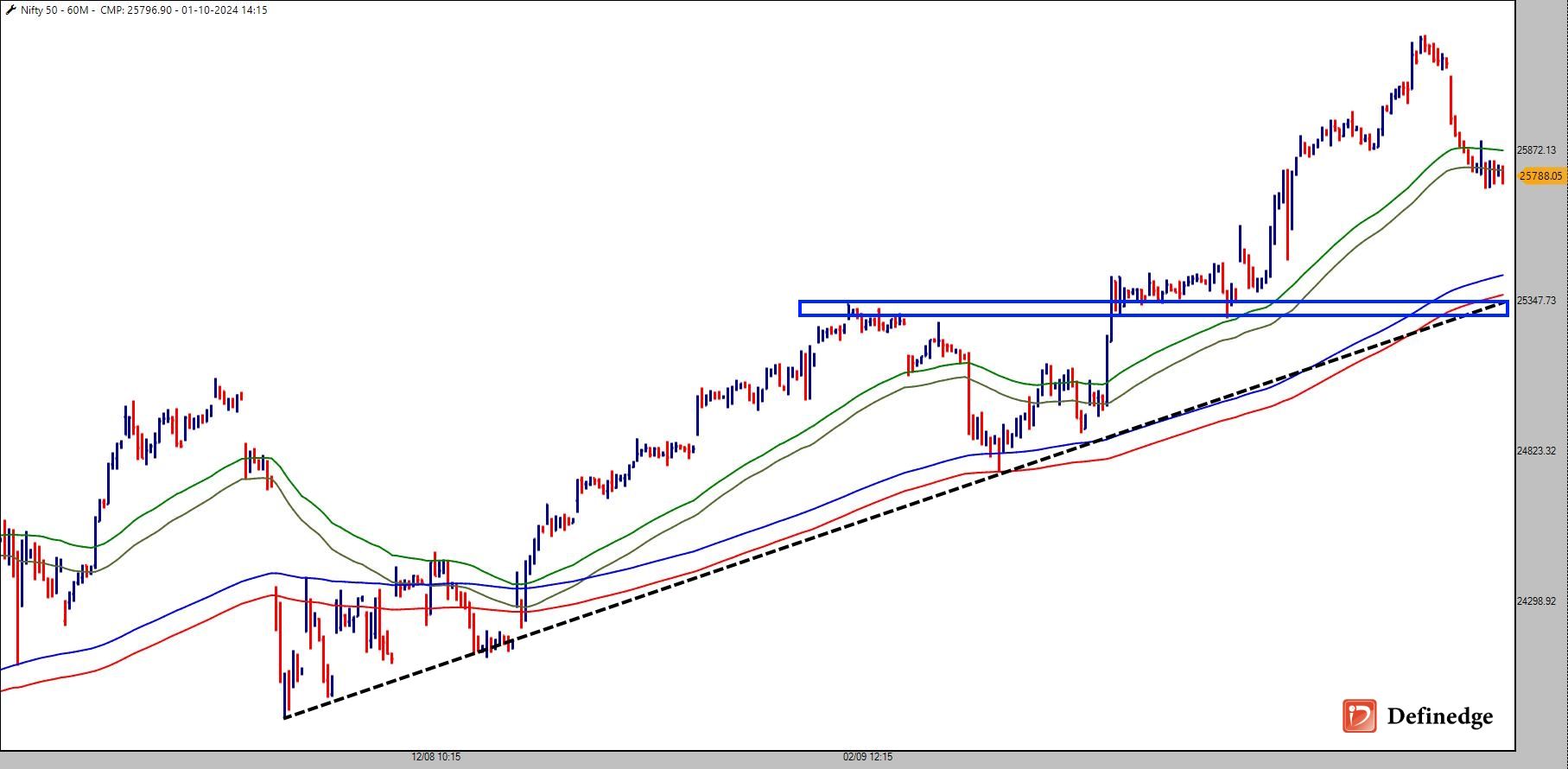

Nifty50 Hourly Chart

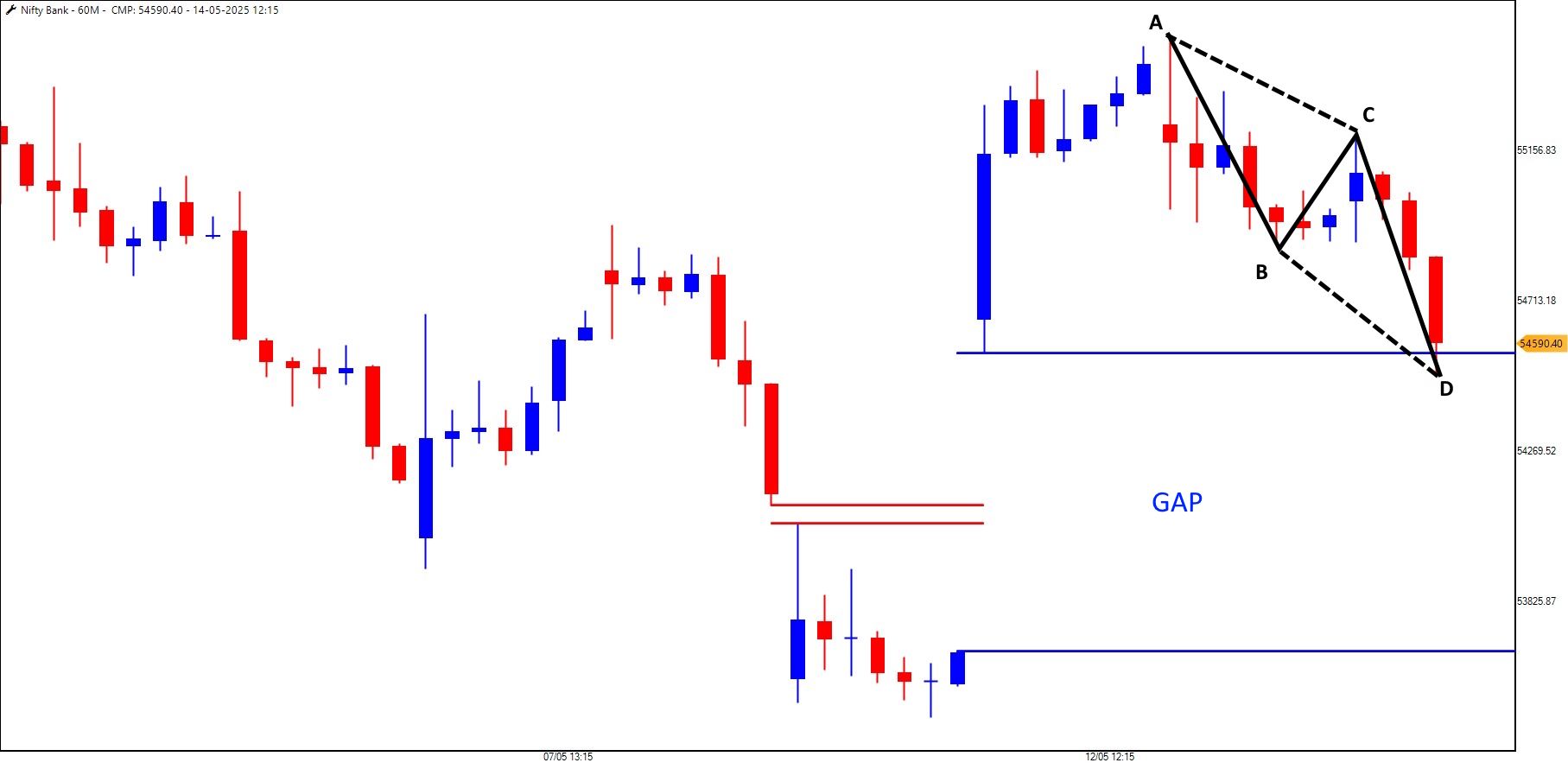

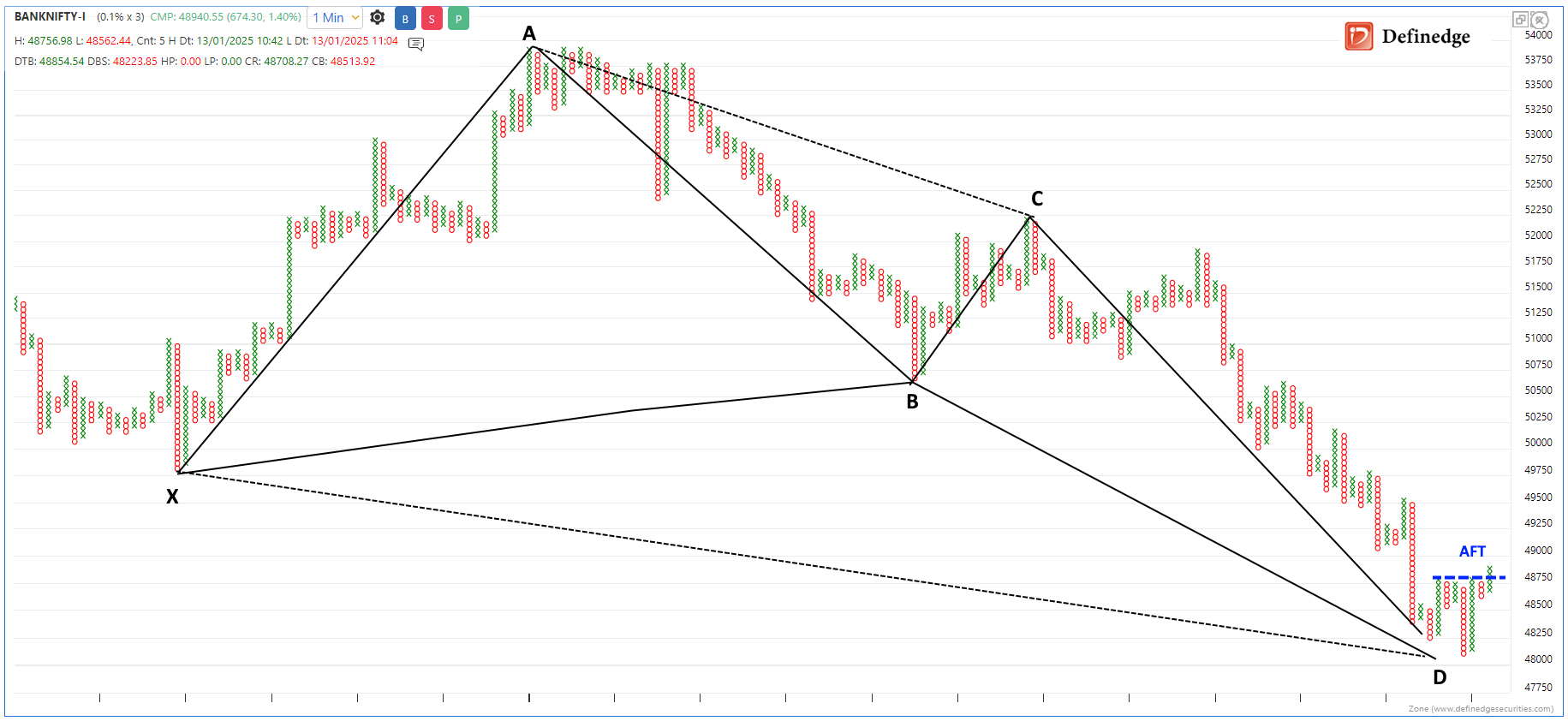

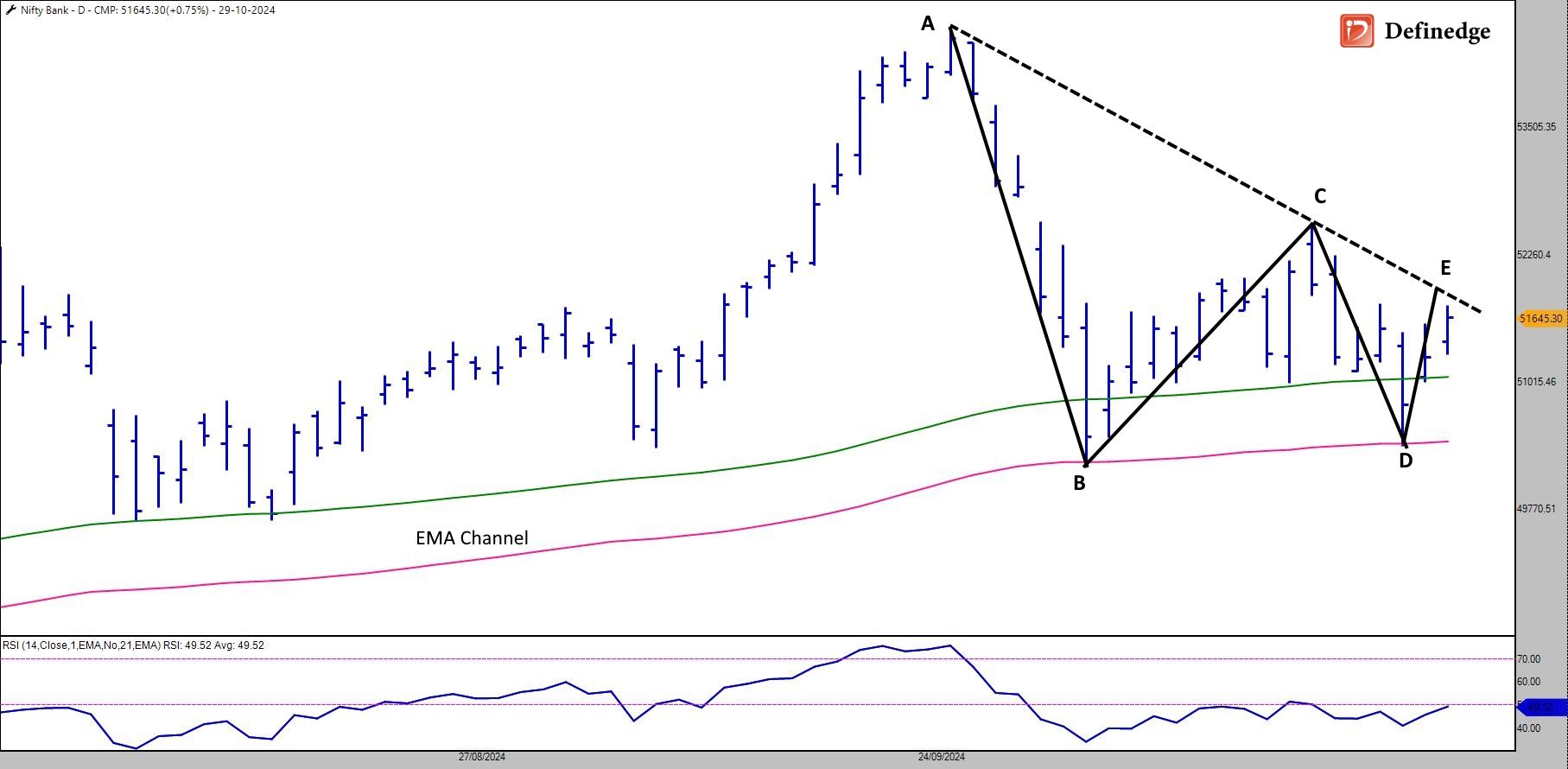

Bank Nifty Hourly Chart

To learn Harmonic Patterns, Click here

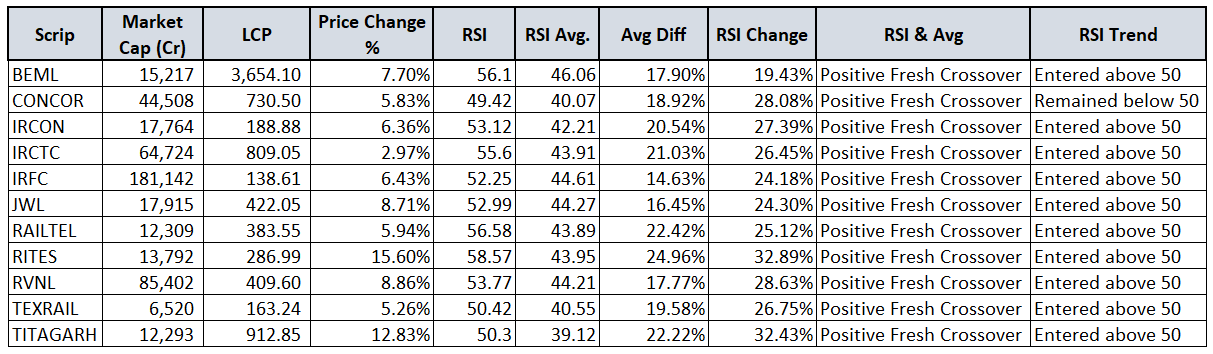

Definedge Railway Index Weekly Chart

RSI of Definedge Railway Index Constituents (Weekly):

To learn Harmonics, Click here

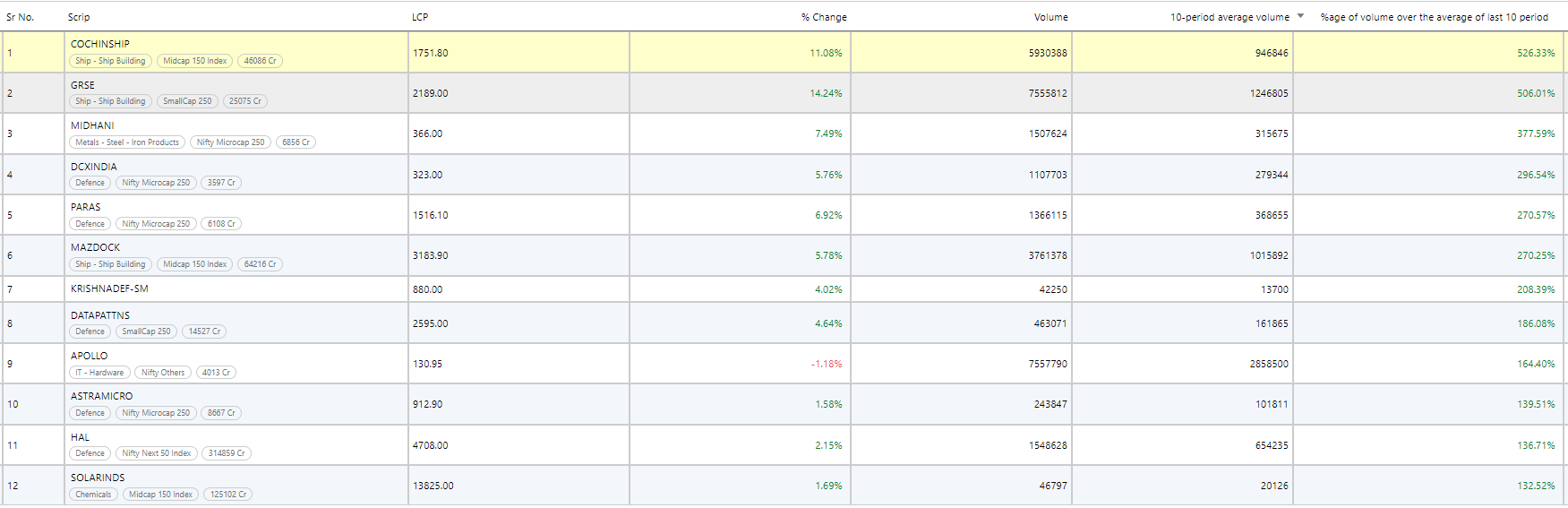

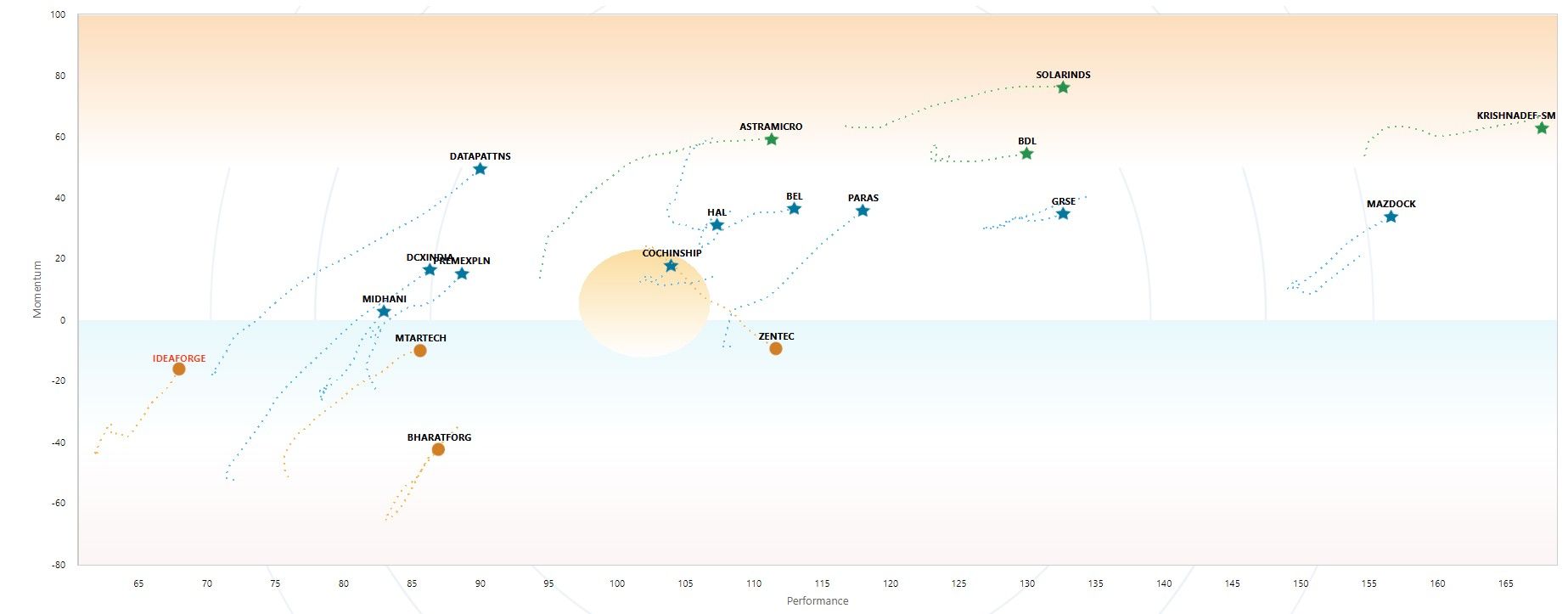

Defence stocks experienced a promising volume spike in the first hour of trading today, the beginning of a new trend?

Following the Pahalgam attack, many traders hesitated to take new positions, bracing for a potential war. This cautious sentiment, driven more by fear than facts, led to a herd mentality that caused many to miss a significant trend in the market.

At Definedge, we believe in staying anchored to an objective, system-based approach—relying on what charts and data reveal, not speculation.

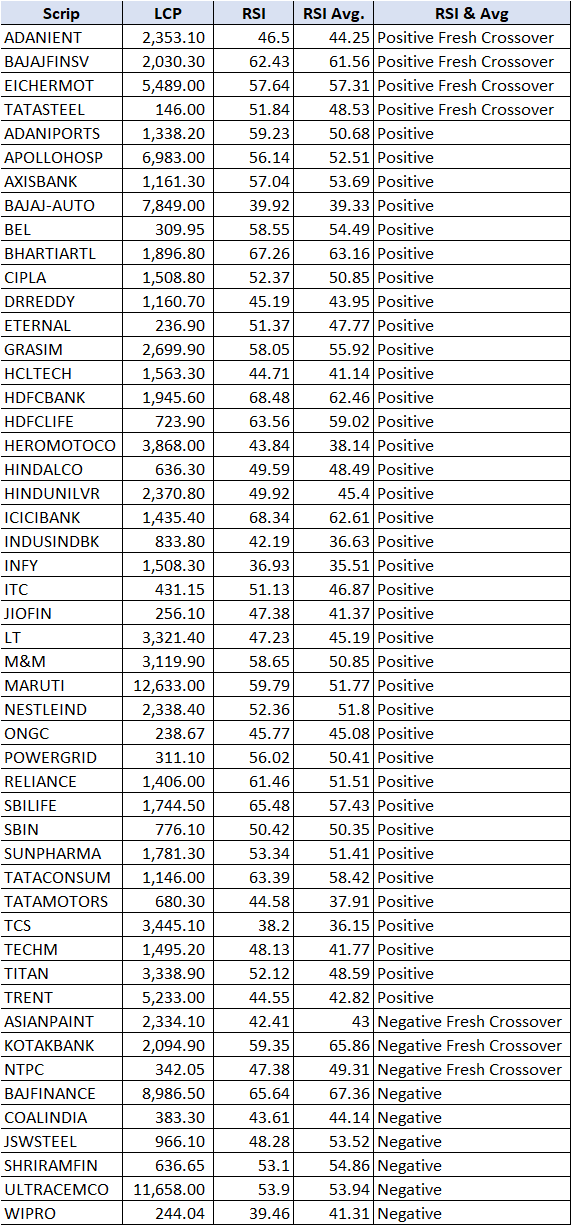

A Look at the Nifty50

Point & Figure Chart (0.25% x 3 Daily)

The Nifty50 recently broke out of a four-column triangle pattern on the P&F chart—a classic continuation pattern. This move was confirmed by an Anchor Column Follow Through (AFT), suggesting renewed bullish strength. Minor resistance lies at the 45-degree trendline, but the breakout is technically significant.

Heikin Ashi Weekly Chart

On the Heikin Ashi chart, the Nifty reversed near the 200-week exponential moving average (WEMA) channel. It formed multiple bullish candles and successfully cleared a key resistance zone. This chart setup reinforces the positive outlook.

RSI Indicator: Momentum Still Bullish

Perhaps the most compelling statistic comes from the RSI Indicator Digger scanner: 41 of the 50 Nifty stocks currently show a positive weekly RSI trend. This signals strong underlying momentum, with bulls clearly maintaining control.

Be Objective, Stay Prepared

While equity markets inherently carry risk, letting fear drive decisions often leads to missed opportunities. Traders should stay alert to trend change levels. As per the P&F chart, a close below 24,000 would negate the current bullish setup. A follow-through below this level will help confirm whether it’s a reversal or simply a consolidation.

At Definedge, we continue to trust the systems. The charts speak louder than emotions. Are you listening?

To learn Harmonic Trading, Click here

To learn about Harmonic Patterns, Click here

When the King moves with thunder, it’s either the drums of war—or the birth of something legendary.

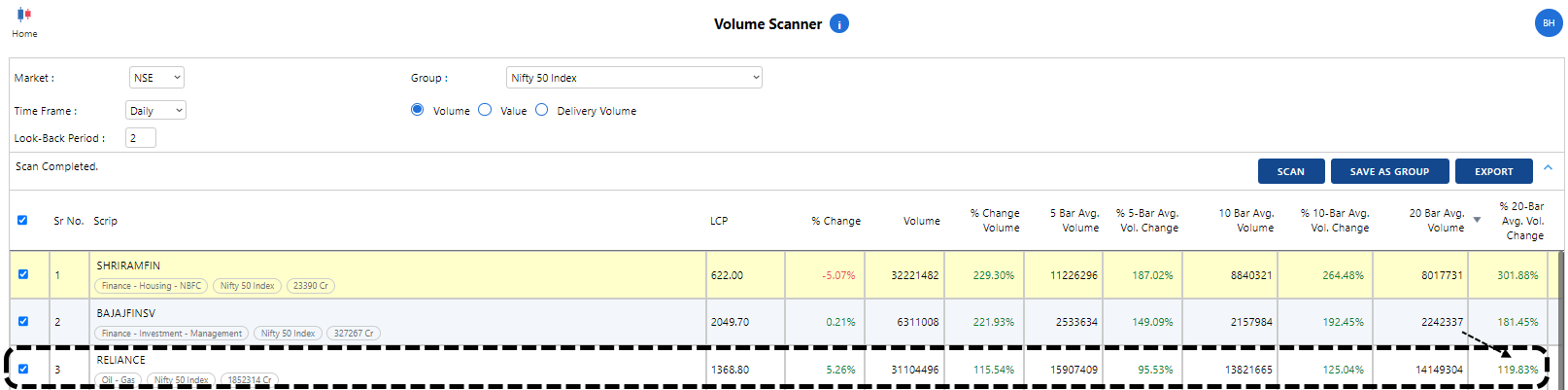

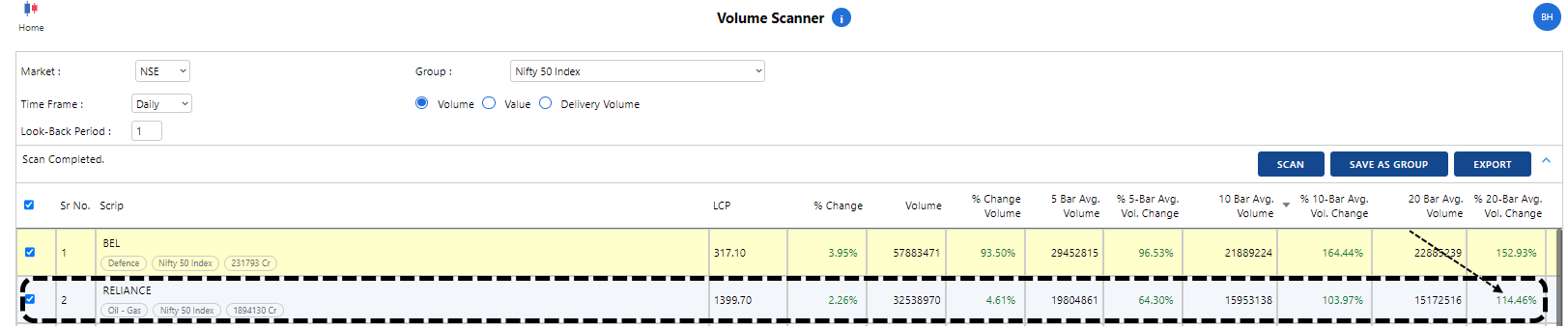

Every evening, like clockwork, I scan the volume charts—my eyes fixed especially on the Nifty50. These aren’t just numbers; they are whispers of what’s to come. Volume, after all, is the market's heartbeat, and lately, it’s been pounding.

On the 28th and 29th of April 2025, Reliance surged—not just in price, but in sheer force. The trading volume exploded to more than double its 20-day average. When price and volume rise hand in hand, it's rarely a coincidence. That alignment often foreshadows something powerful building beneath the surface.

I have attached the volume scans and daily charts from those two days. Take a look—you might catch a glimpse of the storm gathering.

Volume Scanner 28th April 2025

Volume Scanner29th April 2025

Daily Chart

On the chart, the stock breaks the falling trendline, followed by a Super Pattern.

The DeMAP suggests most of the stocks are above the sea level signalling the strength in the sector.

@BK It's 200 Channel... The Blue is 200DEMA (High) and Red is 200DEMA (Low).

Recent trade has been long since ~22,800 and still counting.

Do You See any Warning Bells or Signs of Exit?

@Deepakk Chabria 200DEMA Channel.

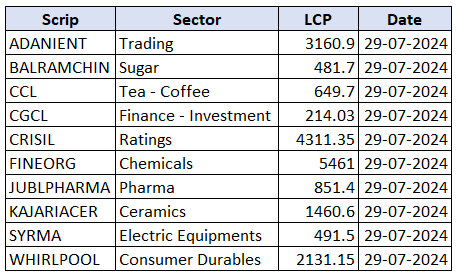

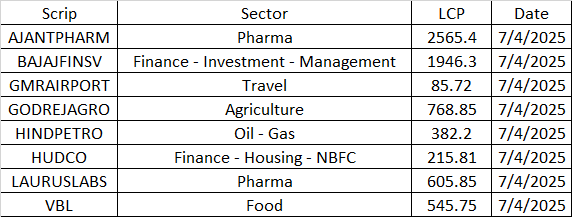

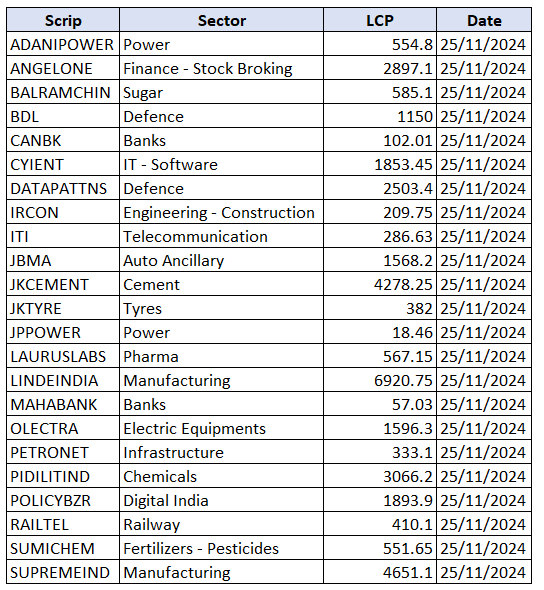

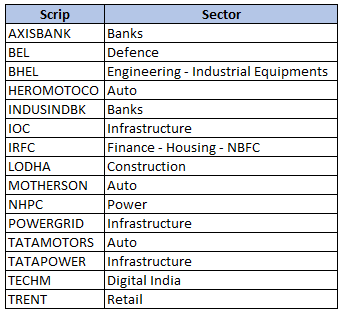

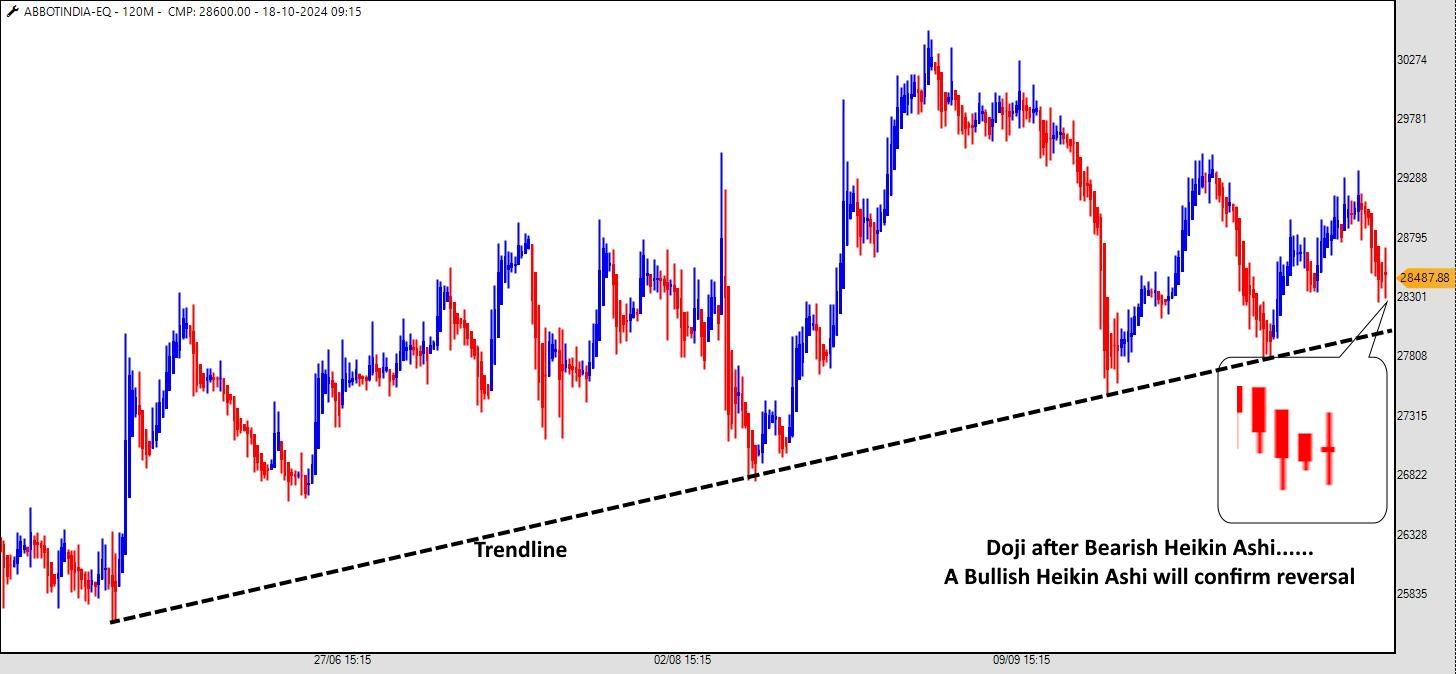

Stocklist 13th April 2025

@Subramanya Joshi It's a Gap tool.

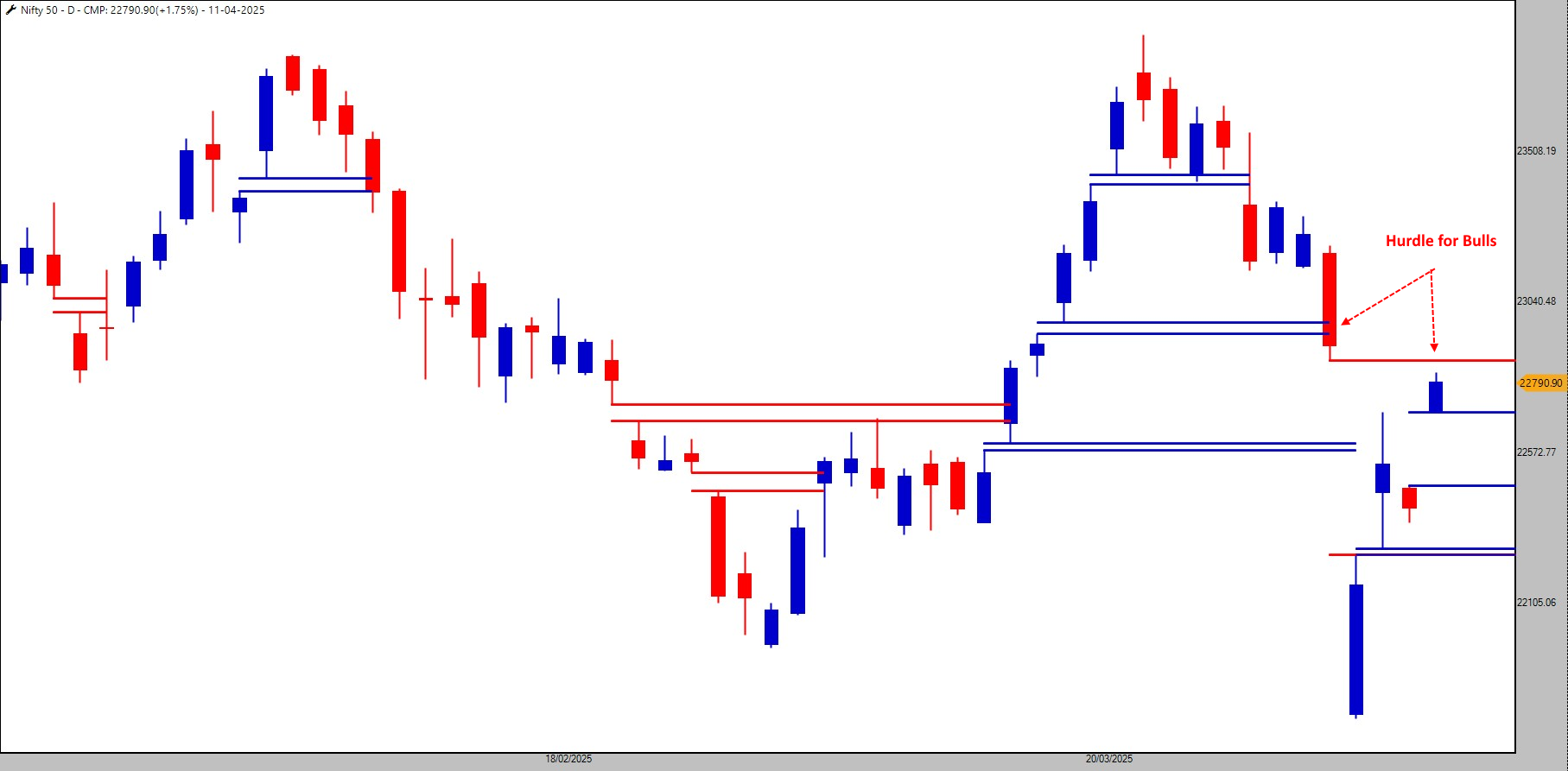

A gap-down on cards as Gift Nifty indicates an opening down of ~250 points.

Considering the Nifty (spot) chart, the multiple trendlines and previous swings indicate the major support area of the 22,800-23,000 zone.

If bulls manage to hold this, it may potentially turn into a buying opportunity. Wait for the markets to react to the support zone.

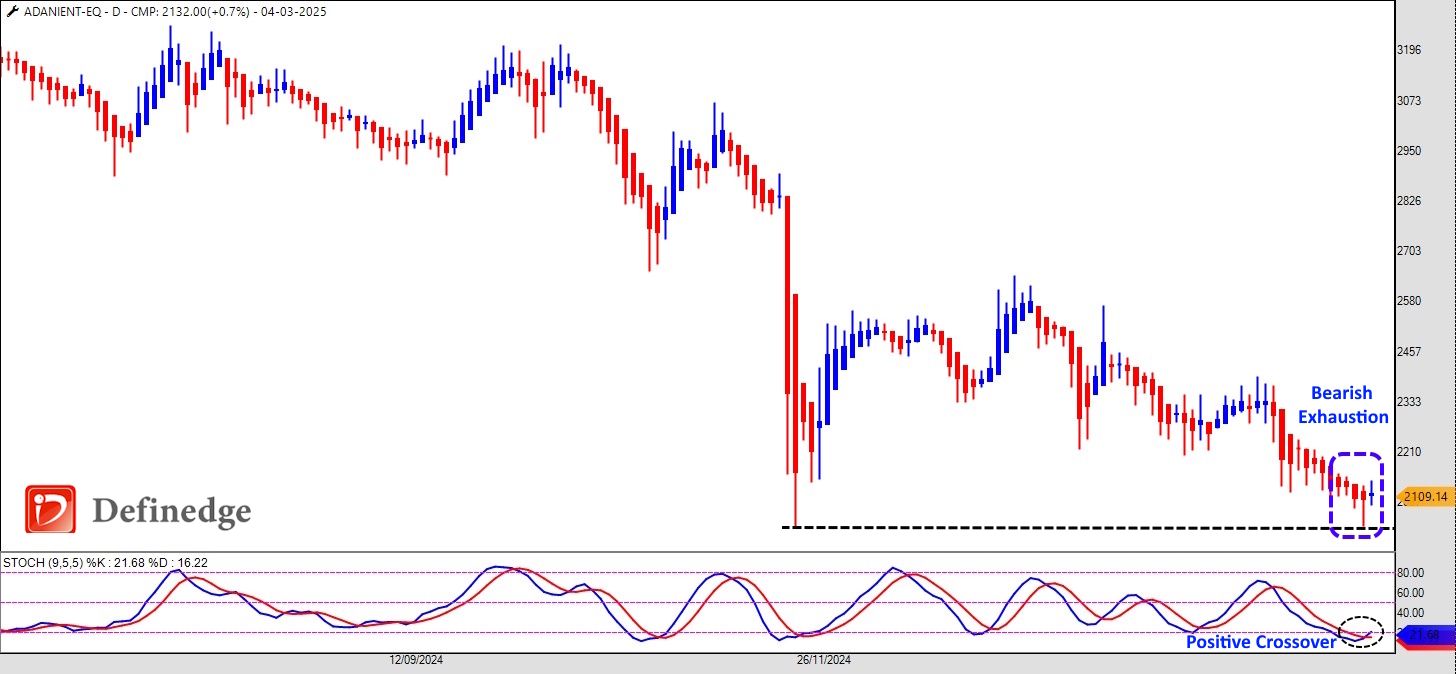

@Prashant Vaikunthe Will keep a check till the Bearish exhaustion unfolds on the chart.

Super Pattern - P&F Chart

Rising Three Pattern - Candlestick Chart

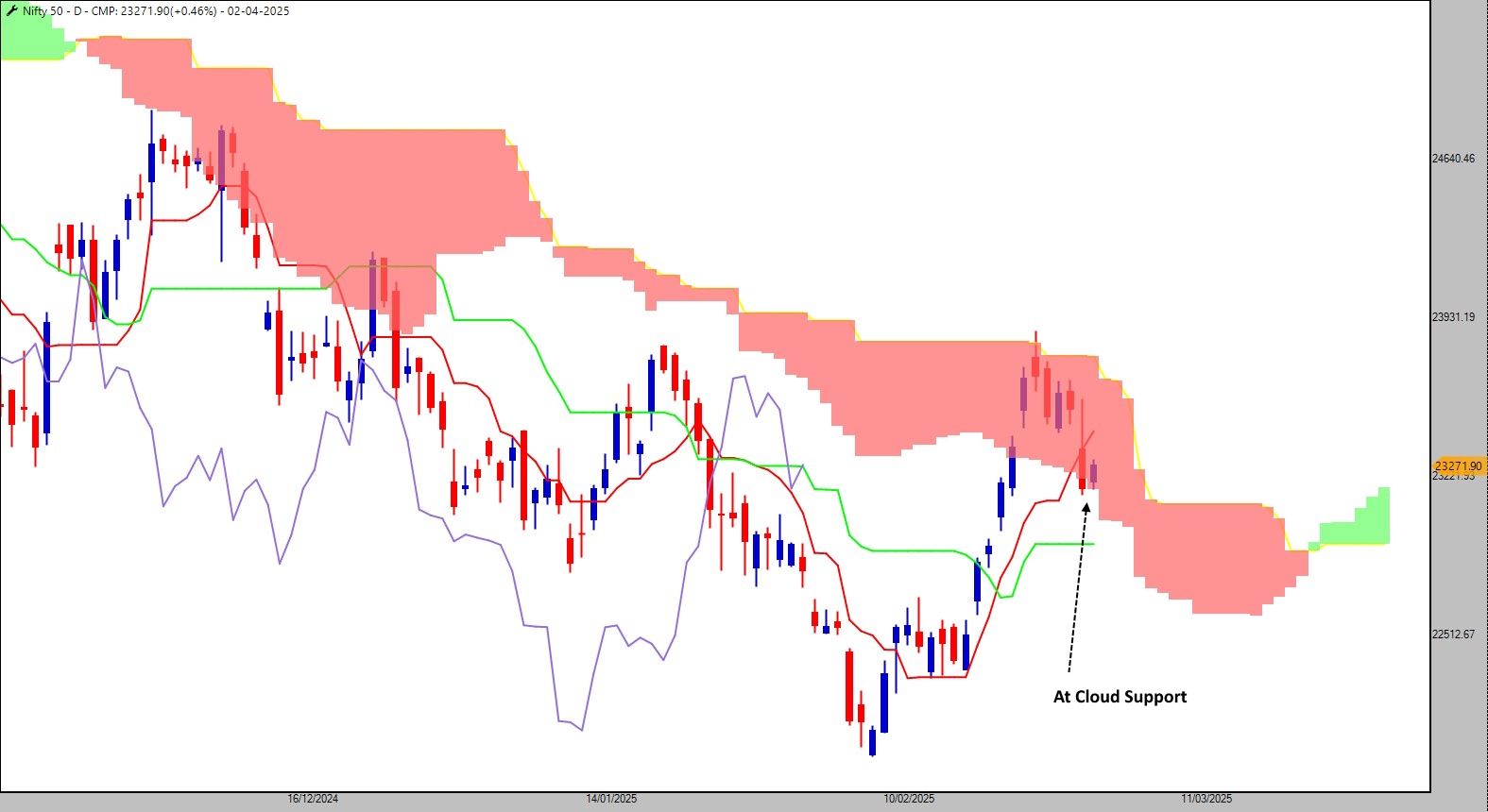

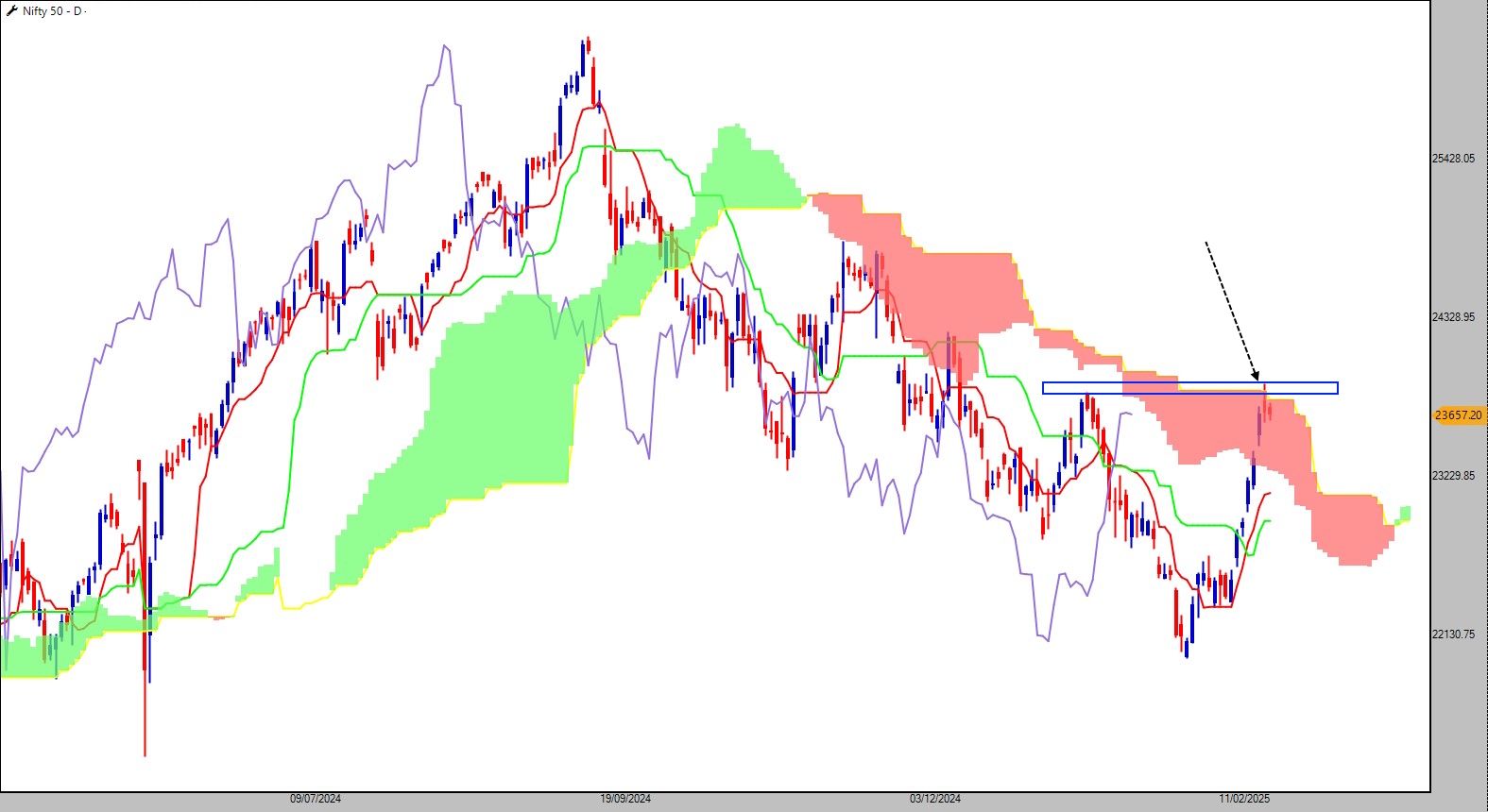

The Ichimoku Indicator offers a comprehensive analysis of market trends, support and resistance levels, and potential reversals, clearly and visually representing market conditions.

If you want to learn Ichimoku more, read our blog.

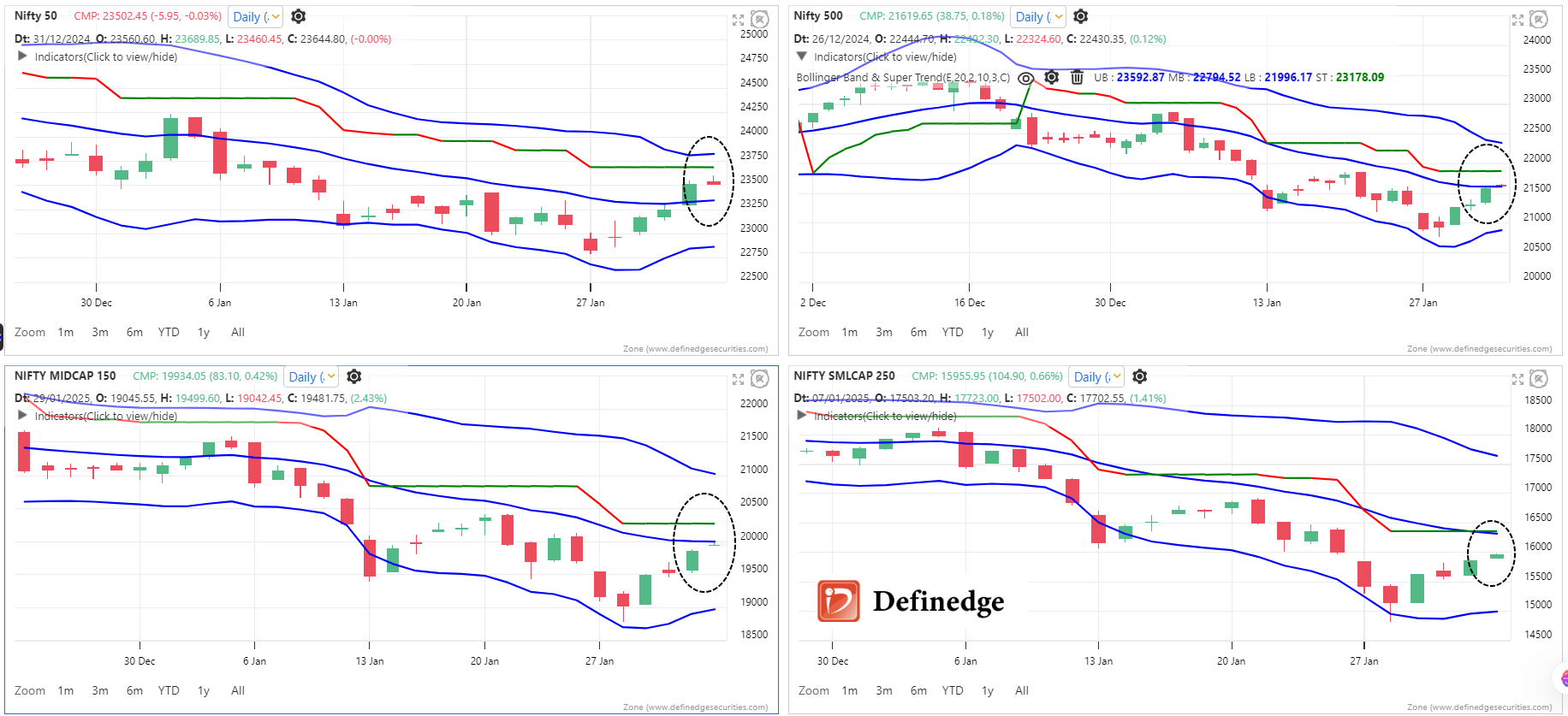

Here are the Nifty50 and Nifty500 daily chart:

Nifty50

Nifty500

The observed consolidation pattern in Coal India over the past three months, followed by a decisive breach of the 400 resistance level accompanied by heightened volume, suggests a potential shift in market sentiment. This initial breakout, however, faces a critical test at the 200DEMA channel, spanning 408 to 419.

A successful break through this zone, characterized by sustained volume and price action above the upper boundary, would strengthen the hypothesis of a potential bottom formation.

Conversely, failure to overcome this resistance could indicate a temporary bullish surge within a broader consolidation phase, necessitating further observation to ascertain the stock's long-term trajectory.

ICICI Bank - 1233 to 1289

@Prashant Vaikunthe If it's overstretched, it won't result in a breakout. If there is a breakout, it means demand exists.

You can't guarantee a breakout will work, so there is a stop-loss. If it's affordable and fits your risk parameters, take a risk; otherwise, wait for a follow-up with an affordable risk.

@Deepakk Chabria You can create it in the System Builder.

@Deepakk Chabria On its way sir...

@Nishant Ajugia 34EMA

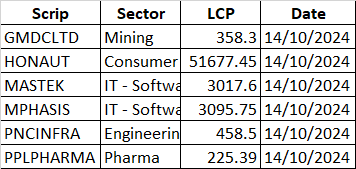

The market's current downturn has instilled a sense of unease, echoing the famous line, "Risk hai toh Ishq hai." However, in the reversal trading, calculated risk is paramount. And right now, the Nifty Midcap100 index is flashing signals that warrant attention.

Despite the prevailing bearish sentiment, the emergence of multiple bullish harmonic patterns on the Nifty Midcap100 indicates a potential reversal.

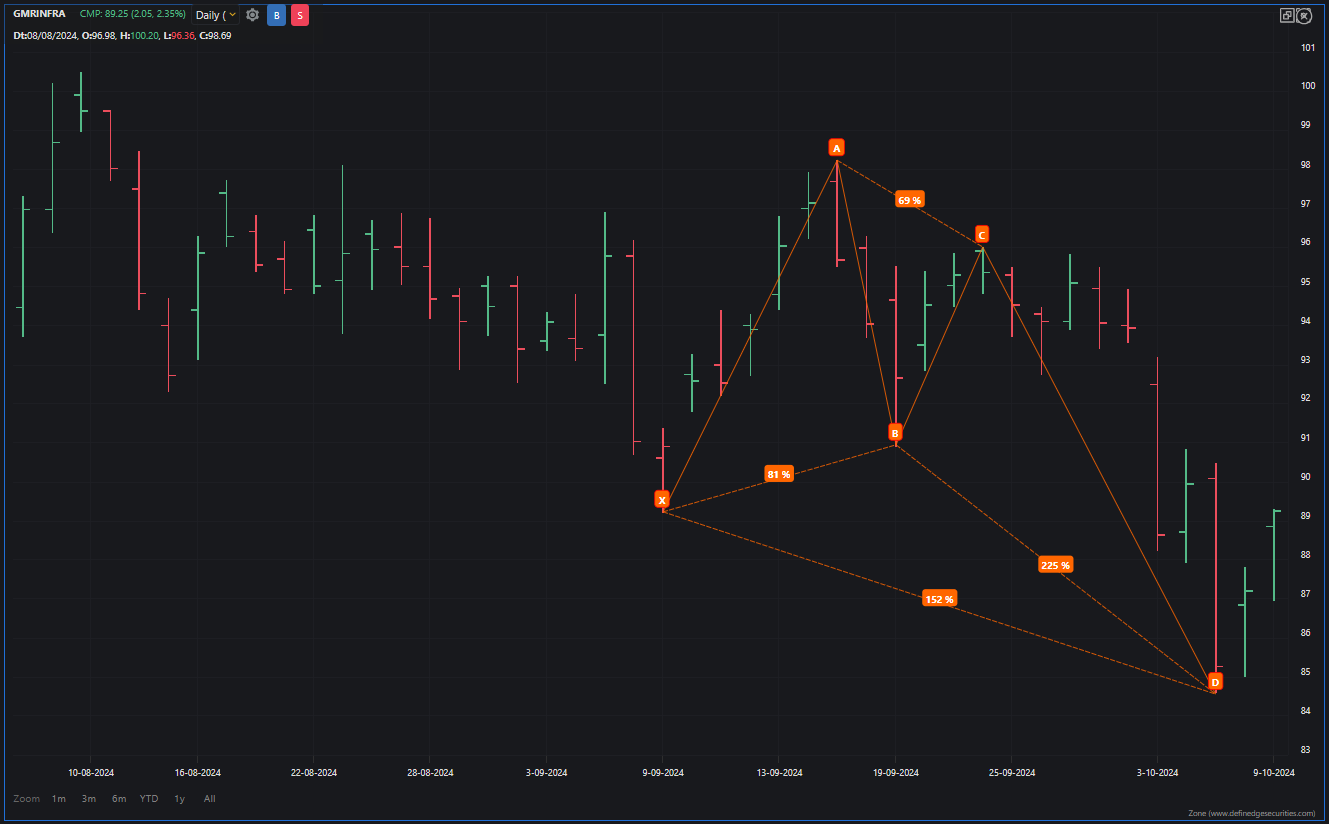

1. Bullish Black Swan Harmonic Pattern on the Daily Chart

2. Bullish White Swan Harmonic Pattern on the Hourly Chart

The validity of these bullish harmonic patterns hinges on the index holding above its recent low of 48,503. As long as this level remains intact, the potential for a midcap rally remains strong. A breach of this level would invalidate the patterns and suggest further downside.

What are you buying? Let us know in the comments below.

Hi @Radhakanta Samantara! We have emailed the Excel file to all participants, which you can also find on the course page.

If you have any questions, please join our Q&A sessions or watch the helpful videos. We are here to support you!

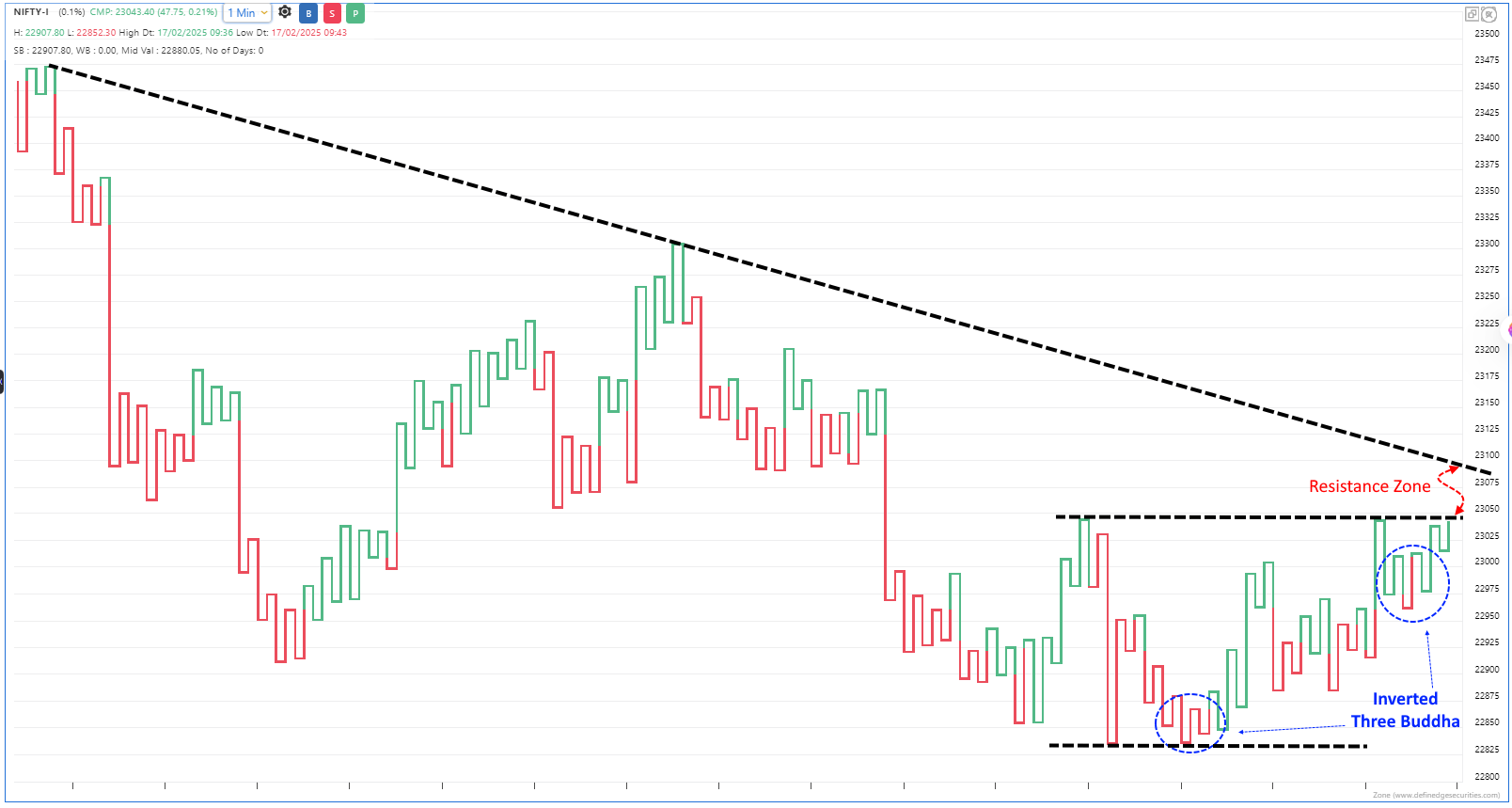

Nifty Futures - Resistance zone @ 23,050-23,115

@SANDIPAN SARKAR Vertical Count on the Options Chart with the DBS as SL.

@Deepakk Chabria Great!

Valentine’s Day and stock market trading might seem like two completely different worlds—one centered around love, and the other around money.

But at their core, both share important principles that can inspire us to live better, both personally and professionally.

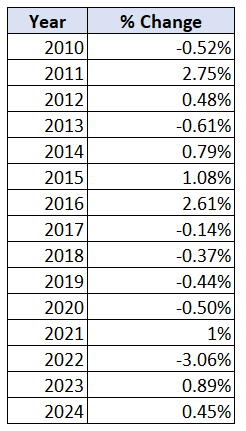

Well, here is the Nifty50 performance on the Valentine's Day.

*If the 14th Feb falls on Saturday, the performance of the 13th Feb is considered, and the 15th Feb if it's Sunday.

Dear Sir,

There are Q&A for all the courses available on the Gurukul.

We do Live Q&A for the Harmonic Course every 30-45 days (on Saturday). If you enrol now, you can also view the previous Q&A.

Sir, this message was posted at 23.45 hrs, and our support is available from 9am to 6pm on weekdays and 10am to 3pm on Saturdays. Please call our Support Team at 020-61923200, and we will see what can be done.

Read more about the strategy here

When analyzing sectors relative to the Nifty50, technical analysts often rely on ratio charts to identify outperforming and underperforming sectors. But what if we could go a step further and spot a bullish setup on these ratio charts? Such setups could strengthen our medium-term view on which sector is likely to outperform.

To identify a strong sector, use the following parameters on a ratio chart and scan them using tools like RZone:

Golden Cross: When the short-term moving average crosses above the long-term moving average on a ratio chart, it signals a potential long-term bullish trend for that sector.

RSI Positive Crossover: Look for the RSI crossing above 50, signaling that momentum is shifting in favor of the bulls.

RSI Above 50: The RSI should stay above the 50 midline, confirming that the sector is in a strong bullish phase.

This combination of indicators is a powerful setup for identifying sectors likely to outperform for an extended period.

Here is the sector found using the scanner.

Nifty Financial Services / Nifty 50 Ratio Chart:

Want to learn how to scan for these setups? Let us know in the comments below!

@Ritesh Badai No Sir.

@Deepakk Chabria Swap to Largecaps.

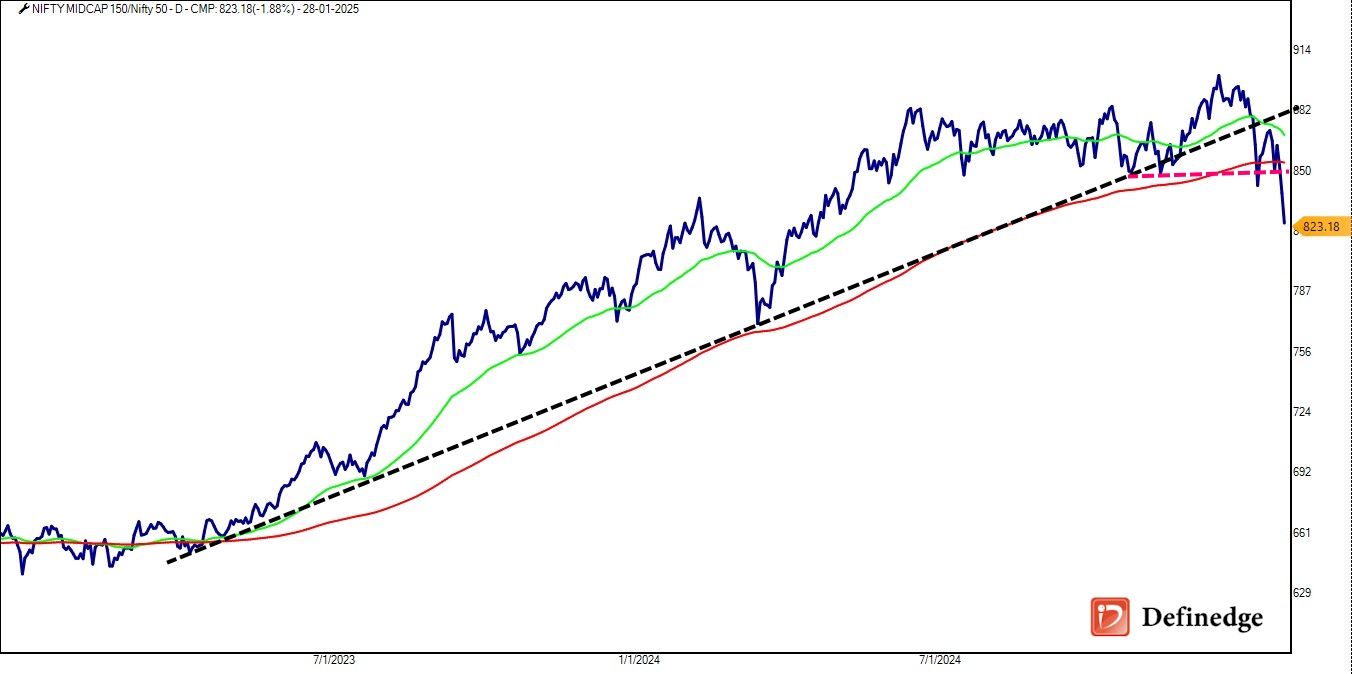

Timing is key in stock trading, but knowing when to buy what is crucial too. Traders often face the decision of whether to focus on midcap or largecap stocks. Both have their cycles of outperformance and underperformance, and identifying these cycles is essential for making profitable trades.

The Role of Ratio Charts

To analyze these cycles, traders use ratio charts, which compare the performance of one group of stocks against another. The NiftyMidcap150/Nifty50 ratio chart compares midcap stocks to largecap stocks, offering insights into market trends.

Analyzing the NiftyMidcap150/Nifty50 Ratio Chart

Currently, the ratio chart shows a topping structure and a breakdown from a rising and horizontal trendline, signalling the end of midcap outperformance. More convincingly, the ratio has fallen below both the 50-day and 200-day moving averages, indicating a shift from midcaps to largecaps.

What Does This Mean for Investors?

The breakdown in the ratio chart suggests it's time to focus on largecap stocks. Largecaps are typically more stable and less volatile, making them an attractive choice in uncertain market conditions. This shift marks a transition from riskier, higher-growth midcaps to more reliable, safer investments in largecaps.

So, Goodbye Midcaps, Welcome Largecaps — it's time for a more cautious investment strategy.

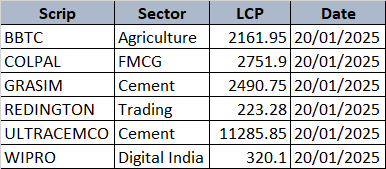

Stock List 25th Jan 2025

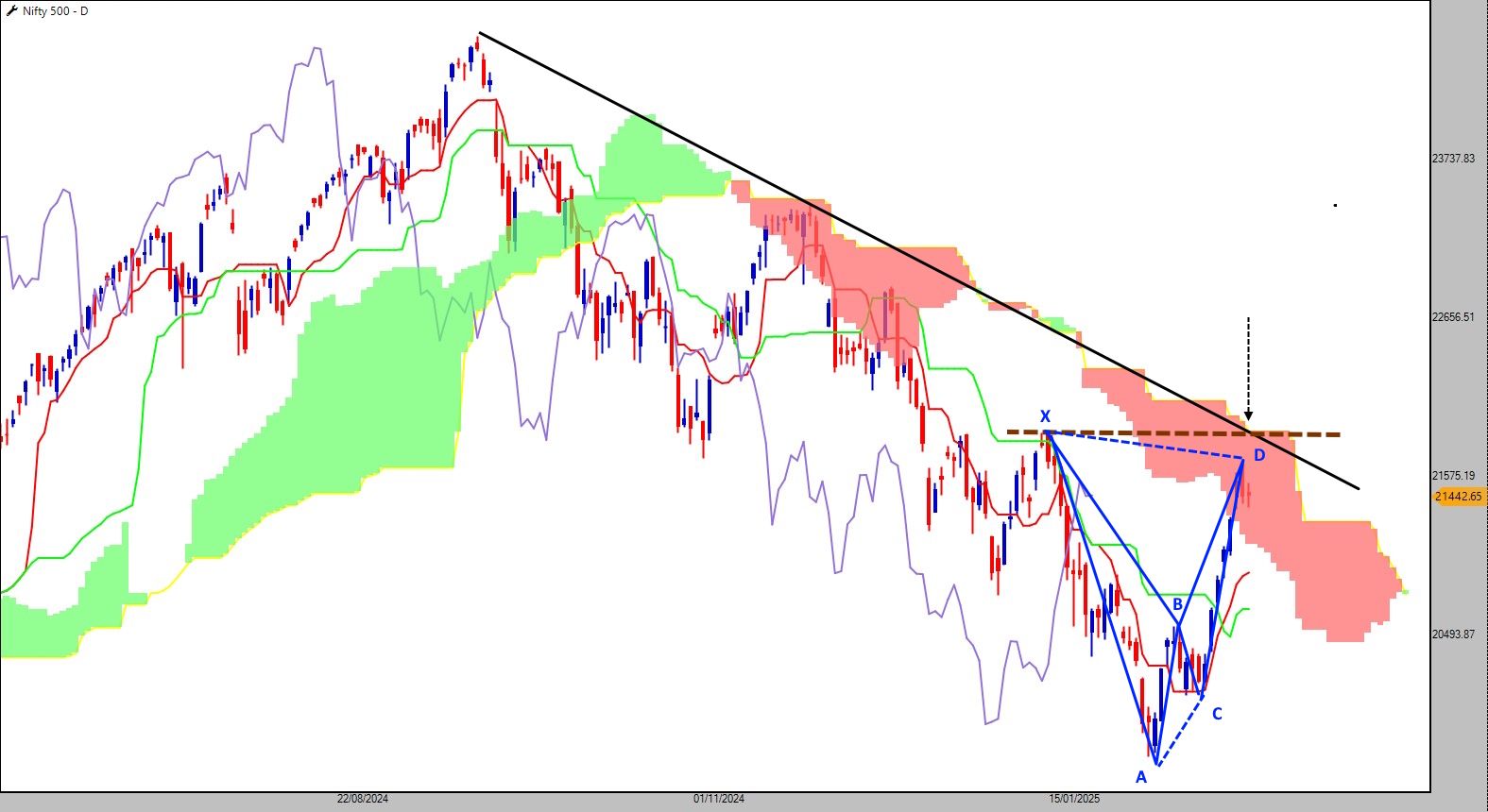

On the weekly chart of Nifty 500, the bears lack the follow-up momentum after breaking the previous swing low, and the current candlestick pattern highlights that exhaustion may be another case of failure for bears.

Some interesting stats on the constituents of Nifty500 on the RSI indicator. Want to read more about RSI, click here

Around 60% of the stocks are currently in the positive zone, which indicates that a majority of the market is seeing bullish momentum. Let's break this down further:

What's your take on the markets, write in the comment below.

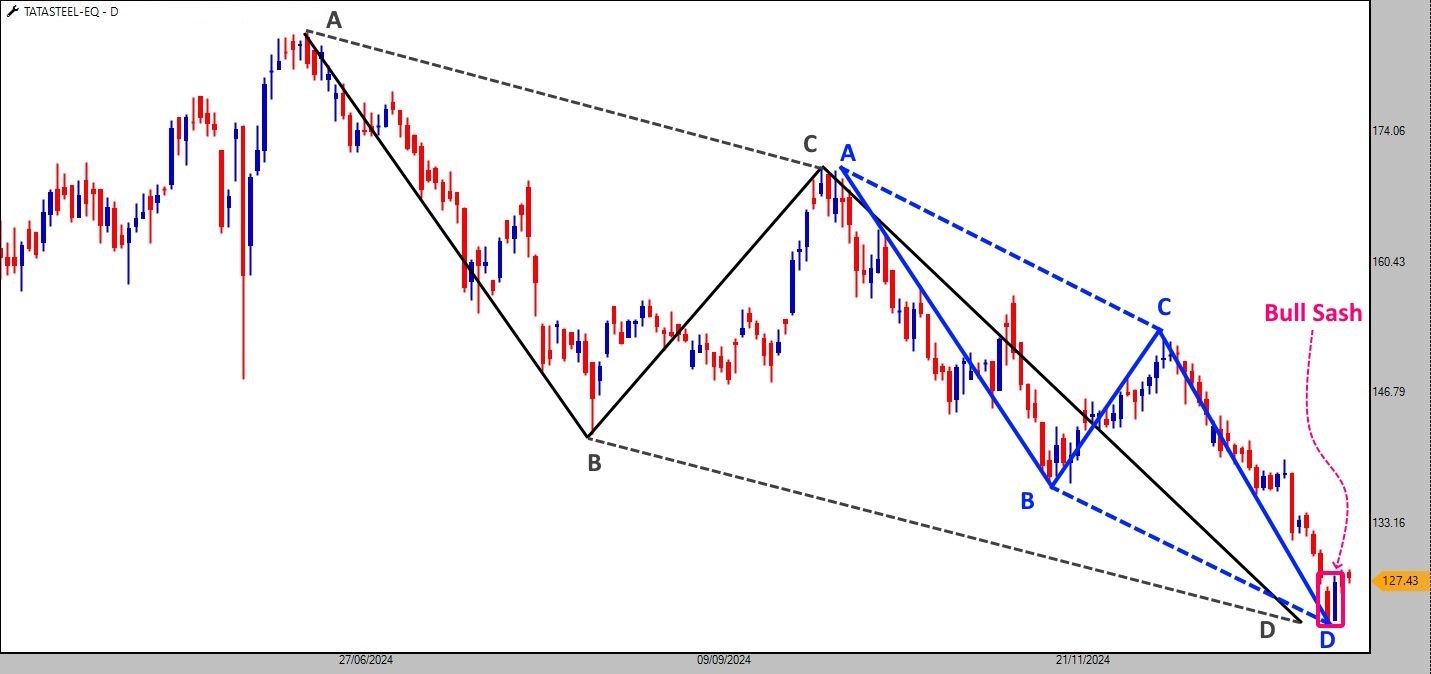

Pattern negates on the Close below 122.

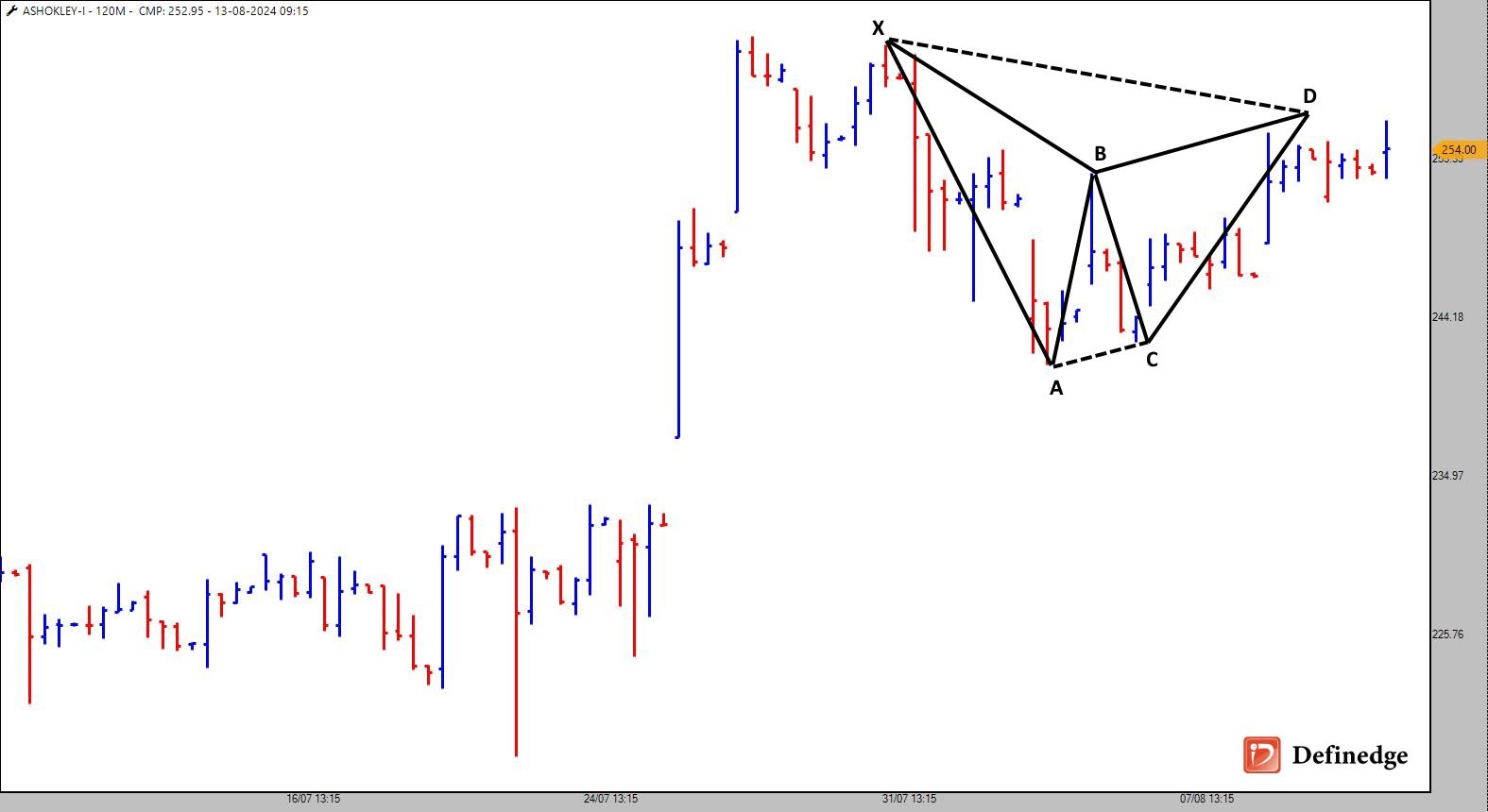

Pattern negate below 48,500.

Stock List 11th Jan 2025

Bank Nifty - 50,7xx to 51,300+

Nifty50 slips back below its 200DEMA as the last week witnessed the bearish momentum.

Nifty50

But there is something exciting for bulls as well.

The Nifty Midcap150 and Nifty SMLCAP250 are hovering around the 50DEMA and are 4% and 5%, respectively, away from their 200DEMA.

Nifty Midcap150

Nifty SMLCAP250

Hey, bulls, it's time to shift focus on outperforming Midcap and SmallCap stocks.

Pattern negates below 1,740

@Muhammed Zuber Saleem Mansoori Sir, I request you to watch this video on Point & Figure

The Nifty 50 index recently staged a strong comeback, rallying from 23,300 to 24,700 levels. However, technical analysis suggests that the momentum might be waning, with the index potentially entering a period of range-bound trading.

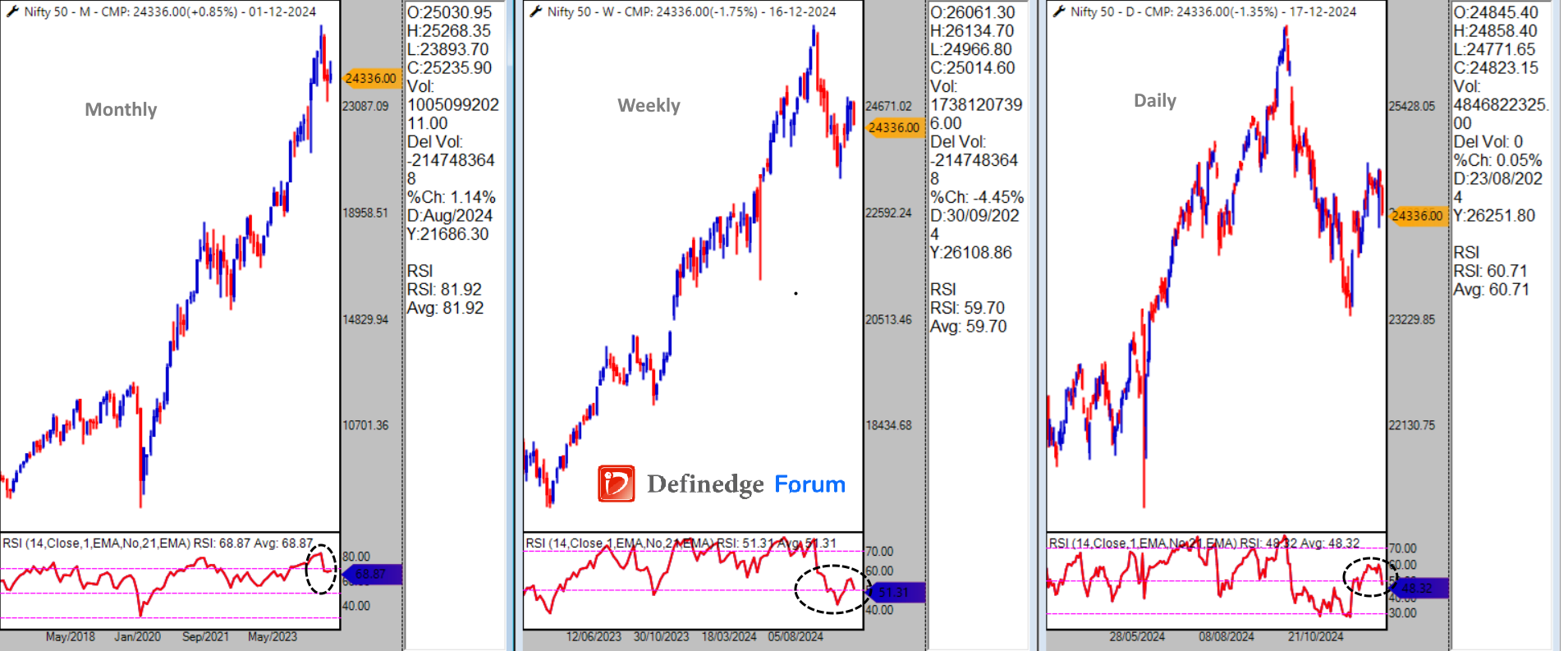

We are glad many of you are following the Bold Bulls Setup of Monthly, Weekly and Daily RSI.

Monthly RSI: At 68, the monthly RSI indicates a bullish long-term trend and the uptrend for the Nifty remains intact.

Weekly & Daily RSI: Both the weekly and daily RSI are trending below 60, around the 50 level. This signals a neutral stance, suggesting that the current momentum might be losing steam.

Bulls would need to drive the market higher with a more decisive and rapid move to regain control and resume the uptrend. Until then, the Nifty may consolidate within a defined range, and traders should focus on stock-specific action.

@Amit Tuli Thanks for following the strategy and sharing your experience.

Regarding Bold Bulls on Candlestick (OHLC) and P&F, both have different calculations for RSI. I would suggest to stick with one. The RSI on multi-time frames is recommended on the OHLC chart.

For entry, you can implement based on 0.25%, but if you think about the setup, it will qualify when the stock is in the momentum+trend. Hence, when the stock qualifies for the Bold Bulls, it will likely be with the DTB pattern.

@Arko Currently, we don't have the feature of Running or Fresh in Pattern Finder.

Your feedback is appreciated. We will check with the app team about the possibility of implementing it.

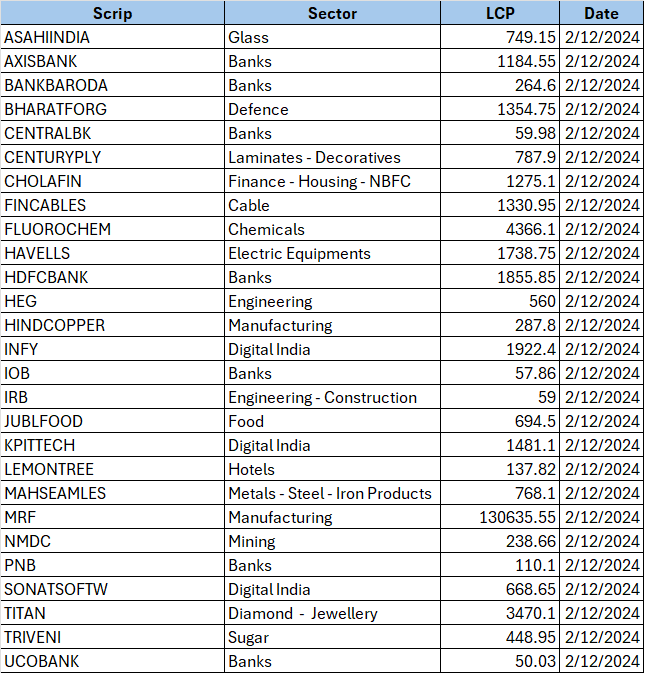

Stocklist 7th Dec 2024

@Radhakanta-Samantara You can watch here https://www.youtube.com/watch?v=Vk_jNaHwosI

Nifty 24,600 to 24,850

The Bulls can be in the game above 24,600 while the breach of 24,350 will be important to watch on weekly expiry.

@Radhakanta Samantara Feedback appreciated. We will work on it.

Stocklist 30th November 2024

Hi Sir,

Request you check the Insights page, where you can find various technical and fundamental analysis studies.

You can start from here https://insight.definedgesecurities.com/category/basics-of-technical-analysis/

Infy 1,930 to 1,875

Want to Learn Harmonics?

Visit our Definedge Gurukul https://gurukul.definedgesecurities.com/courses/harmonic-trading-patterns-simplified/

The Bulls must cross 24,360-24,370 to be convinced to look for an expiry around 24,500.

It seems to be the range-bound day if 24,100-24,370 is not breached.

Bank Nifty can be the one that can lead the Nifty higher as HDFCBANK closed above Rs.1,800.

The Nifty opened strong on Monday but faced resistance, as highlighted. Profit-booking was witnessed in the first hour which could be due to the expiry week.

The market needs to decisively break through the recommended resistance level to sustain the uptrend.

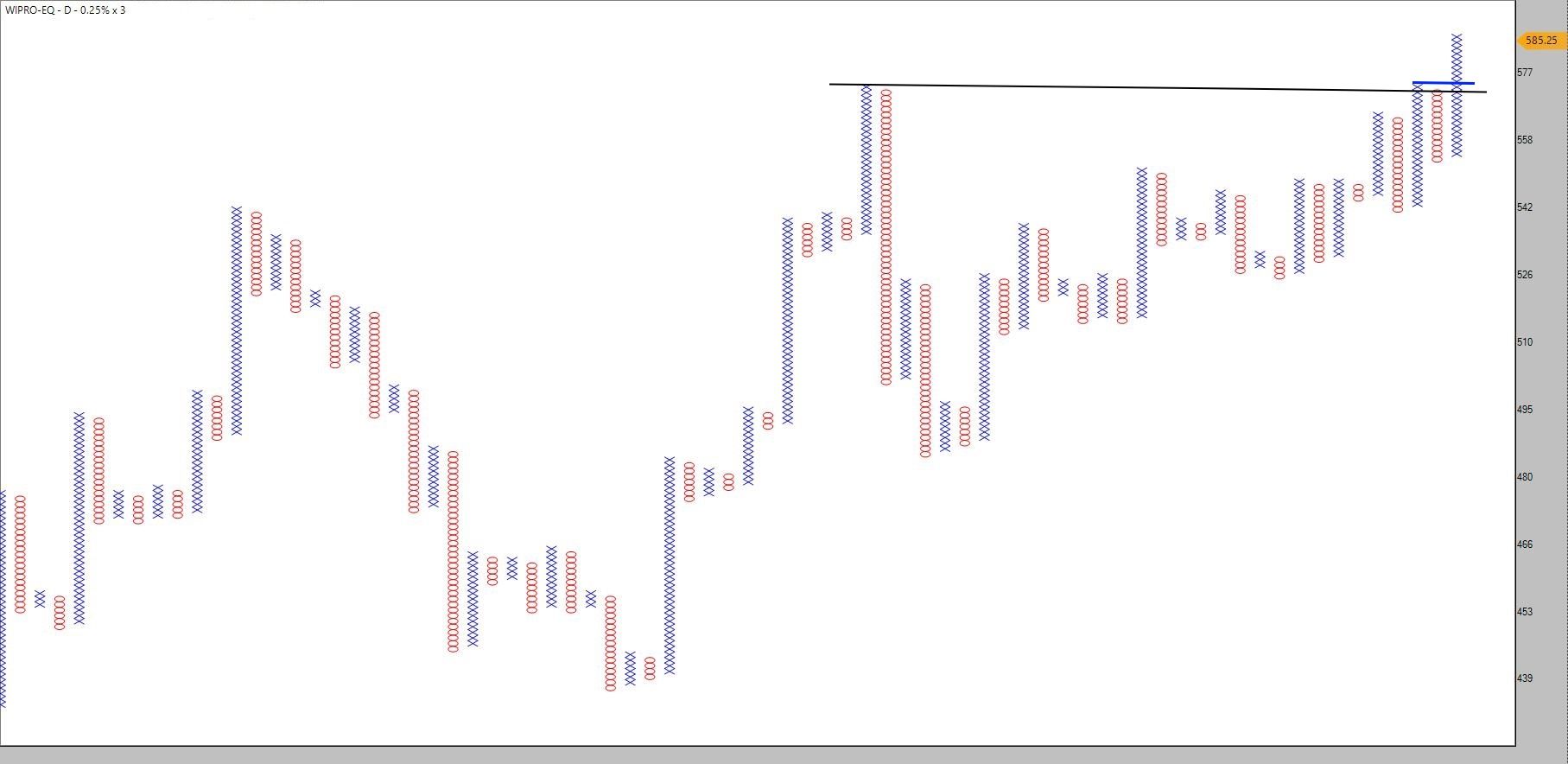

HCL Tech

Persistent

Wipro

As highlighted by the Bullish Harmonic, the Nifty has reversed, and GIF Nifty indicates an opening of around 24,300. I will book profits at the open because of...

Nifty will now enter the major resistance zone of 24,327-24,600 at 62DEMA Channel, sloping downwards.

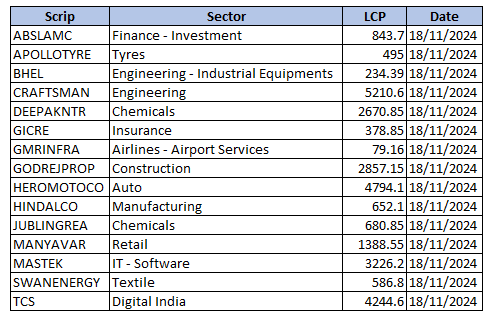

Stocklist 23rd November 2024

The Harmonic pattern still hasn't been negated.....Can we rally above 24,000?

(CMP-23,700)

Hi Sir, Sagar from our team will connect with you on the same.

@Tejas Shah Sir Scanner facility is available in RZone Pro. Request you to check here https://www.definedgesecurities.com/products/rzone/

The Nifty has reversed back to 23,500, with 200DEMA (Close) placed at 23,540, but the major hurdle lies at 23,660, which is 23,660.

Last week, the index slipped in the 200DEMA Channel {200DEMA-High and 200DEMA-Low} and hasn't closed above the 200DEMA-High. Though there was an attempt by bulls, bears convincingly took an opportunity in Tuesday's last hour of the trading day.

It's another attempt by the Bulls today. The Nifty is trading 200 points up at 23,550 around 10 a.m., and if they manage to close the day above 23,660, this is a sign of a potential reversal on the chart.

What are your thoughts?

Do share your views.

@Ashutosh Jain 10 Weeks...I am not considering average.

@Shyam S Sir, the platforms are separate, which makes it challenging to synchronize all the data between them.

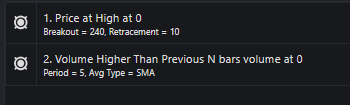

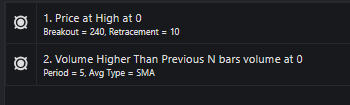

Here is a screenshot of the system builder in case you wish to create the system in your login.

@Deepak Singla Thank you for your message.

Sir both the entities and the server are separate, which makes it challenging to synchronize all the data between them.

In case you wish to create the system in your login, here is the screenshot of the system builder.

@Nisanth TS Yes.

Many stocks are within the 10% range of the 52-week high, but only Banco qualifies due to volumes.

In the ancient philosophy of Yin-Yang, the concept of duality teaches that within every bad, there is something good, and within every good, there is something bad. This dynamic balance is not just a mystical idea; it has practical applications in various aspects of life, including investing.

Looking at the present market momentum, we see a classic example of the Yin-Yang principle in action. The Nifty50 and Nifty500 indices are both down more than 10% from their respective highs, signalling a bearish phase. Yet, despite the broad market pullback, some stocks continue to show outperformance, trading at or near their 52-week or all-time highs.

The Skyline Strategy

For traders with a Long-Only Strategy, focusing on stocks that are holding up well despite a broader market decline can be a smart strategy in challenging market conditions. We call this approach the Skyline Strategy. The idea is simple - identify stocks within a 10% range of their 52-week or all-time highs. These are stocks that have shown strong relative strength compared to the broader market and may continue to perform well, even as the rest of the market is struggling.

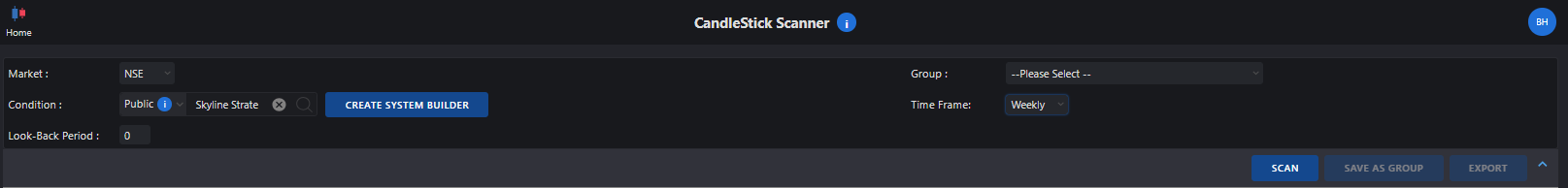

However, finding stocks near their highs alone is not enough to form a reliable trading strategy. To refine the approach further, we add a layer of volume-based filter. Specifically, we look for stocks where the trading volume is at its 10-week high. The rationale behind this is simple - strong volume at or near highs is often a sign of institutional interest and indicates that the stock has the necessary momentum to continue moving upward.

When using this strategy, it's important to scan for stocks using a weekly chart, as the 10-week volume criterion applies to weekly trading data. For traders using RZone, we have made the scanner for this strategy available in the public library, so you can quickly implement it and start identifying stocks that meet the criteria.

Backtesting and Risk Management

As with any trading strategy, it’s essential to backtest the Skyline Strategy to ensure it aligns with your risk tolerance and trading goals. We recommend a risk management approach where the stop loss is set at 10% below the entry price while the target is set at a 25% gain. This risk-to-reward ratio ensures that the potential reward justifies the risk even if a trade doesn’t work out.

@Nirav Merchant Yes it's in Bank Nifty too.

Those you want to understand the Bottom Palanthi Pattern, here it is:

Yesterday's bullish harmonic pattern at the 23,368-23,378 level, followed by a low of 23,350 and a subsequent rise above 23,750, indicated a potential reversal. Check the Chart here

Today, the Nifty50 opened with a positive bias, forming a bullish sash candlestick pattern, further strengthening the reversal signal. This pattern at the 200-day Exponential Moving Average (EMA) channel reinforces the bullish sentiment.

To capitalise on this opportunity, we consider exploring stocks from the Nifty200 index that have also formed bullish sash candlestick patterns. Here is the list:

You can check the Harmonic and Candlestick Course at Definedge Gurukul.

@Saptarshi Ghosh Thanks for correcting....It is 23,378-23,369

It's Do or Die for Nifty at 200DEMA Channel, Will History Repeat?

Nifty 500

Nifty Midcap150

Nifty SMLCAP250

Mangesh Joglekar shares his Options Trading System for the chart he shares with the Definedge family.

Here is the link to the blog

If you are interested in learning "how to find these stocks," please comment below.

@L M Can you plz share the chart which is not matching?

Learn HARMONIC TRADING PATTERNS with Definedge Gurukul

@Rajnandini Darkase Death Cross

@Shyam S Yes it is available in Zone.

You can create in Tradepoint as well.

Criteria

@Arijit Nag Golden Cross is when 50DEMA is above 200DEMA - CMP shouldn't necessarily be above the DEMA's.

How to Find Potentially Bullish Stocks During Market Corrections:

To help our readers identify opportunities in this volatile environment, we focus on two key technical indicators:

Golden Cross on the Daily Chart

Oversold RSI (Relative Strength Index)

A Ready Scanner in RZONE is available for traders looking to take advantage of this market correction.

Read more here https://www.definedgesecurities.com/blog/education/opportunity-in-a-bear-market/

Stocklist 2nd November 2024

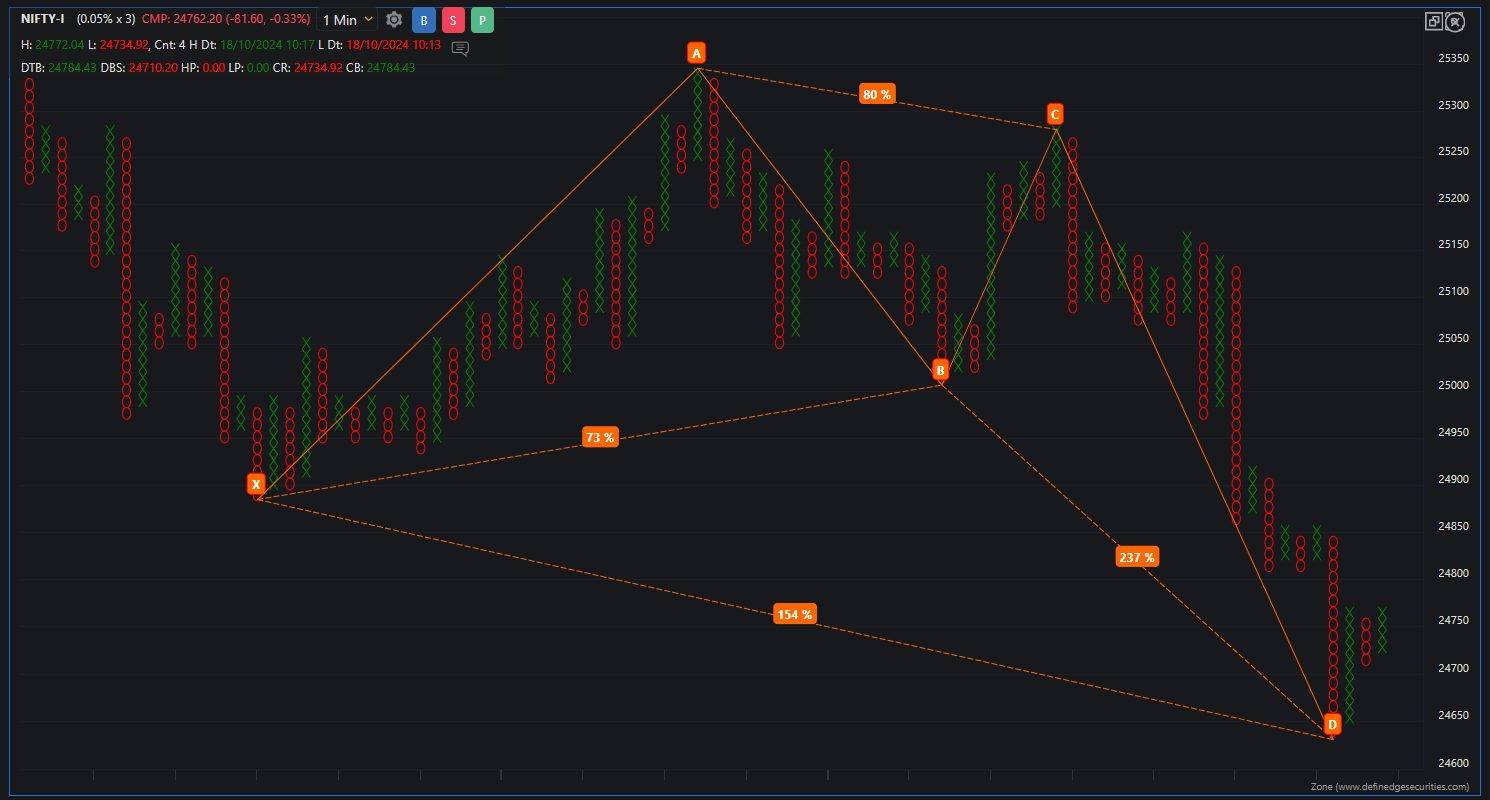

On the Heikin Ashi daily chart of Nifty50, bearish exhaustion is evident at the support zone of the 100DEMA Channel (created using the 100DEMA High and Low), indicating that bears respect the short-term pullback within the long-term bullish trend.

However, this exhaustion does not confirm a bullish reversal until a Bullish Heikin Ashi candle closes above the 100DEMA (High) at 24,628.

Additionally, the oversold RSI supports the potential for reversal, but awaiting confirmation is crucial.

@PRANAV GULABANI 200

Banknifty 51300 to 51700

The Nifty50 Daily 0.25% X 3 Point & Figure (P&F) chart shows some promising technical signals.

The index trades near a crucial support level at the D-Smart Line, 24,557. After hitting a low of 24,567, the Nifty rebounded and closed the week at 24,854, indicating a potential bullish reversal.

If the Nifty can maintain support above 24,557 and close above 25,175, it could signal a renewed uptrend.

Additionally, the PMOX is still showing bullish signs, suggesting that there's still some strength in the market. Momentum is a key factor in market trends, and as long as PMOX remains positive, there's hope that the Nifty will recover and regain its upward trajectory this Diwali.

Stocklist 19th Oct 2024

@Prashant Vaikunthe Enjoy Sir

Bullish Entry Above 24,808 (F)

Pattern Negates Below 24,600 (F)

HAL is breaking out of the falling trendline and the Moving Average (MA) Squeeze.

MA Squeeze is when the price consolidates within 50DEMA and 200DEMA with the golden cross.

Stock list 5th Oct 2024

Pattern Negated

BankNifty Futures - Bullish Harmonic @ 52,250

Pattern Negates below 52,000

Appreciate your feedback. Let us connect with the team on the same.

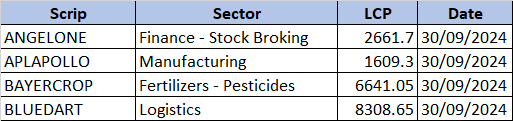

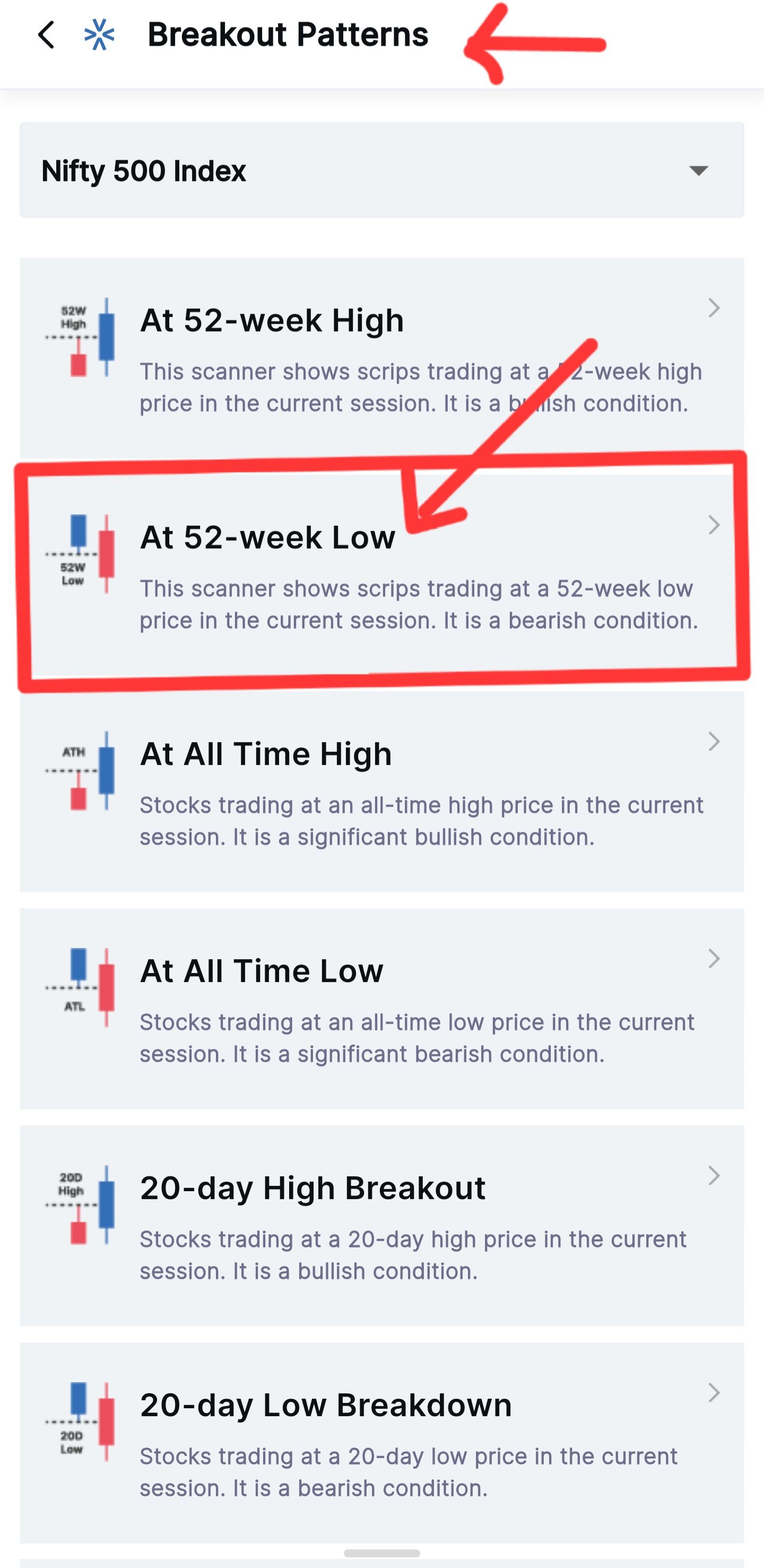

When looking for value buys in fundamentally strong companies, it's often smart to purchase at lower levels, even when a stock is trading near its 52-week low. However, when it comes to trading in a bullish market, the strategy must shift.

In a market where the benchmark index is reaching all-time highs, you MUST avoid stocks that are trading at 52-week lows. These stocks often lack the momentum to benefit from the broader market trend and could potentially underperform.

How can you find these stocks?

It's simple. Open the Zone Mobile App, navigate to the Scanner Page, and select Breakout Scanners 》 At 52-Week Low.

As a trader, your focus should be on stocks that are in momentum and either in sync with or outperforming the benchmark index. This approach will align your trades with the market's bullish momentum, increasing the likelihood of profitable opportunities.

What is your STRATEGY?

Do comment below.

Breakout Retest @ 710

@Ramakrishna Chamarthi It's Adaptive RSI

Hindalco - Getting ready for a BIGGER move - Potentially 900 - may extend to 4-digit levels.

Pattern negates on a close below 640.

@PRANAV GULABANI Yes

GodrejProp 3100CE Oct

Stock appeared on Trividh, but do check Liquidity

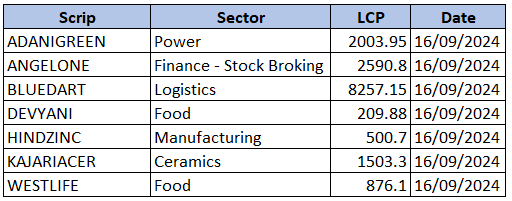

Stocklist 21st Sept 2024

Bank Nifty and Pvt Banks leading the day.

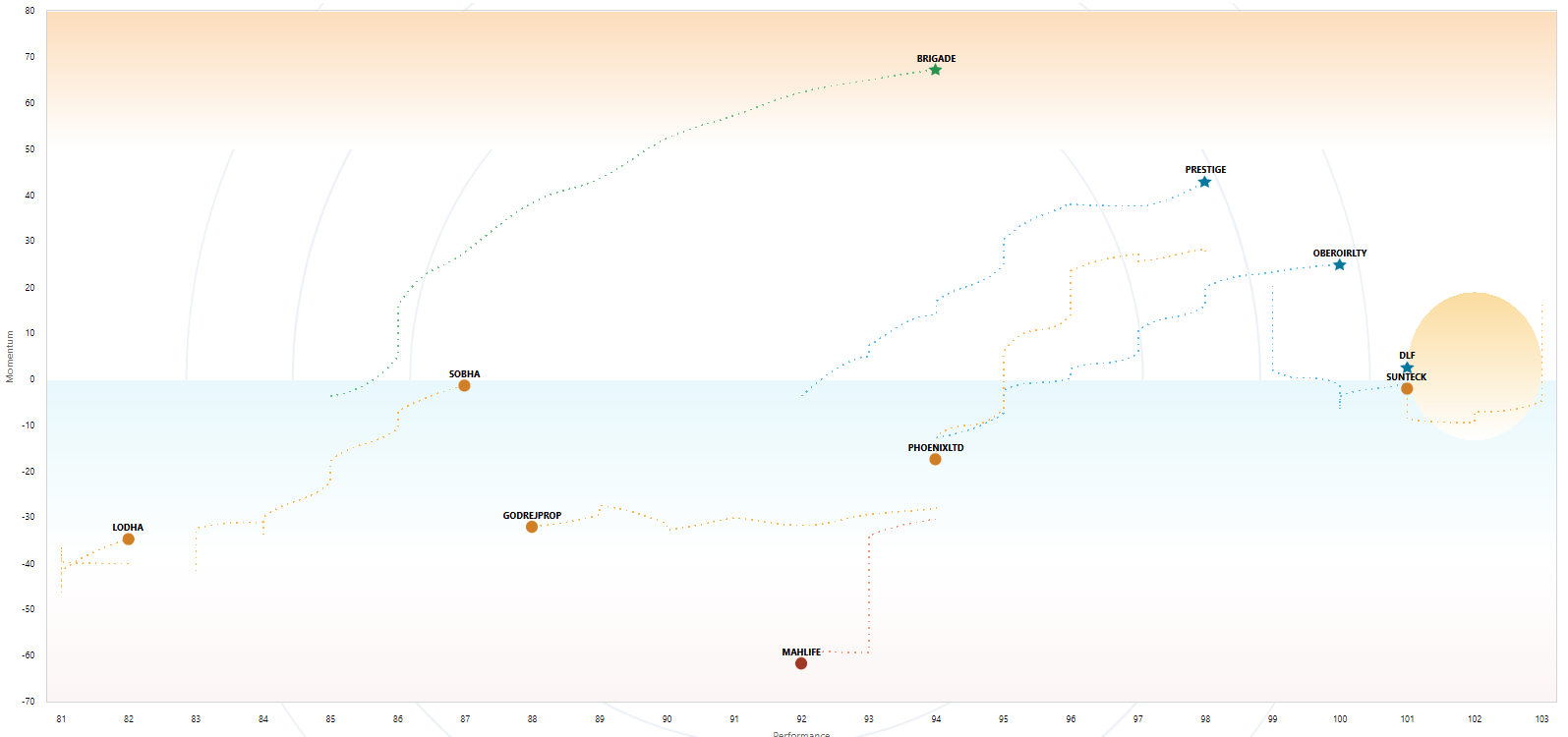

Technically, the Nifty Realty daily chart witnesses the breakout as it reverses from the 62DEMA Channel.

On the DeMAP, few pf the Nifty Realty constituents are gaining momentum and trend.

@Prashant-Vaikunthe Yes. The counts were 29 and 39, both achieved.

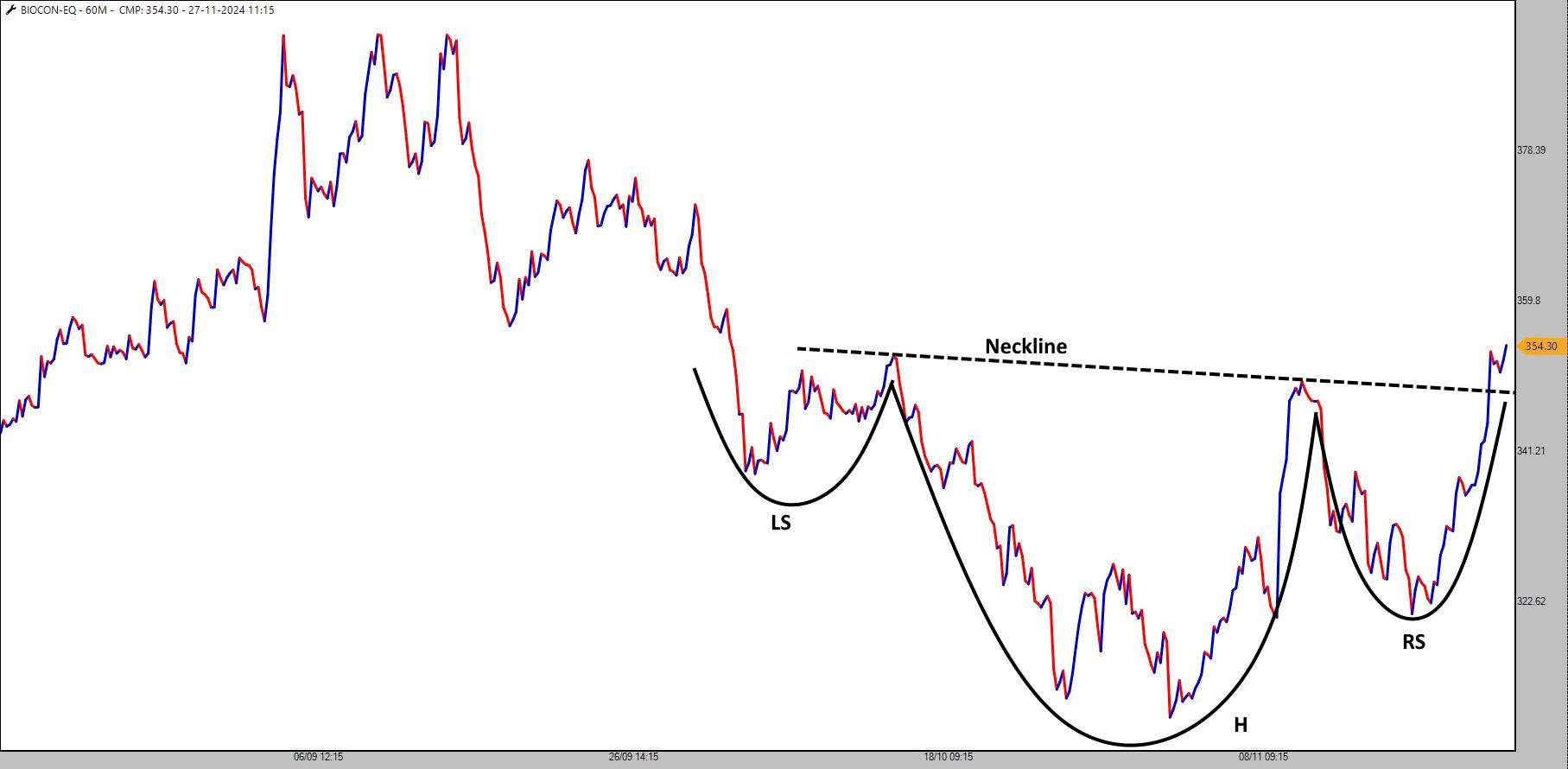

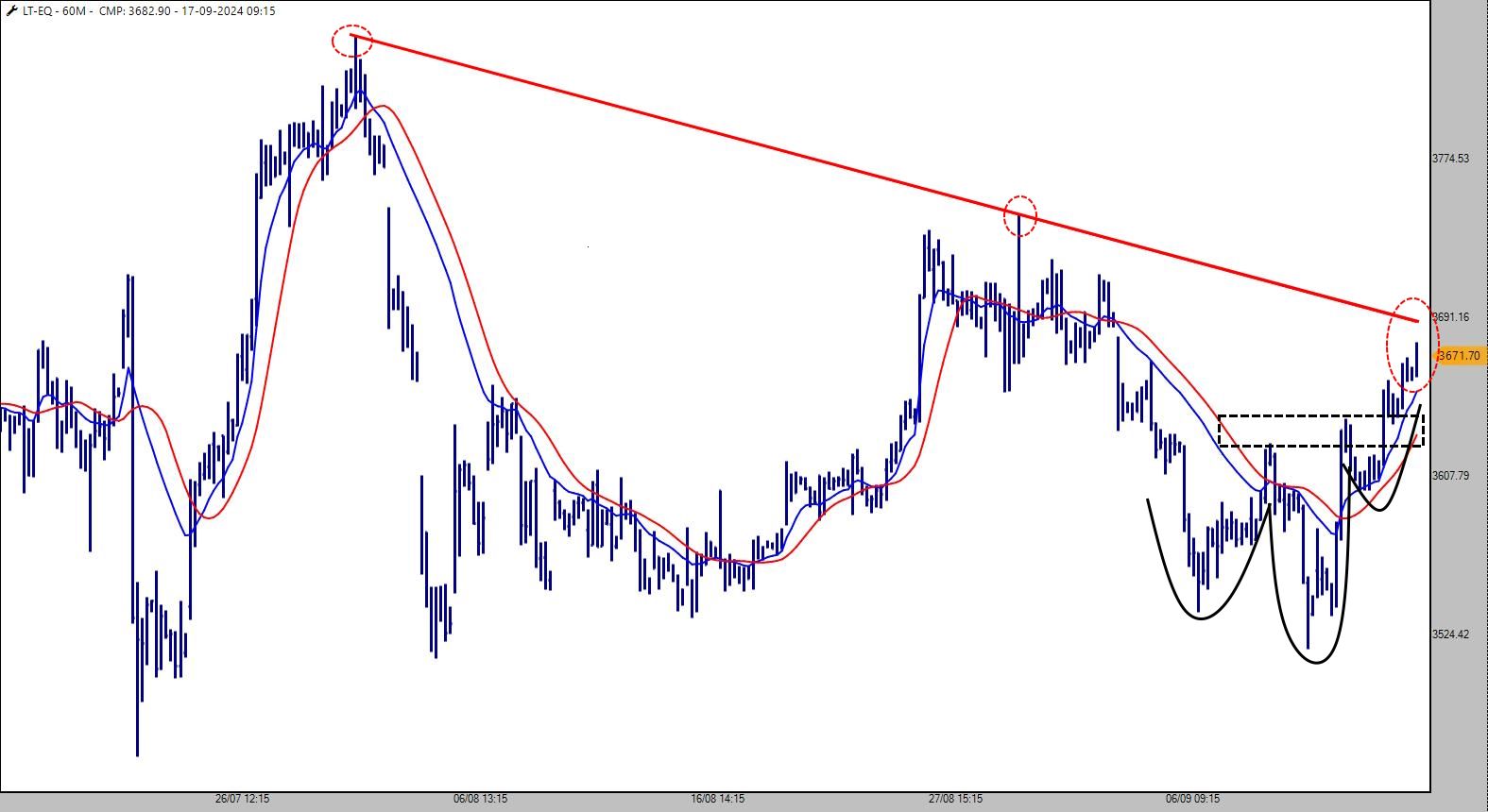

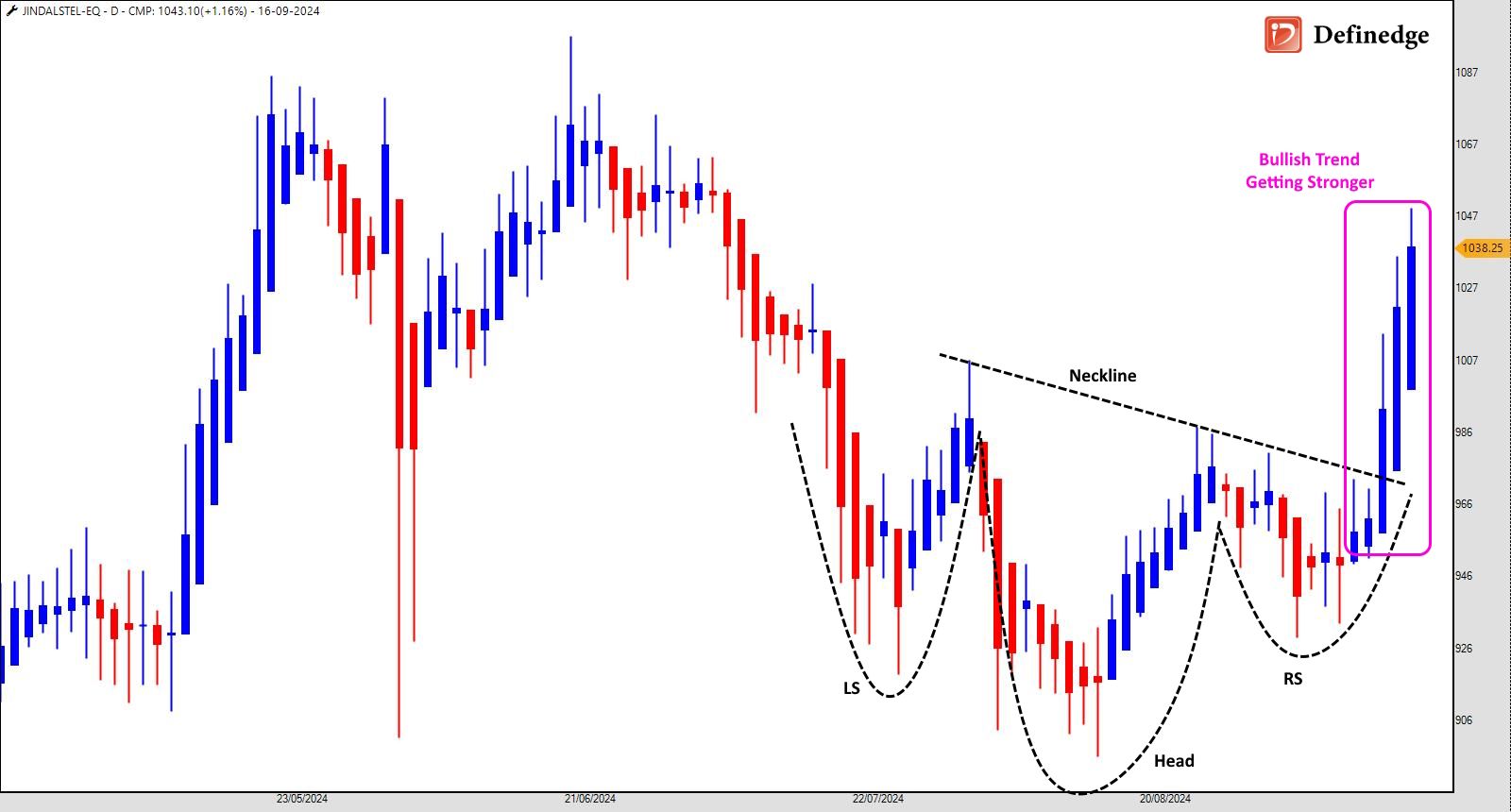

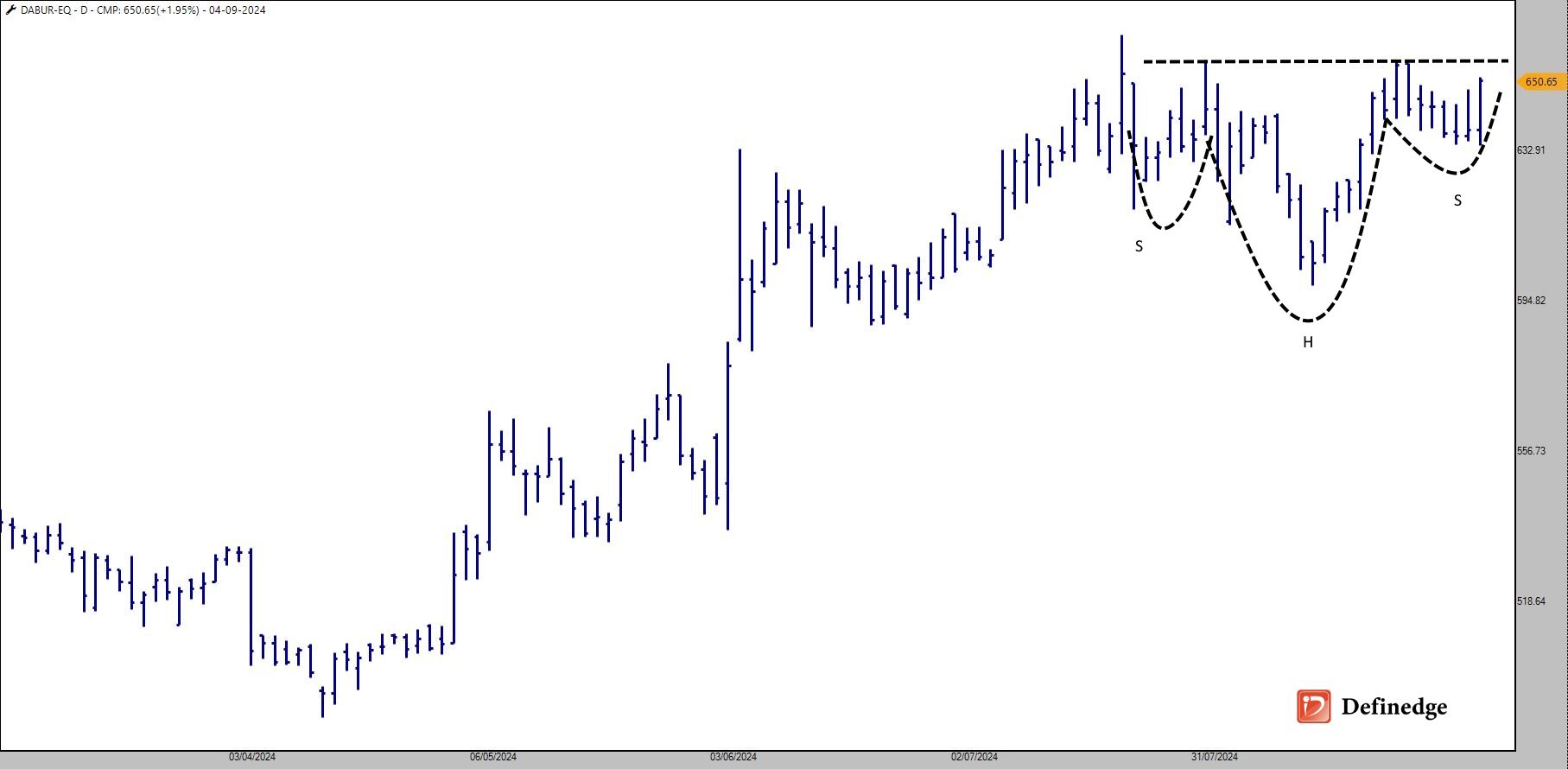

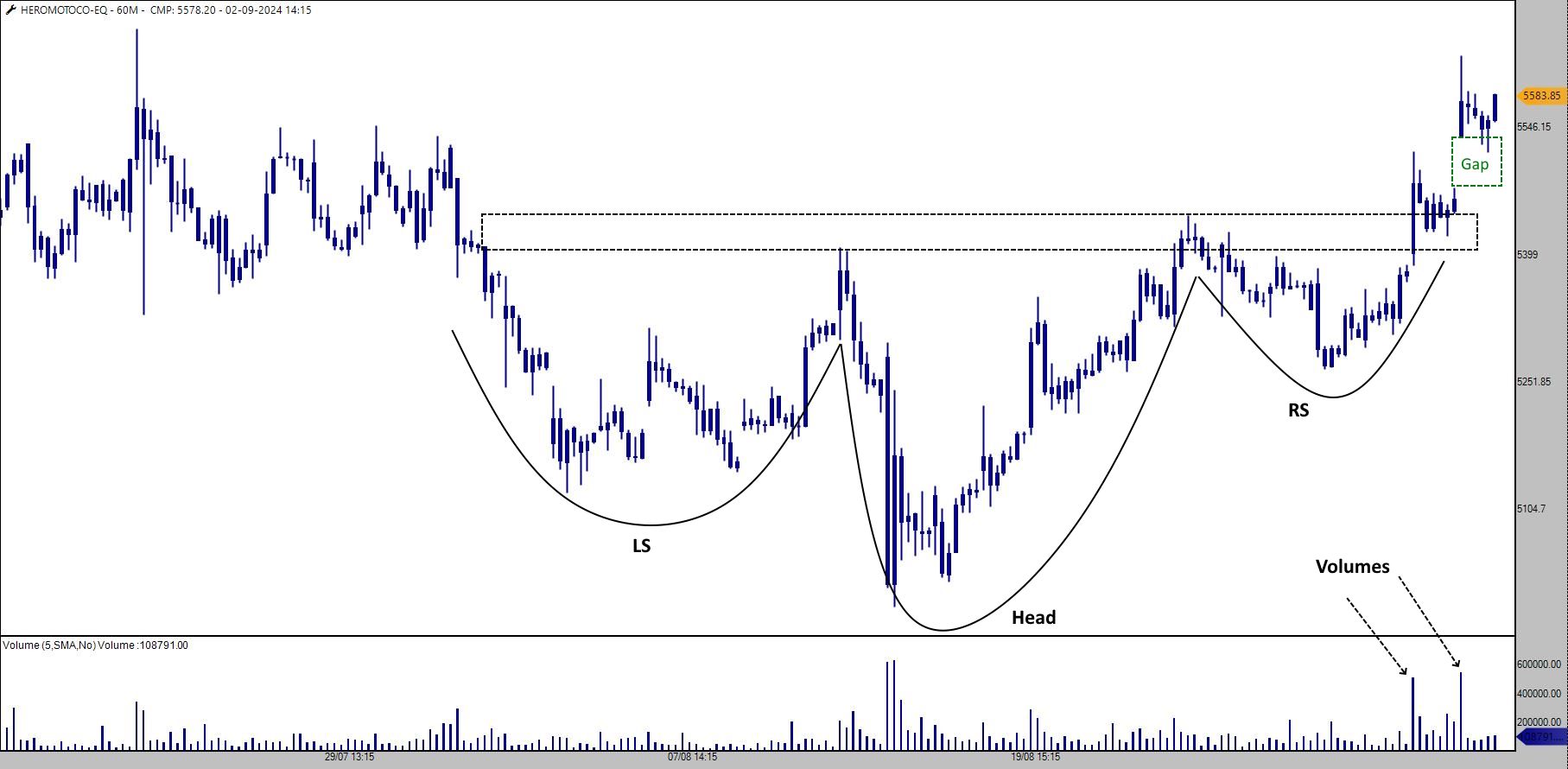

Bullish Head & Shoulder and Trend Getting Stronger on Heikin Ashi Chart

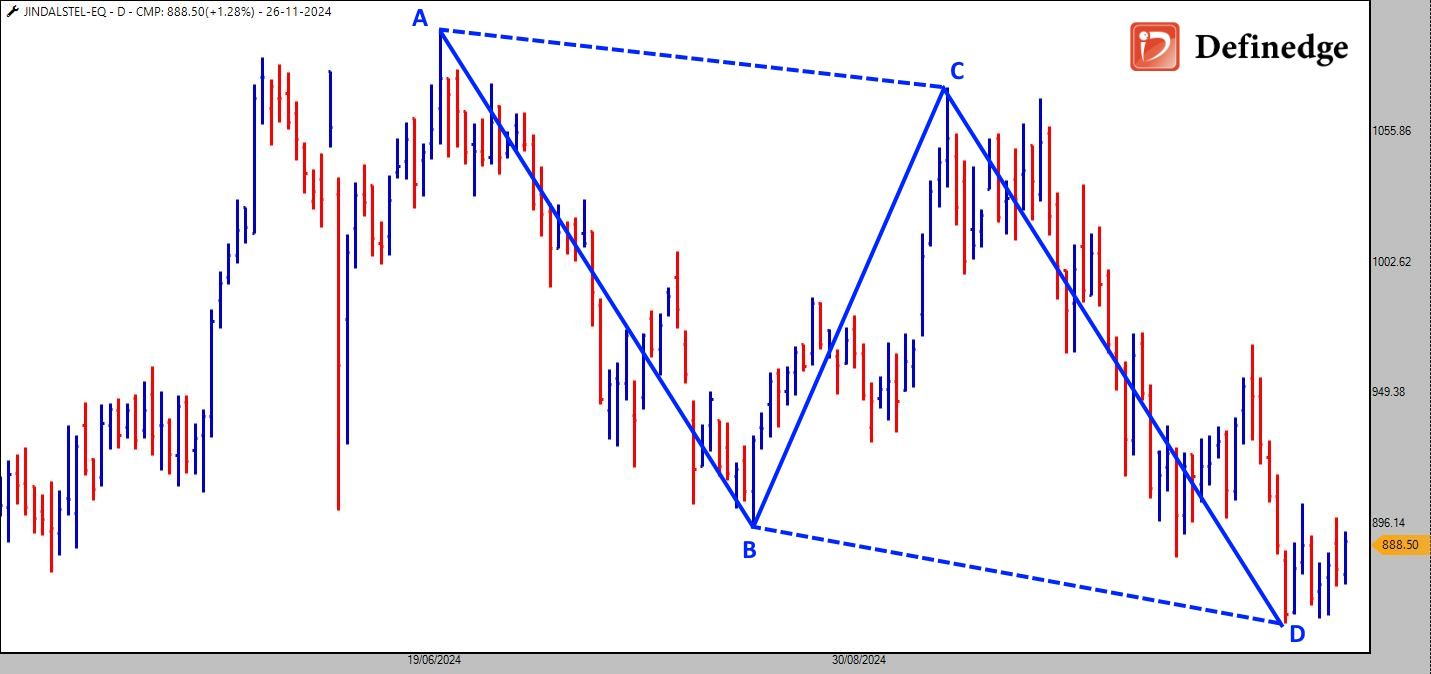

JindalStel 1040CE - TTB Breakout

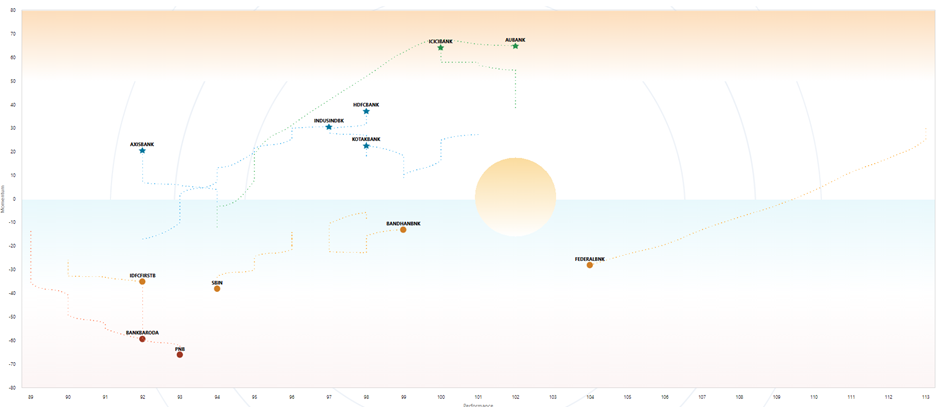

India's private banking sector is again in the spotlight as major players such as Axis Bank, ICICI Bank, Kotak Bank, IndusInd Bank, and HDFC Bank are witnessing strong bullish momentum. As the Nifty index surges to new all-time highs, market analysts and traders are closely watching whether these banking giants can push the Bank Nifty index to its own record levels, given that it's just a few percentage points away.

What is DeMap by Definedge?

DeMap, an advanced analytical tool developed by Definedge, offers traders and investors a unique approach to market analysis using multiple charting methods and indicators.

DeMap stands out by providing market participants with in-depth insights into sectoral trends, helping them identify emerging opportunities in various sectors. Through its price patterns and trend identification tools, DeMap is a guiding torch for traders to stay ahead of market movements and align their strategies with real-time data. You can watch this video to learn about DeMap. Click here

Bank Nifty: Poised for a Breakout?

The Bank Nifty index, comprising the largest banks in India, has been a key driver of market movements. While Nifty has already hit an all-time high, It is trailing slightly behind, just a few percentage points away from its peak. The question remains: Can these private banking giants propel Bank Nifty to new highs?

According to technical analysis from DeMap, these banks exhibit strong chart patterns that indicate further upside potential. The Point & Figure charts for ICICI Bank and Axis Bank show clear breakouts above key resistance levels, signalling a continued bullish trend.

As the Nifty soars to a new all-time high, the Bank Nifty following suit to an all-time high may witness a short-covering rally to achieve new highs.

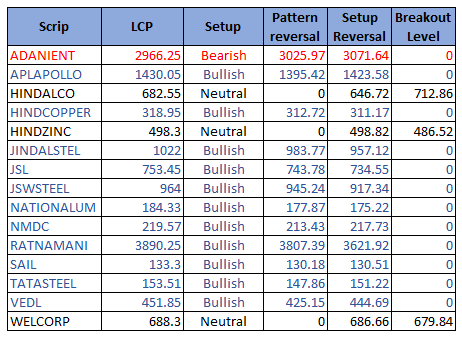

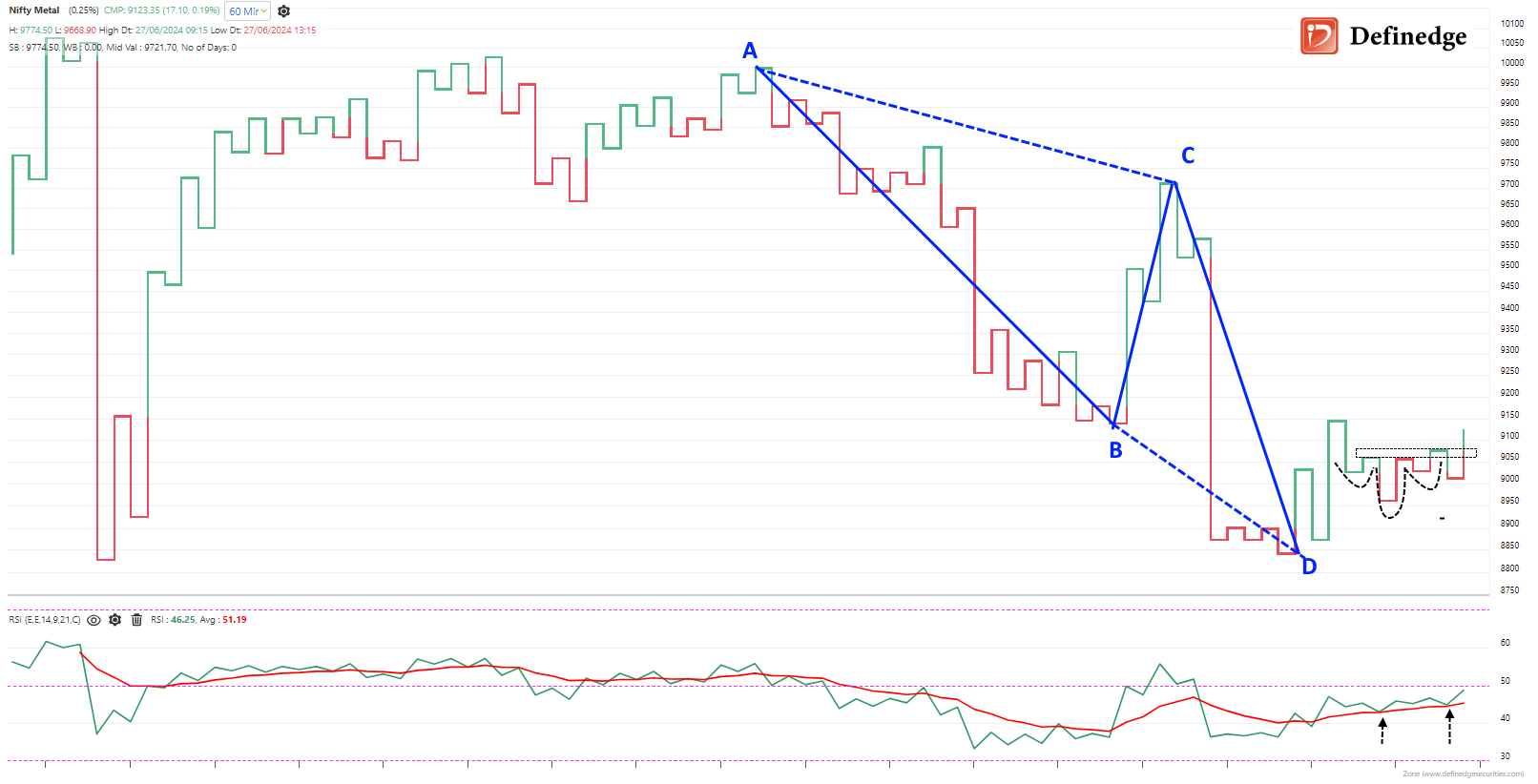

P&F Pattern Setup on Metal Stocks

BankNifty Breaking Out !

@Rajesh Gandhi Below 50713

Technically, the move above 51,500 witnessed multiple rejections.

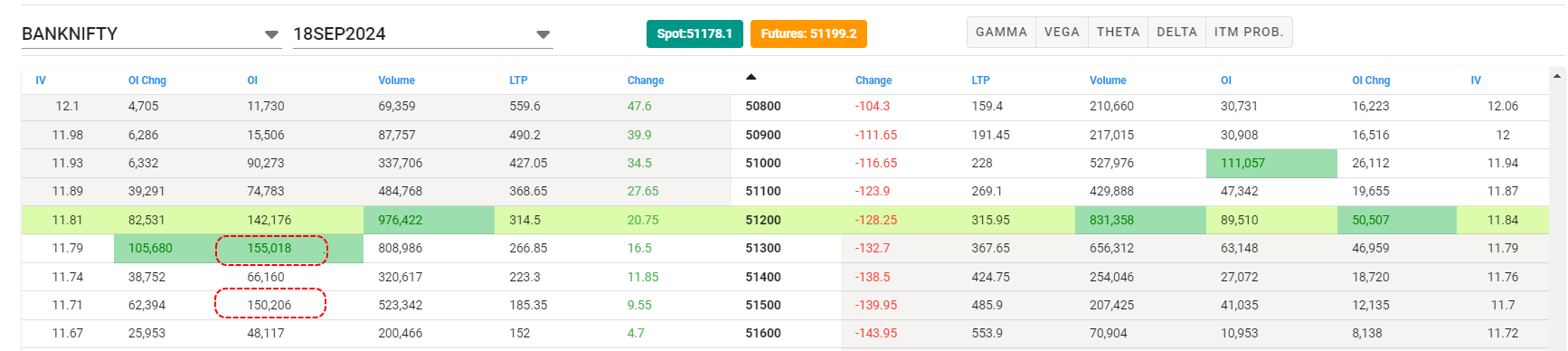

CE Writers are confident of 51,300-51,500 resistance:

The bulls can be in the game only above a convincing move 51,500-51,600 levels.

@Rajesh Gandhi 760

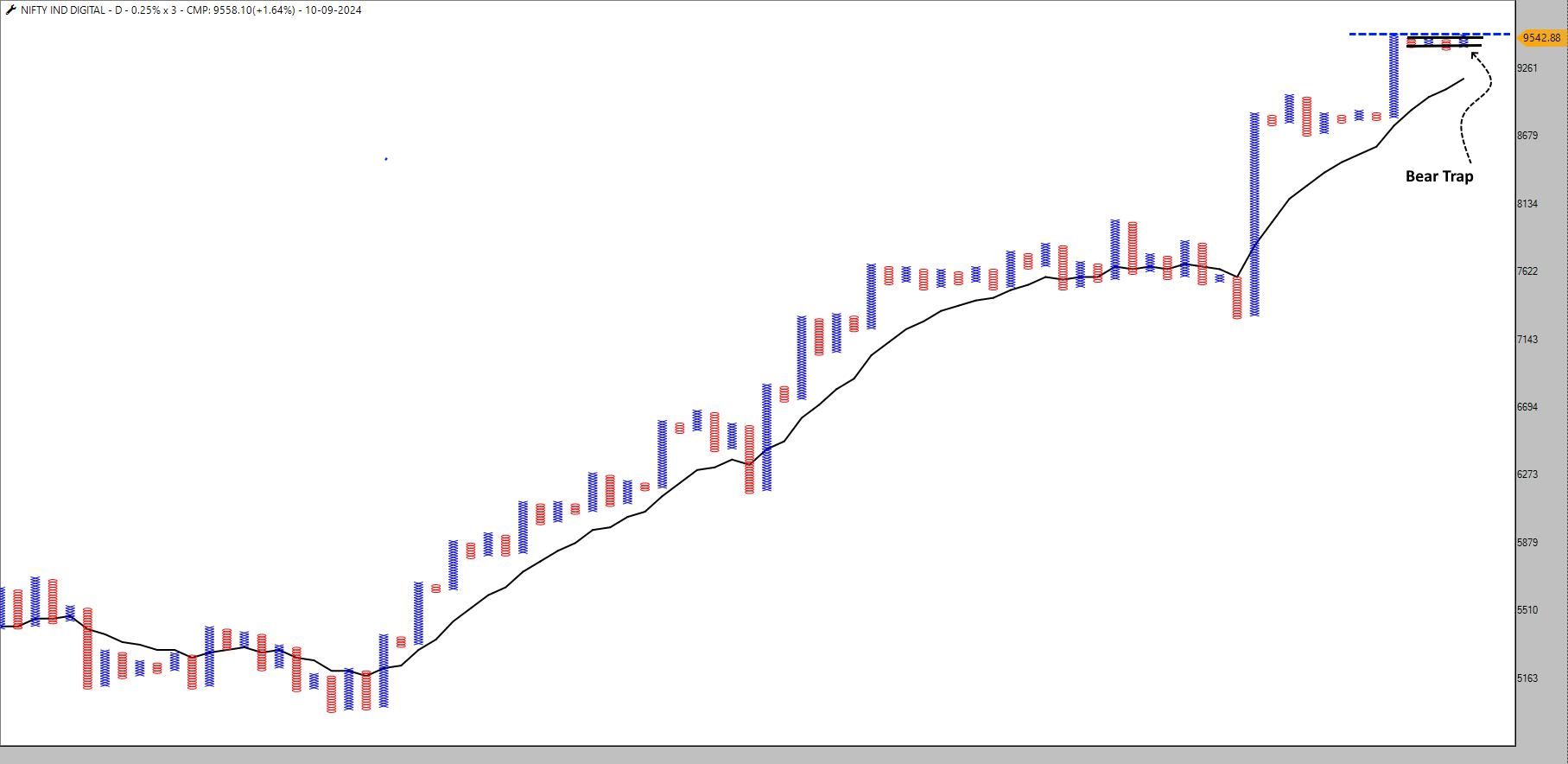

One sector that has garnered significant attention amid this shift is the India Digital sector, represented by the Nifty India Digital Index. This index tracks companies that are at the forefront of India’s digital revolution, including those in IT services, e-commerce, digital finance, and communication technologies. As India continues its push toward digital transformation, the companies in this index are well-positioned to capture growth from increasing internet penetration, digital payments, and the broader push toward a tech-driven economy.

Technical Outlook

Nifty India Digital Index

On the Nifty India Digital Index 0.25% X 3 Point & Figure (P&F) Daily Chart, a clear bear trap is visible after the Anchor column formation. This trap, positioned above the moving average, is a strong technical signal of a potential bullish continuation. The close above the crucial 9,600 level will confirm an anchor column breakout, suggesting that bullish momentum is likely to resume in the coming sessions. Traders and investors should closely watch this level as it could mark the beginning of a fresh upward trend in digital stocks.

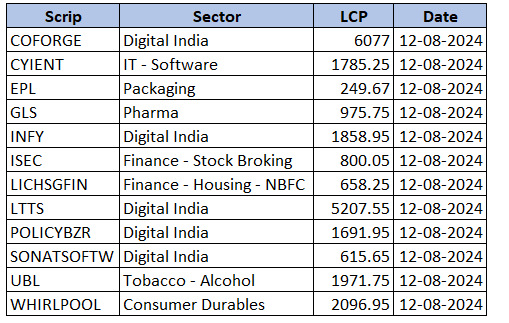

7 Leaders in the Nifty India Digital Index

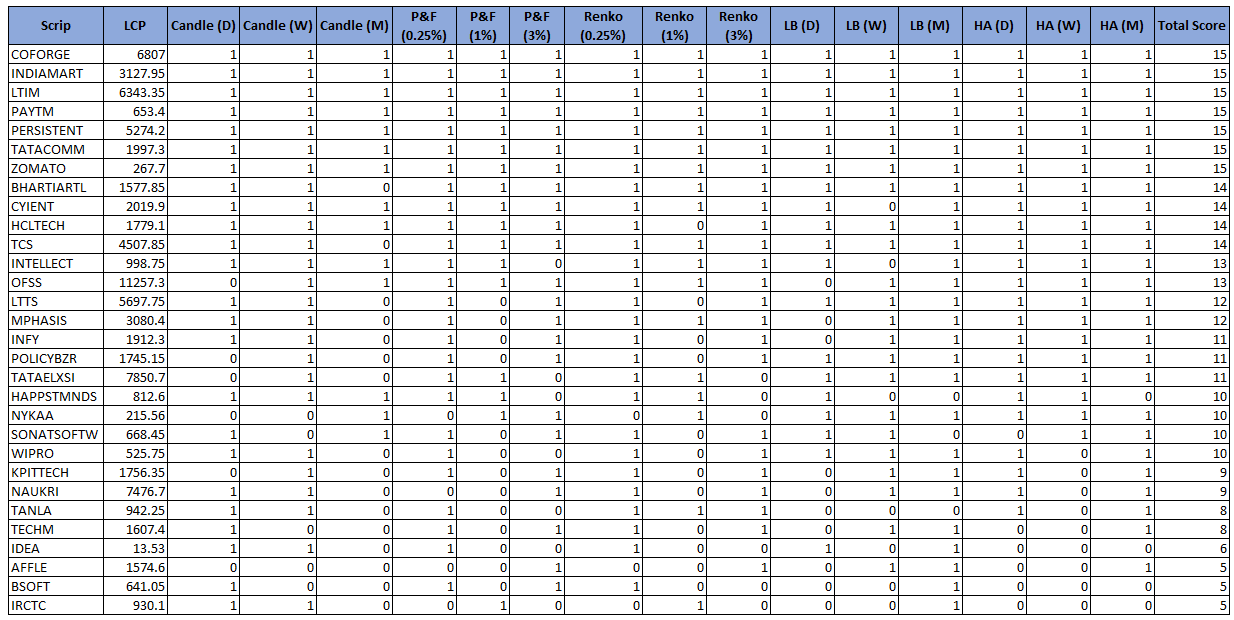

We utilized the “All Chart Matrix” tool to analyse the constituents of the Nifty India Digital Index. This comprehensive analysis ranks stocks based on technical strength, and the following top seven stocks stood out with the highest score of 15:

*as per close on 10th Sept 2024

These companies are leaders in the digital and IT sectors, each playing a crucial role in India’s digital economy. Their strong technical position suggests they may continue to perform well as the market trends upward.

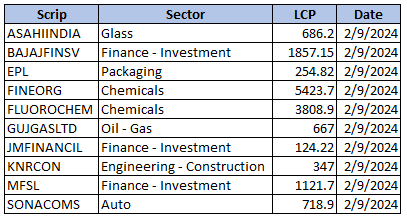

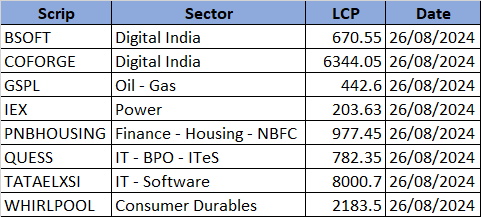

Stocklist 7th Sept 2024

@Sagar Sanghani Sir, this is called "running inverted head and shoulder", a continuation pattern.

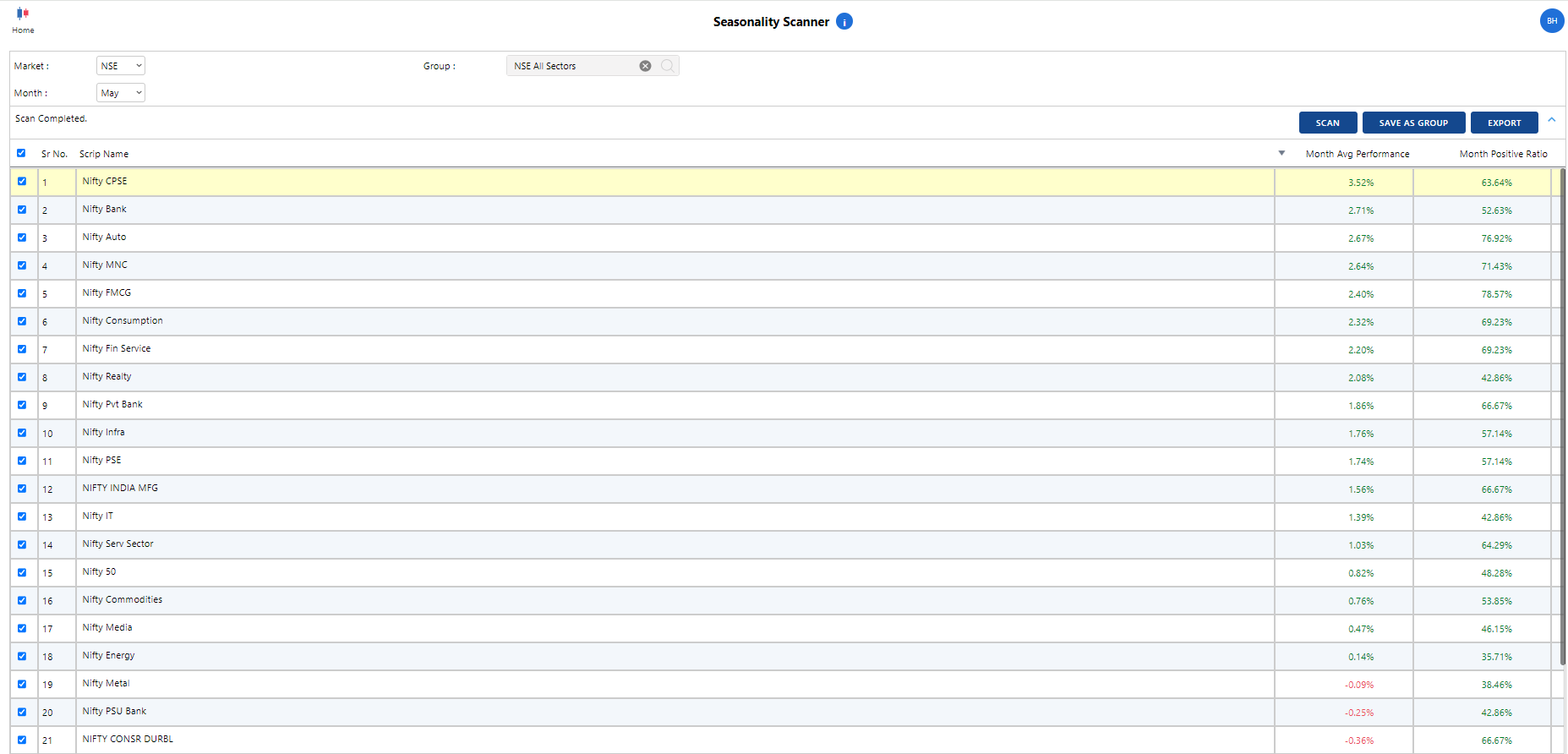

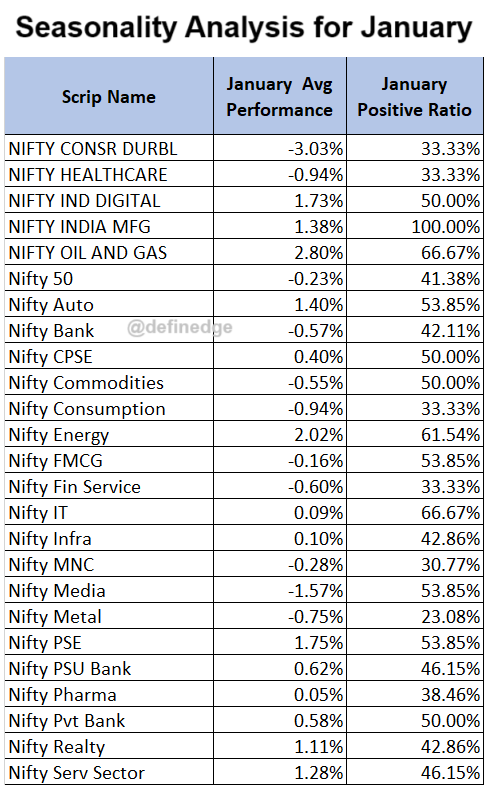

Seasonality analysis is a method for identifying recurring patterns or trends based on specific times of the year. This approach examines how certain periods, such as months, quarters, or even specific dates, historically affect the performance of stocks, commodities, or other assets.

To check the Seasonality Analysis, log into RZone > Click on Seasonality Analysis > Seasonality Index.

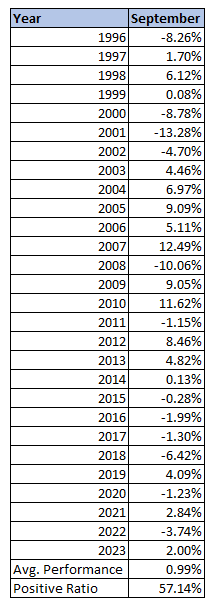

Here is the result for Nifty550 - September month.

Bajaj Finsrv - 1,719 to 1,850+

Stocklist - 31st August 2024

Learn how to read and analyze the Open Interest (OI) chain to create effective trading strategies. Discover the impact of the highest OI on strike prices and how advanced tools like RZone and Opstra by Definedge can help you analyze key option Greeks—Gamma, Vega, Theta, and Delta. Enhance your trading performance by understanding market sentiment and making informed decisions based on detailed OI data.

Dear Sir,

Our team will connect with you over a call.

@Ravindra Kamath You can watch here

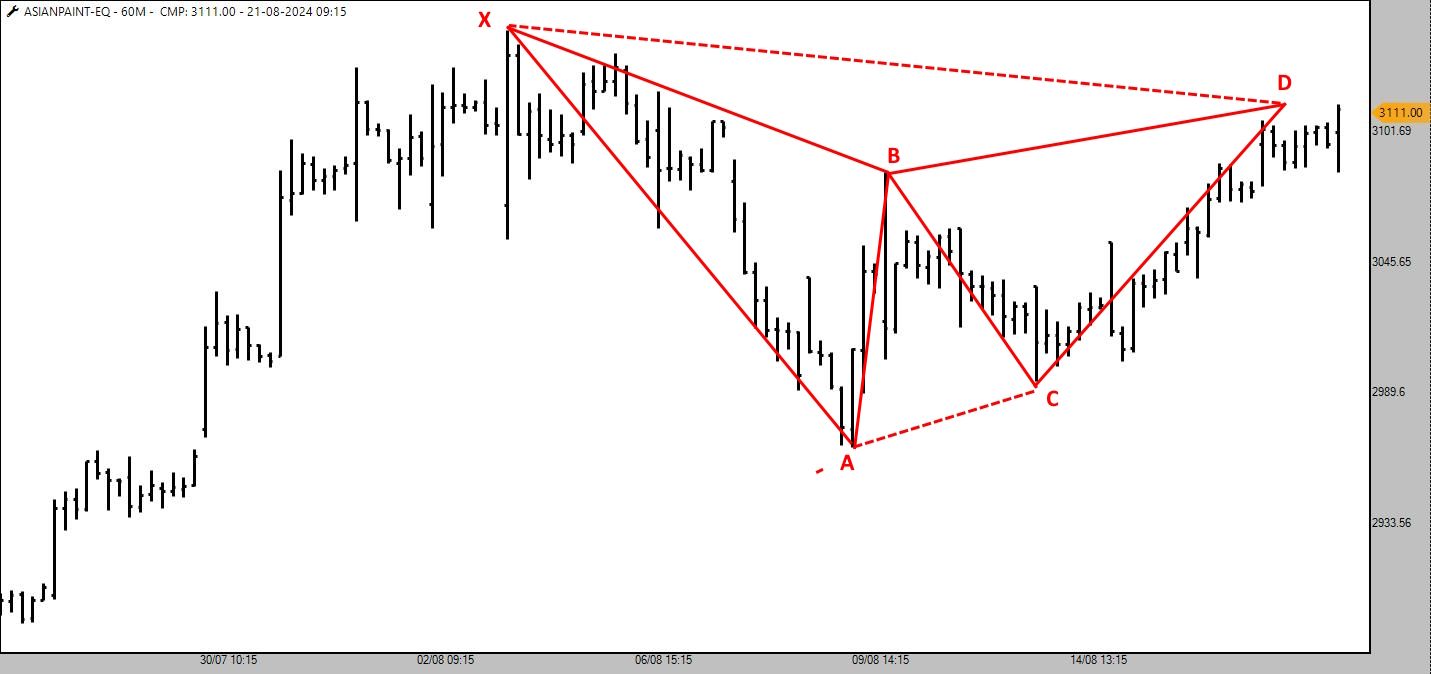

Pattern negates above 3,151

Stocklist - 17th August 2024

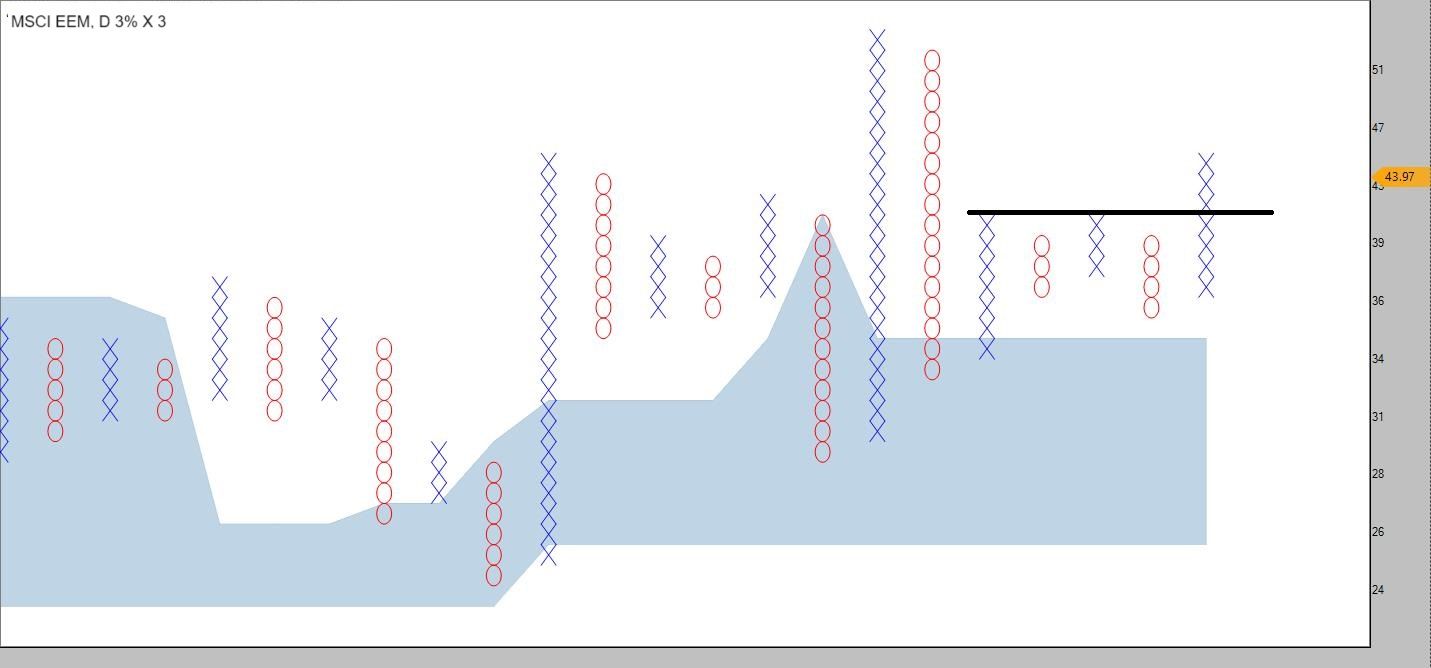

The MSCI Emerging Markets Index is a key benchmark that tracks the performance of large and mid-cap companies across 24 emerging economies. Representing countries like China, India, Brazil, and South Africa, the index offers emerging markets shaping the global economy's future.

Investors look to this index for exposure to economies that often offer higher growth potential than developed markets, albeit with increased risk.

On the P&F chart, the Triple Top Breakout (TTB) indicates that it is time for EEMs to shine against developed countries.

Video will be out soon...Stay Tuned!

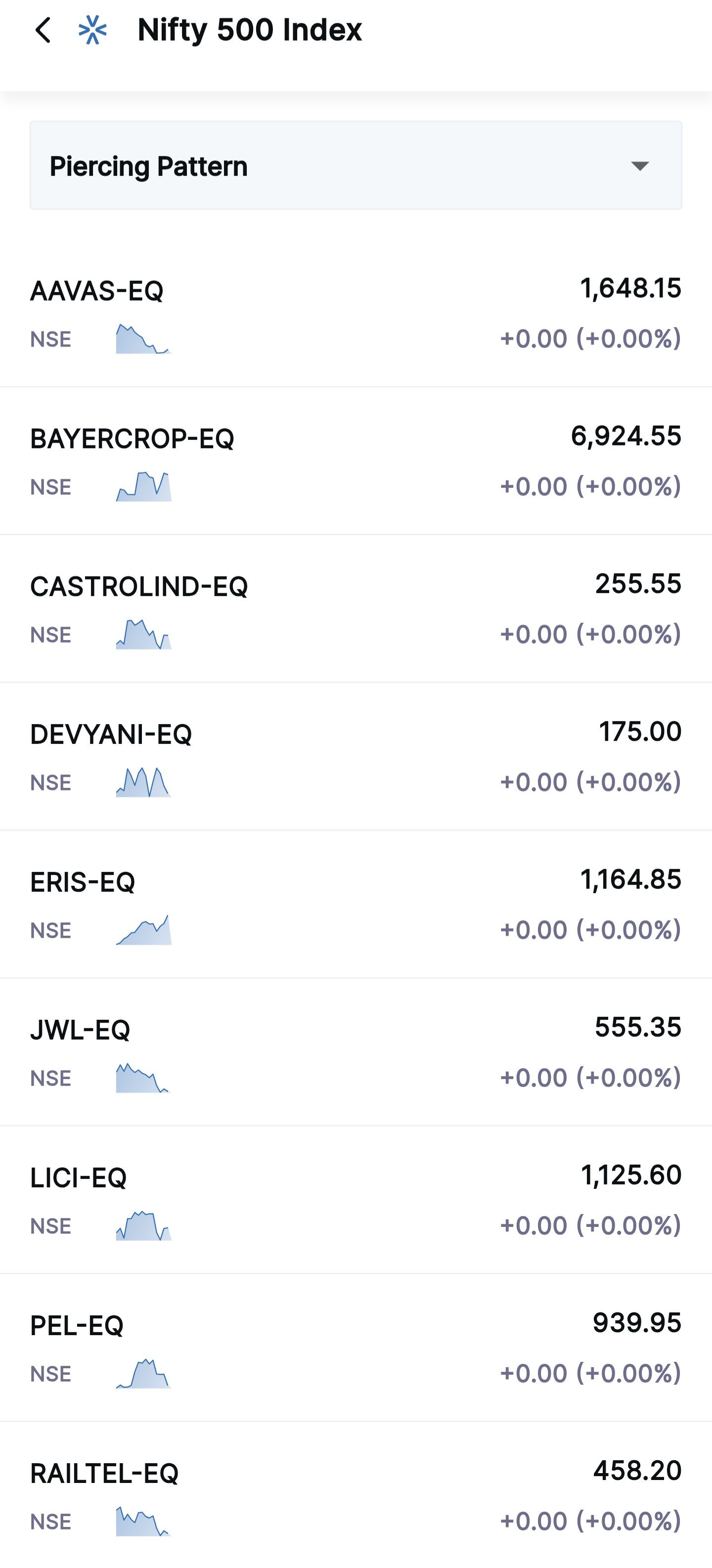

Hey, Gift Nifty predicts the market will open about 300 points higher, around 24,400. By the way, here are some stocks with a bullish candlestick pattern called Piercing.

Source: Zone Mobile

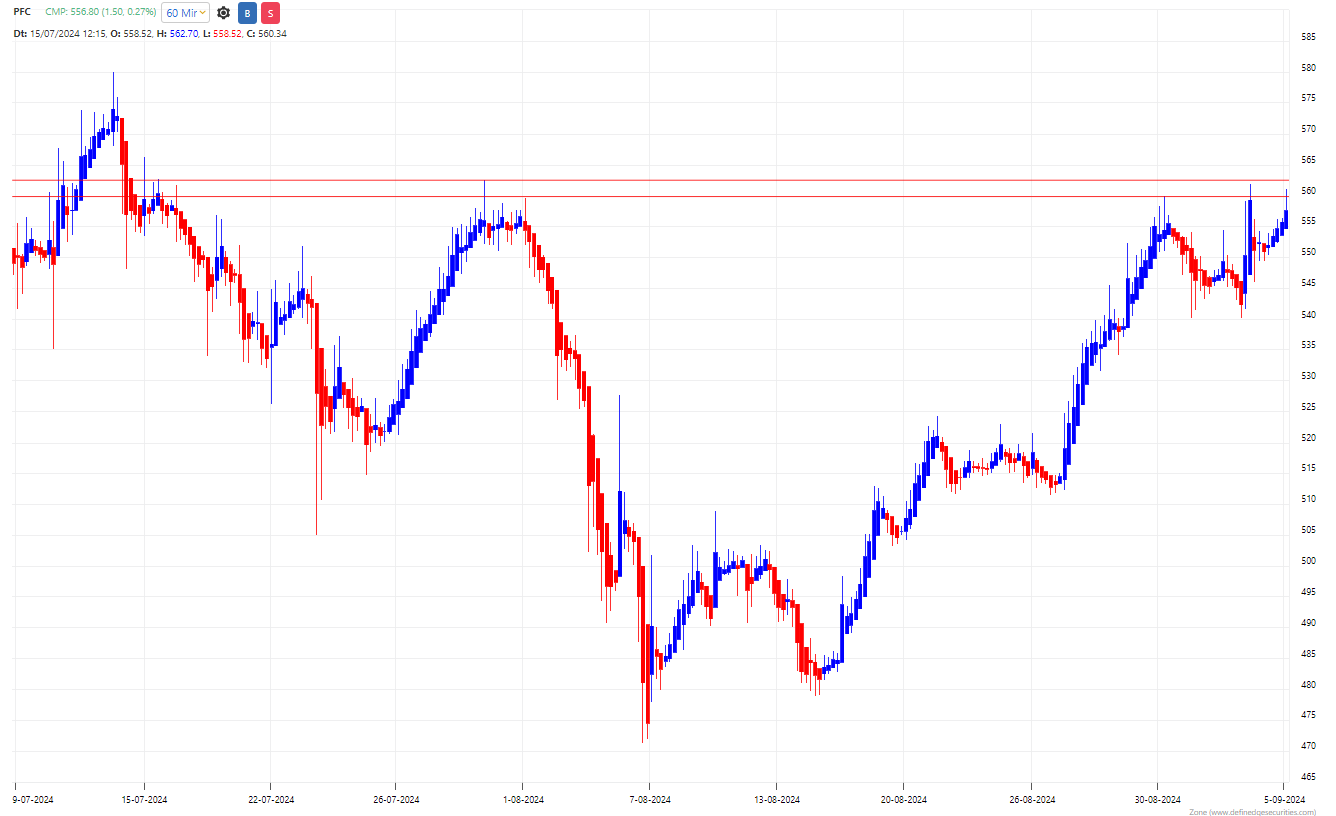

The carry trade has become the focal point of market discussions as the Japanese Yen has appreciated significantly against the Dollar (USD), moving from 162 to 142 in just five weeks. This shift follows the Bank of Japan's (BOJ) decision to increase its key interest rate to around 0.25%. The hike in borrowing costs has led to a cool-off in global equity markets, particularly affecting US fund houses.

Technical Analysis:

The USD/JPY pair has yet to break the December 2023 low of 140, indicating that it remains in a bullish phase according to Dow Theory (positive for the USD).

The Bullish Swan Harmonic Pattern is visible at the low of 141.69 in the demand zone of the 100 MA Channel. The reversal from the current levels can test the 151.35 levels in the short-term while the possibility of the new highs cannot be ignored in the medium-to-long term perspective.

Any weekly close below 140 could signal caution for US equities, potentially causing ripple effects across global markets.

@Shashank Jain Feedback appreciated.

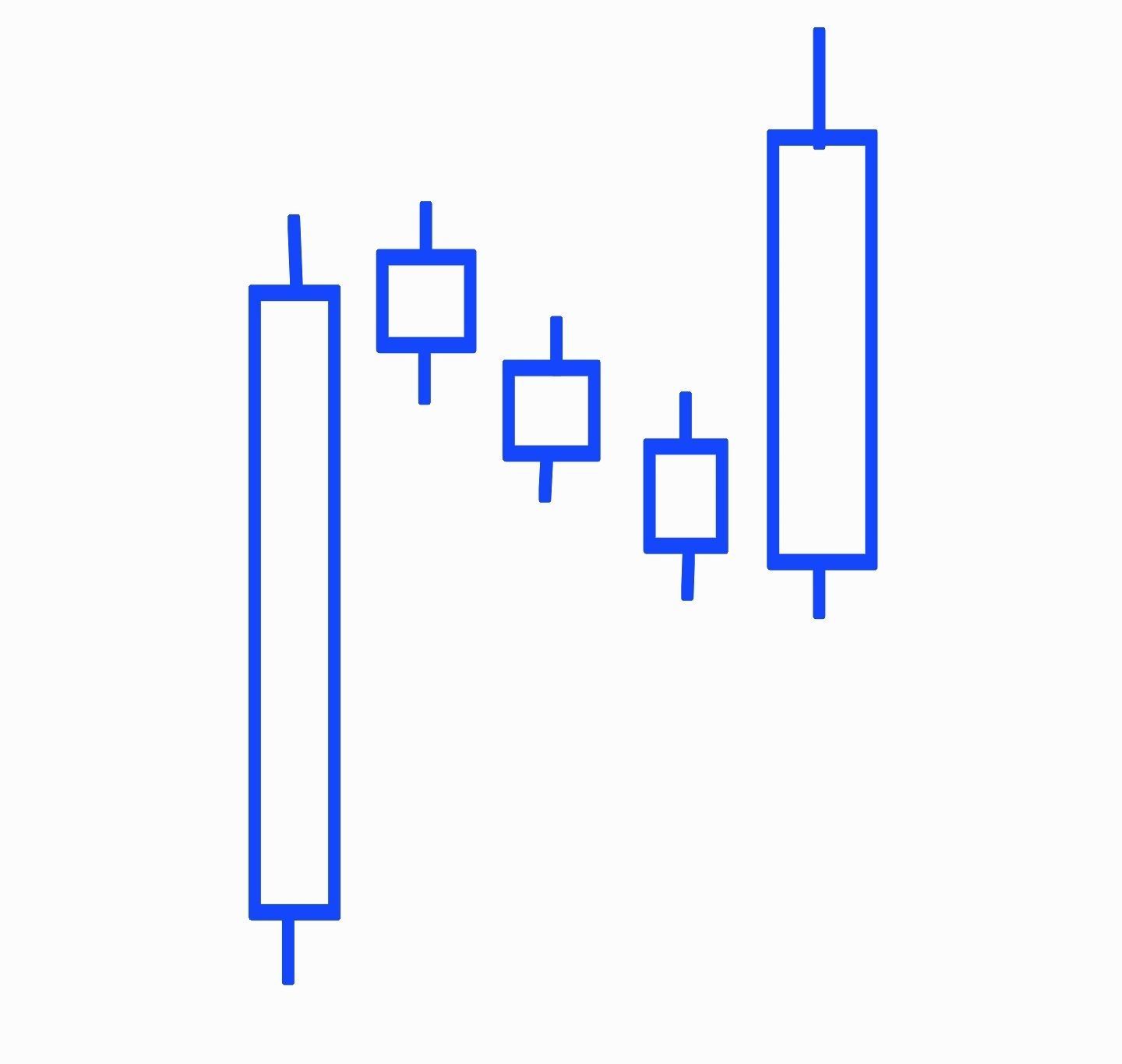

The Rising Three Candlestick is a bullish continuation pattern found in candlestick charting. It signifies that despite short-term bearish movements, the overall trend remains upward. This pattern typically forms over five days and consists of the following components:

Steps to Identify the Rising Three Methods Pattern Using Zone Mobile

To find stocks that qualify for the Rising Three Methods candlestick pattern using Zone Mobile, follow these steps:

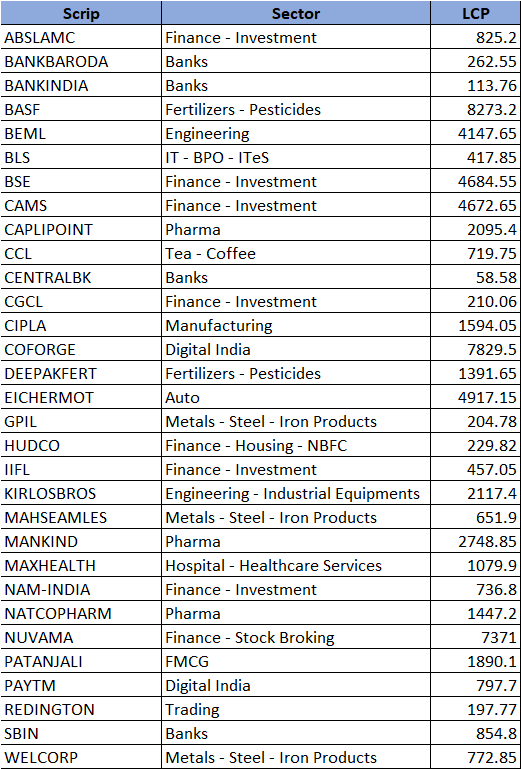

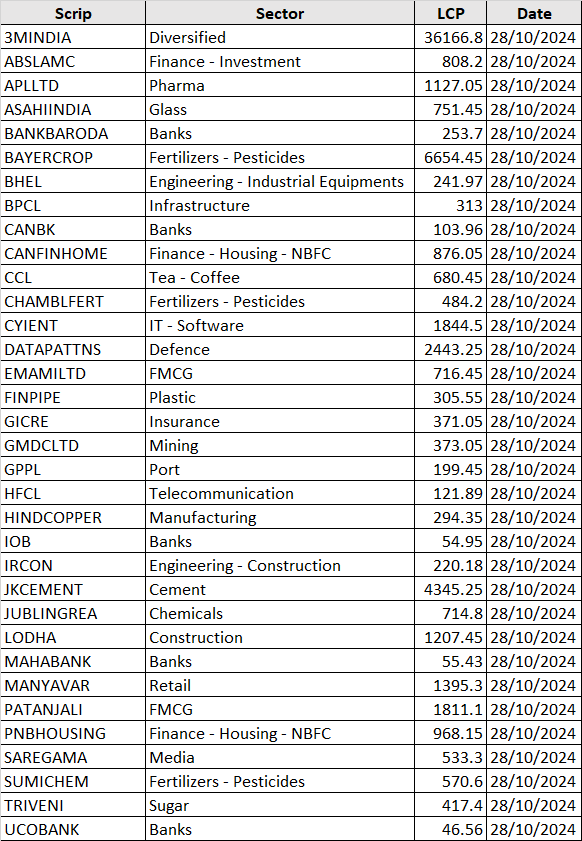

Stocks to Keep on Radar

A list of stocks you can monitor for bullish momentum.

Stocklist - 3rd August 2024